This is the 38th day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

Triple Top Chart Pattern

Introduction

A triple top is regarded to be a variance of the head and shoulders top. Usually the only thing that distinguishes a triple top from a head and shoulders top is the reality that the three peaks that create up the triple top are more or less at the exact same level. The head and shoulders top shows a higher peak – the “head” – between the two shoulders.

Based on to specialists including Murphy, generating a difference between these two patterns is mostly educational because they both suggest the same thing.They are both “reversal” patterns of an upward trend in a stock. The triple top scars an uptrend in the process of becoming a downtrend.

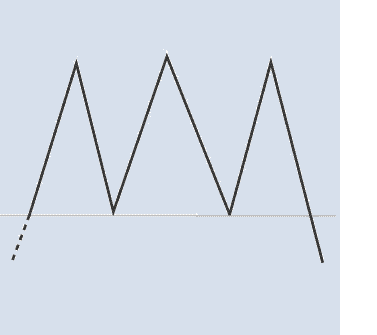

What does a triple top look like?

As shown here, the triple top pattern is made up of three sharp peaks, all at the similar level. A triple top takes place when prices are in an uptrend. Prices increase to a resistance level, retreat, return to the resistance level again, retreat, and lastly, come back to that resistance level for a third time prior to declining. In a classic triple top, the decline following the third peak marks the starting of a downtrend.

Although the three peaks should be sharp and specific, the lows of the pattern can look as rounded valleys. The pattern is finish once prices decline below the lowest low in the development. The lowest low is also called the “confirmation point.”

Bulkowski suggests that this pattern can have many differences. He continues, nevertheless, to suggest that an investor should guarantee that the three peaks are well divided and not function of a over-crowding pattern. “Every top should be part of its own mild high, a specific peak that systems about the encompassing price landscape.”

Elaine Yager, Director of Technical Analysis at Investec Ernst and Company in New York and a member of Recognia’s Board of Advisors suggests they should be noticeably distinct peaks and they do not have to be precisely at the same level.

Why is this pattern important?

As the head and shoulders top that it is similar to so carefully, the triple top is regarded by specialists to be a trusted pattern. Based on to Schabacker, there is a good description for putting reliance on this pattern. The pattern shows three consecutive efforts to break through a opposition level. Price cannot move above a particular point, despite three tries. “Each failing contributes weight to the signs of reversal,” explains Schabacker.

Is volume important in a triple top?

Normally, volume in a triple top is likely to be downward as the pattern forms. Murphy suggests that volume must be lighter on every rally peak. Volume then picks up as prices drop below the verification point and crack into the new downward trend.

Both Bulkowski and Schabacker spot less importance on the downward development of volume. While both consent that investors must see fairly high volume on the first peak, they also consent that volume on the another peaks can be baffled and unusual. Volume should be higher on the peaks then at the lows. Bulkowski’s stats indicate that an investor should see a volume rush at the time of breakout and during the few days next the decline in price below the verification point.

What are the details that I should pay attention to in the triple top?

1. Duration of the Pattern

This pattern can bring upwards of several months to form. Corresponding to Bulkowski, average development time is roughly four months. In inclusion, specialists, including Schabacker and Murphy, concur that the extended the pattern requires to form, the greater the importance of the price move once breakout happens. The three highs do not need to be similarly separated from one another.

2. Need for an Uptrend

The triple top is a reversal pattern marking the transition period between an uptrend and a downtrend in prices. It is crucial to the existence of this pattern that it begin with an uptrend of stock prices.

3. Decisive Breakout

Investors are recommended to wait for prices to create a conclusive crack below the confirmation point of a triple top pattern. If prices do not drop under the confirmation point after the third peak is achieved, the pattern is not a triple top. In a bull market, for example, it is typical to observe three highs which appearance like the starting of a well-formed triple top. If prices, nevertheless, do not fall below the confirmation point, they can just as effortlessly pull separated from the highs set up by the three peaks and then maintain on in the upward trend.

4. Volume

As mentioned, it is common to notice volume reduce as the pattern advances. This should change, nevertheless, when breakout happens. A legitimate breakout should be followed by a rush in volume. Particular specialists are less worried by observing a gradually reducing trend in volume as the pattern advances through its three highs. Schabacker reviews that the volume picture can frequently be puzzled and erratic. 7 All consent, then again, that an trader will need to see a clear increase in volume at the time of the break through the confirmation point.

5. Rally after Breakout

Yager notes that a high percentage of triple tops have rallies back to the point of the breakdown more often than not.

How can I trade this pattern?

beginning by calculating the target price – the minimum anticipated price move. The triple top is calculated in a method like to that for the head and shoulders top.

Determine the height of the pattern by subtracting the lowest low from the highest high in the formation. Then, take off the height from the lowest low. In another words, an investor can anticipate the price to go downwards at least the distance from the breakout point less the height of the pattern.

For example, assume the lowest low of the triple top is 170 and the highest high is 220. The height of the pattern equals 50 (220 – 170 = 50). The minimum target price is 120 (170 – 50 = 120).

Bulkowski calculates that the measure guideline is not totally dependable for the triple top, calculating that nearly 50% of all triple tops will drop short of their minimum target price.

Edwards and Magee inform that real triple tops are few and far in between. So, it creates feel to be careful when evaluating what might originally look like a developing triple top.

According to Edwards and Magee, an investor should never “jump the gun” with a triple top.If the triple top is not finished by breaking through the verification point, experts advise careful attention. The pattern can neglect to finish and just as effortlessly recommence an upwards trend. However, Edwards and Magee also describe that if the pattern has been verified by a legal breakout, then the pattern rarely fails. “Stick to the breakout rule,” they advise, “and you will be safe.”

Rallies are popular with triple tops. An investor can trade that return move to his or her benefit. According to Bulkowski, if an investor overlooks the breakout, there’s still time to place or add to a short situation when prices resume their mass meeting towards the former breakdown level. In this case it would have been 170.

Are there variations in the pattern that I should know about?

1. Hybrid Variation

There is a hybrid variation that appears to be a cross between a double and triple top. The middle peak is slightly lower than the left and right peaks. This is still a valid reversal pattern.

2. Fourth Peak

It is possible for the pattern to display a fourth peak before reversal occurs.

Message for you(Trader/Investor): Google has the answers to most all of your questions, after exploring Google if you still have thoughts or questions my Email is open 24/7. Each week you will receive your Course Materials. You can print it and highlight for your Technical Analysis Training.

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?

TABLE OF CONTENTS

Candlestick and Chart Patterns (15 Days)

7 Most Important Candlestick Chart Patterns

- Gap Down Chart Pattern

- Gap Up Chart Pattern

- Gravestone Short-term Chart Pattern

- Hammer Candle Stick Chart Pattern

- Hanging Man Short-term Stock Chart Pattern

- Inverted Hammer Stock Chart Pattern

- Shooting Star Candle Stick Pattern

Top 2 Bearish Chart Patterns

Top 6 Bullish Chart Patterns

- Engulfing Line (Bullish) Chart Pattern

- Exhaustion Bar Chart Pattern (Bullish)

- Inside Bar Chart Pattern

- Island Bottom Chart Pattern

- Key Reversal Bar (Bullish) Chart Pattern

- Two Bar Reversal (Bullish) Chart Pattern

Indicators & Oscillators (12 Days)

Bullish or Bearish Indicators

Bullish or Bearish Oscillators

- Bollinger Bands Oscillator

- Commodity Channel Index (CCI)

- Fast Stochastic Oscillator

- Know Sure Thing (KST) Oscillator

- Momentum Oscillator

- Moving Average Convergence/Divergence (MACD) Oscillator

- Relative Strength Index (RSI)

- Slow Stochastic Oscillator

- Williams %R Oscillator

Classic Chart Patterns (29 Days)

Bearish Classic Chart Patterns

- Continuation Diamond (Bearish) Chart Pattern

- Continuation Wedge (Bearish)

- Descending Continuation Triangle Chart Pattern

- Diamond Top Chart Pattern

- Double Top Chart Pattern

- Downside Break Chart Pattern – Rectangle

- Flag Bearish Chart Pattern

- Head and Shoulders Top Chart Pattern

- Megaphone Top Chart Pattern

- Pennant Bearish Chart Pattern

- Rounded Top Chart Pattern

- Symmetrical Continuation Triangle (Bearish)

- Top Triangle/Wedge Chart Pattern

- Triple Top Chart Pattern

Bullish Classic Chart Patterns

- Ascending Continuation Triangle Chart Pattern

- Bottom Triangle Or Wedge Chart Pattern

- Continuation Diamond (Bullish) Chart Pattern

- Continuation Wedge Chart Pattern (Bullish)

- Cup with Handle Bullish Chart Pattern

- Diamond Bottom Chart Pattern

- Double Bottom Chart Pattern

- Flag Bullish Chart Pattern

- Head and Shoulders Bottom Chart Pattern

- Megaphone Bottom Chart Pattern

- Pennant Bullish Chart Pattern

- Round Bottom Chart Pattern

- Symmetrical Continuation Triangle Bullish

- Triple Bottom Chart Pattern

- Upside Breakout Chart Pattern – Rectangle

Best Trading Theories (4 Days)

- Basics of Dow theory trading strategy forecasts

- Motive (Impulse) Waves

- Corrective Waves

- Wyckoff Chart Reading

Kind attention: this course is helpful for beginner and intermediate traders. It’s free for everyone. Advanced modules, trading strategies, and data (in-depth) are available for Moneymunch’s premium subscribers.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.