This is the 41th Day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

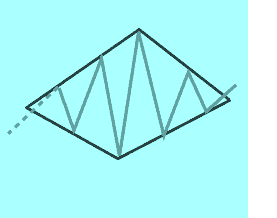

Continuation Diamond (Bullish) Chart Pattern

Implication

A Continuation Diamond (Bullish) is regarded a bullish signal, showing that the existing uptrend may continue.

Description

Diamond patterns generally form over a number of months in very dynamic opportunities. Amount will continue high through the development of this structure. The Continuation Diamond (Bullish) pattern forms considering costs produce higher highs and lower lows in a widening pattern. Then the investing range progressively narrows after the highs peak and the lows start trending upward.

Duration of Pattern

Give consideration to the timeframe of the structure and its connection to your investing time perspectives. The timeframe of the pattern is regarded to be an indicator of the timeframe of the impact of this structure. The extended the structure the longer it will take for the price to move to its target. The shorter the pattern the sooner the price move.

Target Price

The target price produces an significant indicator about the potential price move that this pattern suggests. Give consideration to perhaps the desired cost for this structure is adequate to provide sufficient returns after your prices have been taken into account.

Inbound Trend

The inbound trend is an significant attribute of the structure. A shallow inbound trend may suggest a duration of combination before the cost move suggested by the structure begins. Look for an inbound tendency that is extended than the timeframe of the structure. A ideal tip of thumb is that the inbound trend should be at least two times the schedule of the pattern.

Criteria that Supports

Support and Resistance

Assistance can be discovered at the switching point of the lows and opposition at the top optimum of the Diamond.

Criteria that Refutes

No Volume

A absence of a quantity throughout the structure is an indicator that this pattern may not be dependable.

Short Inbound Trend

An incoming tendency that is considerably smaller than the structure period is an indicator that this structure should be regarded less dependable.

Message for you(Trader/Investor): Google has the answers to most all of your questions, after exploring Google if you still have thoughts or questions my Email is open 24/7. Each week you will receive your Course Materials. You can print it and highlight for your Technical Analysis Training.

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?

TABLE OF CONTENTS

Candlestick and Chart Patterns (15 Days)

7 Most Important Candlestick Chart Patterns

- Gap Down Chart Pattern

- Gap Up Chart Pattern

- Gravestone Short-term Chart Pattern

- Hammer Candle Stick Chart Pattern

- Hanging Man Short-term Stock Chart Pattern

- Inverted Hammer Stock Chart Pattern

- Shooting Star Candle Stick Pattern

Top 2 Bearish Chart Patterns

Top 6 Bullish Chart Patterns

- Engulfing Line (Bullish) Chart Pattern

- Exhaustion Bar Chart Pattern (Bullish)

- Inside Bar Chart Pattern

- Island Bottom Chart Pattern

- Key Reversal Bar (Bullish) Chart Pattern

- Two Bar Reversal (Bullish) Chart Pattern

Indicators & Oscillators (12 Days)

Bullish or Bearish Indicators

Bullish or Bearish Oscillators

- Bollinger Bands Oscillator

- Commodity Channel Index (CCI)

- Fast Stochastic Oscillator

- Know Sure Thing (KST) Oscillator

- Momentum Oscillator

- Moving Average Convergence/Divergence (MACD) Oscillator

- Relative Strength Index (RSI)

- Slow Stochastic Oscillator

- Williams %R Oscillator

Classic Chart Patterns (29 Days)

Bearish Classic Chart Patterns

- Continuation Diamond (Bearish) Chart Pattern

- Continuation Wedge (Bearish)

- Descending Continuation Triangle Chart Pattern

- Diamond Top Chart Pattern

- Double Top Chart Pattern

- Downside Break Chart Pattern – Rectangle

- Flag Bearish Chart Pattern

- Head and Shoulders Top Chart Pattern

- Megaphone Top Chart Pattern

- Pennant Bearish Chart Pattern

- Rounded Top Chart Pattern

- Symmetrical Continuation Triangle (Bearish)

- Top Triangle/Wedge Chart Pattern

- Triple Top Chart Pattern

Bullish Classic Chart Patterns

- Ascending Continuation Triangle Chart Pattern

- Bottom Triangle Or Wedge Chart Pattern

- Continuation Diamond (Bullish) Chart Pattern

- Continuation Wedge Chart Pattern (Bullish)

- Cup with Handle Bullish Chart Pattern

- Diamond Bottom Chart Pattern

- Double Bottom Chart Pattern

- Flag Bullish Chart Pattern

- Head and Shoulders Bottom Chart Pattern

- Megaphone Bottom Chart Pattern

- Pennant Bullish Chart Pattern

- Round Bottom Chart Pattern

- Symmetrical Continuation Triangle Bullish

- Triple Bottom Chart Pattern

- Upside Breakout Chart Pattern – Rectangle

Best Trading Theories (4 Days)

- Basics of Dow theory trading strategy forecasts

- Motive (Impulse) Waves

- Corrective Waves

- Wyckoff Chart Reading

Kind attention: this course is helpful for beginner and intermediate traders. It’s free for everyone. Advanced modules, trading strategies, and data (in-depth) are available for Moneymunch’s premium subscribers.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.