“Technical Analysis Training”

This is the 21th Day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

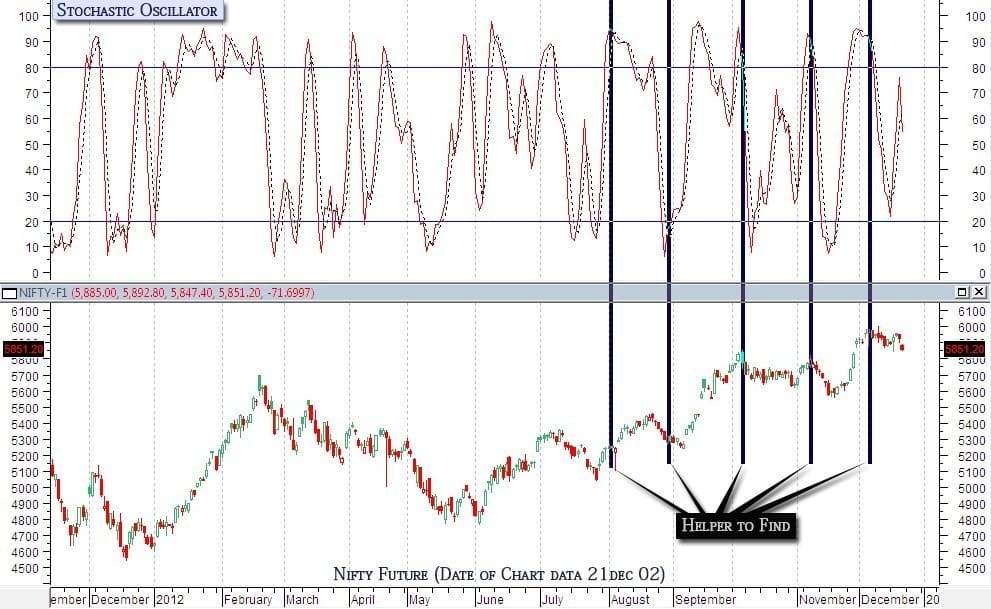

Fast Stochastic Oscillator

Effect of Fast Stochastic Oscillator

Recognize identifies a strong event for a fast stochastic oscillator when:

- Bullish: %K and additionally %D lines fall below and additionally then increase above the twenty threshold, indicating bullish potential, along with a %K occupation cross above the %D line, triggering a bullish signal celebration if our 3 crossovers take place within a 5-day period.

- Bearish: %K and also %D lines increase above and then fall below the 80 limit, indicating bearish prospective, along with a %K occupation cross below the %D occupation, triggering a bearish signal event if or when our 3 crossovers take place in a 5-day period.

Story

The fast stochastic oscillator compares two marks labeled as the %K and additionally %D lines to anticipate the chance of some kind of uptrend or even a downtrend. In price charts, the %K line usually appears because a powerful occupation, plus the %D occupation appears since a dotted occupation. The fast stochastic oscillator can be utilized effectively observe daily, once a week or monthly times.

Based on Martin J. Pring, George Lane developed the stochastic oscillator with the principle which during the course of a uptrend, the closing price tends to increase. However, when the uptrend matures, price tends to close towards the bottom of the price number for the period. Likewise, within a downtrend, the reverse holds true.

The differences amongst the fast and slow stochastic oscillators is the way that the %K and also %D standards are calculated. Slow stochastics are really based upon the moving averages values calculated for fast stochastics. As a result, John J. Murphy writes which most traders favor slow stochastics because the couple tend to be more dependable.

%K

For fast stochastics, the %K value is calculated as follows:

%K = 100 [(C-L)/(H-L)]

Where

C is the latest closing price of the extra stock

L is the lowest price of the stock for the period that you are monitoring. Recognia utilizes a 14-day period since the period observe.

H is the best price of the extra stock for the period you are spying. Recognia takes advantage of a 14-day period like the period to monitor.

%D

For fast stochastics, the %D value is based on top of a 3-period moving average of the %K value. The %D value is determined because follows:

%D = 100 x (H-L)

Just where

H is the sum of C-L inside the endure three times

L is the sum of H-L inside the final 3 periods

Pring identifies a option to distinguish the %K line from the %D occupation will be keep in mind that %K represents “Kwick” motions, whilst %D performances movements which “Dawdle”. Therefore, Edwards and Magee note which “[ordinarily], the %K Line could change movement prior to the %D Occupation. However, whenever %D line changes movement just before the %K occupation, a slow and also steady Reversal is usually indicated.”

Trading Factors

This point identifies that explain trading decisions using stochastics. It must be pointed out, which numerous technical analysts utilize stochastics in combination along with other patterns or oscillators. John J. Murphy, for instance, indicates that “[one] way to combine daily and regular stochastics will be to utilize weekly signals to determine the marketplace direction and also daily signals for timing. It’s another good tip to add together stochastics with RSI.”

As soon as you are using stochastics with price charts, keep the following factors in mind:

ExtremesOnce the %K line nears the 100% or perhaps 0% occupation a potent move is set to occur. Some technical analysts equate the extremes with overbought or oversold circumstances, and also which prices are unable to get any sort of a lot higher or perhaps lower. However, Edwards and also Magee identify which this is certainly not real in all circumstances, and that the extremes instead portray the resilience of a price move.

Divergences

A divergence is mentioned to have happened once the price and oscillator trend lines move in different directions. A price reversal may follow.

Hinges

Lane referred to a flattened %K or %D occupation since hinges. A hinge might indicate that the uptrend or downtrend is actually exhausted, and a price reversal may take place.

Crossovers

Whenever the price has got reached 70 or much higher, and additionally a divergence possess occurred, a crossover is the provide alert. To summarize Lane, Robert W. Colby writes which “the sell alert is a bit more trustworthy when %D has got already flipped down when %K crosses below %D”.”

Similarly, when the price possess reached twenty or perhaps lower, and additionally a divergence has happened, a crossover turns out to be the purchase signal. Robert W. Colby writes that “the buy alert is a bit more trustworthy whenever %D possess undoubtedly up down when %K crosses above %D”.”

Message for you(Trader/Investor): Google has the answers to most all of your questions, after exploring Google if you still have thoughts or questions my Email is open 24/7. Each week you will receive your Course Materials. You can print it and highlight for your Technical Analysis Training.

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?

TABLE OF CONTENTS

Candlestick and Chart Patterns (15 Days)

7 Most Important Candlestick Chart Patterns

- Gap Down Chart Pattern

- Gap Up Chart Pattern

- Gravestone Short-term Chart Pattern

- Hammer Candle Stick Chart Pattern

- Hanging Man Short-term Stock Chart Pattern

- Inverted Hammer Stock Chart Pattern

- Shooting Star Candle Stick Pattern

Top 2 Bearish Chart Patterns

Top 6 Bullish Chart Patterns

- Engulfing Line (Bullish) Chart Pattern

- Exhaustion Bar Chart Pattern (Bullish)

- Inside Bar Chart Pattern

- Island Bottom Chart Pattern

- Key Reversal Bar (Bullish) Chart Pattern

- Two Bar Reversal (Bullish) Chart Pattern

Indicators & Oscillators (12 Days)

Bullish or Bearish Indicators

Bullish or Bearish Oscillators

- Bollinger Bands Oscillator

- Commodity Channel Index (CCI)

- Fast Stochastic Oscillator

- Know Sure Thing (KST) Oscillator

- Momentum Oscillator

- Moving Average Convergence/Divergence (MACD) Oscillator

- Relative Strength Index (RSI)

- Slow Stochastic Oscillator

- Williams %R Oscillator

Classic Chart Patterns (29 Days)

Bearish Classic Chart Patterns

- Continuation Diamond (Bearish) Chart Pattern

- Continuation Wedge (Bearish)

- Descending Continuation Triangle Chart Pattern

- Diamond Top Chart Pattern

- Double Top Chart Pattern

- Downside Break Chart Pattern – Rectangle

- Flag Bearish Chart Pattern

- Head and Shoulders Top Chart Pattern

- Megaphone Top Chart Pattern

- Pennant Bearish Chart Pattern

- Rounded Top Chart Pattern

- Symmetrical Continuation Triangle (Bearish)

- Top Triangle/Wedge Chart Pattern

- Triple Top Chart Pattern

Bullish Classic Chart Patterns

- Ascending Continuation Triangle Chart Pattern

- Bottom Triangle Or Wedge Chart Pattern

- Continuation Diamond (Bullish) Chart Pattern

- Continuation Wedge Chart Pattern (Bullish)

- Cup with Handle Bullish Chart Pattern

- Diamond Bottom Chart Pattern

- Double Bottom Chart Pattern

- Flag Bullish Chart Pattern

- Head and Shoulders Bottom Chart Pattern

- Megaphone Bottom Chart Pattern

- Pennant Bullish Chart Pattern

- Round Bottom Chart Pattern

- Symmetrical Continuation Triangle Bullish

- Triple Bottom Chart Pattern

- Upside Breakout Chart Pattern – Rectangle

Best Trading Theories (4 Days)

- Basics of Dow theory trading strategy forecasts

- Motive (Impulse) Waves

- Corrective Waves

- Wyckoff Chart Reading

Kind attention: this course is helpful for beginner and intermediate traders. It’s free for everyone. Advanced modules, trading strategies, and data (in-depth) are available for Moneymunch’s premium subscribers.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.