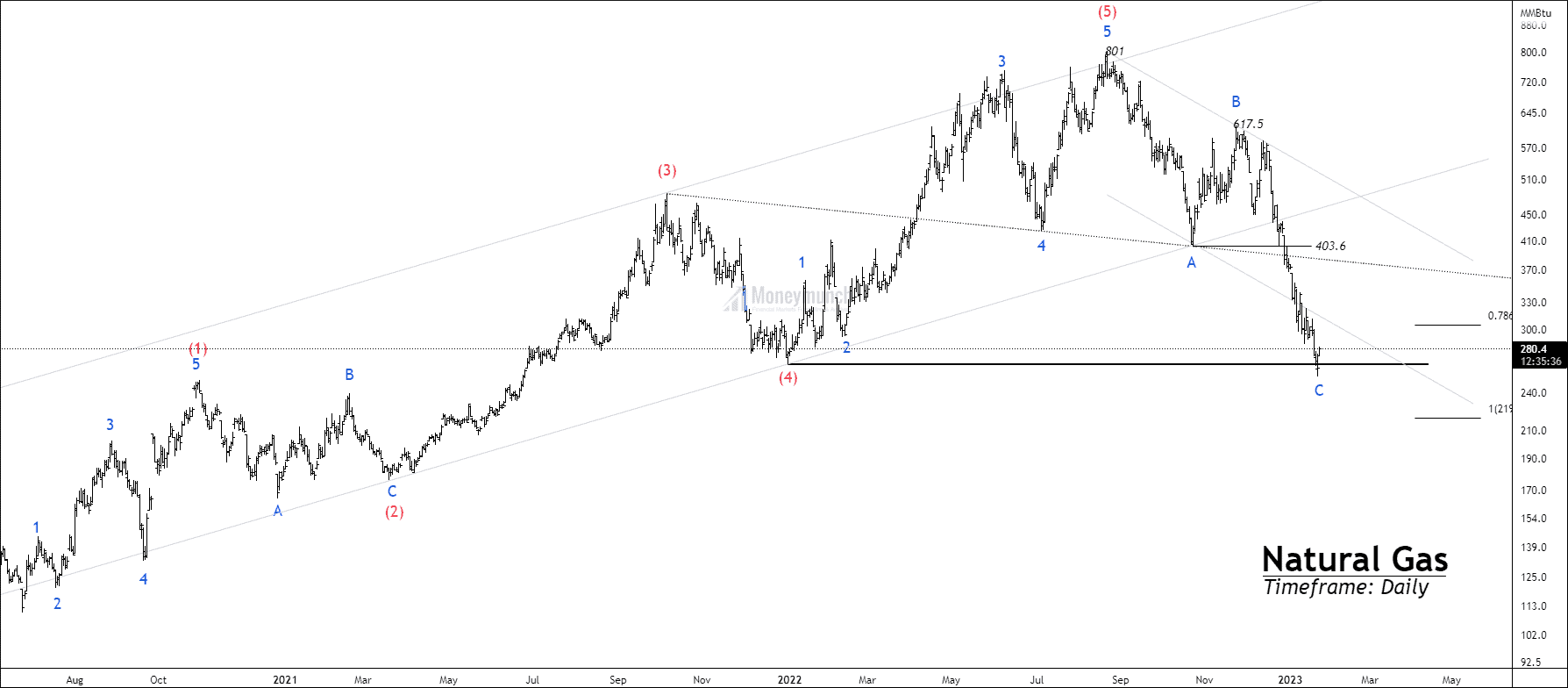

In our previous article, we discussed impulsive wave C and its continuation. On 20 January 2023, Price achieved our all given targets.

Click here: MCX Natural Gas – Elliott Wave projection

Enhance your MCX natural gas trading skills with Moneymunch’s free natural gas trading tips and market analysis. Stay updated on the latest commodity market trends and make profitable trades.

In our previous article, we discussed impulsive wave C and its continuation. On 20 January 2023, Price achieved our all given targets.

Click here: MCX Natural Gas – Elliott Wave projection

Continue reading

Continue readingDo you remember MCX Natural Gas Wave Analysis?

Click Here: MCX Natural Gas – Elliott Wave projection

I have written clearly, “If the price sustains below the lower band of the channel, traders can expect the following targets: 288 – 275 – 267.”

Do you remember MCX Natural Gas Wave Analysis?

Click Here: MCX Natural Gas – Elliott Wave projection

I have written clearly, “If the price sustains below the lower band of the channel, traders can expect the following targets: 288 – 275 – 267.”