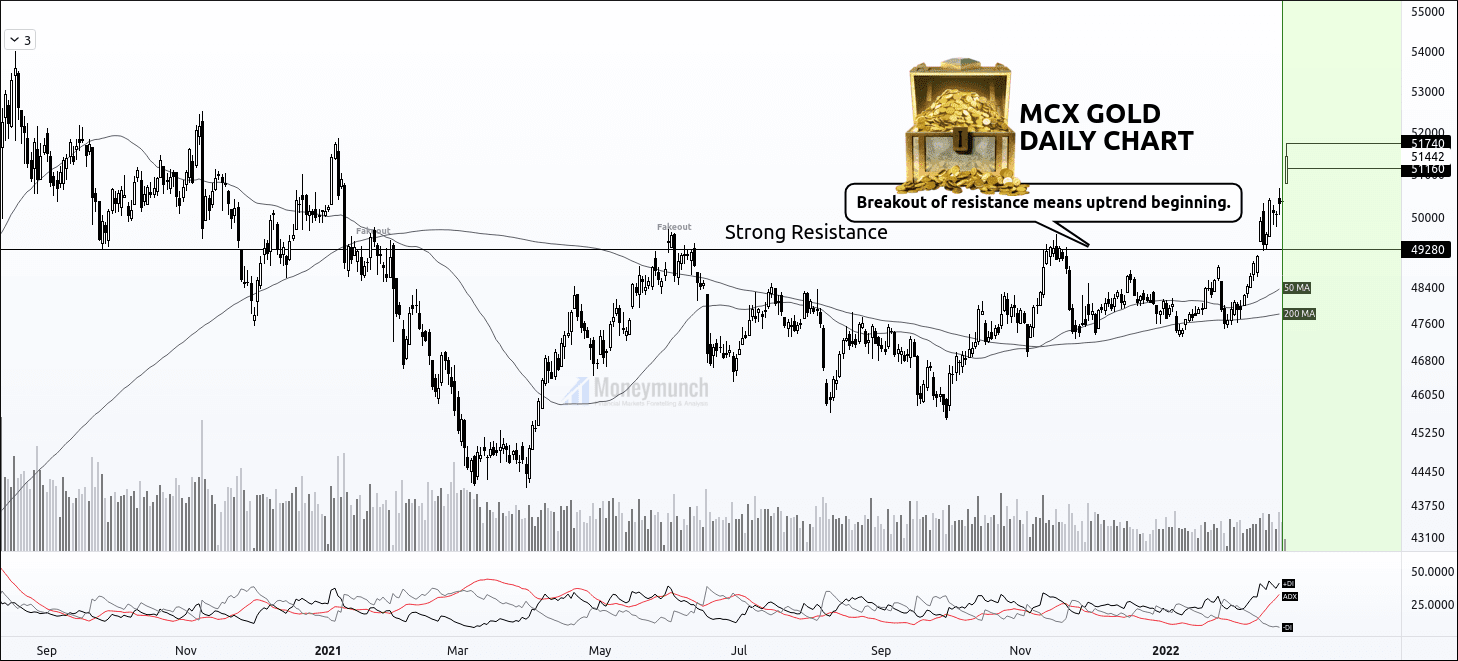

Did you read the gold report? If not, click the below link.

22 Feb 2022: MCX Gold’s Bullish Mode Activated

While the gold price at 50532, I had written, “we will see the gold price above 51160 – 51740“.

Today, it has touched the first & second target. Who bought it? Profit per lot: Rs.1,20,800

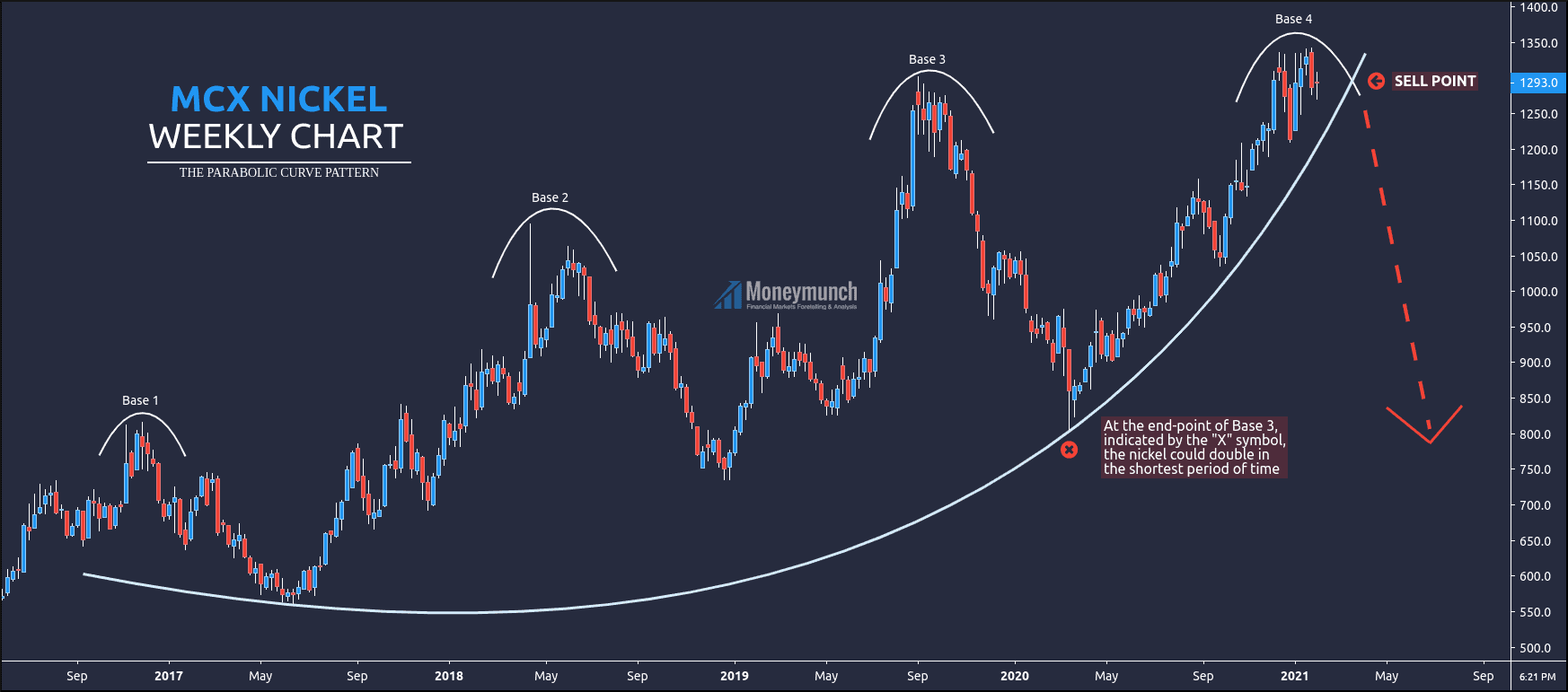

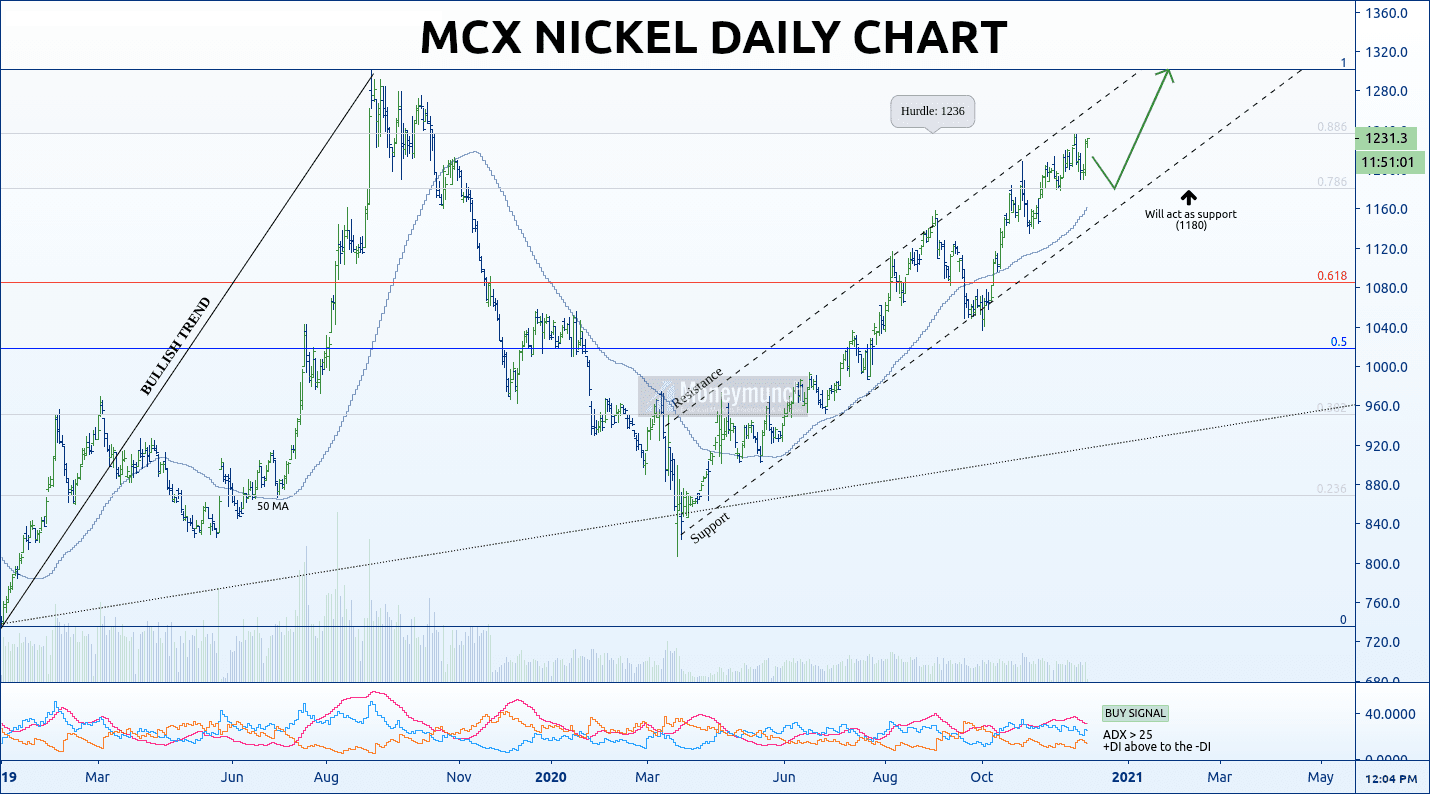

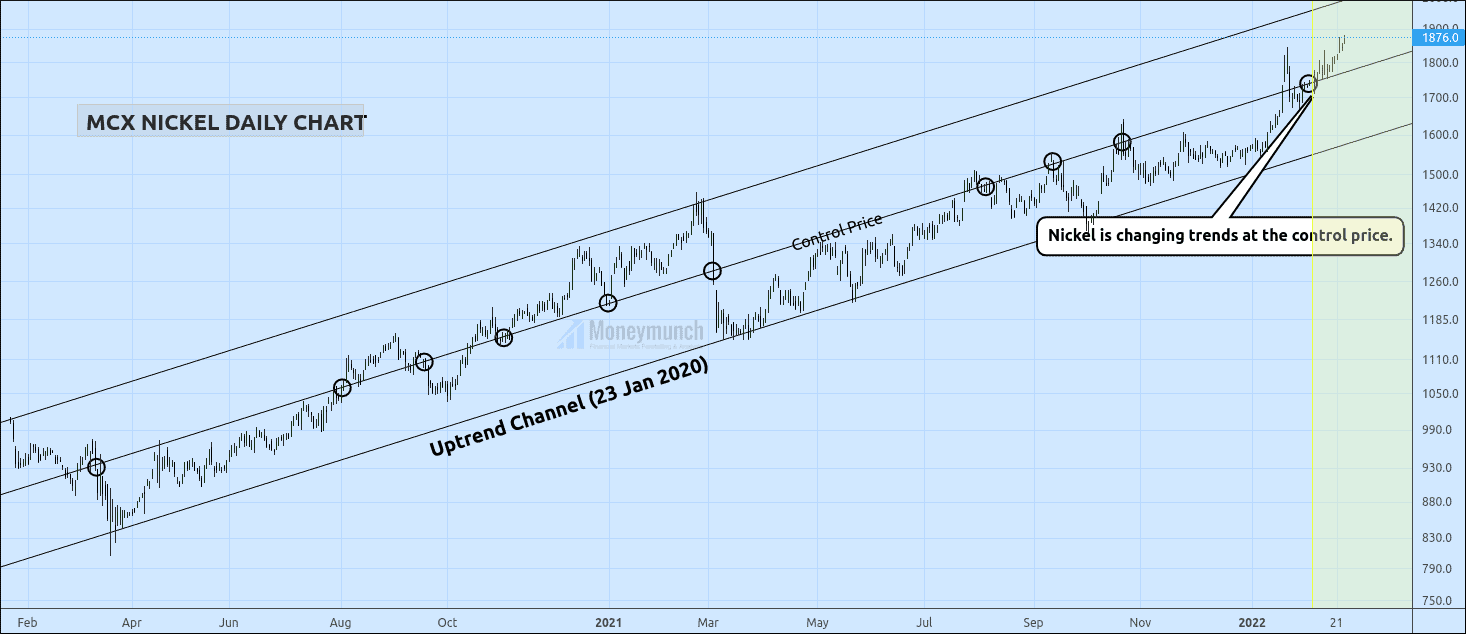

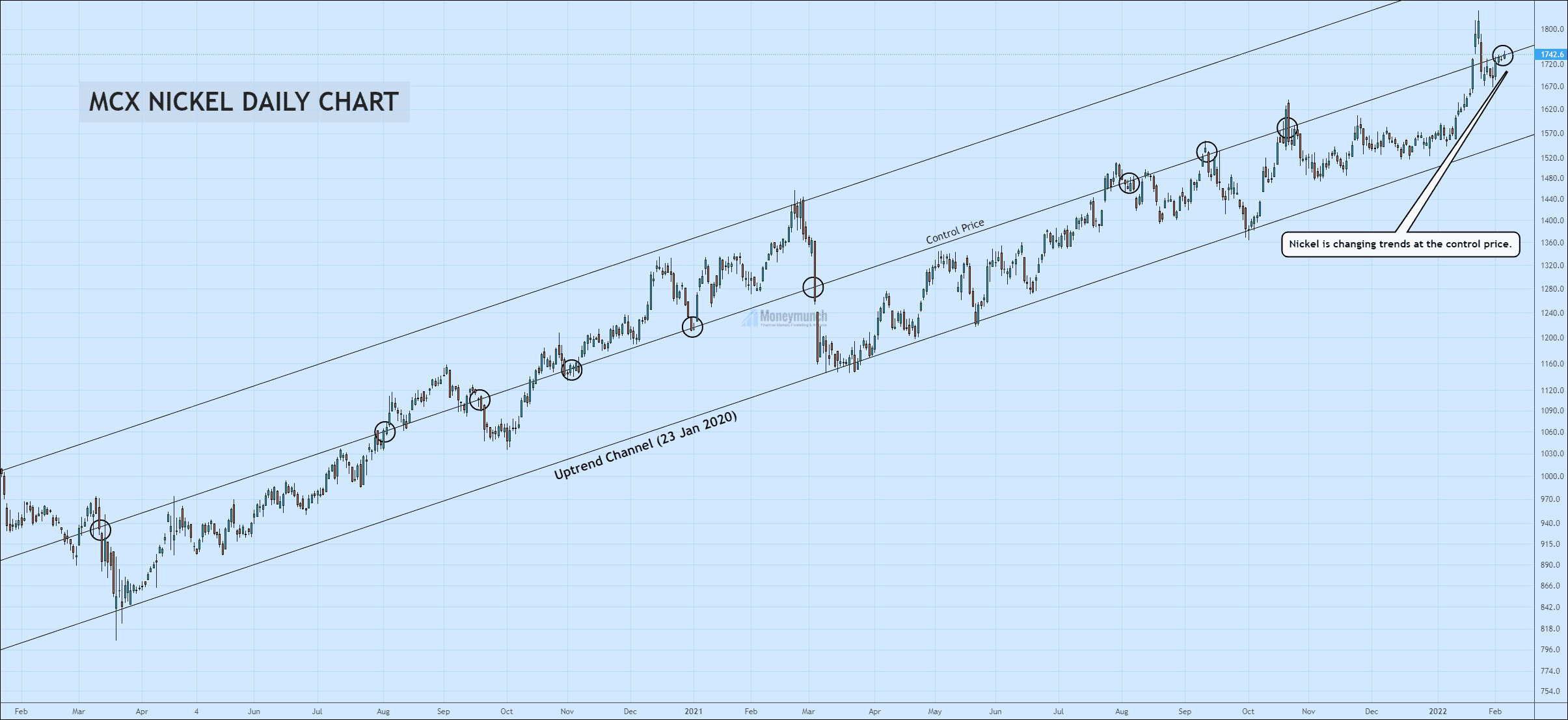

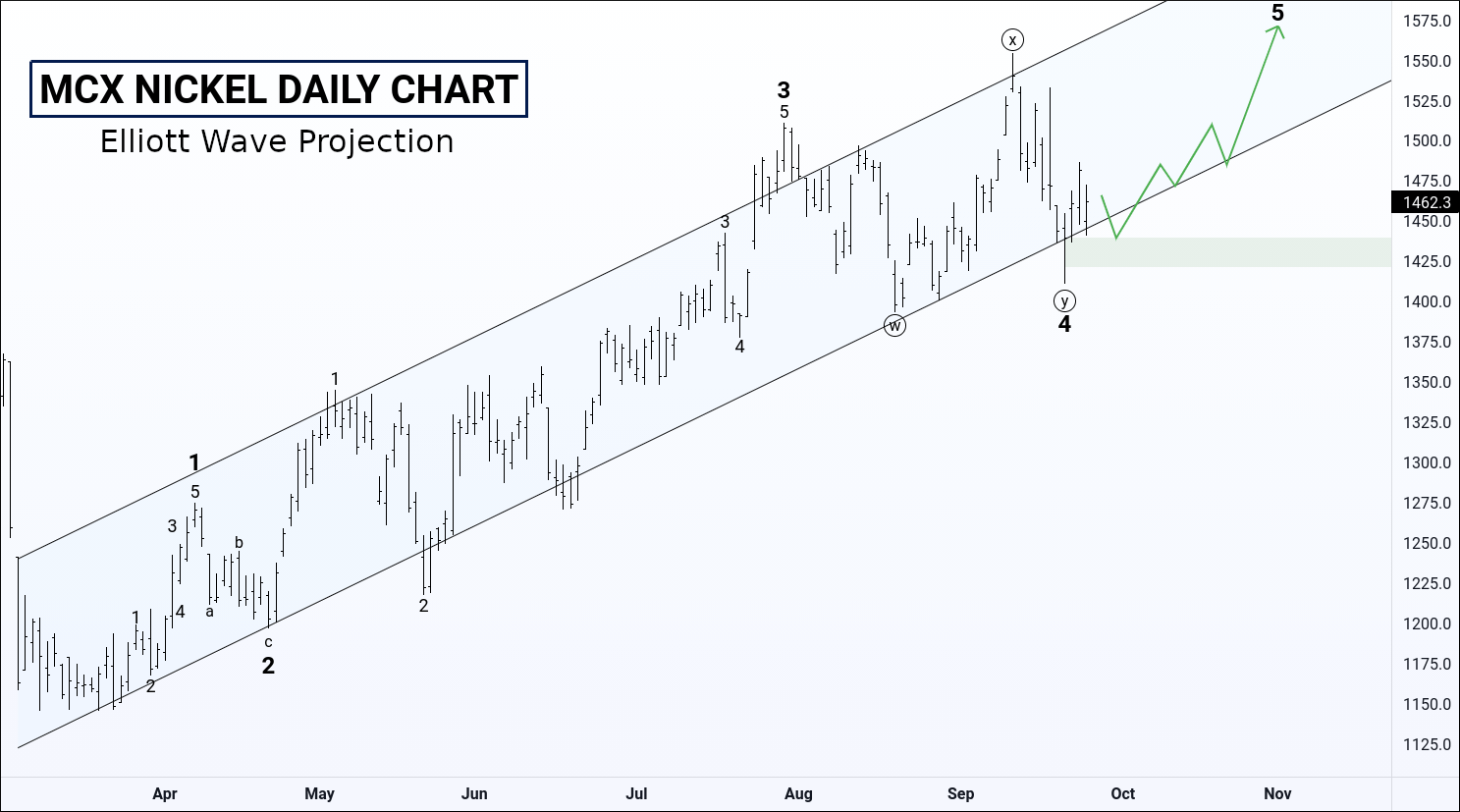

I have updated a full report of Nickel on Feb 6, 2022. Did you read it? If not, click the below link:

2020’s Uptrend Channel Is Everything For MCX Nickel

I had written, “It’s a sign for a buy signal. But intraday or short-term investors should confirm that breakout before proceeding. And they must look out for candle’s fakeout. Afterward, be ready for the targets of 1800 – 1840 – 1876+“.

Today nickel has touched all targets. Who bought it? The target was 133.4 points. Profit per lot: Rs.2,00,100

What else do you need from a free subscription!? To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock