There are plenty of attractive investment opportunities in the Indian stock market right now, but these eight compounding machines you can feel comfortable owning for the long term. And you can get the ninefold return in 10 years.

I have chosen to buy these stocks because they’re ready to blast. You may find almost bottom in all below charts.

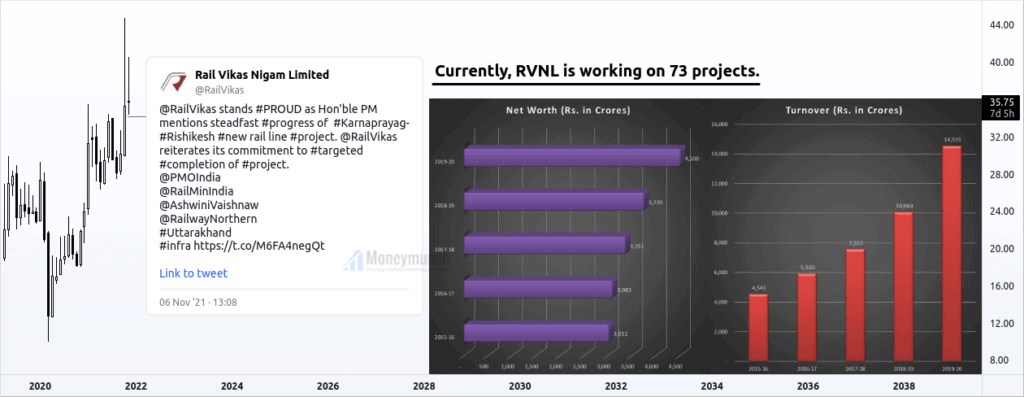

1. RVNL (Rail Vikas Nigam Limited)

Target: Rs.66 – Rs.100+

See the chart above to get why you should invest in RVNL.

2. IDFC First Bank (IDFCFIRSTB)

Target: 124 – 190+

This chart does not need any description. IDFC First Bank’s stock price is worth buying now.

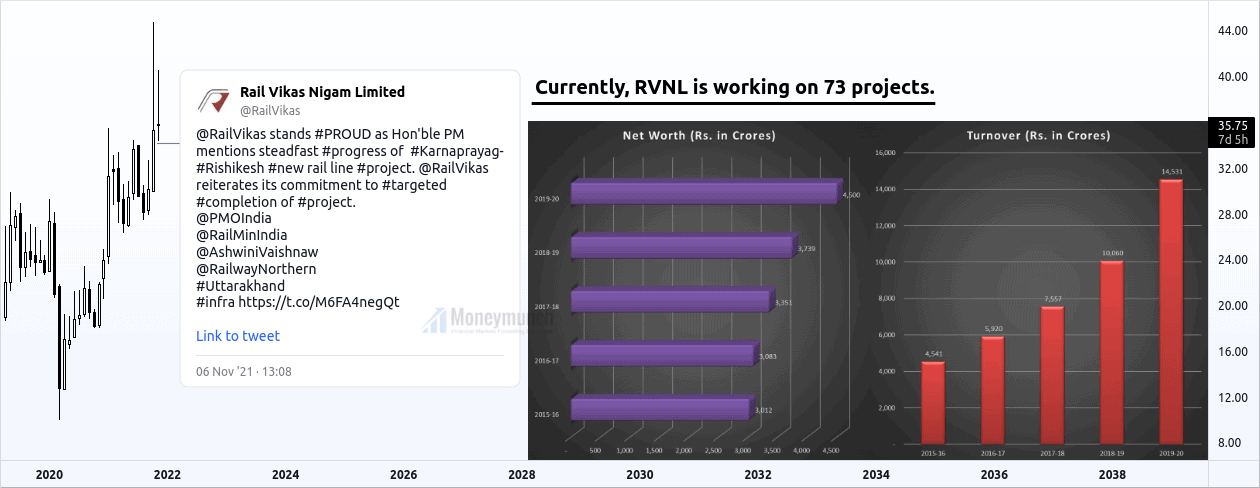

3. Kellton Tech

Target: 194 – 312+

Kellton Tech is AI (Artificial Intelligence), and it’s the future of the next generation. The company’s total revenue (TR) is stable even in a pandemic situation. See chart above its share price isn’t increasing compared to TR.

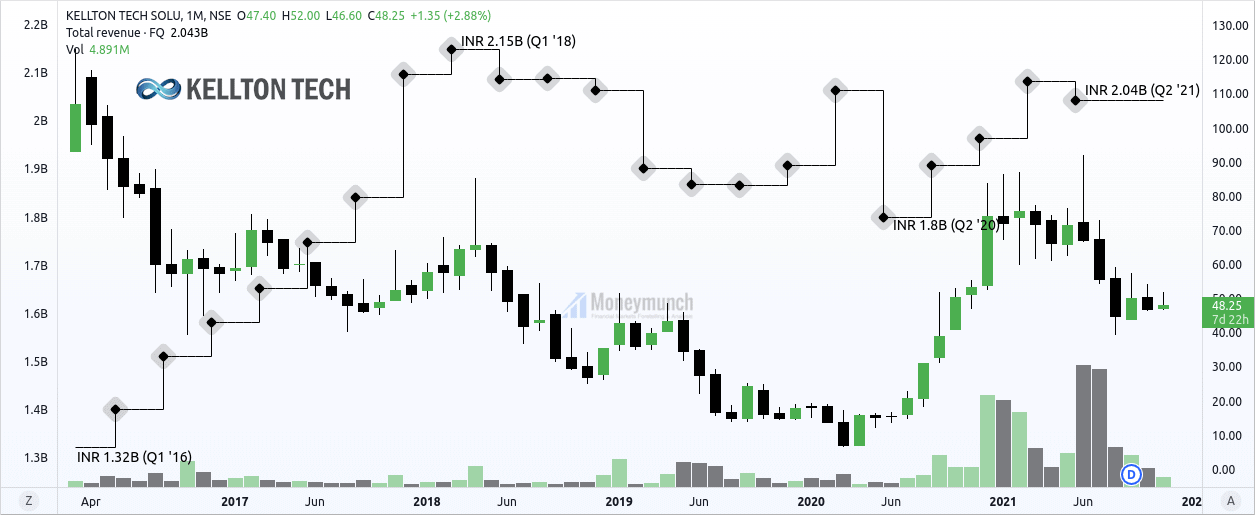

4. Engineers India Limited (EIL)

Targets: Rs.200 – Rs.432 – Rs.690+

EIL is a well-known government corporation, and the total revenue of ’21 is INR 31.44B. It has executed over 5000 assignments consisting of 400 major projects valued at over US$200 Bullion.

In the short term, we will see EIL shares price Rs.200. If you have plans to buy stocks for one decade, then this one is for you.

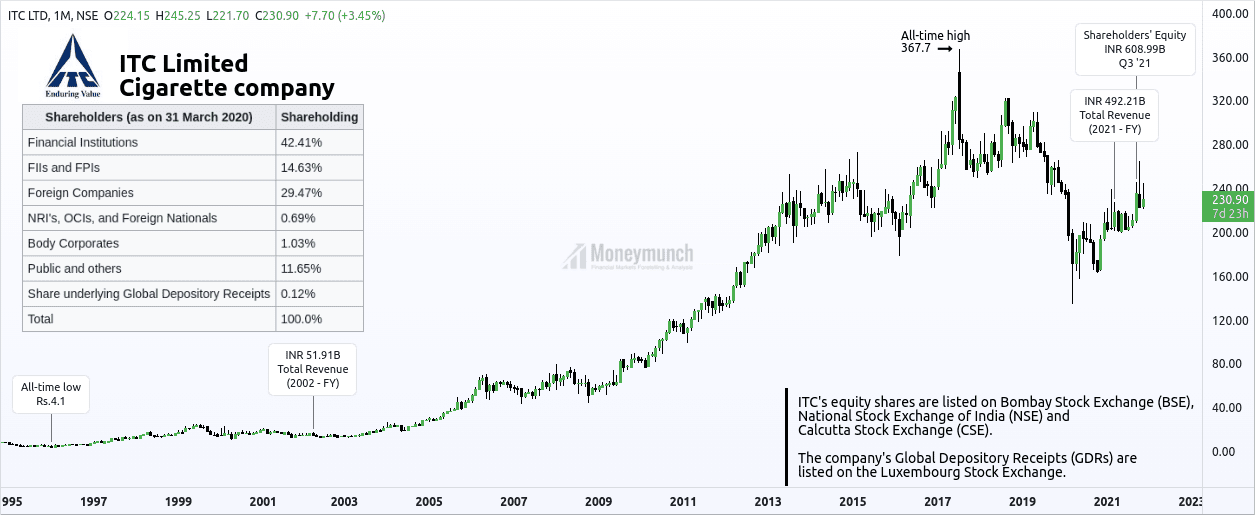

5. ITC (Imperial Tobacco Company of India Limited)

Target: 592 – 956+

ITC’s total revenue (TR) had 51.91B in ’02. At present, its shareholders’ equity is 608.99B and TR 492.21B. Short-term investors can buy and hold for Rs.300 target. And long-term traders should keep for targets level of 592 – 956+.

6. GMR Group (GMRINFRA)

Target: 80 – 102 – 186+

GMR Infra is a long racehorse. It has made a high of Rs.132.35 on Dec ’07. We see this stock price above Rs.186+ in upcoming years. A long position can initiate between the range of Rs.30 – Rs.34.

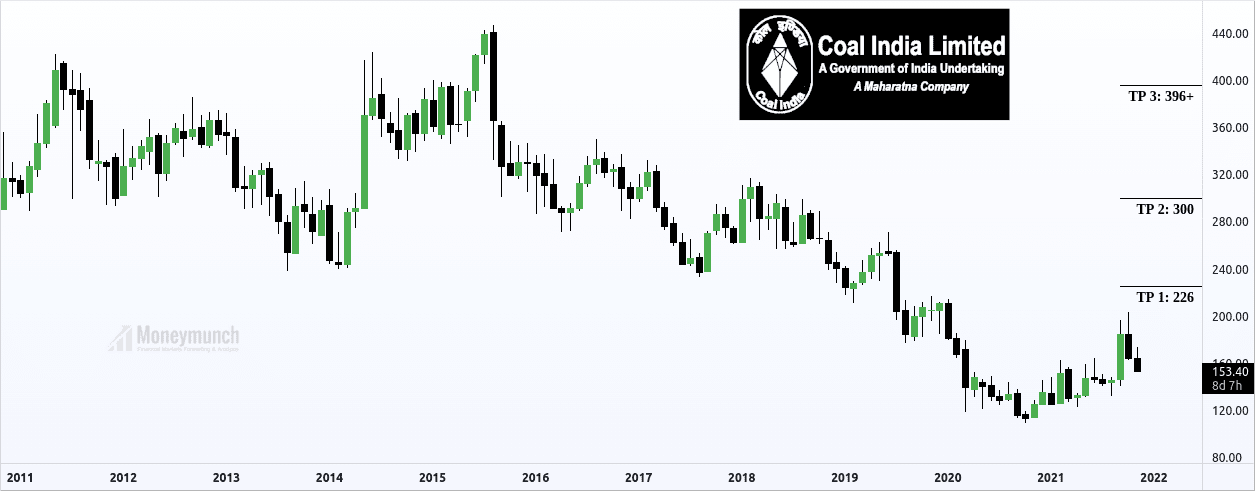

7. Coal India (COALINDIA)

Coal India is a government-owned coal mining and refining corporation. And the largest coal-producing company in the world. We may see the Rs.656 stock price of Coal India in the future.

COVID-19 still exists. This pandemic situation can show the stock price nearby Rs.54 – Rs.56 due to volatility. Who’s planning to invest for the next ten years? You can buy this stock nearby 150 level. And the strong support level is Rs.114.

8. BHEL (Bharat Heavy Electricals Limited)

BHEL has made a high of 390.65 on 01 Nov ’07, and it had made a low of 18.4 during COVID-19 beginning.

According to fundamental research, we may see a retest of the following levels: 42 – 30

Long-term investors can take entry between the range of 60 – 56.

My prediction is BHEL will hit 186 – 300 before 2026. It may take time to break an all-time high and touch the last target of 400 because it’s Indian government-owned engineering and manufacturing enterprise. To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Simple And Powerful 🔥

great analysis man! I like how you approach your argument from different angles.

After breaking resistance we can expect rise

well done

I agree especially after a break of the range. well spotted!

You made me Reconsider my take on the stocks!

perfect perfect. great target

Professional work

Been following you for a while now, ideas are always in-depth and explained very well, it’s been a pleasure following your page. Looking forward to the future with you.

Sniper entry! :)

Thanks for these points. Will surely use it in the future 😃

yes, actually.

But will hold with my SL.

Set up still valid.

Good observation.

description class level…..

Well done…Hard work.

Well done.

Hard work.

Sir, Please explain how we use stochastic and RSI indicators at that entry time?

can you suggest how to select stock for swing or intraday?But how this was brilliant

Great Strategy, I have and keep on modifying the strategy until my trust settles on one. Your work was like a light to my darkness. Good guidance. Thanks a lot, man.

can you upload video on these strategy on your YouTube channel

please🙏

Excellent find.

Thank you for sharing stocks for long-term investment.

I am glad you’re shared.

Wow good. I learned a new concept about investing,

Thank you.

great to see you helping all of us

Thank you for taking the time to do this

GLOBE AND GREEN POWER kaisa hai?

Very good narration. Short & crisp.

NICE