This is the 33th Day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

Head and Shoulders Top Chart Pattern

Implication

A Head and Shoulders Top is regarded a bearish signal. It suggests a feasible reversal of the present uptrend to a new downtrend.

Description

The Head and Shoulders Top is an very well-known pattern one of investors because it’s one of the most dependable of all structures. It also looks to be an simple one to place. Beginner investors usually generate the error of viewing Head and Shoulders anywhere. Experienced technical analysts will notify you that it is tough to identify the genuine situations.

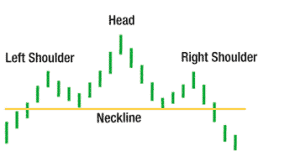

The classic Head and Shoulders Top appearance like a human head with shoulders on both side of the head. A best sample of the pattern has three crisp high points, developed by three effective rallies in the price of the economic application.

The first point – the left shoulder – happens as the price of the economic application in a increasing market occurs a high and then drops back. The second point – the head – occurs when prices increase to an still higher high and then fall back again. The third point – the right shoulder – occurs when prices rise once again but don’t hit the high of the head. Prices then fall back again once they have hit the high of the right shoulder. The shoulders are definitely lower than the head and, in a classic formation, are often approximately match to one different.

A key factor of the pattern is the neckline. The neckline is developed by attracting a line linking two low price points of the formation. The first low point happens at the end of the left shoulder and the starting of the uptrend to the head. The second represents the end of the head and the starting of the upturn to the right shoulder. The neckline can be horizontal or it can pitch up or down. The pattern is finish whenever the support supplied by the neckline is “broken.” This happens when the price of the economic device, dropping from the high point of the right shoulder, moves here the neckline. Technical analysts will usually say that the pattern is not verified until the price closes below the neckline – it is not sufficient for it to trade below the neckline.

There are various differences, many of that are explained here and can be just as legal as the classic development. Another factors – such as volume and the excellence of the breakout – should be regarded in association with the pattern itself

Variations of a Head and Shoulders Top

Following are some variations of the Head and Shoulder pattern that may occur.

The Drooping Shoulder

The sagging shoulder, where the neckline has a downward incline, is highly uncommon and displays overwhelming weak spot. The droop occurs because the price at the end of the head and the starting of the right shoulder has fell even lower than the previous low at the end of the left shoulder and the starting of the head. Most experts consent that a downward incline has bearish effects for market weak spot. When the right shoulder is drooping, the trader will have to wait longer than usual for a important neck break. It should also be recognized that when that important break does occur a lot of the move will have currently occurred.

Varying Width of Shoulders

The classic Head and Shoulders Top is symmetrical. However, if the shoulders don’t match in width, don’t discount the pattern.

Flat Shoulders

While the classic Head and Shoulders Top is made up of three sharp upward points, these need not be present for the pattern to be valid. Sometimes, shoulders can be rounded.

Multiple Head and Shoulders Patterns

Many valid Head and Shoulders patterns are not as well defined as the classical head with a shoulder on either side. It is not uncommon to see more than two shoulders and more than one head. A common version of a multiple Head and Shoulders pattern includes two left shoulders of more or less equal size, one head, and then two right shoulders that mimic the size and shape of the left shoulders.

Volume

Volume is extremely important for this pattern.

For a Head and Shoulders Top the volume pattern is as follows.

Volume is greatest when the left shoulder is creating. In reality, volume is frequently increasing as the uptrend goes on and additional and more buyers need to get in.

Volume is lowest on the right shoulder as investors notice a reversal occurring. Specialists say low volume stages on the right shoulder are a powerful mark of a reversal.

In the head part of the price pattern, volume falls someplace around the energy of the left shoulder and weakness of the right shoulder. Volume often grows when the neckline is broken as the reversal is now finish and downside force starts in serious. One of the key attributes seemed for in a Head and Shoulders Top by experienced Technical Analysts is too much high volume on the breakout.

Even though volume is significant, experts inform us not really to get found up in the exact number of shares getting traded. What is more significant are modifications in the rate of trading.

Important Characteristics

Following are important characteristics for this pattern.

Symmetry

The right and left shoulders peak at about the similar price level. In inclusion, the shoulders are often regarding the exact same length from the head. In another words, there should be about the exact same quantity of time amongst the improvement of the top of the left shoulder and the head as between the head and the top of the right shoulder. In the proper world, the formation will rarely be flawlessly symmetrical. Often one shoulder will be higher than the other or take more time to build.

Volume

Volume is highest on the left shoulder, lowest on the right shoulder and somewhere in between on the head.

Duration of the Pattern

Many experts mention that an typical pattern offers at least three months from beginning to the breakout point when the neckline is broken. It is not unusual, still, for a pattern to last up to six months. The period of the pattern is often called the “width” or “length” of the pattern.

Need for an Uptrend

This is a reversal pattern which marks the transition from an uptrend in prices to a downtrend. This means that the pattern always begins during an uptrend of prices.

Slope of the Neckline

The neckline can mountain up or down. An upward sloping neckline is regarded as to be additional bullish than a downward sloping one, which suggests a weaker position with additional extreme price declines. It is rather uncommon to have a downward sloping neckline for this pattern.

Trading Considerations

Duration of the Pattern

Think about the period of the design and its connection to your trading time horizons. The duration of the pattern is regarded to be an signal of the duration of the impact of this pattern. The longer the pattern the longer it will bring for the price to move to the target price. The shorter the pattern the earlier the price move. If you are thinking about a short-term trading possibility, appearance for a pattern with a short duration. If you are looking at a longer-term trading possibility, look for a pattern with a longer duration.

Target Price

The target price produces an significant indicator regarding the potential price go that this pattern suggests. Think about whether the target price for this pattern is enough to offer adequate rewards after your costs (such as income) have been done into account. A right rule of thumb is that the target price must show a potential return of greater than 5% before a pattern is considered useful. However you must consider the latest price and the volume of shares you plan to trade. Also, check that the target price has not already been attained.

Inbound Trend

The inbound trend is an significant attribute of the pattern. A superficial inbound trend might suggest a period of combination prior to the price move suggested by the pattern starts. Appearance for an inbound trend that is longer then the period of the pattern. A good rule of thumb is that the inbound trend should be at least two times the period of the pattern.

Criteria that Supports

Support and Resistance

Search for a location of support or resistance about the target price. A location of price combination or a powerful Support and Resistance Line at or around the target cost is a powerful signal that the price will go to that point.

Location of Moving Average

The Head and Shoulders Top should be above the Moving Average. Contrast the place of the pattern to a Moving Average of proper length. For short duration patterns use a 50 day Moving Average, for longer patterns use a 200 day Moving Average.

Moving Average Trend

The Moving Average must change way inside the period of the pattern and should head in the way suggested by the pattern. Search at the direction of the Moving Average Trend. For short period patterns use a 50 day Moving Average, for longer patterns use a 200 day Moving Average.

Volume

Volume is highest when the left shoulder is forming.

Volume is lowest on the right shoulder.

In the head part of the price pattern, volume drops anywhere between the energy of the left shoulder and weak spot of the right shoulder.

A powerful volume spike on the day of the pattern verification is a intense indicator in support of the possible for this pattern. The volume spike should be considerably preceding the average of the volume for the duration of the pattern.

Other Patterns

Another reversal patterns (such as Bullish and Bearish Engulfing Lines and Islands) that happen at the peaks and valleys suggest intense resistance at those points. The existence of these patterns within a Head and Shoulders is a strong indicator in support of this pattern.

Criteria that Refutes

No Volume Spike on Confirmation

The absence of a volume spike on the day of the pattern verification is an indicator that this method may not be reputable. In improvement, if the volume has stayed frequent, or was increasing, over the duration of the pattern, then this pattern should be regarded less dependable.

Location of Moving Average

If the Head and Shoulders Top is below the Moving Average then this pattern should be considered less reliable. Compare the location of the pattern to a Moving Average of appropriate length. For short duration patterns use a 50 day Moving Average, for longer patterns use a 200 day Moving Average.

Moving Average Trend

A Moving Average that is trending in the reverse way to that suggested by the pattern is an signal that this pattern is less dependable. Appearance at the way of the Moving Average Trend. For short period patterns use a 50 day Moving Average, for longer patterns use a 200 day Moving Average.

Inbound Trend

An inbound trend that is significantly shorter than the pattern duration is an indication that this pattern should be considered less reliable.

Message for you(Trader/Investor): Google has the answers to most all of your questions, after exploring Google if you still have thoughts or questions my Email is open 24/7. Each week you will receive your Course Materials. You can print it and highlight for your Technical Analysis Training.

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?

TABLE OF CONTENTS

Candlestick and Chart Patterns (15 Days)

7 Most Important Candlestick Chart Patterns

- Gap Down Chart Pattern

- Gap Up Chart Pattern

- Gravestone Short-term Chart Pattern

- Hammer Candle Stick Chart Pattern

- Hanging Man Short-term Stock Chart Pattern

- Inverted Hammer Stock Chart Pattern

- Shooting Star Candle Stick Pattern

Top 2 Bearish Chart Patterns

Top 6 Bullish Chart Patterns

- Engulfing Line (Bullish) Chart Pattern

- Exhaustion Bar Chart Pattern (Bullish)

- Inside Bar Chart Pattern

- Island Bottom Chart Pattern

- Key Reversal Bar (Bullish) Chart Pattern

- Two Bar Reversal (Bullish) Chart Pattern

Indicators & Oscillators (12 Days)

Bullish or Bearish Indicators

Bullish or Bearish Oscillators

- Bollinger Bands Oscillator

- Commodity Channel Index (CCI)

- Fast Stochastic Oscillator

- Know Sure Thing (KST) Oscillator

- Momentum Oscillator

- Moving Average Convergence/Divergence (MACD) Oscillator

- Relative Strength Index (RSI)

- Slow Stochastic Oscillator

- Williams %R Oscillator

Classic Chart Patterns (29 Days)

Bearish Classic Chart Patterns

- Continuation Diamond (Bearish) Chart Pattern

- Continuation Wedge (Bearish)

- Descending Continuation Triangle Chart Pattern

- Diamond Top Chart Pattern

- Double Top Chart Pattern

- Downside Break Chart Pattern – Rectangle

- Flag Bearish Chart Pattern

- Head and Shoulders Top Chart Pattern

- Megaphone Top Chart Pattern

- Pennant Bearish Chart Pattern

- Rounded Top Chart Pattern

- Symmetrical Continuation Triangle (Bearish)

- Top Triangle/Wedge Chart Pattern

- Triple Top Chart Pattern

Bullish Classic Chart Patterns

- Ascending Continuation Triangle Chart Pattern

- Bottom Triangle Or Wedge Chart Pattern

- Continuation Diamond (Bullish) Chart Pattern

- Continuation Wedge Chart Pattern (Bullish)

- Cup with Handle Bullish Chart Pattern

- Diamond Bottom Chart Pattern

- Double Bottom Chart Pattern

- Flag Bullish Chart Pattern

- Head and Shoulders Bottom Chart Pattern

- Megaphone Bottom Chart Pattern

- Pennant Bullish Chart Pattern

- Round Bottom Chart Pattern

- Symmetrical Continuation Triangle Bullish

- Triple Bottom Chart Pattern

- Upside Breakout Chart Pattern – Rectangle

Best Trading Theories (4 Days)

- Basics of Dow theory trading strategy forecasts

- Motive (Impulse) Waves

- Corrective Waves

- Wyckoff Chart Reading

Kind attention: this course is helpful for beginner and intermediate traders. It’s free for everyone. Advanced modules, trading strategies, and data (in-depth) are available for Moneymunch’s premium subscribers.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.