Join Over 1 Million Traders Receiving

Get the best investing tips, strategies, and news straight to your inbox.

In which market are you interested?

Stock, Commodity, Forex Trading Ideas & Analysis

Whether you are a beginner or a professional trader, Moneymunch.com’s trade setup, research, analysis, and educational articles have been helping investors for over a decade.

Trade Ideas

Read free trading insights, ideas, and in-depth analysis by selecting your preferred market platform.

FREE Subscriptions

Choose your preferred platform for daily trading tips, analysis & free education straight to your inbox.

Today’s market: research | analysis | stories LATEST ARTICLES

NSE FINCABLES & COFORGE – Premium Setup

NSE FINCABLES – Premium Setup

NSE COFORGE- Swing Setup

NSE STYLAM – Trading Insights & Update

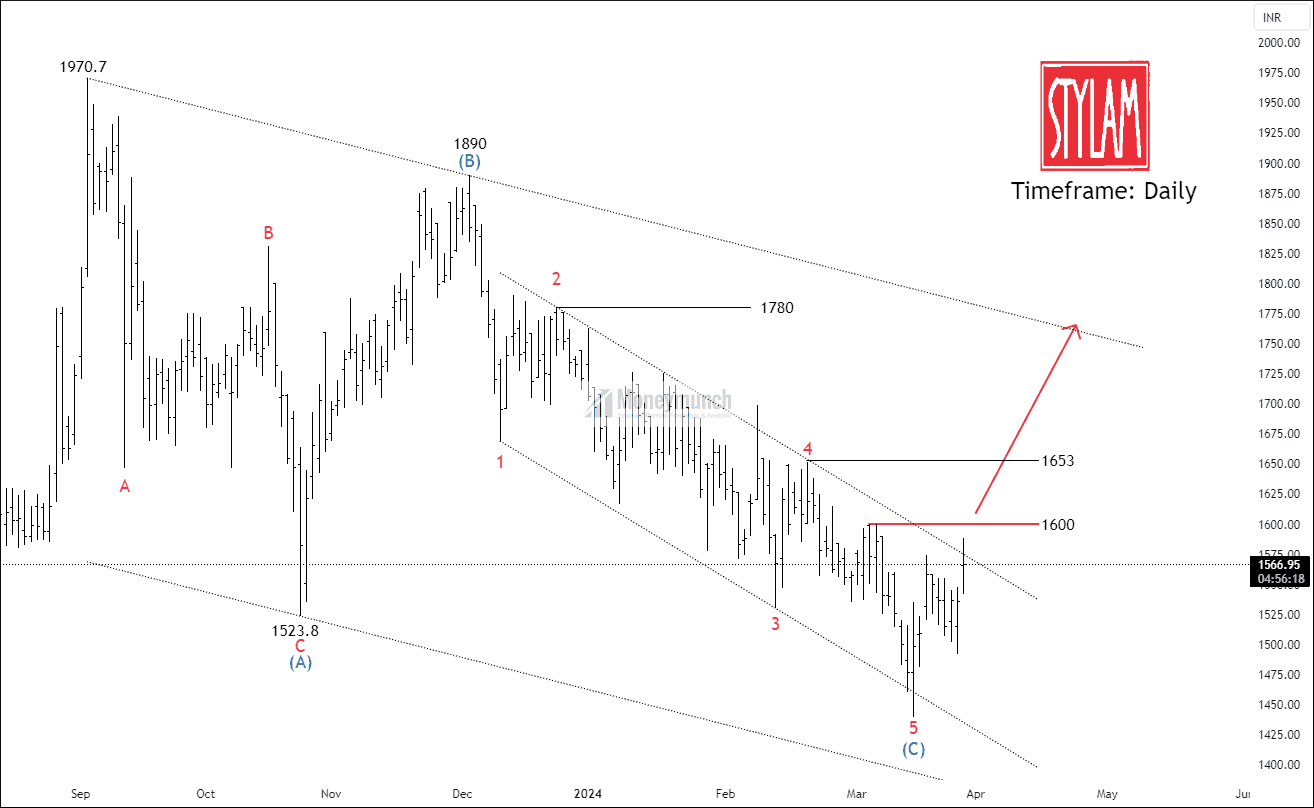

Do you remember the NSE STYLAM Wave projection?

Visit here: NSE STYLAM – Elliott Wave Projection

BEFORE

BEFORE

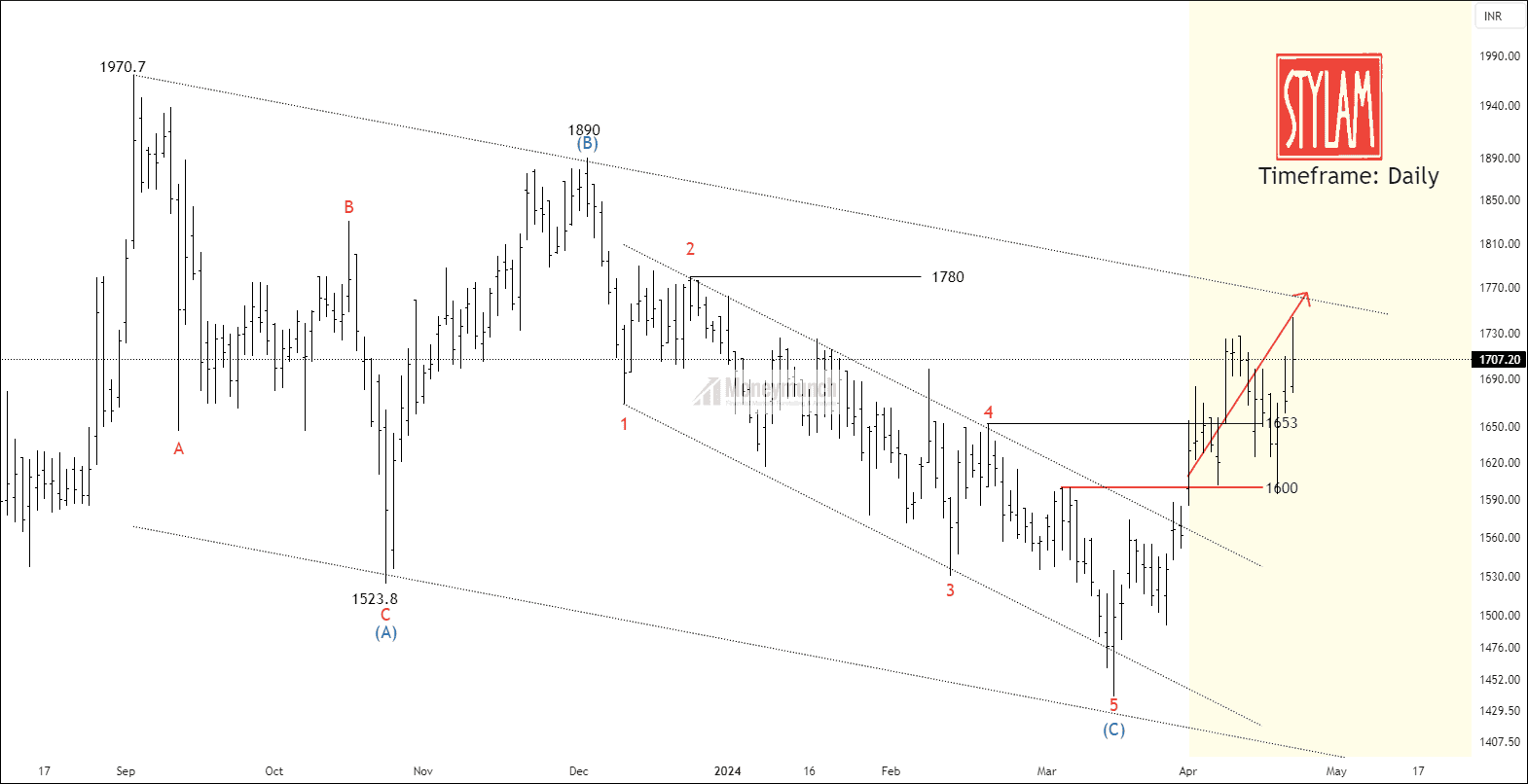

We had written clearly,”If the price breaks out the resistance, traders can trade for the following targets: 1653 – 1728 – 1780+“.

AFTER

AFTER

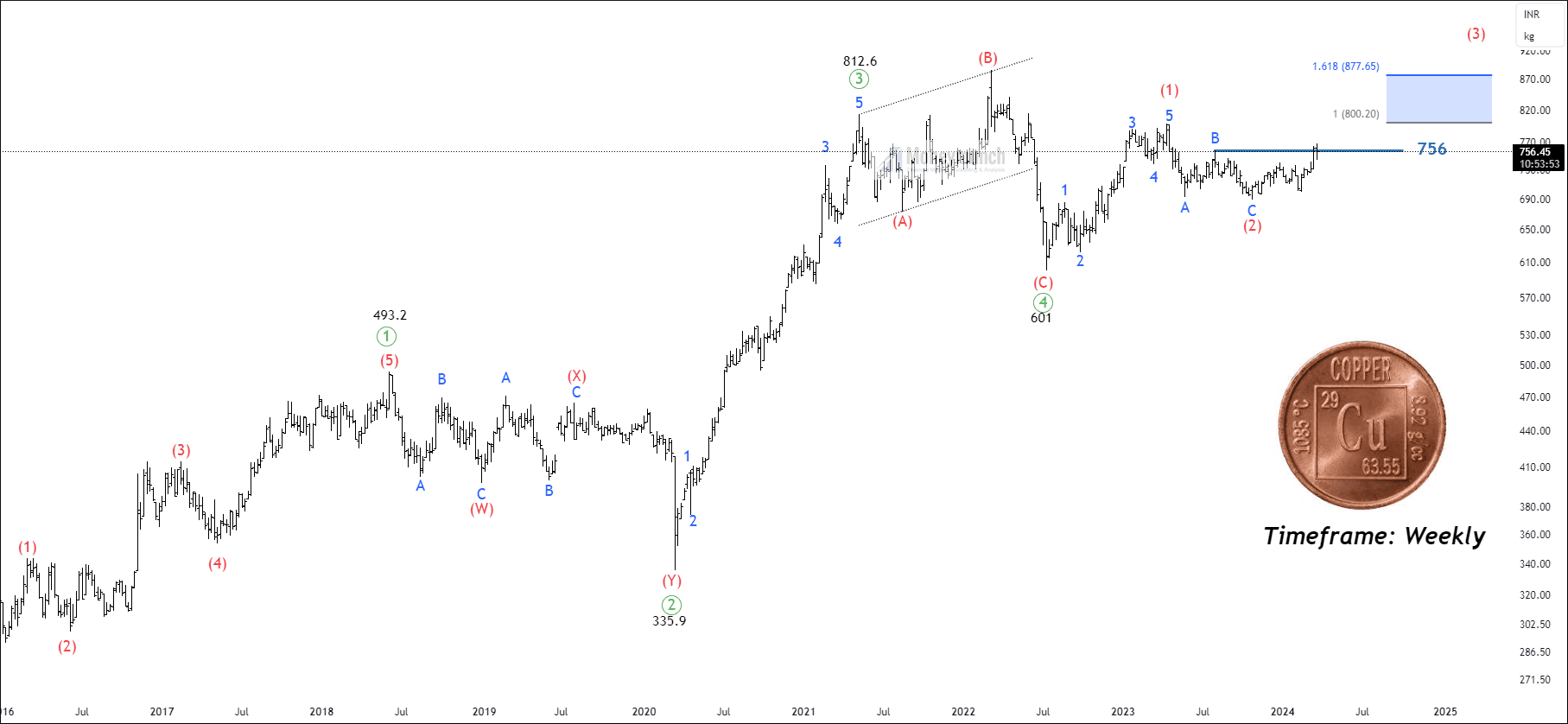

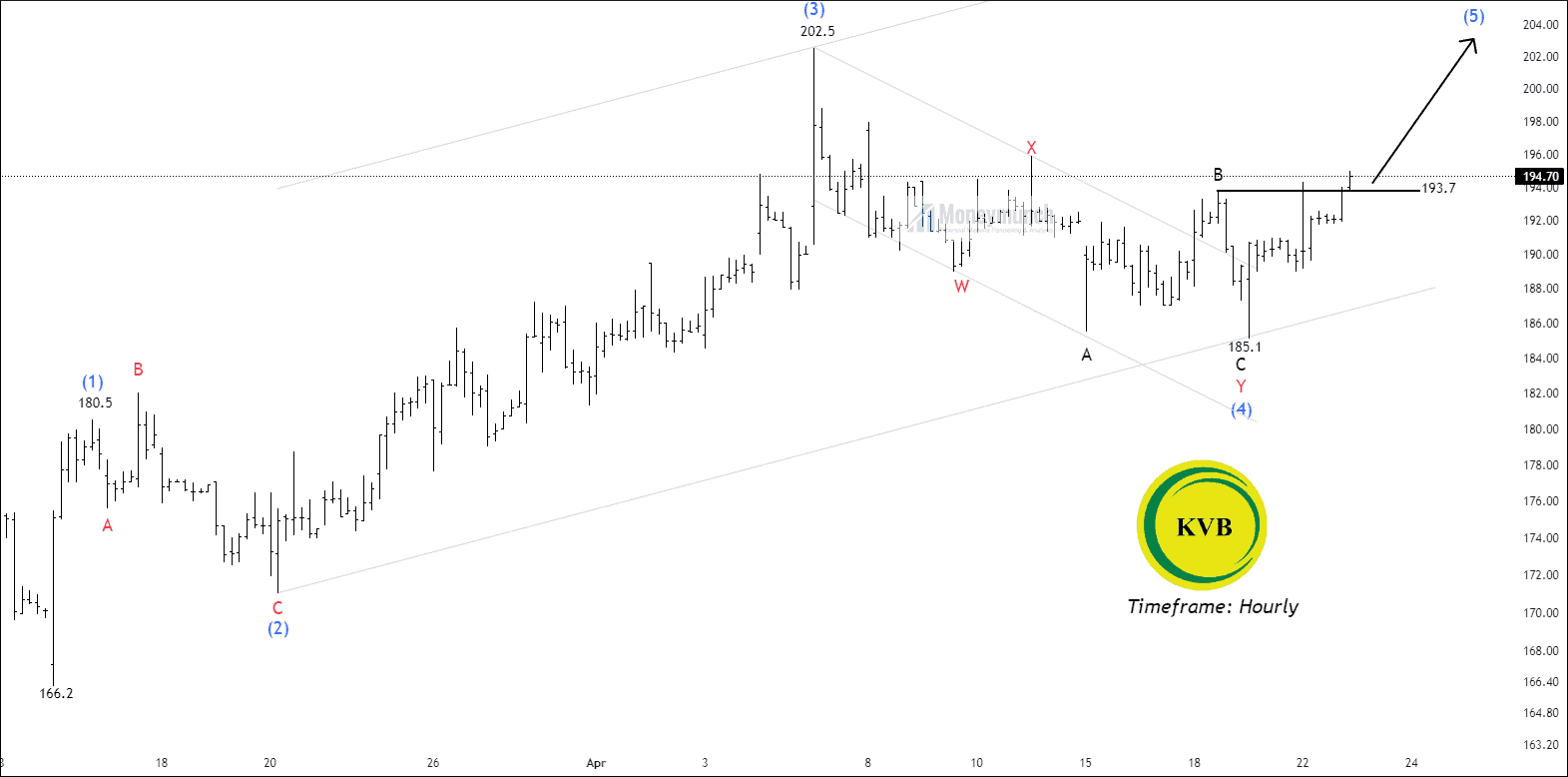

Will NSE COPPER Reach the Final Target?

Did you trade MCX Copper Wave Setup?

Click here: Long-Term View: IS MCX Copper Preparing For A Take-Off?

BEFORE

BEFORE

Sub-wave c of wave (2) of wave ((4)) occurred at 689.5. If the price breaks out wave B at 756, traders can trade for the following targets: 800 – 840 – 877+.

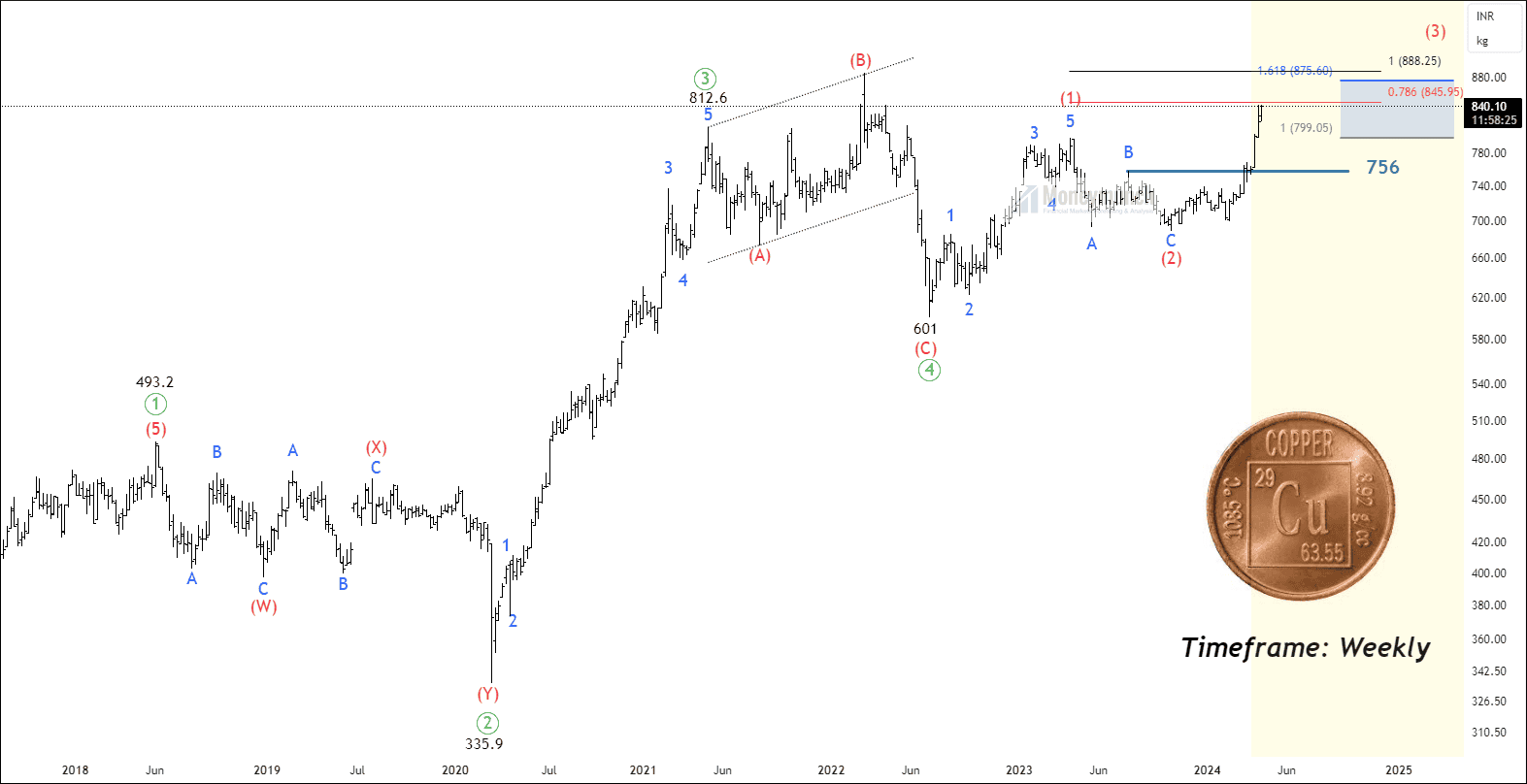

AFTER

AFTER

Read the Moneymunch’s Most Popular Publications

Recently published comments: Read what they’re talking about…

60-Day Technical Analysis Course

Trending Topics

Basics of investing and personal finance

In case you missed it…

Moneymunch’s Free Support: Invest and Trade with Confidence

Investing and trading in the financial markets can be daunting for many people, especially beginners. That’s why Moneymunch offers free support to help its readers invest and trade with confidence. Our team of experienced financial analysts and market experts provides valuable insights and tips on various investment options, market trends, and trading strategies. With our free support, you can learn how to navigate the markets, make informed investment decisions, and achieve your financial goals. We believe that everyone deserves a chance to build a secure financial future, and we are committed to providing the resources and support needed to help our readers succeed.

Making the right investments at the right time and in the right place can form a strong foundation for a secure financial future, even with just a few trades.

– Moneymunch.com

Lock

Lock

Good setups:)

Wow! your analysis is working very well. I must say your wave technique is working in every worst market conditions.

What do you think about Nifty Next 50? Can you share your views on it?

It worked well!

Pls sir nifty and banknifty share

We need more setups like this.