The Over-trade Tornado Code: A Trader’s Roadmap

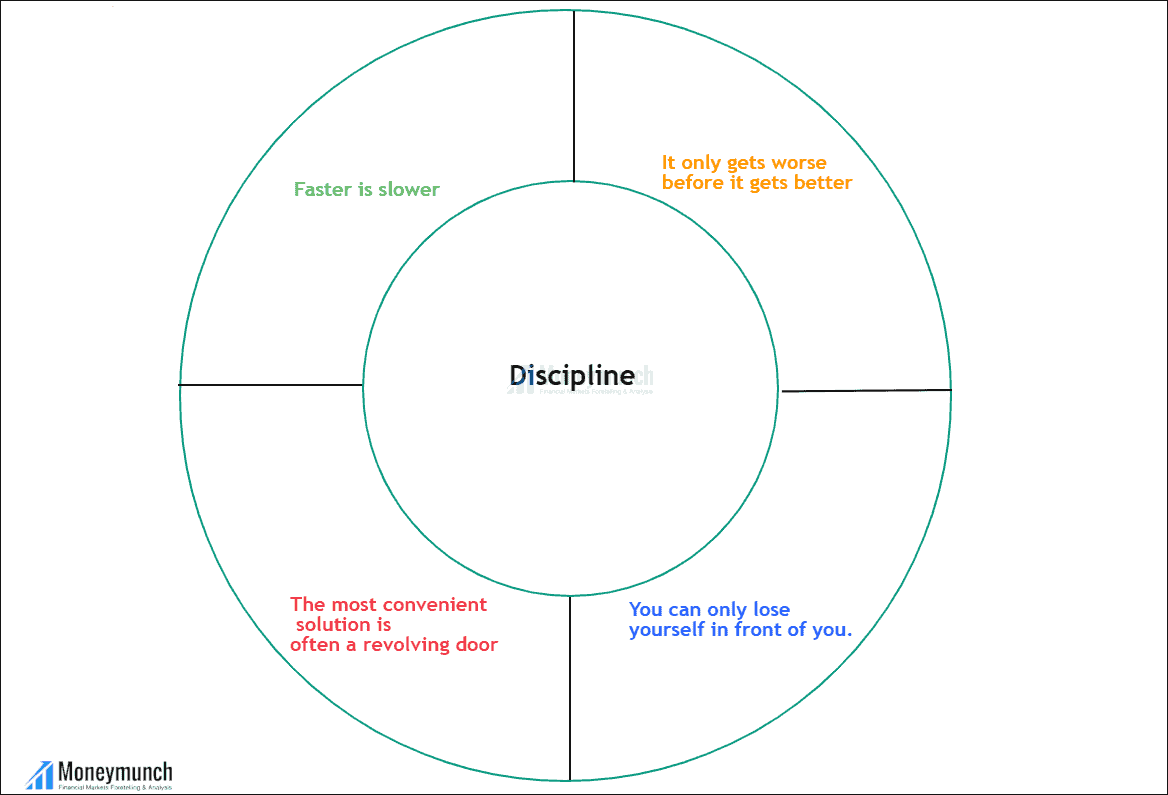

Part 10: Trading Psychology – Discipline

Discipline is nothing but self-control. Applied to trading, discipline is one of the most crucial factors on the road to profitability without discipline you will generally fail on the road to success! Because without discipline, you won’t stick to the rules, and you won’t continue to develop in the long run, you’ll do something productive here and there, but that’s not enough! If you want to develop discipline, you have to make your daily actions a habit.

Continue reading

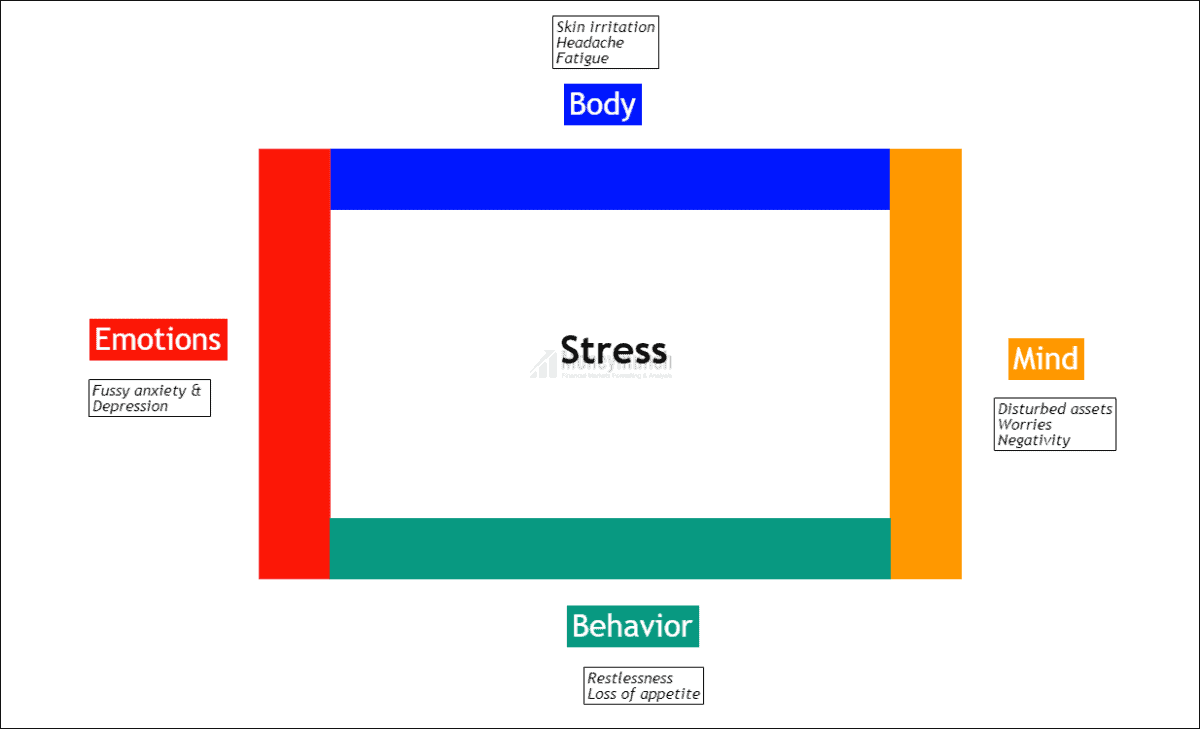

Continue readingPart 9: Trading Psychology – Stress in trading

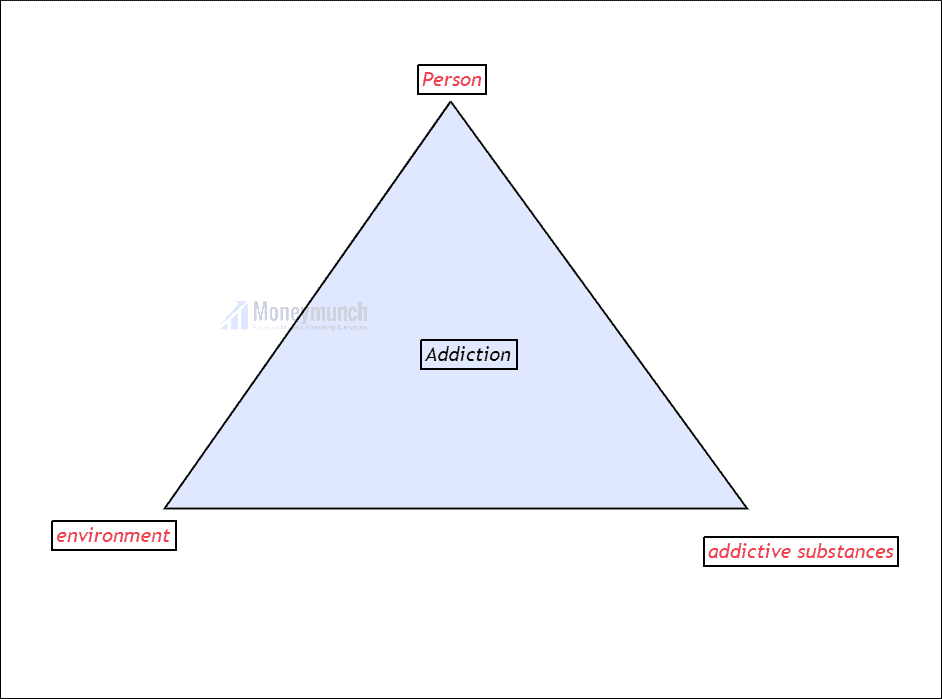

Part 8: Trading Psychology –Trading addiction

Part 7: Trading Psychology – Too much knowledge

Trading system:

It is a superstition to think that the one with the most knowledge is the better trader, it is usually the other way around as more knowledge can create confusion. True to the motto “if you want to catch two rabbits, you won’t catch one”. Unfortunately, I have to disappoint anyone who focuses on several trading systems and wants to master all of them perfectly, it will turn out rather badly. You will see several things from several differentContinue reading