NSE FINCABLES – Premium Setup

Only subscribers can read the full article. Please log in to read the entire text.

NSE COFORGE- Swing Setup

Only subscribers can read the full article. Please log in to read the entire text.

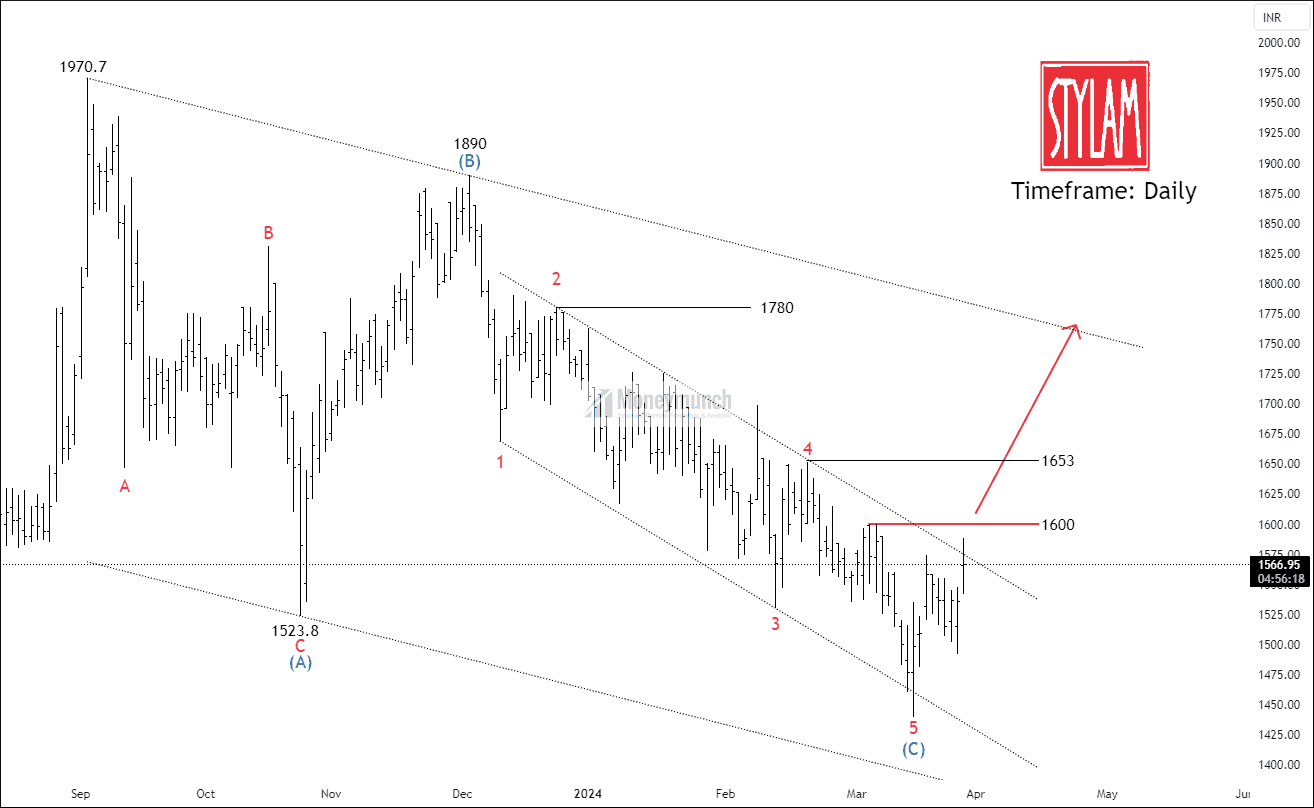

Do you remember the NSE STYLAM Wave projection?

Visit here: NSE STYLAM – Elliott Wave Projection

BEFORE

BEFORE

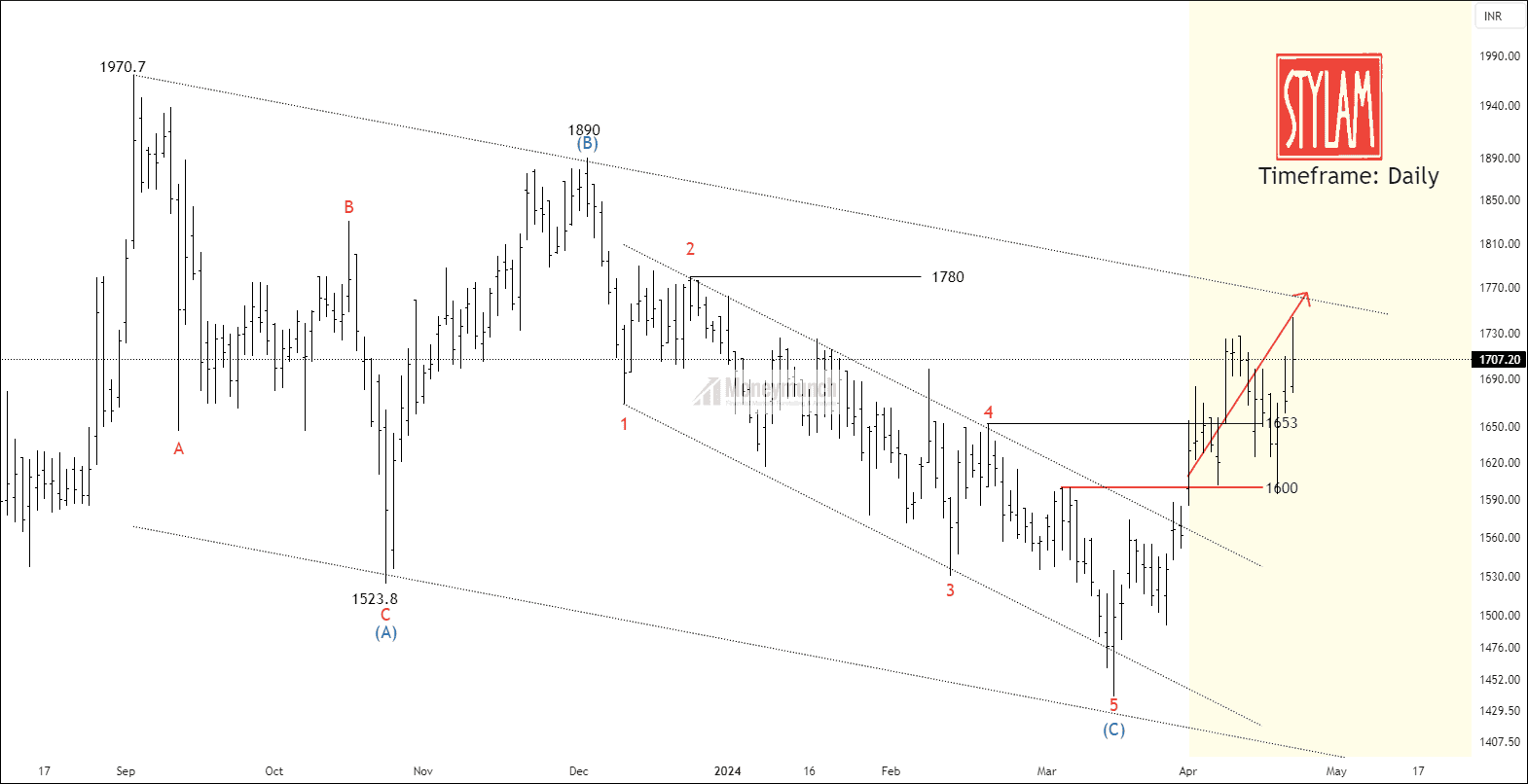

We had written clearly,”If the price breaks out the resistance, traders can trade for the following targets: 1653 – 1728 – 1780+“.

AFTER

AFTER

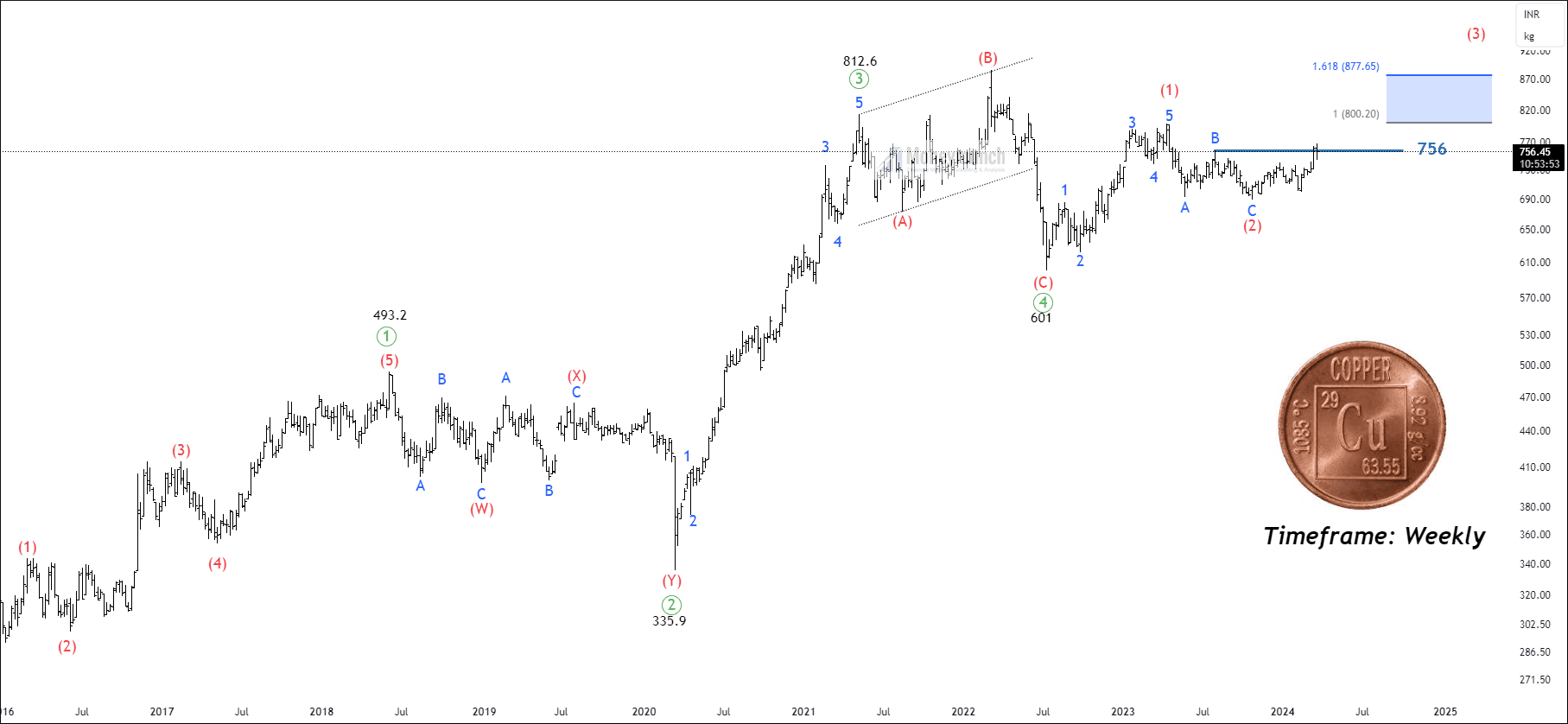

Did you trade MCX Copper Wave Setup?

Click here: Long-Term View: IS MCX Copper Preparing For A Take-Off?

BEFORE

BEFORE

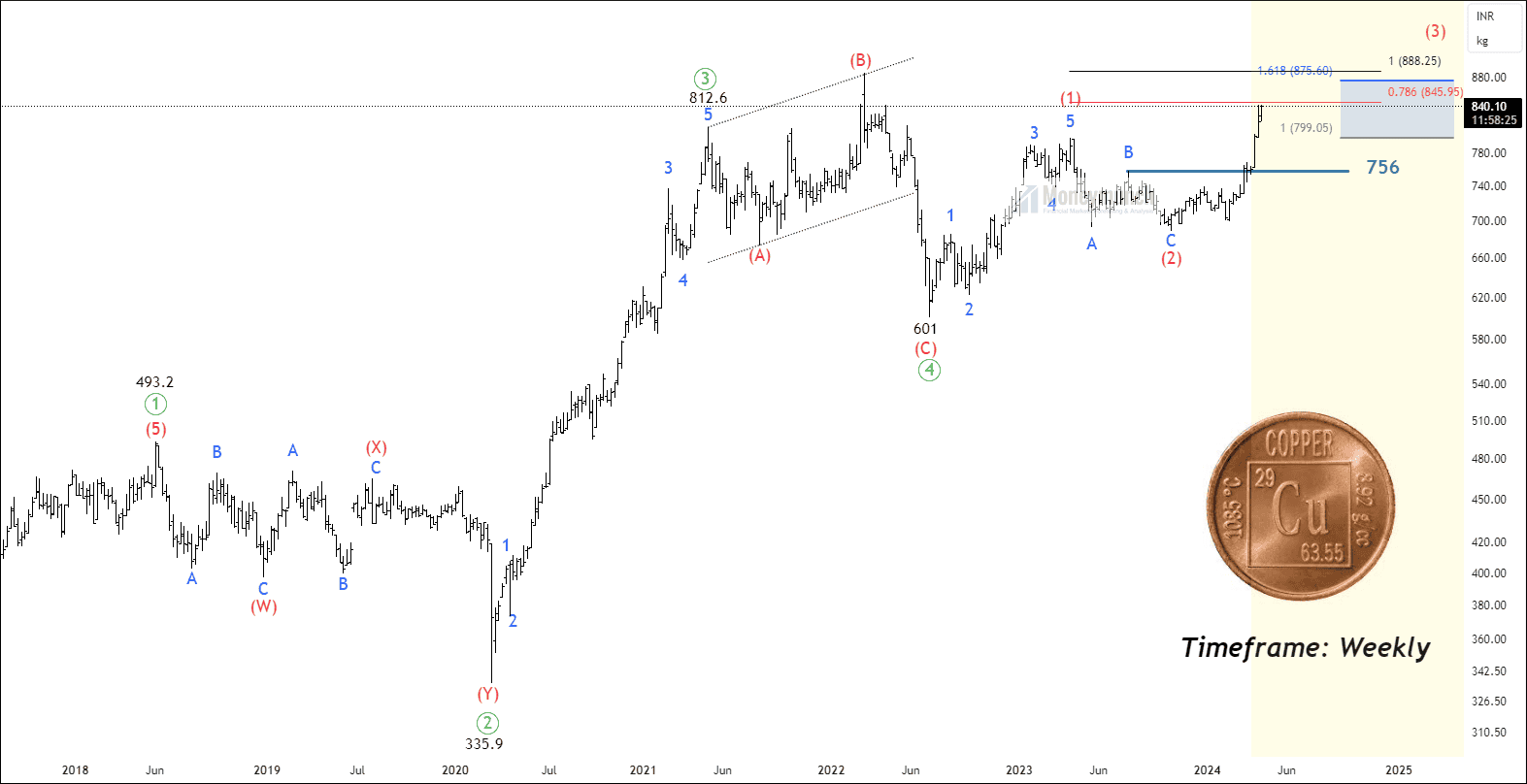

Sub-wave c of wave (2) of wave ((4)) occurred at 689.5. If the price breaks out wave B at 756, traders can trade for the following targets: 800 – 840 – 877+.

AFTER

AFTER