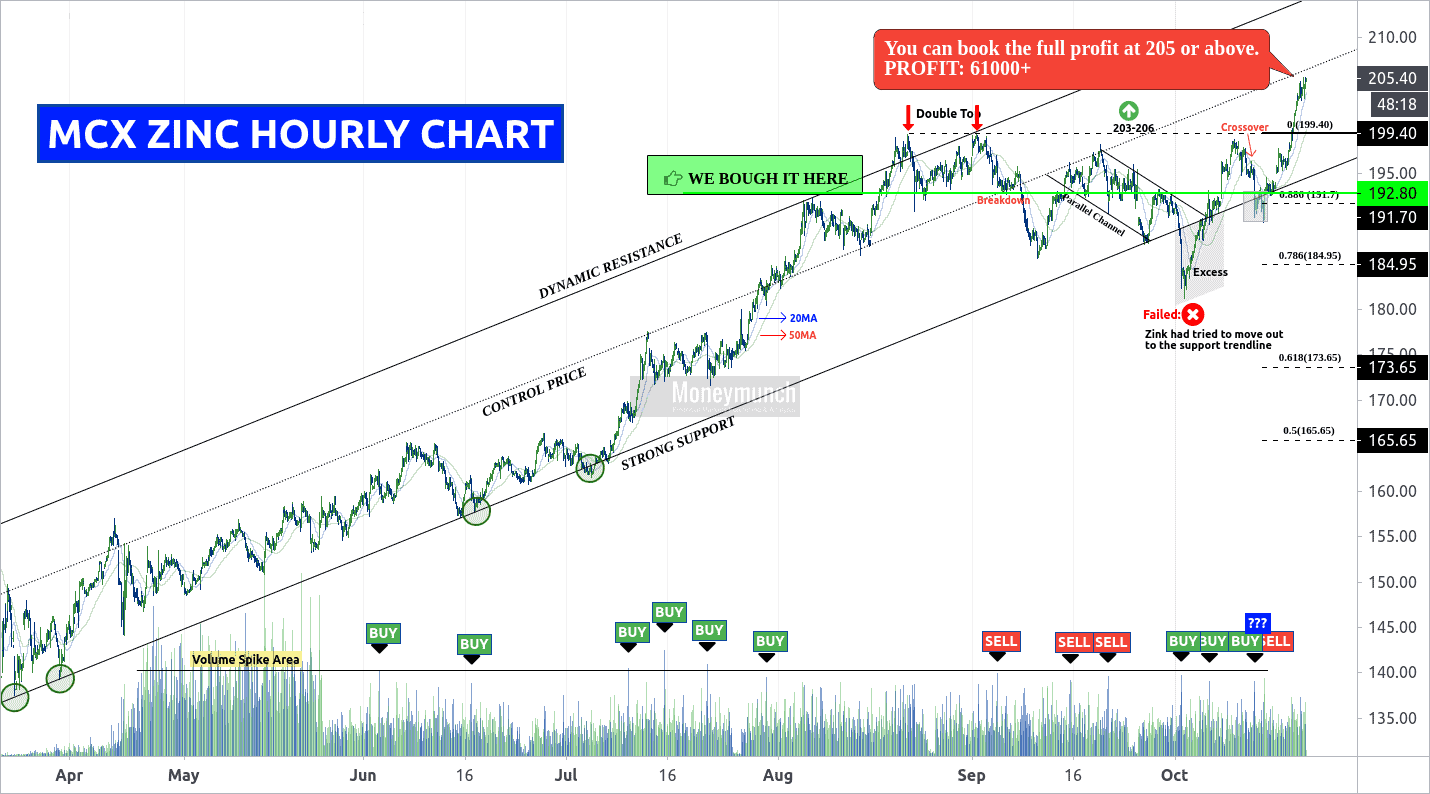

MCX Zinc Analysis

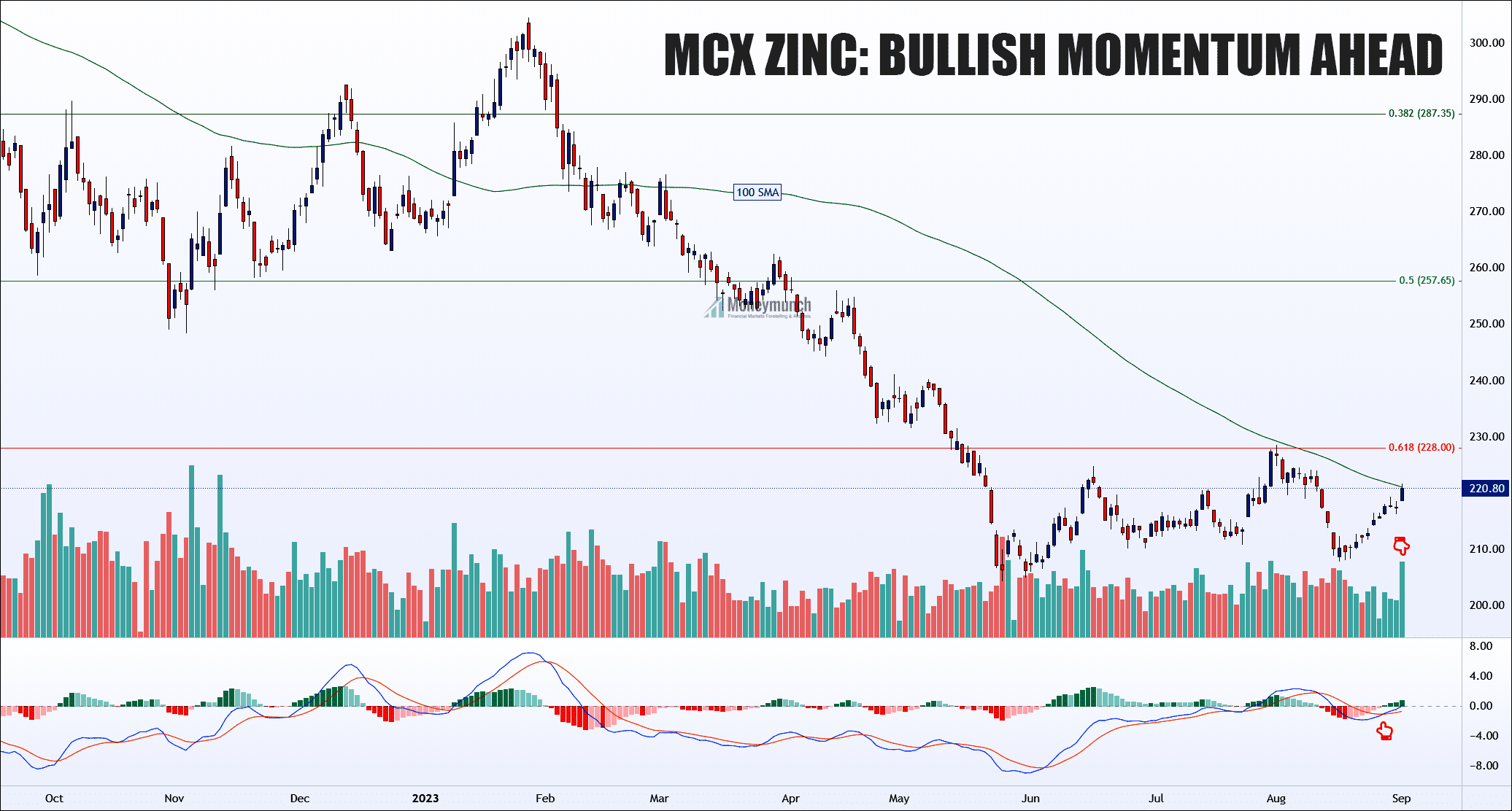

Examining the daily chart of MCX Zinc utilizing Fibonacci retracement, notable developments are observed. In May 2023, Zinc breached the 61.8% retracement level but did not test the subsequent level at 78.6%. Instead, it retraced back to the 61.8% level. The pivotal level of 228 suggests that the downtrend in Zinc may have concluded. This level holds significance as it could propel Zinc upwards, targeting levels of 236, 242, and potentially 257.6.

According to the principles of Fibonacci retracement, a weak trend reversal signal is indicative of a weak trend. Therefore, if Zinc breaches the red trendline, a potential downside with target prices of 212, 206, and 200 could be anticipated. Caution is advised between the 61.8% retracement level and the trendline.

MCX Aluminum Outlook

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock