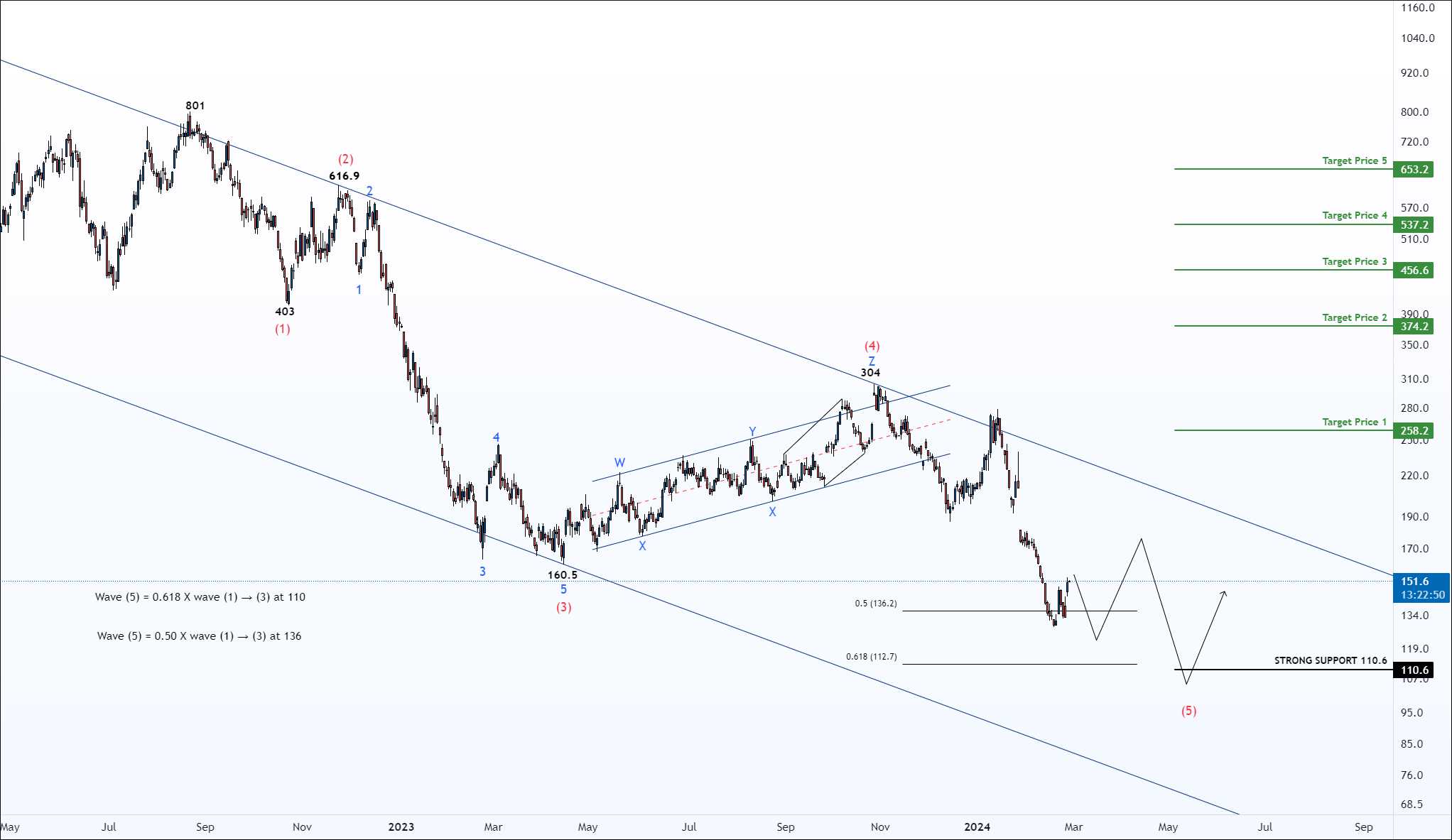

Did you trade MCX Copper Wave Setup?

Click here: Long-Term View: IS MCX Copper Preparing For A Take-Off?

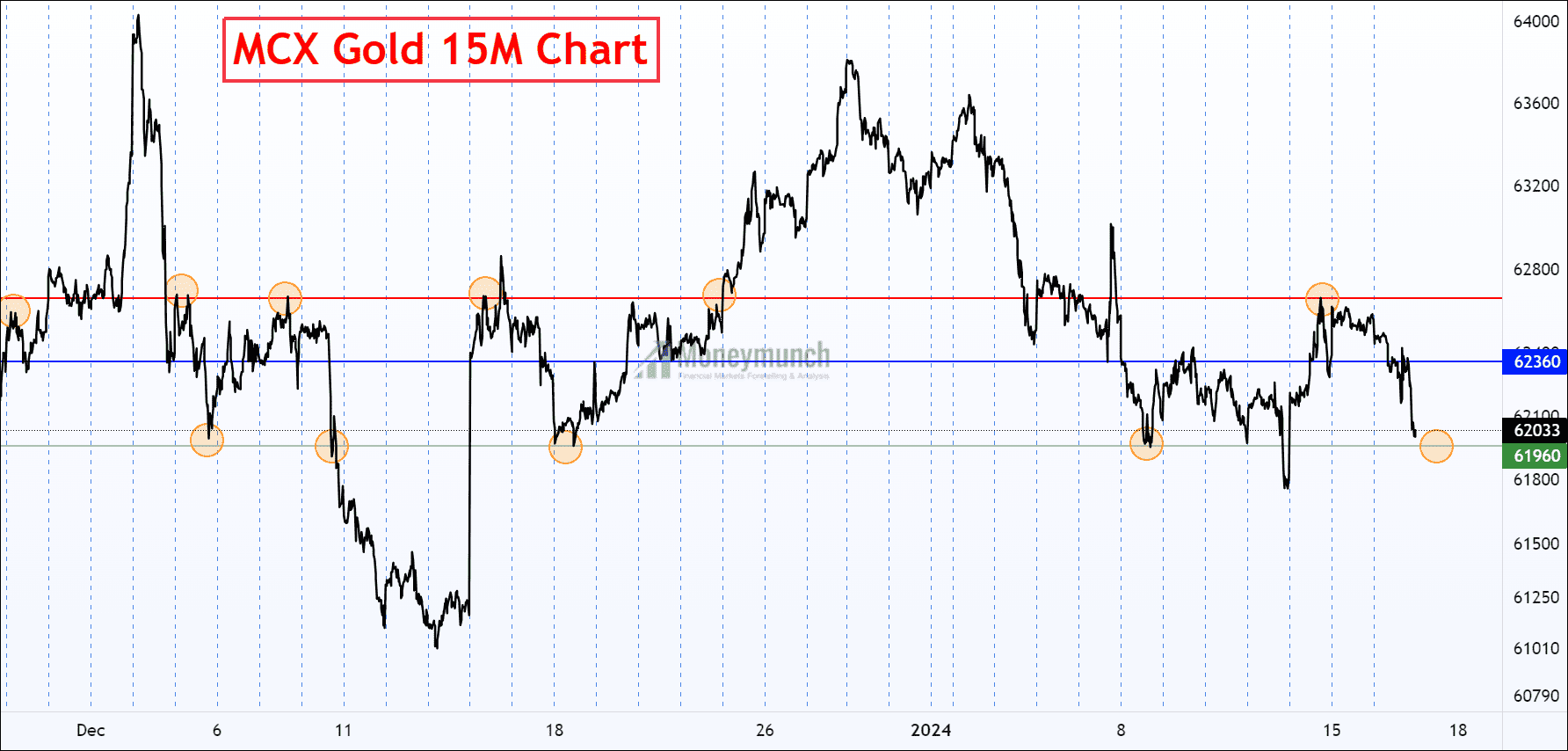

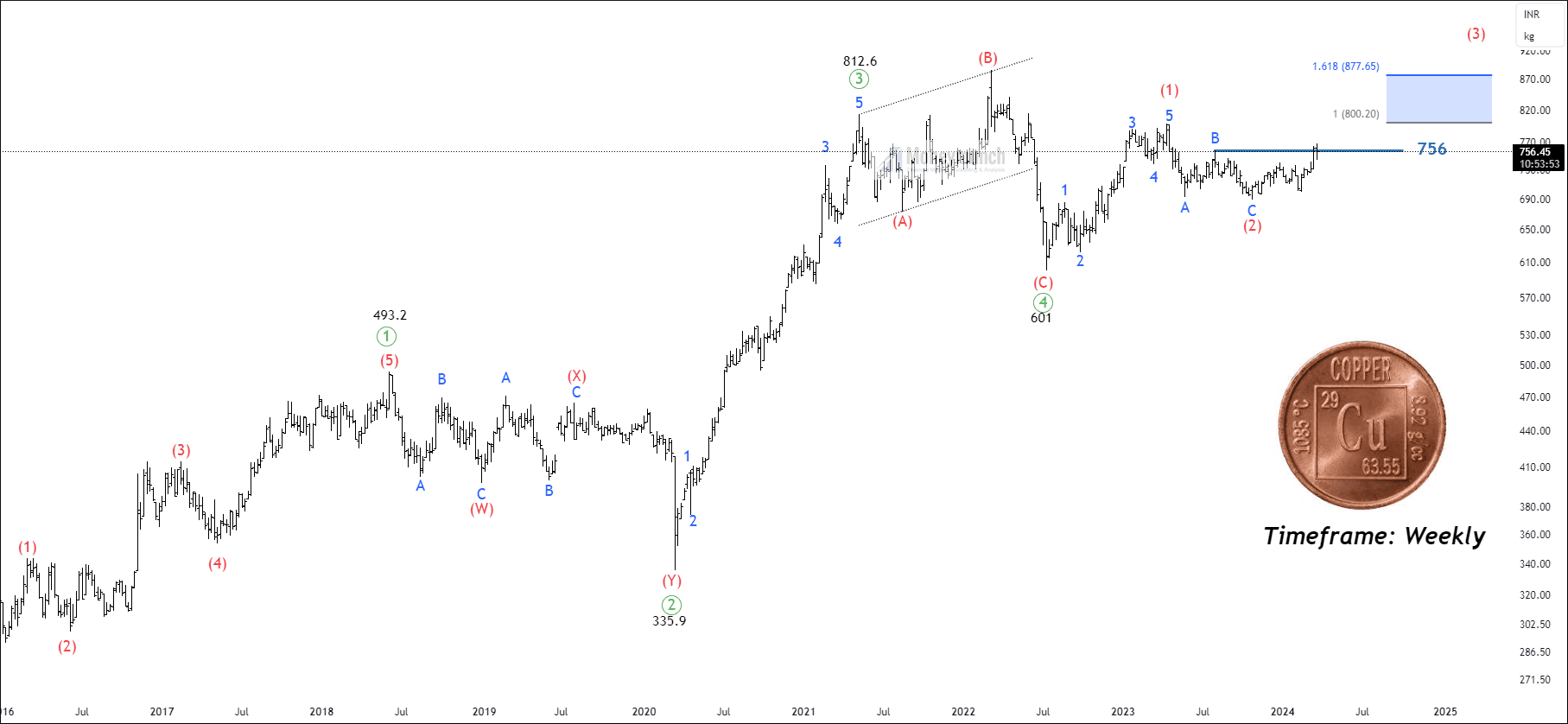

BEFORE

BEFORE

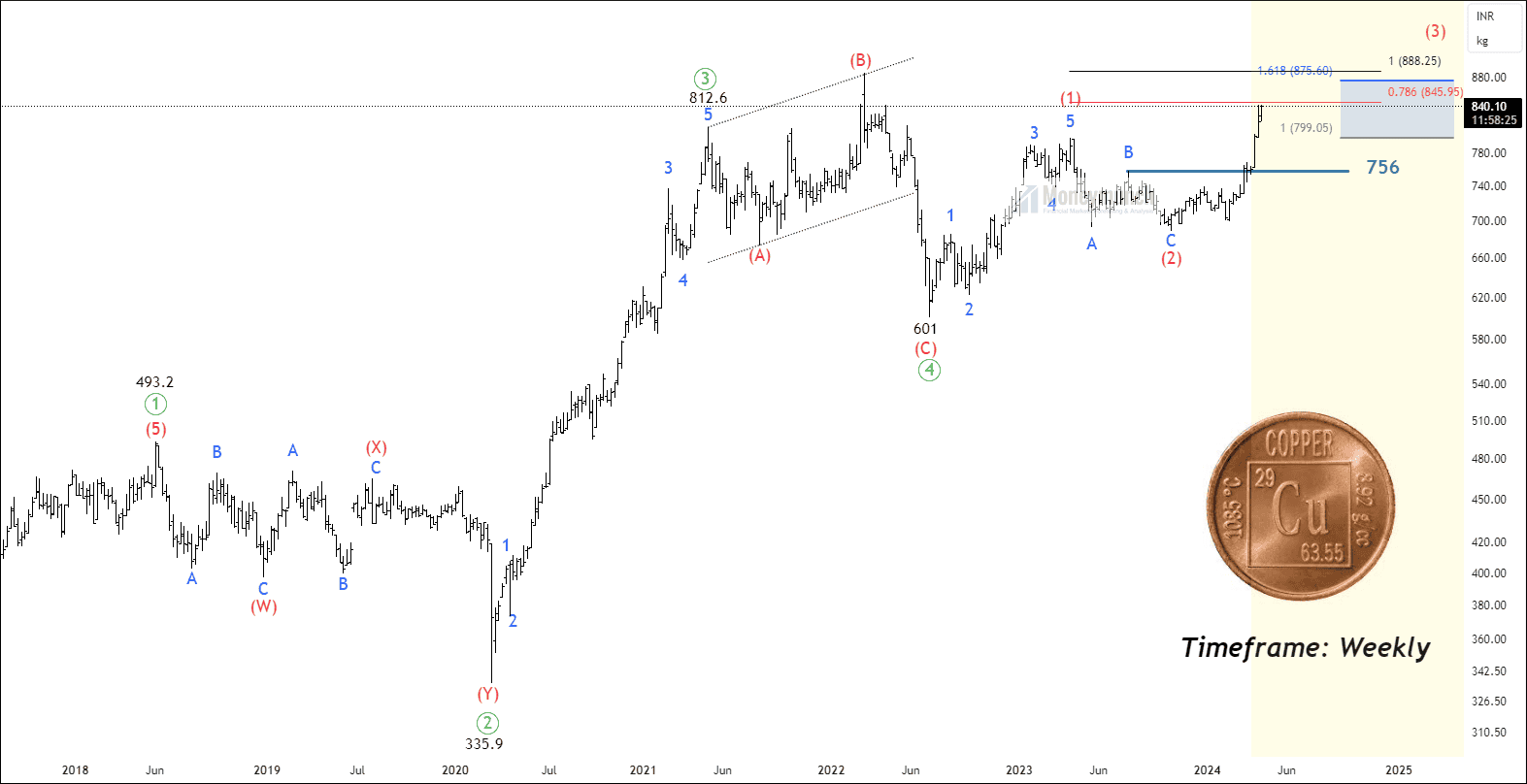

Sub-wave c of wave (2) of wave ((4)) occurred at 689.5. If the price breaks out wave B at 756, traders can trade for the following targets: 800 – 840 – 877+.

AFTER

AFTER