The Wyckoff Method is one of the four timeless approaches to market analysis (the other three being Dow Theory, Shabacker’s chart patterns, Elliott Wave Theory and Gann’s swing trading approach). It was developed in the early part of the 20th Century and has been continuously refined through the present day. The Wyckoff Method is a vital, classic approach to trading which reads the market through price bars and volume. Although technical indicators may be used, they are unnecessary under the Wyckoff Method.

Richard D. Wyckoff was a Wall Street broker and trader in the early part of the 20th Century. Wyckoff was a broker and witnessed the operations of the largest traders of his day first hand as an ‘insider’ and learned to translate their activities in the ticker tape and bar charts. As he watched traders and investors make poor trading decisions based on rumor, opinion and guesswork, he wrote a newsletter that quickly became so widely read on Wall Street that it would often affect stock prices. He later wrote courses for traders and books on tape reading (including the first day trader’s manual) and his experiences on the Street.

The Wyckoff Method has been used by astute traders for nearly 80 years. It is a complete method for understanding and trading the markets. It is used effectively by day traders, swing traders and investors in all markets including equities, commodities, index futures and FX with equal success. Many of today’s top market technicians acknowledge Wyckoff as the basis for their understanding of the markets, and the Method has spawned spin-offs such as VSA.

Dr. Gary Dayton is an expert in the Wyckoff Method. He has studied and applied Wyckoff for the past decade and has been mentored by an acknowledged Wyckoff master. Dr. Gary is also an outstanding educator of the Method who conveys the Wyckoff Method and principles in a simple and concise manner easily understood by his students.

TABLE OF CONTENTS

Candlestick and Chart Patterns (15 Days)

7 Most Important Candlestick Chart Patterns

- Gap Down Chart Pattern

- Gap Up Chart Pattern

- Gravestone Short-term Chart Pattern

- Hammer Candle Stick Chart Pattern

- Hanging Man Short-term Stock Chart Pattern

- Inverted Hammer Stock Chart Pattern

- Shooting Star Candle Stick Pattern

Top 2 Bearish Chart Patterns

Top 6 Bullish Chart Patterns

- Engulfing Line (Bullish) Chart Pattern

- Exhaustion Bar Chart Pattern (Bullish)

- Inside Bar Chart Pattern

- Island Bottom Chart Pattern

- Key Reversal Bar (Bullish) Chart Pattern

- Two Bar Reversal (Bullish) Chart Pattern

Indicators & Oscillators (12 Days)

Bullish or Bearish Indicators

Bullish or Bearish Oscillators

- Bollinger Bands Oscillator

- Commodity Channel Index (CCI)

- Fast Stochastic Oscillator

- Know Sure Thing (KST) Oscillator

- Momentum Oscillator

- Moving Average Convergence/Divergence (MACD) Oscillator

- Relative Strength Index (RSI)

- Slow Stochastic Oscillator

- Williams %R Oscillator

Classic Chart Patterns (29 Days)

Bearish Classic Chart Patterns

- Continuation Diamond (Bearish) Chart Pattern

- Continuation Wedge (Bearish)

- Descending Continuation Triangle Chart Pattern

- Diamond Top Chart Pattern

- Double Top Chart Pattern

- Downside Break Chart Pattern – Rectangle

- Flag Bearish Chart Pattern

- Head and Shoulders Top Chart Pattern

- Megaphone Top Chart Pattern

- Pennant Bearish Chart Pattern

- Rounded Top Chart Pattern

- Symmetrical Continuation Triangle (Bearish)

- Top Triangle/Wedge Chart Pattern

- Triple Top Chart Pattern

Bullish Classic Chart Patterns

- Ascending Continuation Triangle Chart Pattern

- Bottom Triangle Or Wedge Chart Pattern

- Continuation Diamond (Bullish) Chart Pattern

- Continuation Wedge Chart Pattern (Bullish)

- Cup with Handle Bullish Chart Pattern

- Diamond Bottom Chart Pattern

- Double Bottom Chart Pattern

- Flag Bullish Chart Pattern

- Head and Shoulders Bottom Chart Pattern

- Megaphone Bottom Chart Pattern

- Pennant Bullish Chart Pattern

- Round Bottom Chart Pattern

- Symmetrical Continuation Triangle Bullish

- Triple Bottom Chart Pattern

- Upside Breakout Chart Pattern – Rectangle

Best Trading Theories (4 Days)

- Basics of Dow theory trading strategy forecasts

- Motive (Impulse) Waves

- Corrective Waves

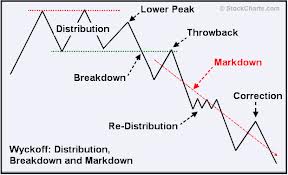

- Wyckoff Chart Reading

Kind attention: this course is helpful for beginner and intermediate traders. It’s free for everyone. Advanced modules, trading strategies, and data (in-depth) are available for Moneymunch’s premium subscribers.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

hii

gurujii

i lost 95000 on option trading..

plz give me right call sir