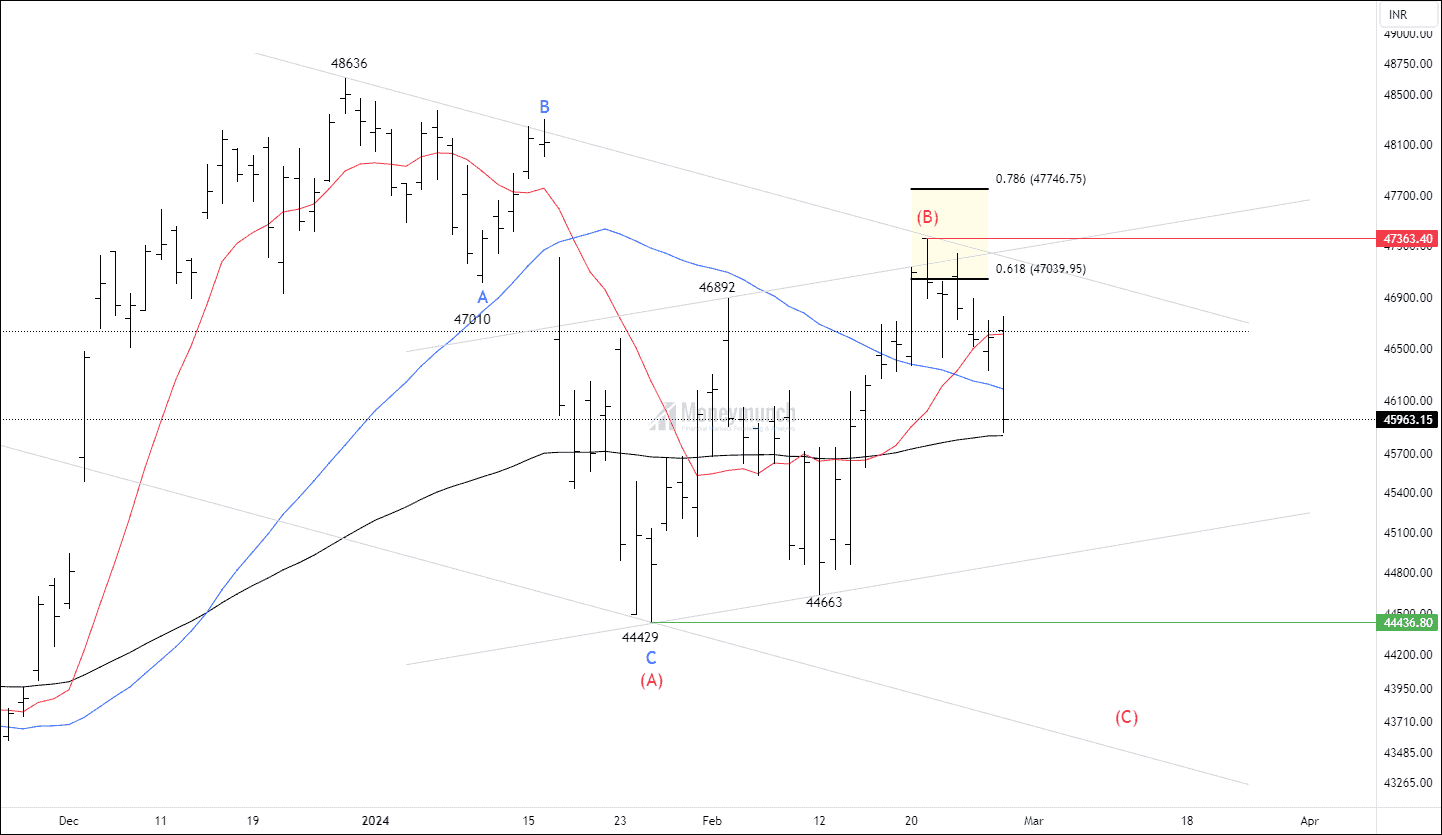

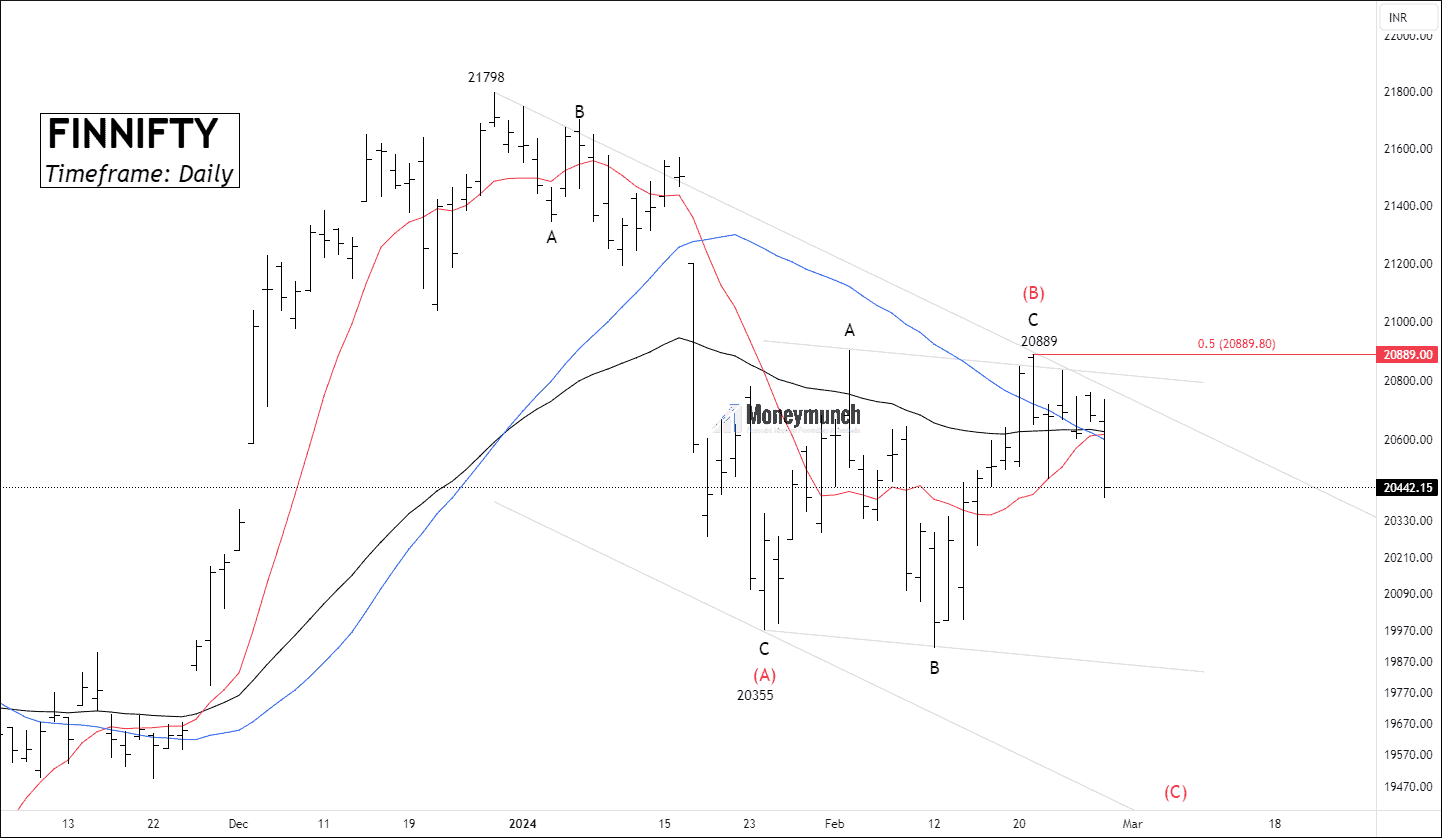

Timeframe: Daily

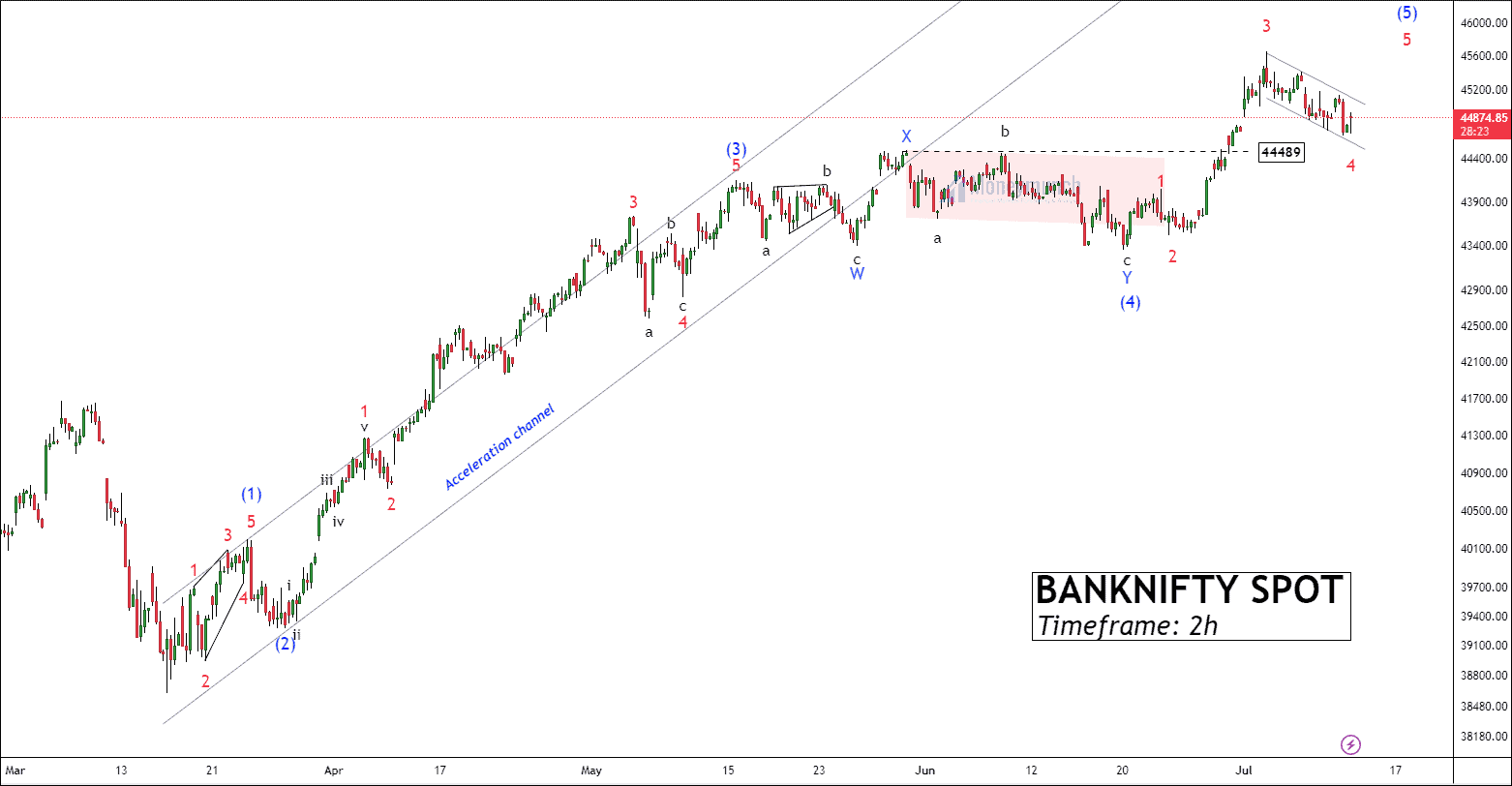

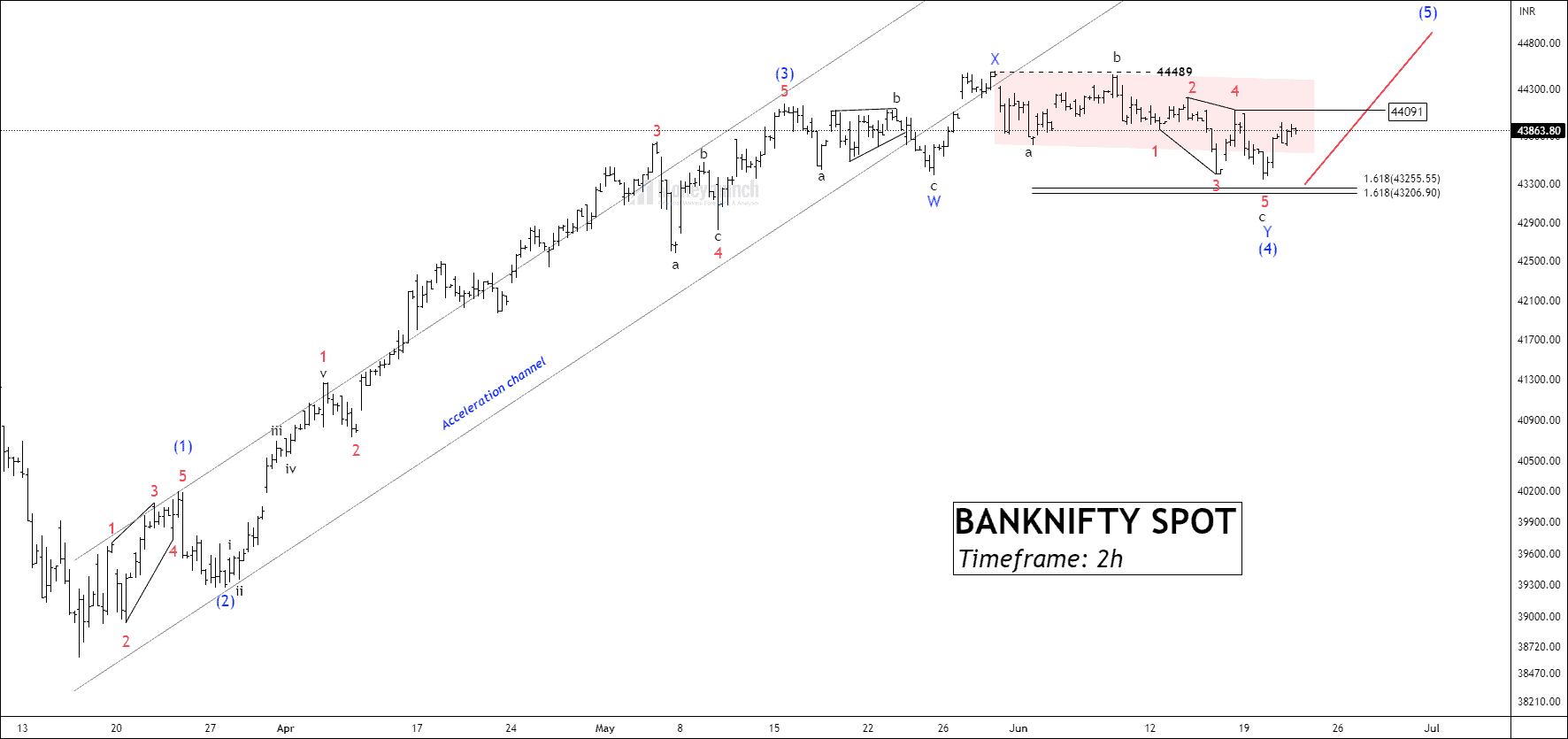

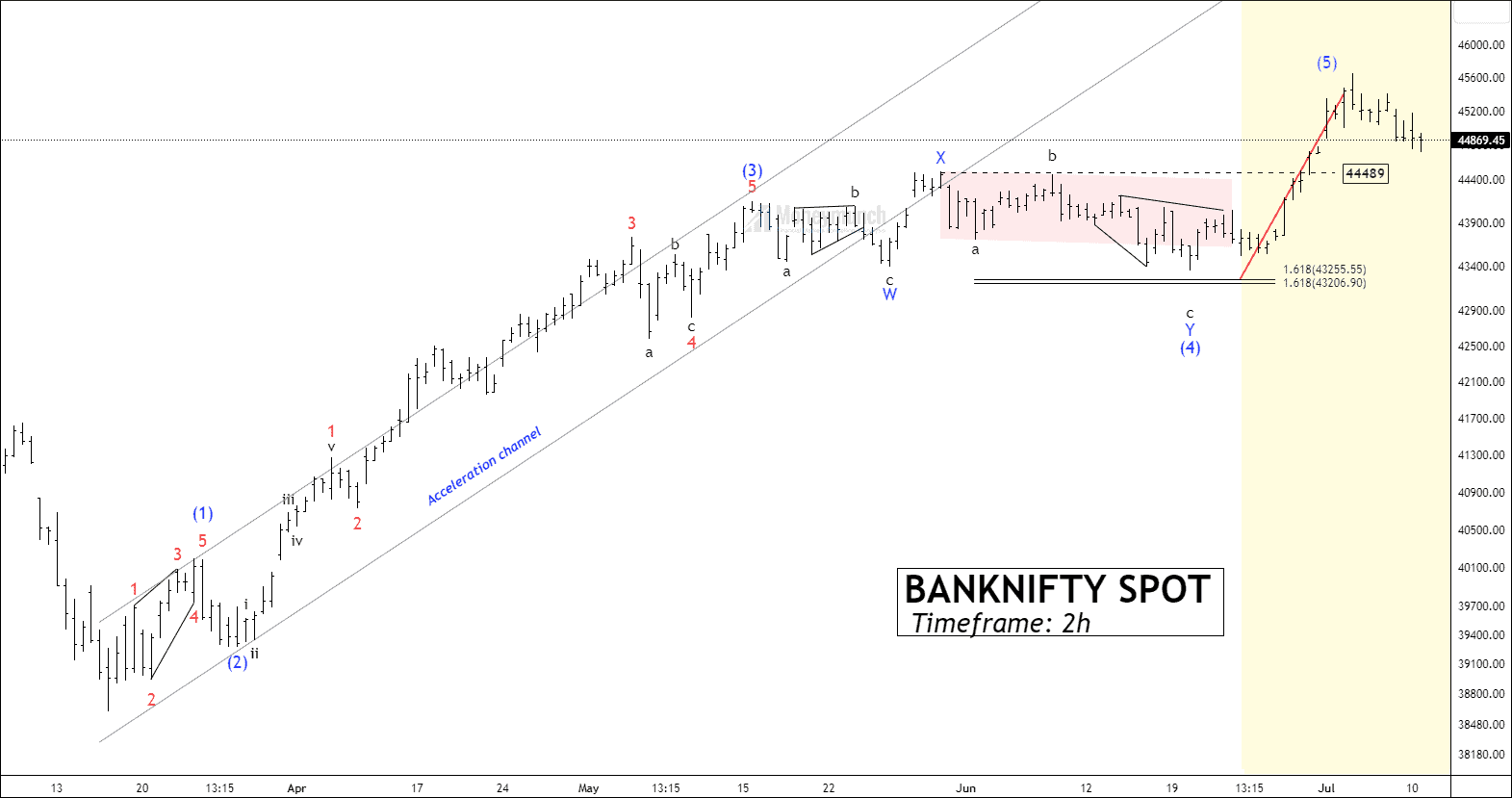

The bank nifty spot has broken down 10/35/50 Moving average and trading at 100 Exponential moving average that spots weakness. From the low of 44429 to the high of 47363, the ADX of the price fell to 15.92.

According to Elliott Wave, the current structure can be labeled A-B-C correction. It’s acceptable to expect a flat as wave B retraced 78.6%.

Alert bulls! There are only two opportunities:

(1) At the lower band after completion of wave C.

(2) Only after the breakout of wave (B).

Wave C can occur near wave the low of (C). sellers can extend targets after the aggressive breakdown of wave C. If the price is falling and reaching too far from the breakdown place, the move can be reliable as an impulsive.

Trade setup with entry, exit, and invalidation is only available for premium subscribers.

Continue reading

Continue reading