This is the 50th Day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

Rounded Top Chart Pattern

Implication

A Rounded Bottom is considered a bullish signal, indicating a possible reversal of the current downtrend to a new uptrend.

Description

The pattern is confirmed when the price breaks out above its moving average.

Important Characteristics

Following are important characteristic to look for in a Rounded Bottom.

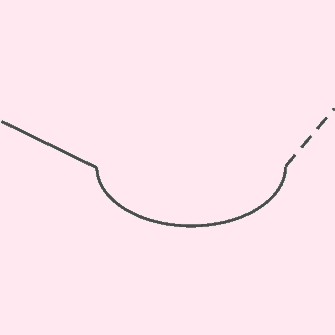

Shape

The price pattern forms a gradual bowl shape. There should be an obvious bottom to the bowl. Price can fluctuate or be linear; however, the overall curve should be smooth and regular, without obvious spikes. For example, a V-shaped turn would not be considered a rounded bottom.

Volume

Volume tends to mirror the price pattern. Consequently, as the rounded bottom begins to descend, volume tends to decrease as bearishness wanes and investors become indecisive. Following a period of relative inactivity, at the bottom of the bowl, the price pattern starts its upward turn. As sentiment becomes more decisively bullish, volume tends to increase. When looking at volume in a rounded bottom pattern, Robert D. Edwards and John Magee note that “volume accelerates with the [price] trend until often it reaches a sort of climactic peak in a few days of almost ‘vertical’ price movement on the chart.”

Duration of the Rounded Bottom

Rounded Bottoms are long-term patterns. Martin J. Pring identifies that the pattern can occur over a period of about 3 weeks, but can also be observed over several years.

Trading Considerations

Duration of the Pattern

The duration of the pattern indicates the significance of the price movement. John J. Murphy writes that rounded bottoms “are usually spotted on weekly or monthly charts that span several years. The longer they last, the more significant they become.”

Target Price

Understandably, investors like to buy at the lowest possible price. However, even the most promising-looking rounded bottoms patterns can fail. To determine whether a downturn has bearish potential, watch the price at the bottom of the downturn. For a rounded bottom, the price tends to hover and bounce between an upper and lower price limit. You may observe this behavior for weeks or even years, as knowledgeable investors accumulate stock at the lowest possible price.

Clifford Pistolese advises that, “If well-informed, long-term investors are buying within the trading range, the eventual breakout will probably be to the upside.” To manage risk, both Pistolese and Thomas N. Bulkowski suggest that investors buy stock when the breakout actually occurs.

Price may end higher or lower than it was at the beginning of the formation. After an upside breakout, technical analysts may use the starting price at the left side of the bowl to determine where the price may head. However, you will want to monitor the stock with interest.

Criteria that Supports

Volume

Volume should parallel the price formation, dropping off as the pattern reaches the bottom, then increasing as the new uptrend is established.

Moving Average

Moving averages help to determine whether the rounded bottom has the potential for an upside breakout. For a rounded bottom, the price should cross the moving average when it begins to ascend. When this crossover occurs, the pattern is “confirmed”.

Criteria that Refutes

Shape

A development is not a real curved underneath when it does not include a duration of combination. Combination appears following the descent when the cost at the foundation of the structure seems to jump between an top and bottom restrict. While, there are V-shaped designs that give effective returns, the rounded bottoms are a more dependable and foreseeable enhancement

Underlying Behavior

A Rounded Bottom kinds as trader belief shifts slowly from bearishness to bullishness. As the opinion turns down toward the bottom, there is a fall off in investing amount due to the indecisiveness in the industry. There is a stage of combination at the bottom as investing bounces within a certain range, then finally there is a steady upturn tagging the shift to bullishness. As customers become additional significant regarding the bullishness, there is an enhance in trading volume.

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?

TABLE OF CONTENTS

Candlestick and Chart Patterns (15 Days)

7 Most Important Candlestick Chart Patterns

- Gap Down Chart Pattern

- Gap Up Chart Pattern

- Gravestone Short-term Chart Pattern

- Hammer Candle Stick Chart Pattern

- Hanging Man Short-term Stock Chart Pattern

- Inverted Hammer Stock Chart Pattern

- Shooting Star Candle Stick Pattern

Top 2 Bearish Chart Patterns

Top 6 Bullish Chart Patterns

- Engulfing Line (Bullish) Chart Pattern

- Exhaustion Bar Chart Pattern (Bullish)

- Inside Bar Chart Pattern

- Island Bottom Chart Pattern

- Key Reversal Bar (Bullish) Chart Pattern

- Two Bar Reversal (Bullish) Chart Pattern

Indicators & Oscillators (12 Days)

Bullish or Bearish Indicators

Bullish or Bearish Oscillators

- Bollinger Bands Oscillator

- Commodity Channel Index (CCI)

- Fast Stochastic Oscillator

- Know Sure Thing (KST) Oscillator

- Momentum Oscillator

- Moving Average Convergence/Divergence (MACD) Oscillator

- Relative Strength Index (RSI)

- Slow Stochastic Oscillator

- Williams %R Oscillator

Classic Chart Patterns (29 Days)

Bearish Classic Chart Patterns

- Continuation Diamond (Bearish) Chart Pattern

- Continuation Wedge (Bearish)

- Descending Continuation Triangle Chart Pattern

- Diamond Top Chart Pattern

- Double Top Chart Pattern

- Downside Break Chart Pattern – Rectangle

- Flag Bearish Chart Pattern

- Head and Shoulders Top Chart Pattern

- Megaphone Top Chart Pattern

- Pennant Bearish Chart Pattern

- Rounded Top Chart Pattern

- Symmetrical Continuation Triangle (Bearish)

- Top Triangle/Wedge Chart Pattern

- Triple Top Chart Pattern

Bullish Classic Chart Patterns

- Ascending Continuation Triangle Chart Pattern

- Bottom Triangle Or Wedge Chart Pattern

- Continuation Diamond (Bullish) Chart Pattern

- Continuation Wedge Chart Pattern (Bullish)

- Cup with Handle Bullish Chart Pattern

- Diamond Bottom Chart Pattern

- Double Bottom Chart Pattern

- Flag Bullish Chart Pattern

- Head and Shoulders Bottom Chart Pattern

- Megaphone Bottom Chart Pattern

- Pennant Bullish Chart Pattern

- Round Bottom Chart Pattern

- Symmetrical Continuation Triangle Bullish

- Triple Bottom Chart Pattern

- Upside Breakout Chart Pattern – Rectangle

Best Trading Theories (4 Days)

- Basics of Dow theory trading strategy forecasts

- Motive (Impulse) Waves

- Corrective Waves

- Wyckoff Chart Reading

Kind attention: this course is helpful for beginner and intermediate traders. It’s free for everyone. Advanced modules, trading strategies, and data (in-depth) are available for Moneymunch’s premium subscribers.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.