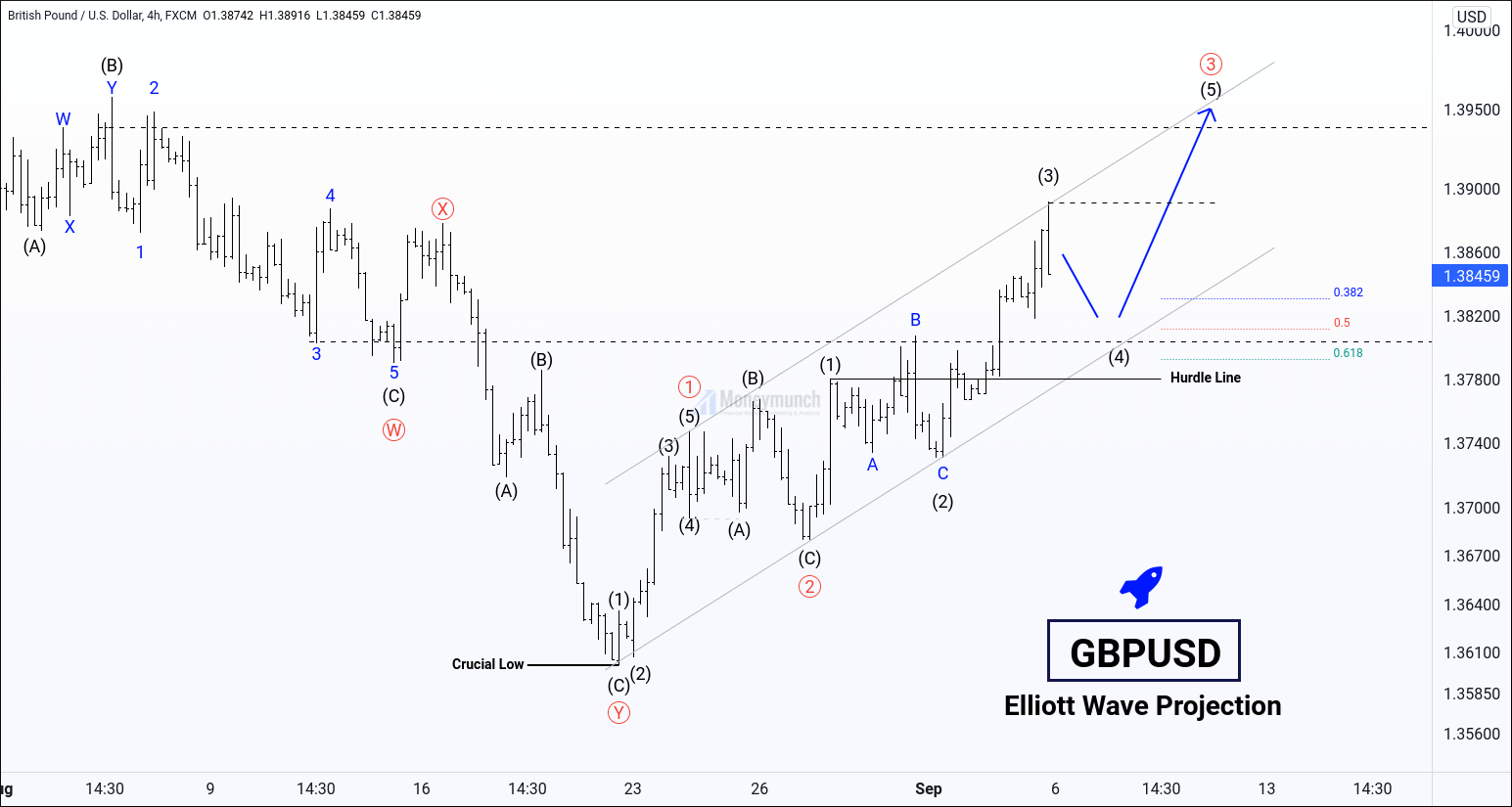

Extreme low has given us beautiful Impulsive structures.

Wave ((1))

Wave Nature: Motive wave

Type of motive wave: Impulse (Five waves)

Wave ((2))

Wave Nature: Corrective waves

Type of corrective pattern: Irregular or Expanded flat.

Retracement of wave ((2)): 50% of wave ((1)).

Wave ((3))

Wave Nature: Impulse (3rd wave can only be an Impulse with 5 waves)

Extension of wave ((3)) :

At this motion, price is riding on sub-wave (3) of wave ((3)).

Wave has an extension of ((3)) 161.8%, but the party is not over yet.

We are to get waves (4) and (5) of wave ((3)). One can expect 2.618% of wave ((3)) and even more!

Sub-waves of wave ((3)) :

Wave (1) is an impulse.

Wave (2) is an irregular flat.

Wave (3) is an impulse.

Extension: 161.8% of wave 1

The price extension of wave (3) is 161.8%. If the price breaks the 1.39154 level without any correction, we will have a powerful extension.

Wave (4):

According to rules of alternation, if the second wave seems flat & time-consuming, then wave four can be sharp and quick.

We may get a running triangle or a zigzag correction.

Common Retracement: 38.2% of 3rd wave at 1.38305

50% of 3rd wave at 1.38101

61.8% of 3rd wave at 1.37924

50% retracement for wave 4 is acceptable for two reasons:

1. An Important support level is the 1.38107 – 50% retracement level of Wave 3.

2. Wave 4 is more often complete nearby the sub-wave (4) of wave ((3)).

If the price breaks the hurdle line, Continue reading

Lock

Lock