Analyzing Gold’s Technical Trends and Economic Influences

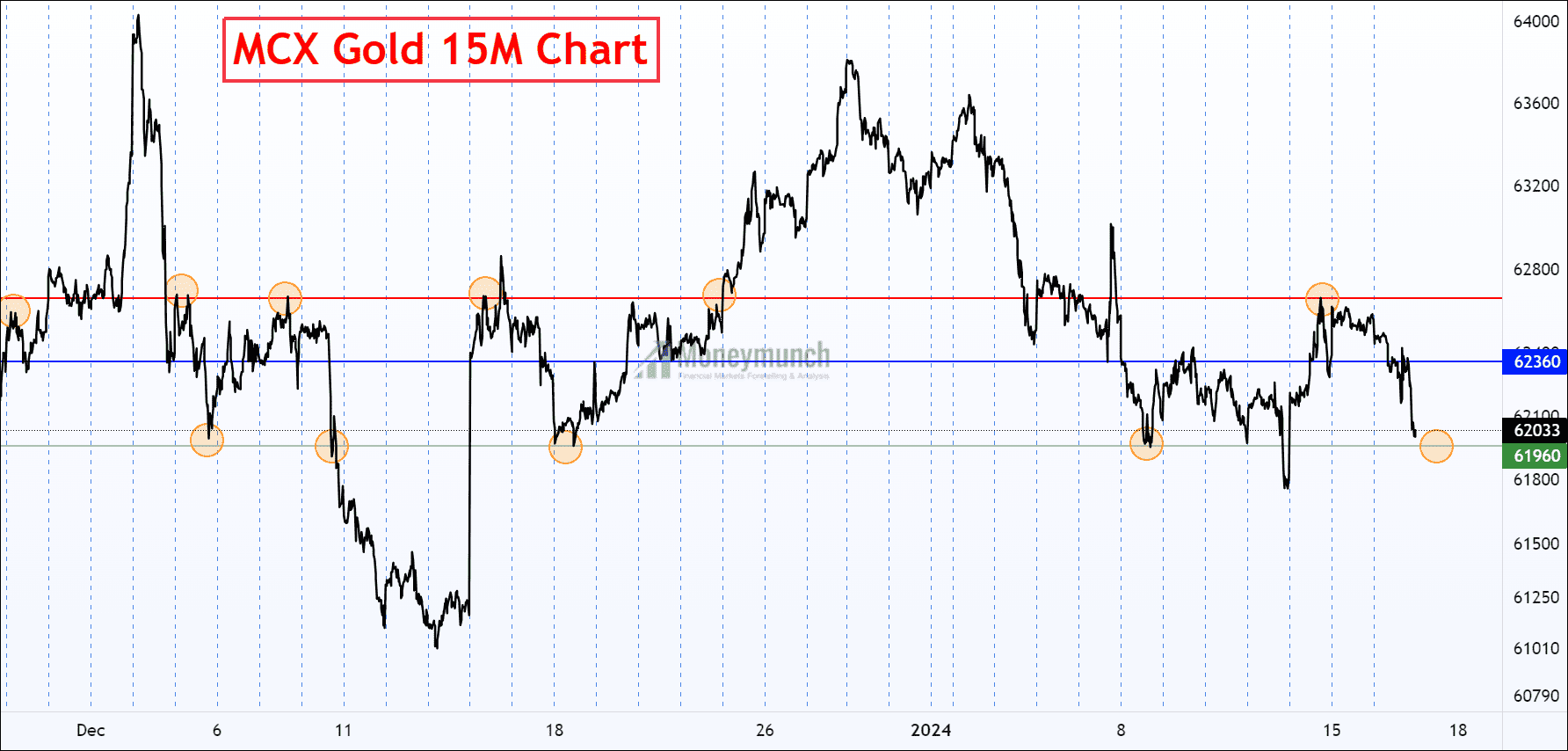

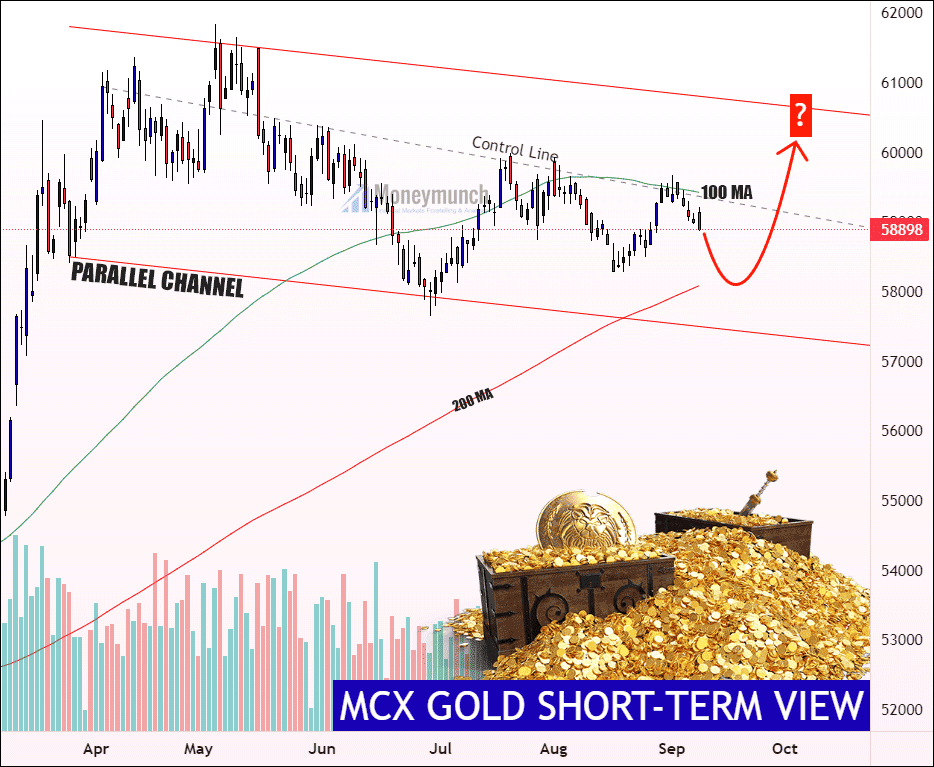

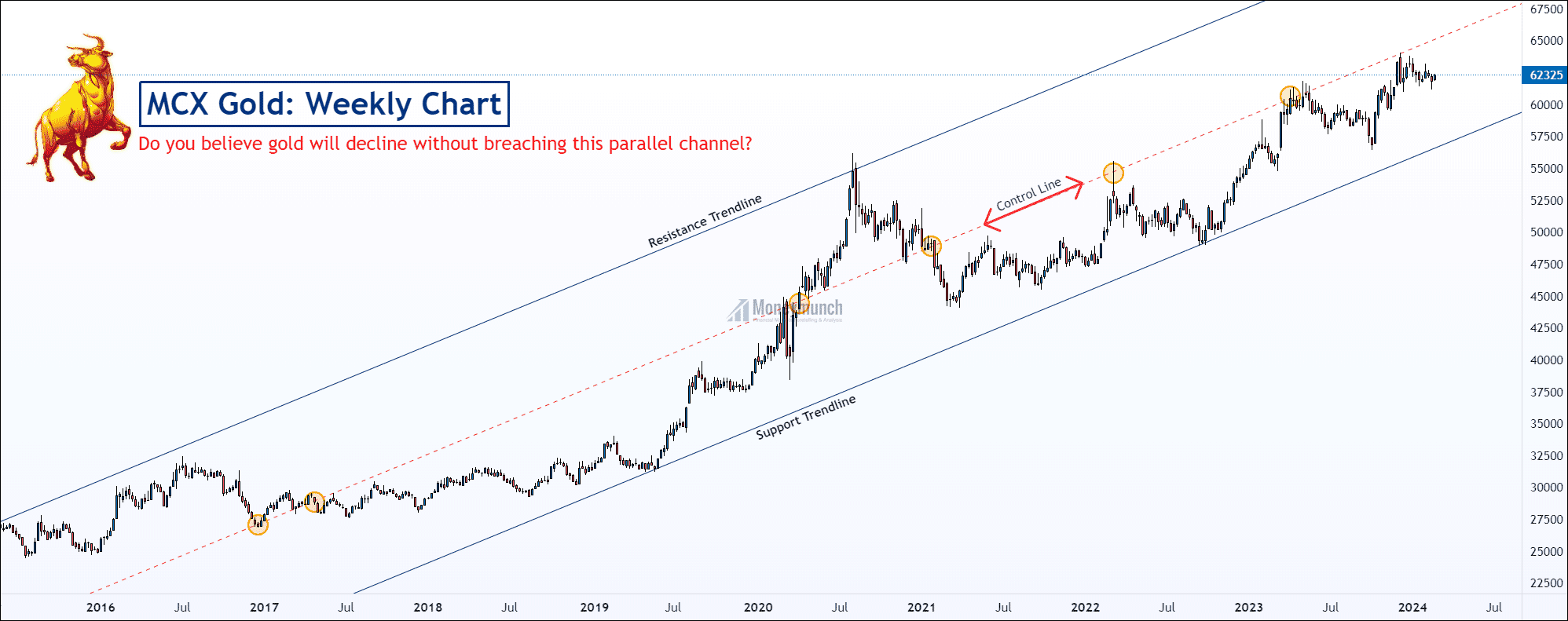

MCX Gold is currently moving within a parallel channel, suggesting potential upticks to 63600 – 64160 – 65000 levels. Last week, it rose by 0.75%, gaining 467 points.

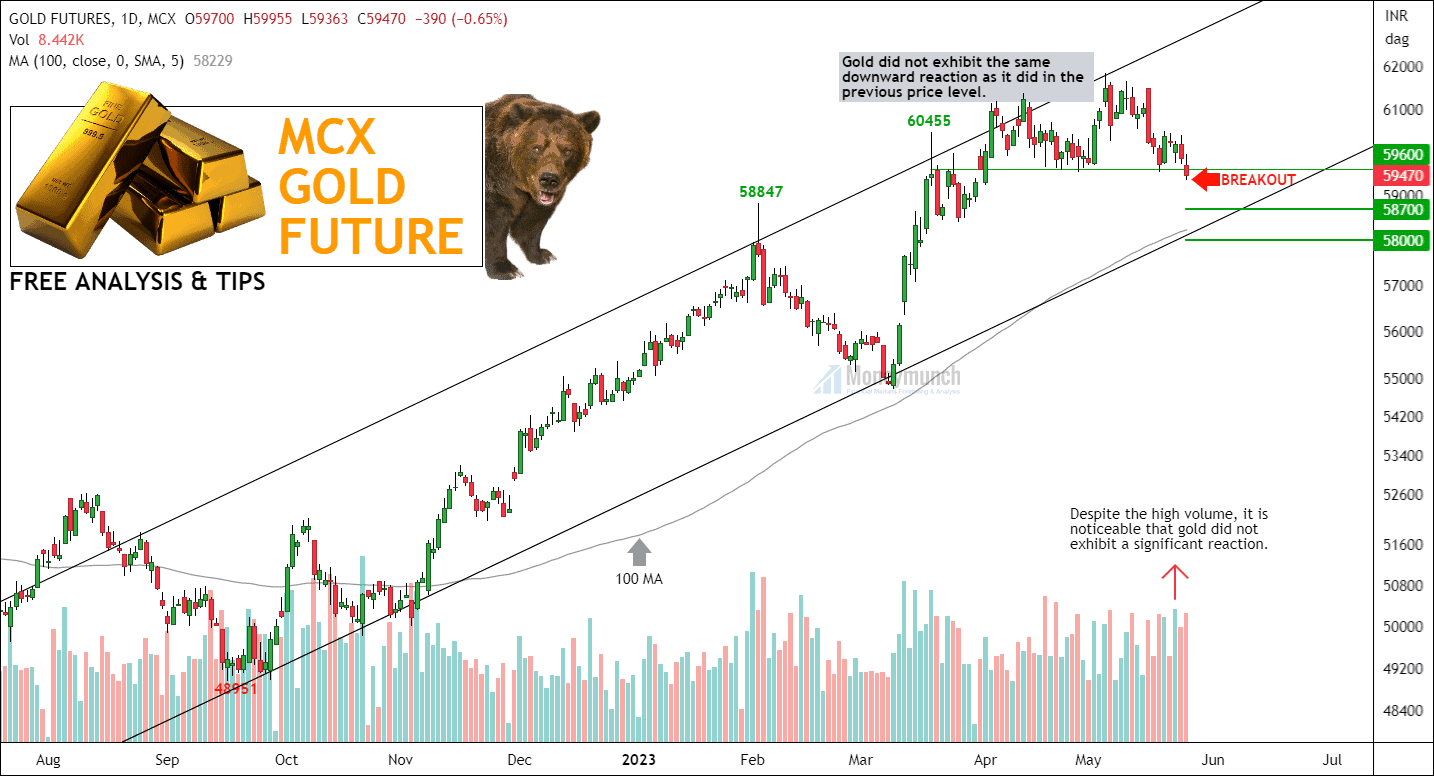

Gold faces selling pressure near the Control Line. To maintain an upward trend, it must break the 62600 level. If not, it may drop to 61160 – 59600, especially for intraday traders.

Key Economic Events:

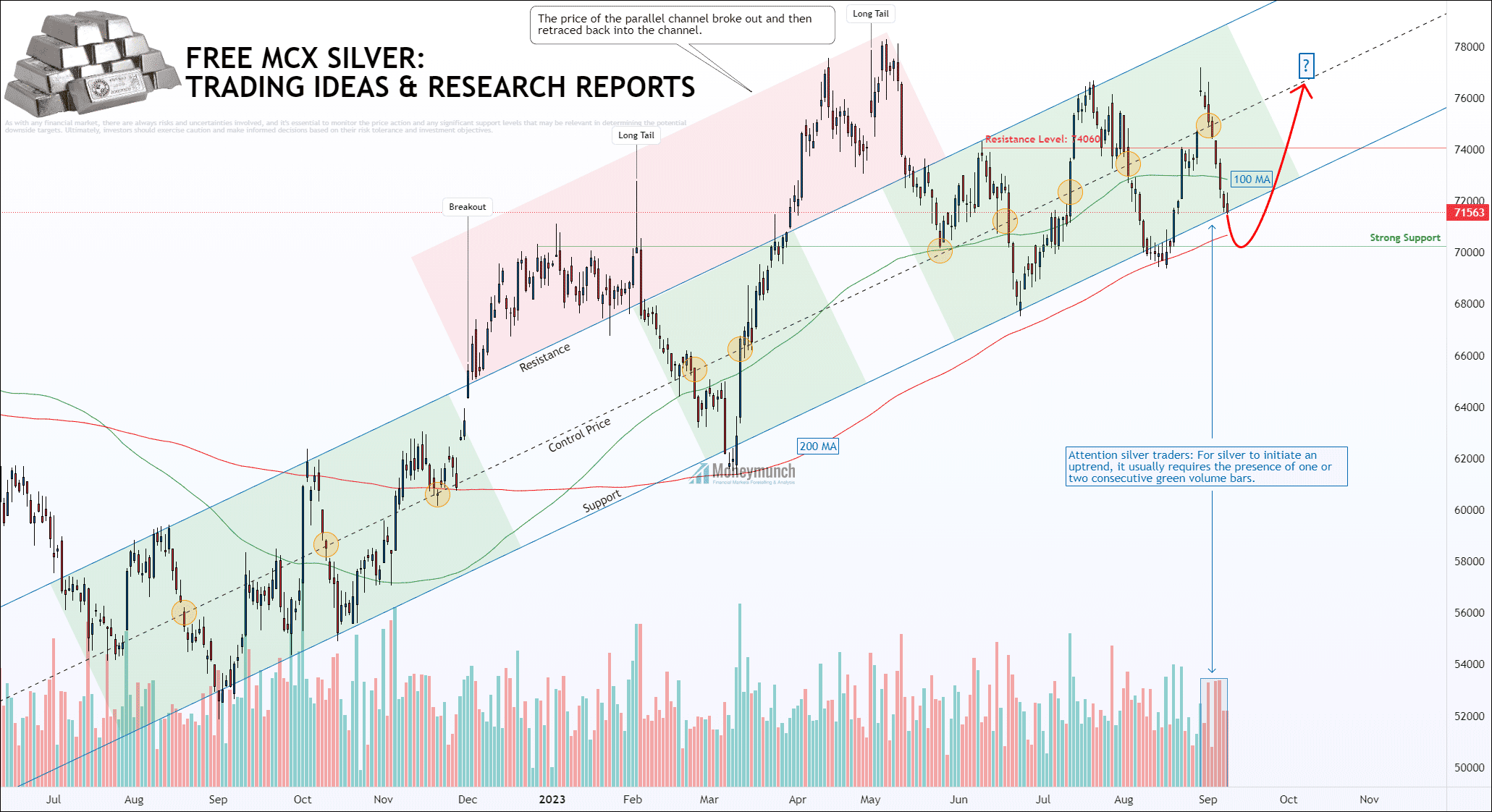

These events might affect gold, silver, crude oil, and natural gas prices:

Continue reading