This is the 39th Day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

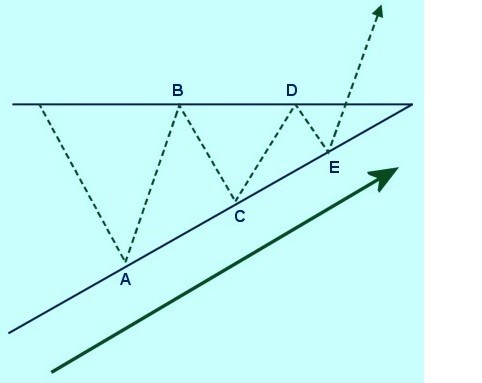

Ascending Continuation Triangle Chart Pattern

Implication

An Ascending Continuation Triangle is regarded a bullish indication. It suggests a potential extension of the existing uptrend.

An Ascending Continuation Triangle shows 2 converging trendlines. The reduce trendline is increasing and the upper trendline is side to side.

This structure happens considering the lows are moving progressively higher although the highs are preserving a frequent cost level.

The structure will own two highs and 2 lows, all pressing the trendlines.

This structure is verified when the cost breaks out of the triangle enhancement to shut above the upper trendline.

Quantity is an significant element to think about. Mostly, amount follows a dependable structure: quantity should reduce as the cost swings back and forth amongst an more and more filter variety of highs and lows. However, when breakout happens, there should be a apparent enhance in amount. If this amount picture is not obvious, individuals should be cautious about measures based on this Triangle.

Important Characteristics

Following are important characteristics about this pattern.

Occurrence of a Breakout

Technical analysts pay close understanding to how long the Triangle provides to create to its top. The basic rule is that costs should break out – obviously enter one of the trendlines – somewhere between three-quarters and two-thirds of the horizontal width of the development. The break out, in other words, should happen well earlier the structure reaches the apex of the Triangle.

Duration of the Triangle

The Triangle is a fairly short-term structure. It may take among one and 3 months to develop.

Shape of Triangle

The horizontal top trendline need not be completely horizontal but it should be near to horizontal.

Volume

Traders should see amount reducing as the design advances toward the apex of the Triangle. At breakout, though there should be a obvious enhance in quantity.

Trading Considerations

Pattern Duration

Give consideration to the period of the structure and its connection to your investing time perspectives. The timeframe of the structure is regarded to be an indication of the timeframe of the impact of this structure. The extended the pattern the extended it will take for the price to move to the Target. The shorter the structure the earlier the cost move. If you are researching a short-term trading alternative, look for a structure with a short period. If you are researching a longer-term trading opportunity, look for a structure with a extended length.

Target Price

The desired cost produces an significant indicator about the prospective cost move that this structure signifies. Consider whether the focus on cost for this structure is adequate to provide sufficient gains after your costs have been utilized into account.

Criteria that Supports

Volume

Volume should reduce as the structure varieties.

Criteria that Refutes

Moving Average

The entrance of the 200-day Moving Average by the cost is a incorrect bear signal.

Rising or Stable Volume

Volume should reduce as the structure forms. If volume continues to be the equivalent or improves this signal is less dependable.

Underlying Behavior

In this structure costs side gradually reduce in a converging pattern i.e. there are lower highs and lower lows showing that bears are successful over bulls. However, at the breakout point the bulls emerge the victors and the price rises.

Message for you(Trader/Investor): Google has the answers to most all of your questions, after exploring Google if you still have thoughts or questions my Email is open 24/7. Each week you will receive your Course Materials. You can print it and highlight for your Technical Analysis Training.

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?

TABLE OF CONTENTS

Candlestick and Chart Patterns (15 Days)

7 Most Important Candlestick Chart Patterns

- Gap Down Chart Pattern

- Gap Up Chart Pattern

- Gravestone Short-term Chart Pattern

- Hammer Candle Stick Chart Pattern

- Hanging Man Short-term Stock Chart Pattern

- Inverted Hammer Stock Chart Pattern

- Shooting Star Candle Stick Pattern

Top 2 Bearish Chart Patterns

Top 6 Bullish Chart Patterns

- Engulfing Line (Bullish) Chart Pattern

- Exhaustion Bar Chart Pattern (Bullish)

- Inside Bar Chart Pattern

- Island Bottom Chart Pattern

- Key Reversal Bar (Bullish) Chart Pattern

- Two Bar Reversal (Bullish) Chart Pattern

Indicators & Oscillators (12 Days)

Bullish or Bearish Indicators

Bullish or Bearish Oscillators

- Bollinger Bands Oscillator

- Commodity Channel Index (CCI)

- Fast Stochastic Oscillator

- Know Sure Thing (KST) Oscillator

- Momentum Oscillator

- Moving Average Convergence/Divergence (MACD) Oscillator

- Relative Strength Index (RSI)

- Slow Stochastic Oscillator

- Williams %R Oscillator

Classic Chart Patterns (29 Days)

Bearish Classic Chart Patterns

- Continuation Diamond (Bearish) Chart Pattern

- Continuation Wedge (Bearish)

- Descending Continuation Triangle Chart Pattern

- Diamond Top Chart Pattern

- Double Top Chart Pattern

- Downside Break Chart Pattern – Rectangle

- Flag Bearish Chart Pattern

- Head and Shoulders Top Chart Pattern

- Megaphone Top Chart Pattern

- Pennant Bearish Chart Pattern

- Rounded Top Chart Pattern

- Symmetrical Continuation Triangle (Bearish)

- Top Triangle/Wedge Chart Pattern

- Triple Top Chart Pattern

Bullish Classic Chart Patterns

- Ascending Continuation Triangle Chart Pattern

- Bottom Triangle Or Wedge Chart Pattern

- Continuation Diamond (Bullish) Chart Pattern

- Continuation Wedge Chart Pattern (Bullish)

- Cup with Handle Bullish Chart Pattern

- Diamond Bottom Chart Pattern

- Double Bottom Chart Pattern

- Flag Bullish Chart Pattern

- Head and Shoulders Bottom Chart Pattern

- Megaphone Bottom Chart Pattern

- Pennant Bullish Chart Pattern

- Round Bottom Chart Pattern

- Symmetrical Continuation Triangle Bullish

- Triple Bottom Chart Pattern

- Upside Breakout Chart Pattern – Rectangle

Best Trading Theories (4 Days)

- Basics of Dow theory trading strategy forecasts

- Motive (Impulse) Waves

- Corrective Waves

- Wyckoff Chart Reading

Kind attention: this course is helpful for beginner and intermediate traders. It’s free for everyone. Advanced modules, trading strategies, and data (in-depth) are available for Moneymunch’s premium subscribers.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.