This is the 28th Day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

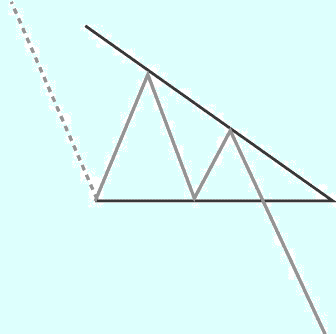

Descending Continuation Triangle Chart Pattern

Implication

A Descending Continuation Triangle is regarded a bearish signal, suggesting that the present downtrend might continue.

Description

A Descending Continuation Triangle features two converging trend lines. The bottom trend line is side to side and the top trend line mountains downward. The design shows lows happening at a frequent rate stage, with highs moving continually lower. The pattern indicates two highs pressing the upper trend line and two lows touching the lower trend line.

This pattern is confirmed whenever the price breaks out of the triangle constitution to close further down the lower trend line.

Amount is an significant factor to consider. Typically, volume follows a reliable pattern: volume should diminish as the price swings back and forth between an progressively narrow range of highs and lows. Then again, when breakout occurs, there should be a noticeable increase in volume. If this volume image is not clear, investors should be cautious about decisions made dependent on this design.

Important Characteristics

Following are important characteristics about this pattern.

Occurrence of a Breakout

Technical analysts purchase close awareness to how long the Triangle requires to determine to its apex. The basic rule is that prices should break out – certainly penetrate the lower trend line – somewhere amongst three-quarters and two-thirds of the horizontally width of the creation. The break out, in other words, should happen well before the pattern achieves the apex of the Triangle. The closer the breakout happens to the apex the less trustworthy the design.

Duration of the Triangle

The Triangle is a comparatively short-term pattern. This might consume from one to three months to form.

Shape of Descending Triangle

The horizontal bottom trend line require not be perfectly horizontal.

Volume

Investors must view volume decreasing as the pattern progresses toward the apex of the Triangle. At breakout, however, here must be a significant increase in volume.

Trading Considerations

Duration of Pattern

Think about the duration of the pattern and its interconnection to your trading time intelect. The period of the design is considered to be an signal of the duration of the effect of this pattern. The longer the pattern the longer it will consume for the price to accomplish its target. The small the pattern the faster the price changes. In case you are thinking about a short-term trading possibility, browse for a pattern with a short period. If you are considering a longer-term trading opportunity, look for a pattern with a longer duration.

Target Price

The concentrate on volume produces an essential indication about the prospective price move that this pattern shows. Choose whether the target price for this pattern is enough to provide adequate returns after your costs (like as profits) have been taken into fund. A ideal rule of thumb is that the target price must indicate a potential return of greater than 5% before a pattern should be thought to be helpful. However you must consider the current amount and the volume of shares you intend to trade. Also, confirm that the target price has not at the moment been reached.

Inbound Trend

The inbound trend is an important characteristic of the pattern. A shallow inbound trend may indicate a period of consolidation before the price move indicated by the pattern begins. Look for an inbound trend that is longer than the duration of the pattern. A good rule of thumb is that the inbound trend should be at least 2 times the duration of the pattern.

Criteria that Supports

Look for a region of support at the bottom trend line and a line of resistance at the highest high of the Triangle.

Moving Average

Compare prices to the 200 day Moving Average. When prices are close to or touch the 200 day Moving Average this alert is considered stronger.

Volume

A strong volume increase on the day of the pattern confirmation is a strong indicator in support of the potential for this pattern. The volume spike should be significantly above the average of the volume for the duration of the pattern. In addition, the volume during the duration of the pattern should be declining on average.

Criteria that Refutes

No Volume Spike on Breakout

The lack of a volume spike on the day of the pattern confirmation is an indication that this pattern may not be reliable. In addition, if the volume has remained constant, or was increasing, over the duration of the pattern, then this pattern should be considered less reliable.

Short Inbound Trend

An inbound trend that is significantly shorter than the pattern duration is an indication that this pattern should be considered less reliable.

Underlying Behavior

This pattern with its increasingly higher highs and constant lows indicates that sellers are more aggressive than buyers.

Message for you(Trader/Investor): Google has the answers to most all of your questions, after exploring Google if you still have thoughts or questions my Email is open 24/7. Each week you will receive your Course Materials. You can print it and highlight for your Technical Analysis Training.

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?

TABLE OF CONTENTS

Candlestick and Chart Patterns (15 Days)

7 Most Important Candlestick Chart Patterns

- Gap Down Chart Pattern

- Gap Up Chart Pattern

- Gravestone Short-term Chart Pattern

- Hammer Candle Stick Chart Pattern

- Hanging Man Short-term Stock Chart Pattern

- Inverted Hammer Stock Chart Pattern

- Shooting Star Candle Stick Pattern

Top 2 Bearish Chart Patterns

Top 6 Bullish Chart Patterns

- Engulfing Line (Bullish) Chart Pattern

- Exhaustion Bar Chart Pattern (Bullish)

- Inside Bar Chart Pattern

- Island Bottom Chart Pattern

- Key Reversal Bar (Bullish) Chart Pattern

- Two Bar Reversal (Bullish) Chart Pattern

Indicators & Oscillators (12 Days)

Bullish or Bearish Indicators

Bullish or Bearish Oscillators

- Bollinger Bands Oscillator

- Commodity Channel Index (CCI)

- Fast Stochastic Oscillator

- Know Sure Thing (KST) Oscillator

- Momentum Oscillator

- Moving Average Convergence/Divergence (MACD) Oscillator

- Relative Strength Index (RSI)

- Slow Stochastic Oscillator

- Williams %R Oscillator

Classic Chart Patterns (29 Days)

Bearish Classic Chart Patterns

- Continuation Diamond (Bearish) Chart Pattern

- Continuation Wedge (Bearish)

- Descending Continuation Triangle Chart Pattern

- Diamond Top Chart Pattern

- Double Top Chart Pattern

- Downside Break Chart Pattern – Rectangle

- Flag Bearish Chart Pattern

- Head and Shoulders Top Chart Pattern

- Megaphone Top Chart Pattern

- Pennant Bearish Chart Pattern

- Rounded Top Chart Pattern

- Symmetrical Continuation Triangle (Bearish)

- Top Triangle/Wedge Chart Pattern

- Triple Top Chart Pattern

Bullish Classic Chart Patterns

- Ascending Continuation Triangle Chart Pattern

- Bottom Triangle Or Wedge Chart Pattern

- Continuation Diamond (Bullish) Chart Pattern

- Continuation Wedge Chart Pattern (Bullish)

- Cup with Handle Bullish Chart Pattern

- Diamond Bottom Chart Pattern

- Double Bottom Chart Pattern

- Flag Bullish Chart Pattern

- Head and Shoulders Bottom Chart Pattern

- Megaphone Bottom Chart Pattern

- Pennant Bullish Chart Pattern

- Round Bottom Chart Pattern

- Symmetrical Continuation Triangle Bullish

- Triple Bottom Chart Pattern

- Upside Breakout Chart Pattern – Rectangle

Best Trading Theories (4 Days)

- Basics of Dow theory trading strategy forecasts

- Motive (Impulse) Waves

- Corrective Waves

- Wyckoff Chart Reading

Kind attention: this course is helpful for beginner and intermediate traders. It’s free for everyone. Advanced modules, trading strategies, and data (in-depth) are available for Moneymunch’s premium subscribers.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.