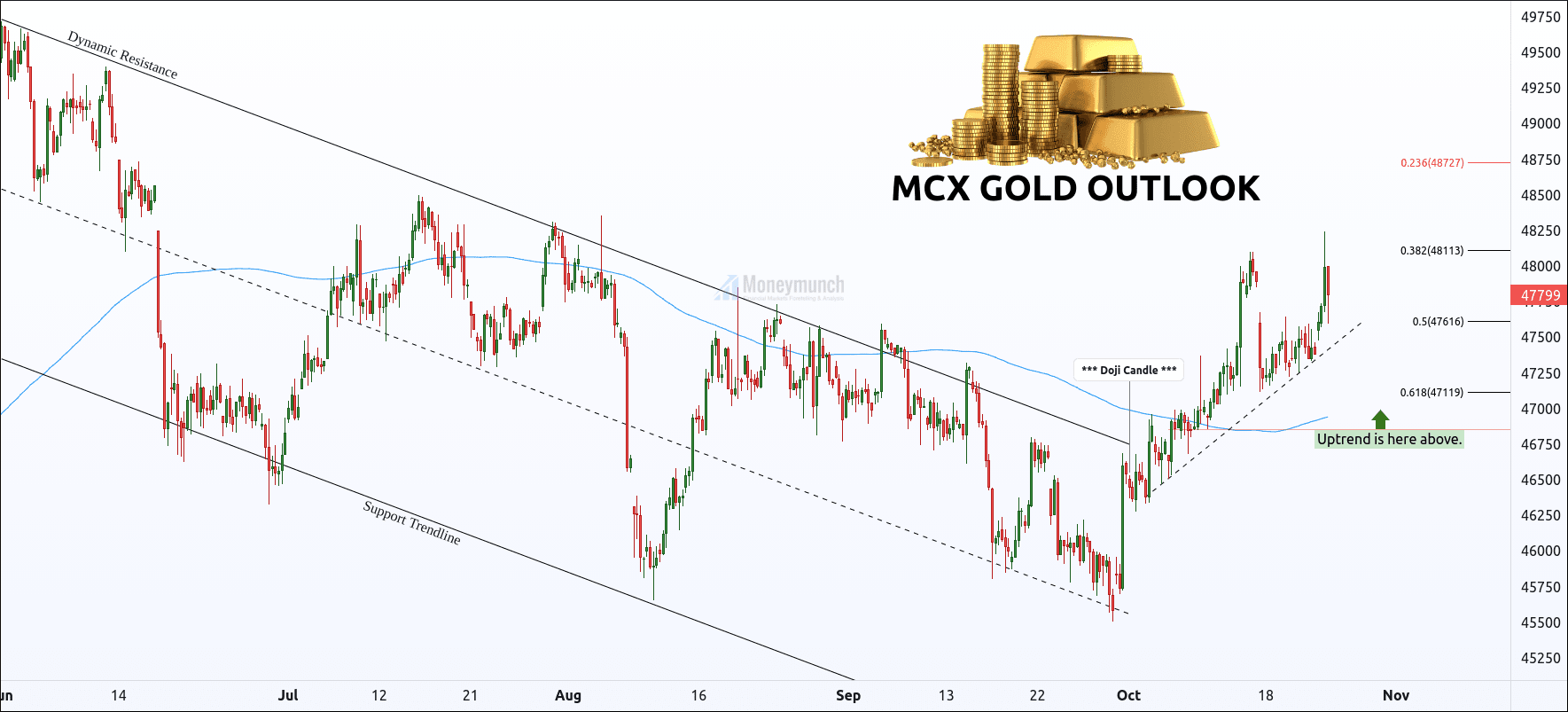

If not, you can read it here: Gold Price Analysis – Key Levels and Targets for Intraday Traders

Highlighted in bold yesterday, we emphasized, “Finding a foothold at 61960, MCX Gold prices hinge on a crucial juncture. A crossover and break today could lead to target prices of 61860, 61760, and 61560.”

Gold successfully achieved all target prices within a single trading session.

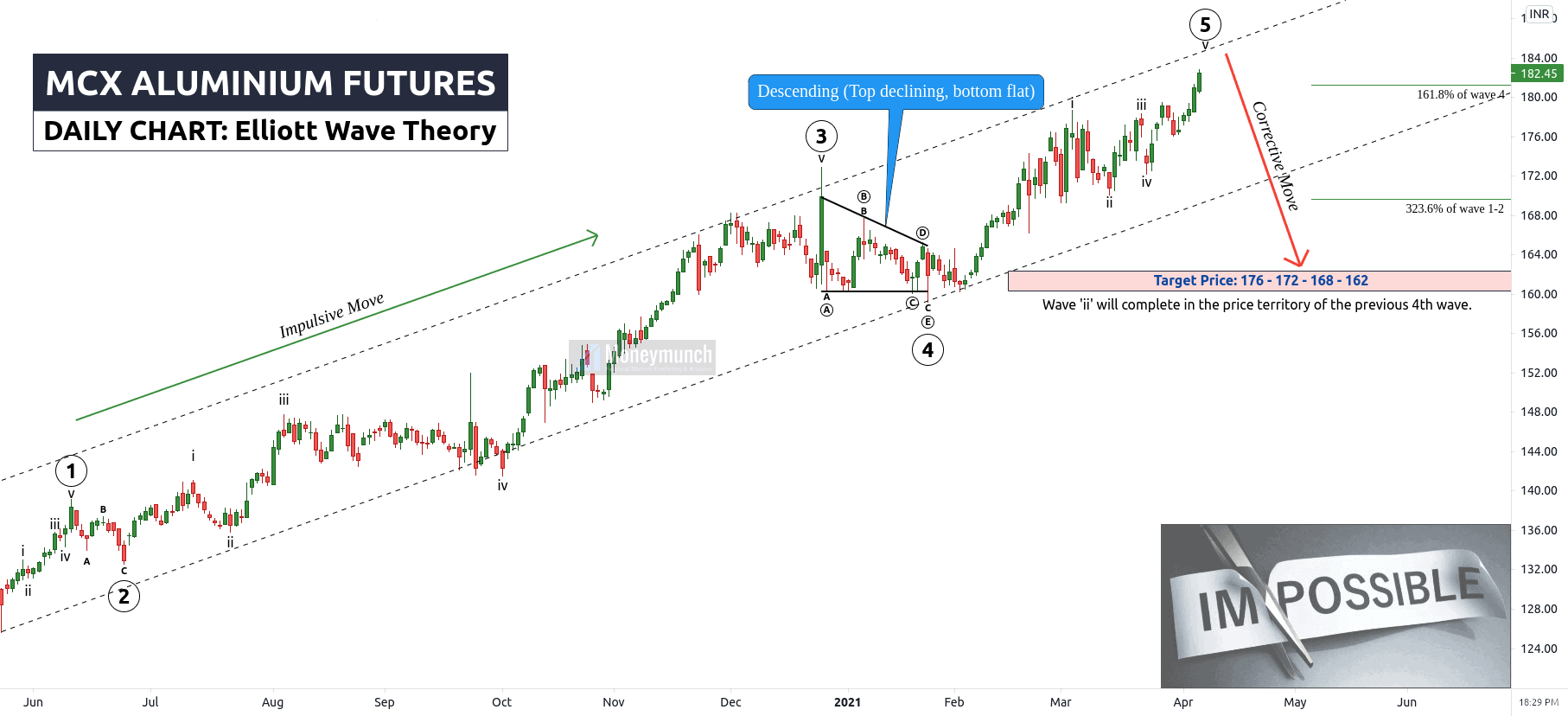

Reminder to our premium subscribers: Aluminum Report – it’s on the verge of hitting our first target.Continue reading

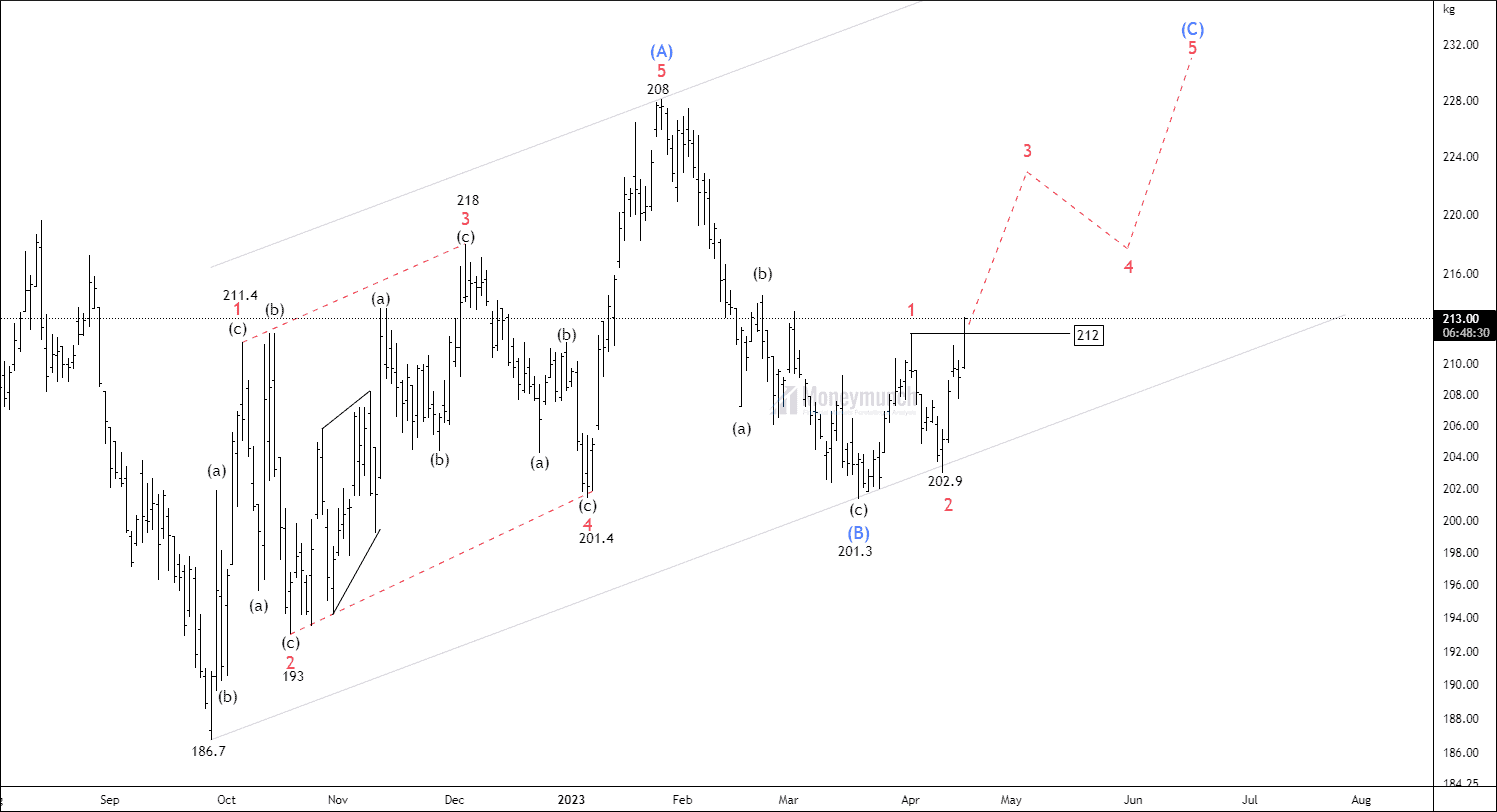

Lock

Lock