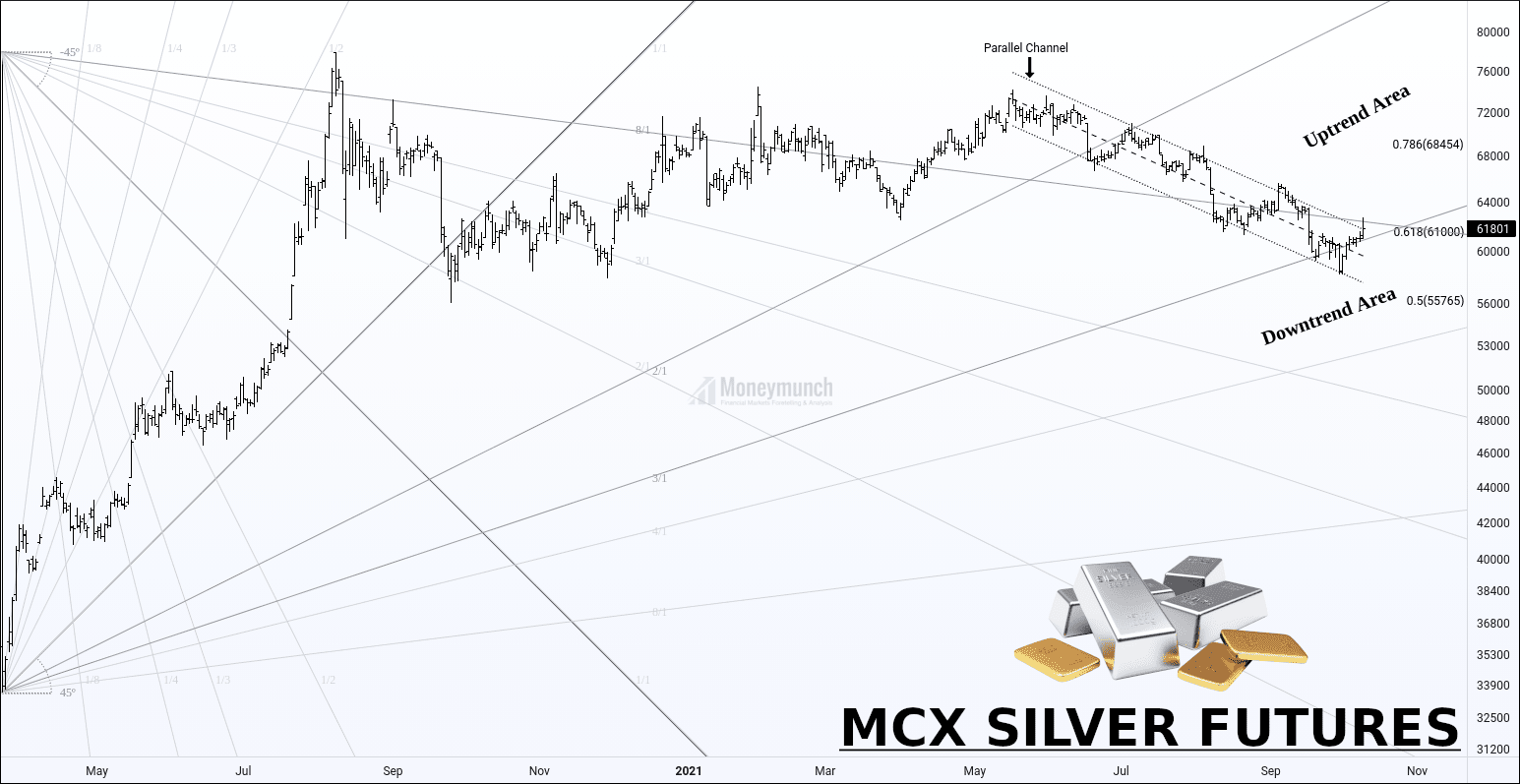

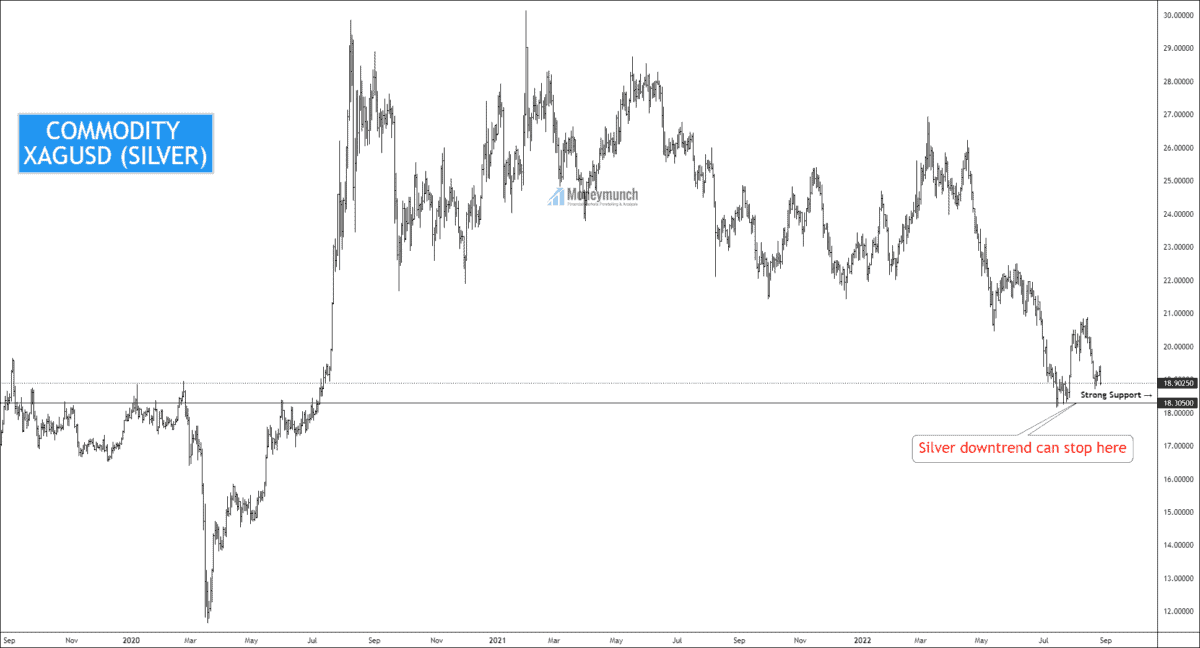

Silver(XAGUSD) has formed a downtrend channel for more than 48 weeks. Price has made a high of 30.03, and sellers entered the market.

Price Action Perspective:

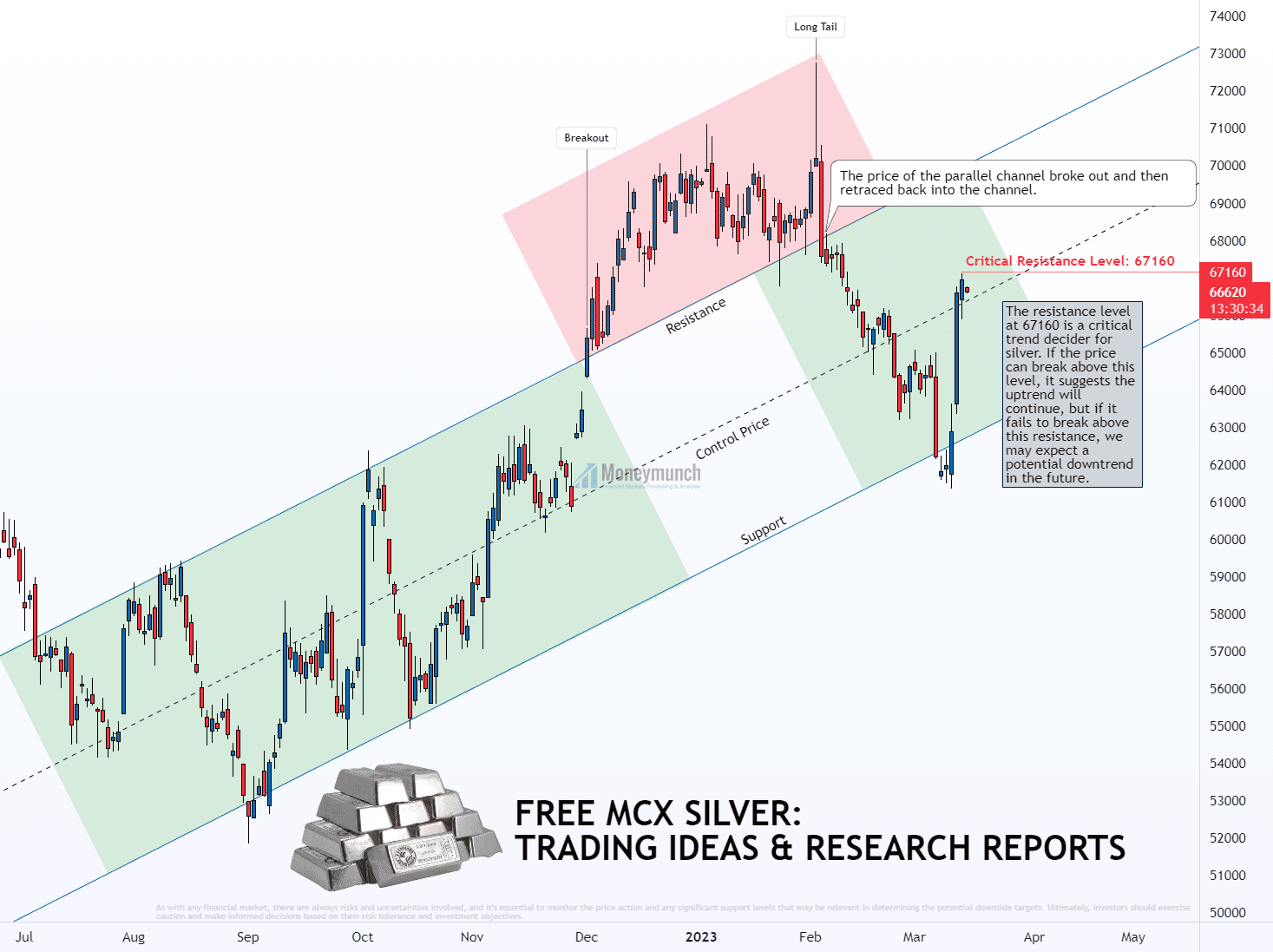

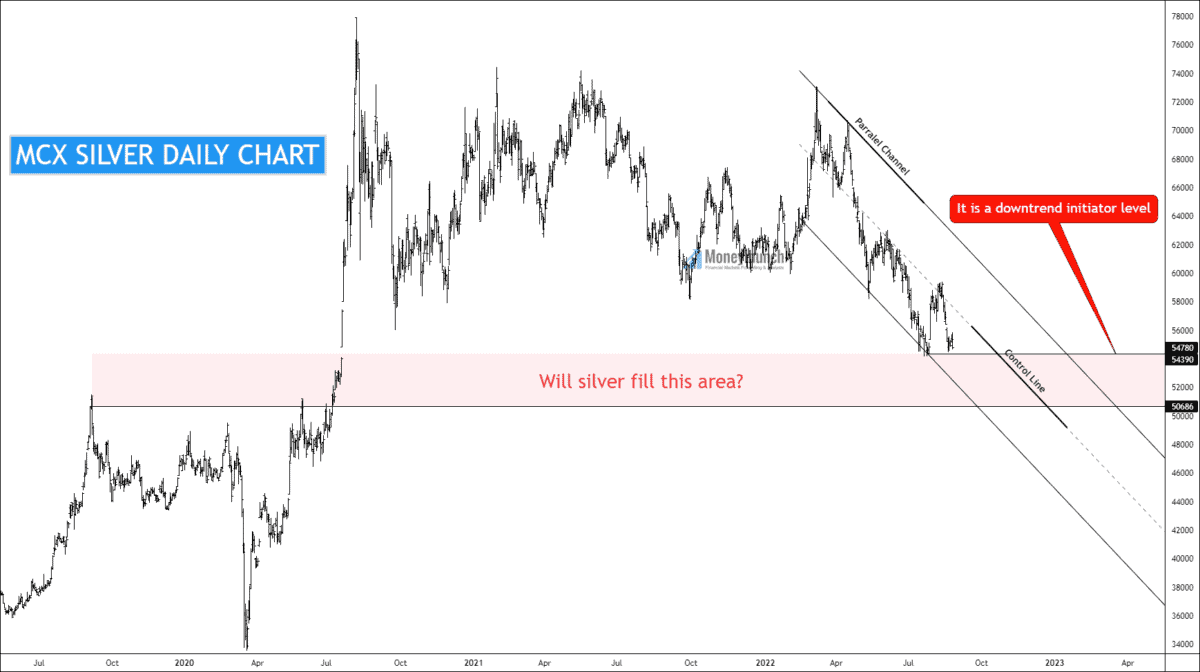

Price has made a series of Lower Highs and Lower Lows, and the control line gives nine touches.

According to Dow theory, if the price breaks the previous LL, it will make a new LL. The upper band & lower band has provided strong reversals to the price.

After breaking the LL, if the price gives a breakout of the downtrend channel, it indicates the worst fundamentals. And if the price gets reversed to create the lower band of the downtrend channel, the price will march to the upper band touch.

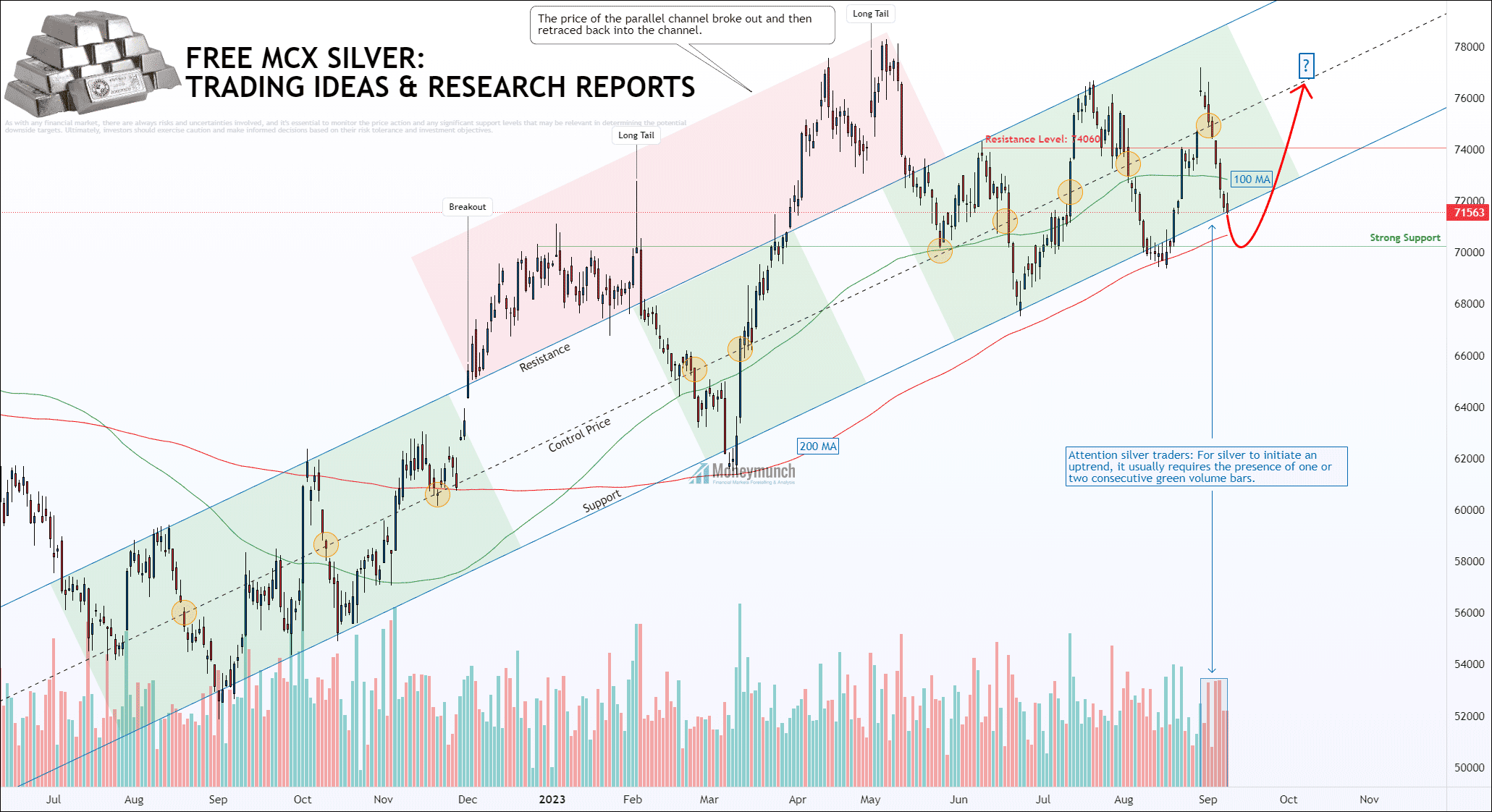

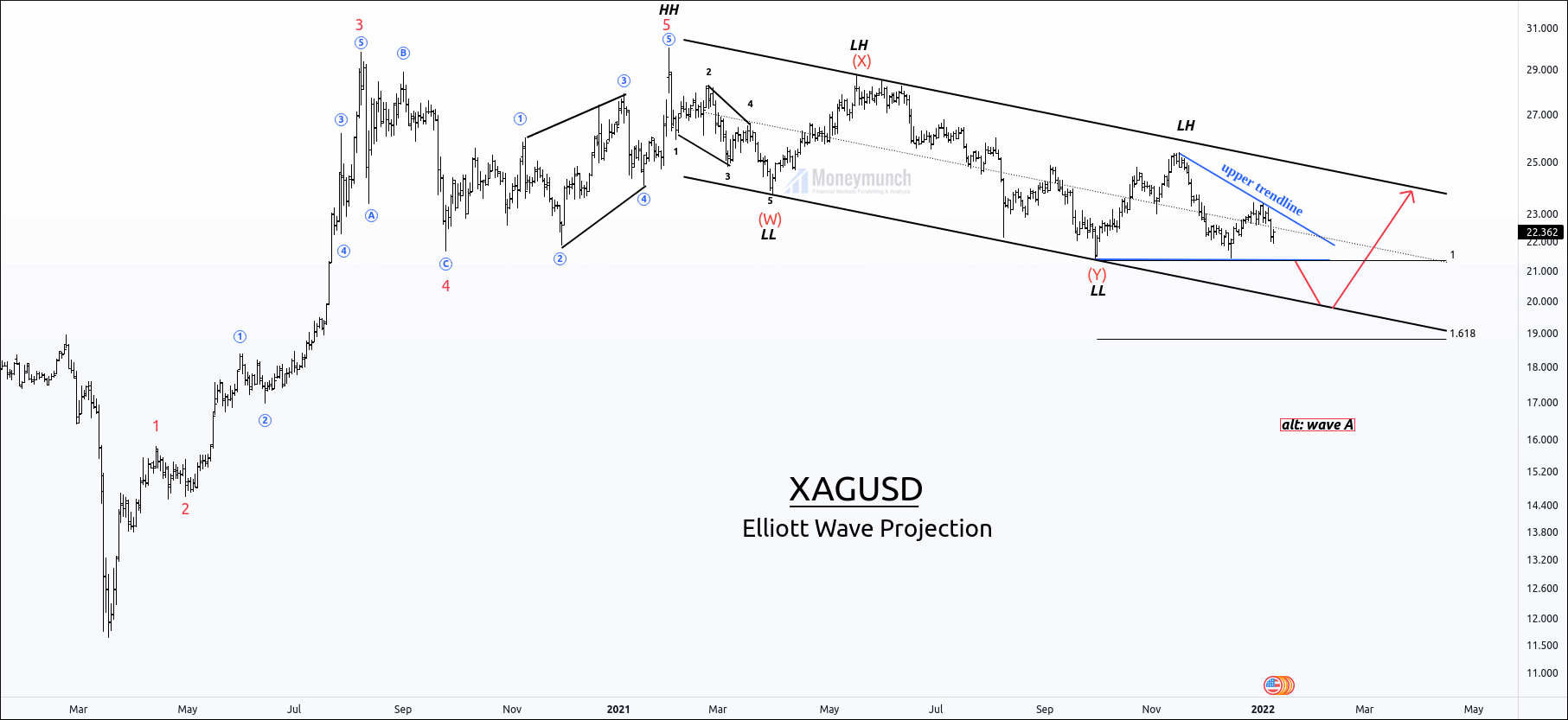

Elliott Perspective:

Price has constituted a corrective structure, where price has completed double zigzag(w-x-y).

It will create the last leg wave Z in order to complete the Triple correction. After making the last leg Z, silver will start a five-wave impulsive wave.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Only subscribers can read the full article. Please

log in to read the entire text.

Continue reading

Continue reading

Lock

Lock