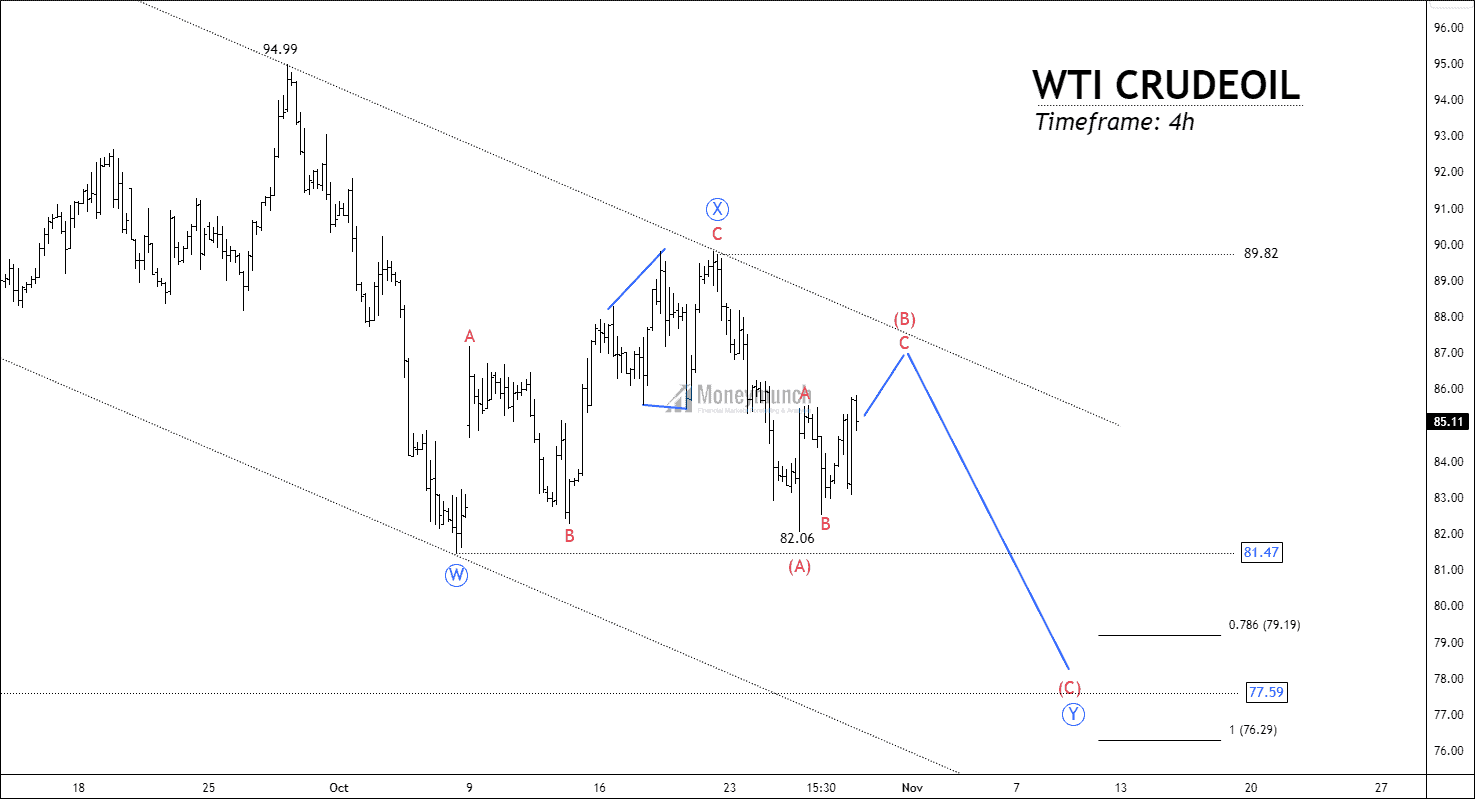

WTI CRUDEOIL – Elliott Wave Perspective

Is Crude Oil forming wave (5) of its wave cycle?

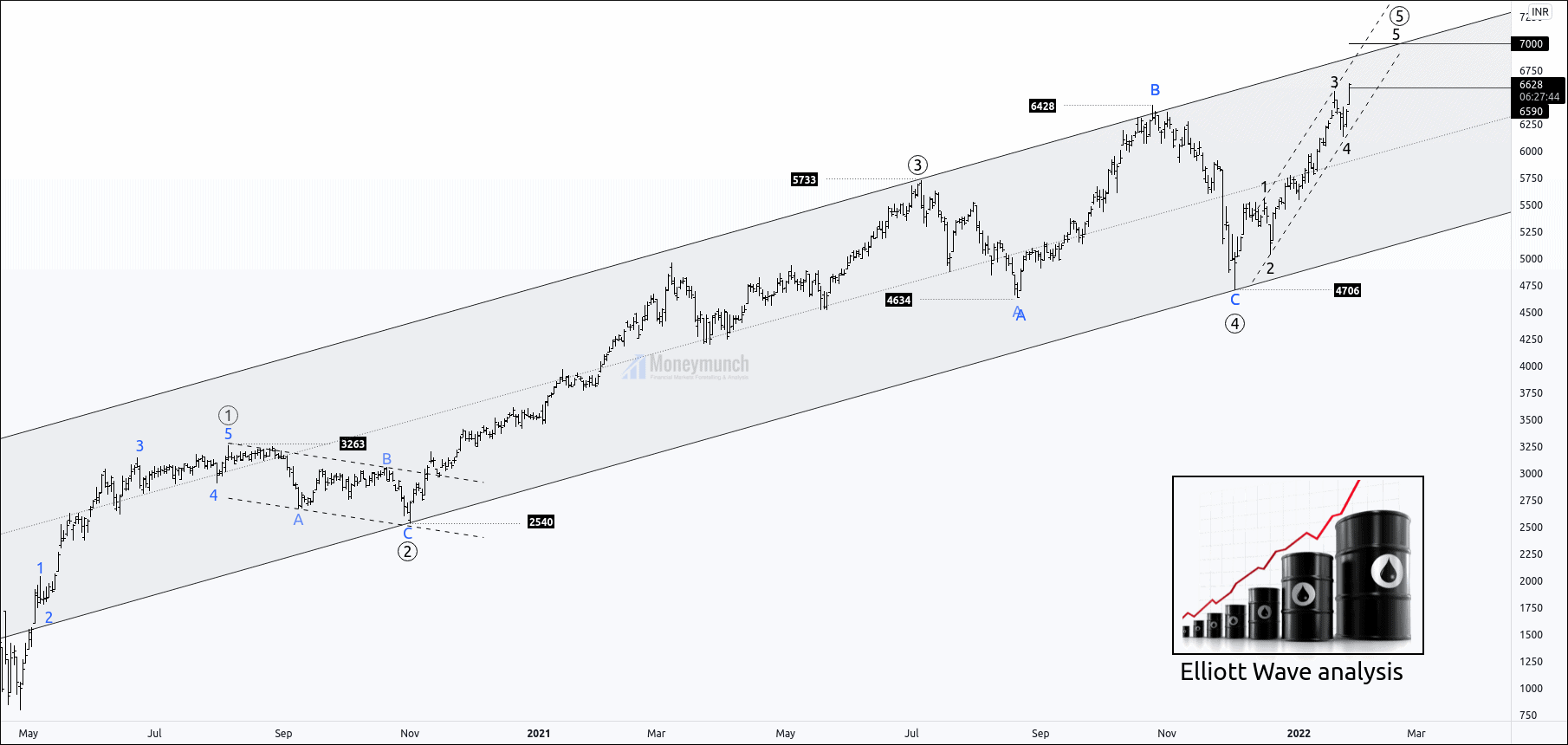

EWT: Will Crude Oil Reach 7000?

Crude oil is forming impulsive waves ((5)).

After the completion of wave ((3)), the price had started complex running flat of the corrective wave ((4)).

Wave B has crossed the high of wave ((3)), but wave B couldn’t break the low of wave A.

Price has made a failure of swing low, which was a rejection of a downtrend, and crude oil gained momentum.

Price has exceeded the sub-wave B of wave ((4)).

Sub-wave 4 of wave ((5)) is in progress.

If their price breaks out the high of wave 3, we can expect the following target for final sub-wave 6697-6785-6865+. It means the price has bullish sentiments above wave three and vice versa.

Breakout of the parallel channel shows the weakness of the impulsive wave. Note that wave four can never overlap the starting point of wave 1.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

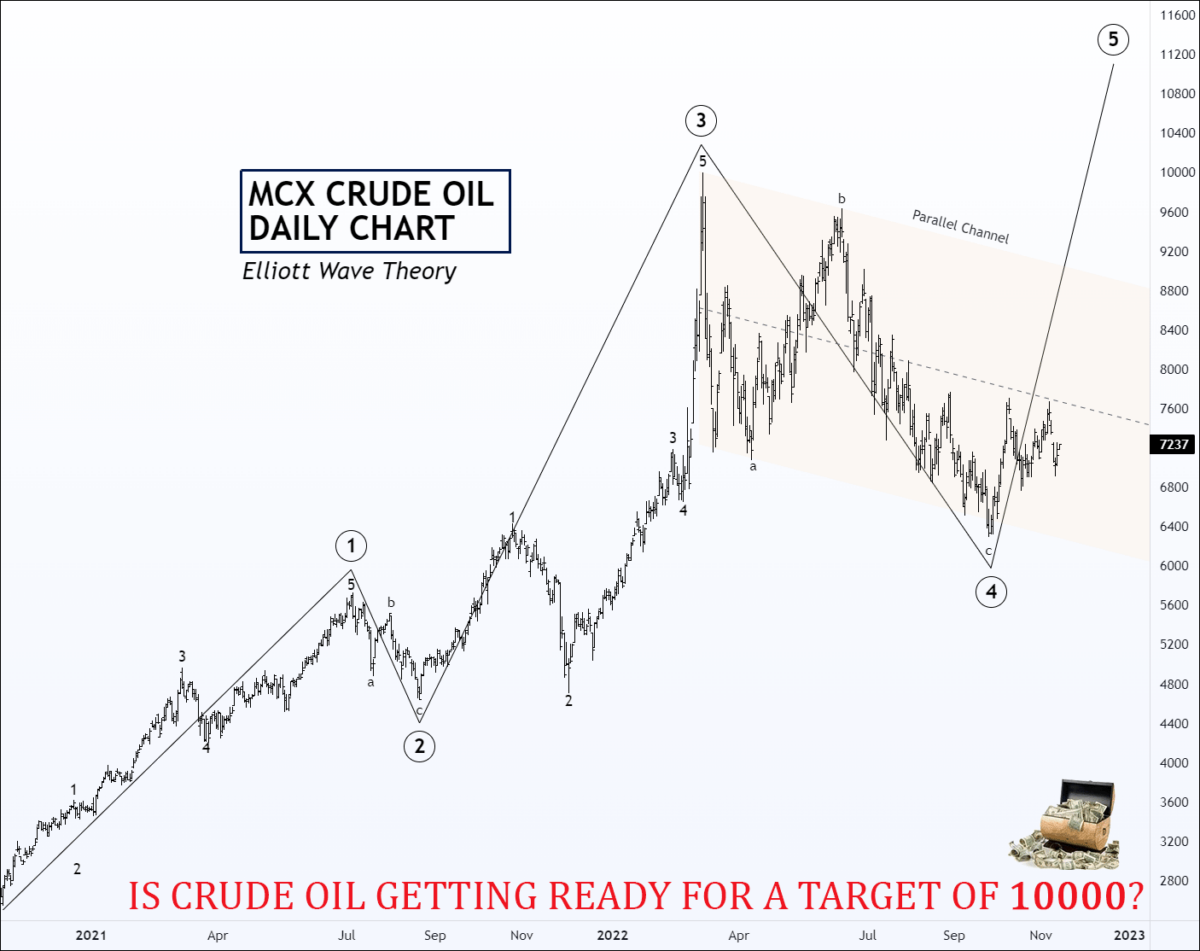

Crude Oil Elliott Wave Cycles Point More Upside

Price had made an extreme low at 795 on 20 Apr ’20.

It had started a quick recovery after an inviolable bottom-out. Due to bearish sentiments and no evidence of the verified bottom, it had constructed 2nd wave correction. The second wave retraced 38.2% of wave 1, which indicates a sturdy bull trend is ahead!

The acceleration phase lasted for 246 days and, the Fibonacci extension of wave 3 was 161.8% of the wave.

The public participation increased when the price had broken up the high of the first wave. It has the signal for bulls that crude was likely to make a new high.

After the acceleration phase, the price has corrected the bull phase with a double zigzag. It had retraced 38.2% of wave 3.

This correction was sharp in comparison with 2nd wave.

According to the above chart,

Wave 2 has taken 89 trading sessions to correct wave 1.

Wave 4 has taken 45 trading sessions to correct wave 3.

Wave 4 was a surprising disappointment for the bull traders.

Here, wave 3 is not a power extended because it hadn’t moved across wave 1.618% of wave 1.

According to the Elliott wave principle, commodities are more often extending at the 5th wave.

Currently, the price has made a new high of 6428.

Price has entered the corrective phase.

It is constructing the 4th sub-wave of the impulsive wave ((5)).

There are two possibilities,

1. If the price breaks the parallel channel, we can expect 50% to 61.8% retracement for wave 4. Be aware of the fake breakout!

Remember, entry is also not possible without an exact reversal signal.

Caution: Wave 4 can never overlap the starting point of wave 1.

2. Price is on the control line of the base channel.

The safe trader can enter the buying position when price breaks the wave B.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

MCX Gold & Crude Oil: Downside Risk?

Update 2: Gold Price Slowly Going Upside

Did you read the previous report of MCX Gold? If not, click the below link to read it.

Unlocking The Next Targets of MCX Gold, Crude oil, & Aluminium

I had written, “Key levels: 48113 – 47616

MCX gold has been moving under the range of 48113 – 47616. It’s a very crucial point. We may see a continued uptrend ahead if it breaks and close above 0.382 retracement level. That can be up to 48260 – 48490 – 48600 – 48700“.

Gold has taken a reversal after hitting the first target. Do you think it will go upside from here? To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Update: Beware, Crude Oil Bulls – That’s the Beginning of the End

First, click the below link and read the full crude oil report.

Unlocking The Next Targets of MCX Gold, Crude oil, & Aluminium

Here I had written in clear words, “Crude oil may keep running upward for the levels of 6360 – 6500+. To maintain an uptrend, it has to crossover the hurdle level of 6290 by closing above”.

It has touched the first target and bounced off to entry-level again. MCX crude oil will keep moving forward until kick at the last TP.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock