This is the 18th Day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

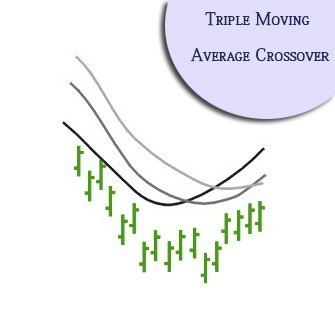

Triple Moving Average Crossover

Effect of Triple M.A.

When a shorter moving average (of a security’s price) crosses a moderate moving average, as well as the medium crosses a longer moving average, a bullish or bearish signal is produced this depends on the way of the crossovers.

Story

A moving average is an indicator that concerts the average worth of a security’s price more than a period of time. This excellent type of event occurs whenever a shorter moving average crosses a moderate moving average, and also the medium moving average crosses a longer moving average. The moving average times used in the celebration are really 4, 9 and 18 day. Whenever the 4-day crosses above/below the 9-day moving average, the event possess “started”. The celebration is “confirmed” whenever 9-day moving average crosses above/below the 18-day moving average.

A bullish signal is produced once the direction of the crossovers is above e.g. the shorter crosses above the moderate plus the moderate crosses above the longer. A bearish alert is generated whenever the movement of the crossovers is below.

These games are really based on top of straight forward moving averages. A straight forward moving average is certainly one just where equal weight is taking into account to any single price around the calculation period. For instance, a 9-day straight forward moving average is calculated if you take the sum of the very last 9 days of a stock’s close price and additionally then separating by 9. Other kinds of moving averages, that are not supported in this case, are really weighted averages and additionally exponentially smoothed averages.

Trading Factors

Moving averages are lagging indicators because they use ancient information. Making use of them because indicators will likely not get you in during the bottom and also away during the top but can get you in and additionally out somewhere between.

The couple work ideal in trending price designs, in which a good uptrend or downtrend is strongly in place.

Factors that Supports

Indicators that are fine appropriate to using moving averages consist of the MACD and Momentum.

Main Behavior

Moving averages flourish in trending markets even so they generate numerous false signals in choppy, sideways markets.

Message for you(Trader/Investor): Google has the answers to most all of your questions, after exploring Google if you still have thoughts or questions my Email is open 24/7. Each week you will receive your Course Materials. You can print it and highlight for your Technical Analysis Training.

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?

TABLE OF CONTENTS

Candlestick and Chart Patterns (15 Days)

7 Most Important Candlestick Chart Patterns

- Gap Down Chart Pattern

- Gap Up Chart Pattern

- Gravestone Short-term Chart Pattern

- Hammer Candle Stick Chart Pattern

- Hanging Man Short-term Stock Chart Pattern

- Inverted Hammer Stock Chart Pattern

- Shooting Star Candle Stick Pattern

Top 2 Bearish Chart Patterns

Top 6 Bullish Chart Patterns

- Engulfing Line (Bullish) Chart Pattern

- Exhaustion Bar Chart Pattern (Bullish)

- Inside Bar Chart Pattern

- Island Bottom Chart Pattern

- Key Reversal Bar (Bullish) Chart Pattern

- Two Bar Reversal (Bullish) Chart Pattern

Indicators & Oscillators (12 Days)

Bullish or Bearish Indicators

Bullish or Bearish Oscillators

- Bollinger Bands Oscillator

- Commodity Channel Index (CCI)

- Fast Stochastic Oscillator

- Know Sure Thing (KST) Oscillator

- Momentum Oscillator

- Moving Average Convergence/Divergence (MACD) Oscillator

- Relative Strength Index (RSI)

- Slow Stochastic Oscillator

- Williams %R Oscillator

Classic Chart Patterns (29 Days)

Bearish Classic Chart Patterns

- Continuation Diamond (Bearish) Chart Pattern

- Continuation Wedge (Bearish)

- Descending Continuation Triangle Chart Pattern

- Diamond Top Chart Pattern

- Double Top Chart Pattern

- Downside Break Chart Pattern – Rectangle

- Flag Bearish Chart Pattern

- Head and Shoulders Top Chart Pattern

- Megaphone Top Chart Pattern

- Pennant Bearish Chart Pattern

- Rounded Top Chart Pattern

- Symmetrical Continuation Triangle (Bearish)

- Top Triangle/Wedge Chart Pattern

- Triple Top Chart Pattern

Bullish Classic Chart Patterns

- Ascending Continuation Triangle Chart Pattern

- Bottom Triangle Or Wedge Chart Pattern

- Continuation Diamond (Bullish) Chart Pattern

- Continuation Wedge Chart Pattern (Bullish)

- Cup with Handle Bullish Chart Pattern

- Diamond Bottom Chart Pattern

- Double Bottom Chart Pattern

- Flag Bullish Chart Pattern

- Head and Shoulders Bottom Chart Pattern

- Megaphone Bottom Chart Pattern

- Pennant Bullish Chart Pattern

- Round Bottom Chart Pattern

- Symmetrical Continuation Triangle Bullish

- Triple Bottom Chart Pattern

- Upside Breakout Chart Pattern – Rectangle

Best Trading Theories (4 Days)

- Basics of Dow theory trading strategy forecasts

- Motive (Impulse) Waves

- Corrective Waves

- Wyckoff Chart Reading

Kind attention: this course is helpful for beginner and intermediate traders. It’s free for everyone. Advanced modules, trading strategies, and data (in-depth) are available for Moneymunch’s premium subscribers.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

I require this training. How to start. Please advise.