This is the 32th Day course in a series of 60-Days called “Technical Analysis Training“

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

Flag Bullish Chart Pattern

Implication

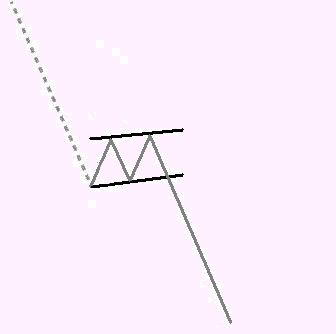

A Flag (Bearish) is considered a bearish signal, showing that the existing downtrend may continue.

Description

A Flag (Bearish) uses a high, or almost vertical decline in price, and is made up of two synchronous trendlines which kind a rectangular flag structure. The Flag can be horizontal (as though the breeze is blowing it), then again it usually has a minor upward trend.

The vertical downtrend, that precedes a Flag, might take place because of buyers’ side effects to a negative company statement, like as a court case, or a abrupt and unannounced deviation of a CEO. The acute cost decrease is occasionally introduced to as the “flagpole” or “mast”.

The rectangular flag shape is the system of what technical analysts recommend to as combination. Combination happens whenever the price appears to bounce amongst an upper and lower price limitation. The Flag (Bearish) pattern constitution displays the effect of sellers that are prepared to sell at a lower cost, and the increase of buyers who unintentionally drive up the price as they contend to buy at the ideal possible price.

A bearish signal occurs when the price rebounds beyond the lower trendline of the Flag formation, and continues the original downward price movement. This is considered a pattern confirmation.

When speaking about Flags, technical analysts may use jargon and refer to the flag as “flying at half-mast”. Visually, this reference is nothing like a flag at half-mast, such as on a day of national mourning. Instead, this term refers to the location of the flag – at the mid-point of what would otherwise be a continuous downtrend.

Important Characteristics

Following are important characteristics for this pattern.

Trend lines

Flags are too much the same to Pennants. Still, with a Flag, the price trend lines tend to run synchronous, while with a Pennant, the price trend lines tend to border on. John J. Murphy reports that a price fall below the lower trend line may suggest the resumption of the downtrend.

Volume

As the Flag produces, the volume tends to reduce. Still, you will usually observe a acute surge in volume at the end of a Flag, whether it is bearish or bullish.

Duration of the Pattern

Martin Pring records in his book, Technical Analysis described that “Flags can form in a stage as short as 5 days or as longs as 3 to 5 weeks.” John J. Murphy determines that Flags “often previous no longer than one or two weeks.”

Trading Considerations

Possibility of Price Reversal

In some rare situations, the price will break towards the authentic price motion, and produce a reversal trend. The pattern reversal might be signaled during the Flag constitution by a pattern of growing volume, as compared to the additional typical decrease.

Duration of the Pattern

The duration of the pattern is based on the level of the price changes (integration). The better the variations, the longer a pattern will consume to formulate.

Target Price

It is commonly held that the length of the flagpole indicates the potential price decrease. When the Flag completes, the price typically jumps to replicate the height of the original flagpole, while continuing in the direction of the inbound trend.

Criteria that Supports

Volume

Volume must reduce significantly as the pattern forms.

A powerful volume surge on the day of the pattern verification is a powerful signal in support of the possible for this pattern. The volume spike should be importantly preceding the average of the volume for the period of the pattern. In inclusion, the volume over the course of the pattern should be declining on average.

Criteria that Refutes

Duration of the Pattern

Corresponding to Martin Pring, a pattern that surpasses “4 weeks to create should … be managed with careful attention”. After 4 weeks, desire in the stock is probably to reduction to point that it is unexpected to proceed in a powerful downtrend.

No Volume Spike on Breakout

The absence of a volume spike on the day of the pattern ratification is an denotation that this pattern may not be dependable. In inclusion, if the volume has continued frequent, or was improving, over the period of the pattern, therefore this pattern should be regarded less dependable and may in fact reverse.

Long Inbound Trend

Shabacker writes that, “whenever a mast is extended … and it’s Flag fairly small, we should obviously hope the motion to be quite well fatigued when its suggested goal is achieved.” He recommends that when you notice this creation, and a price extension will take place, it is ideal to use the flagpole as a “yard-stick” to show the level at what to “accept profits, move aside, and watch for further chart improvements.”

Underlying Behavior

This pattern is efficiently a intermission in a downtrend. The price has received ahead of itself with a high increase; so market exercise takes a break prior to proceeding the downtrend. This pause is mirrored in the lowering trading volume. Just as, a spike in volume markings the resumption of the downtrend.

Message for you(Trader/Investor): Google has the answers to most all of your questions, after exploring Google if you still have thoughts or questions my Email is open 24/7. Each week you will receive your Course Materials. You can print it and highlight for your Technical Analysis Training.

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?

TABLE OF CONTENTS

Candlestick and Chart Patterns (15 Days)

7 Most Important Candlestick Chart Patterns

- Gap Down Chart Pattern

- Gap Up Chart Pattern

- Gravestone Short-term Chart Pattern

- Hammer Candle Stick Chart Pattern

- Hanging Man Short-term Stock Chart Pattern

- Inverted Hammer Stock Chart Pattern

- Shooting Star Candle Stick Pattern

Top 2 Bearish Chart Patterns

Top 6 Bullish Chart Patterns

- Engulfing Line (Bullish) Chart Pattern

- Exhaustion Bar Chart Pattern (Bullish)

- Inside Bar Chart Pattern

- Island Bottom Chart Pattern

- Key Reversal Bar (Bullish) Chart Pattern

- Two Bar Reversal (Bullish) Chart Pattern

Indicators & Oscillators (12 Days)

Bullish or Bearish Indicators

Bullish or Bearish Oscillators

- Bollinger Bands Oscillator

- Commodity Channel Index (CCI)

- Fast Stochastic Oscillator

- Know Sure Thing (KST) Oscillator

- Momentum Oscillator

- Moving Average Convergence/Divergence (MACD) Oscillator

- Relative Strength Index (RSI)

- Slow Stochastic Oscillator

- Williams %R Oscillator

Classic Chart Patterns (29 Days)

Bearish Classic Chart Patterns

- Continuation Diamond (Bearish) Chart Pattern

- Continuation Wedge (Bearish)

- Descending Continuation Triangle Chart Pattern

- Diamond Top Chart Pattern

- Double Top Chart Pattern

- Downside Break Chart Pattern – Rectangle

- Flag Bearish Chart Pattern

- Head and Shoulders Top Chart Pattern

- Megaphone Top Chart Pattern

- Pennant Bearish Chart Pattern

- Rounded Top Chart Pattern

- Symmetrical Continuation Triangle (Bearish)

- Top Triangle/Wedge Chart Pattern

- Triple Top Chart Pattern

Bullish Classic Chart Patterns

- Ascending Continuation Triangle Chart Pattern

- Bottom Triangle Or Wedge Chart Pattern

- Continuation Diamond (Bullish) Chart Pattern

- Continuation Wedge Chart Pattern (Bullish)

- Cup with Handle Bullish Chart Pattern

- Diamond Bottom Chart Pattern

- Double Bottom Chart Pattern

- Flag Bullish Chart Pattern

- Head and Shoulders Bottom Chart Pattern

- Megaphone Bottom Chart Pattern

- Pennant Bullish Chart Pattern

- Round Bottom Chart Pattern

- Symmetrical Continuation Triangle Bullish

- Triple Bottom Chart Pattern

- Upside Breakout Chart Pattern – Rectangle

Best Trading Theories (4 Days)

- Basics of Dow theory trading strategy forecasts

- Motive (Impulse) Waves

- Corrective Waves

- Wyckoff Chart Reading

Kind attention: this course is helpful for beginner and intermediate traders. It’s free for everyone. Advanced modules, trading strategies, and data (in-depth) are available for Moneymunch’s premium subscribers.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.