NSE FINCABLES – Premium Setup

Only subscribers can read the full article. Please log in to read the entire text.

NSE COFORGE- Swing Setup

Only subscribers can read the full article. Please log in to read the entire text.

Get free share market NSE & BSE stocks, cash equity, futures, options, and all nifty trading tips and market research reports that enhance your knowledge and take your trading game to the next level.

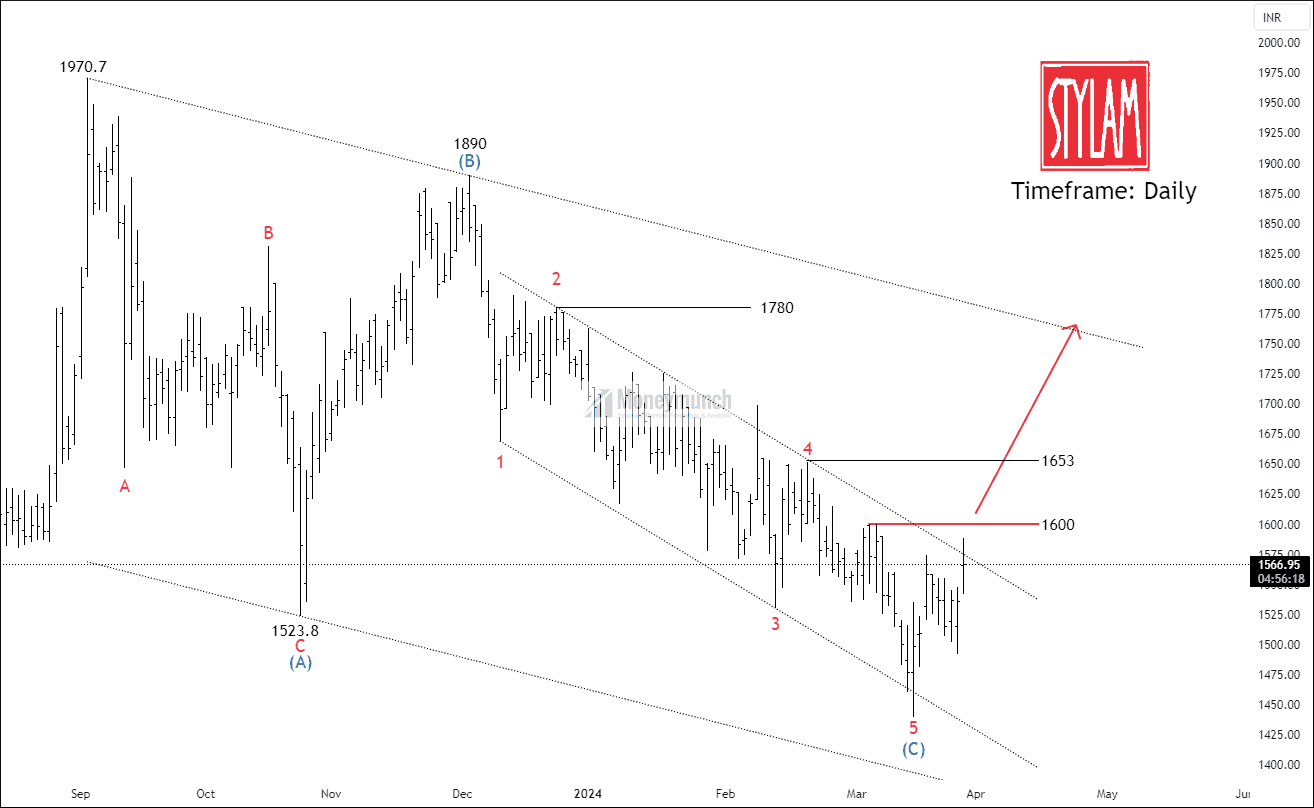

Do you remember the NSE STYLAM Wave projection?

Visit here: NSE STYLAM – Elliott Wave Projection

BEFORE

BEFORE

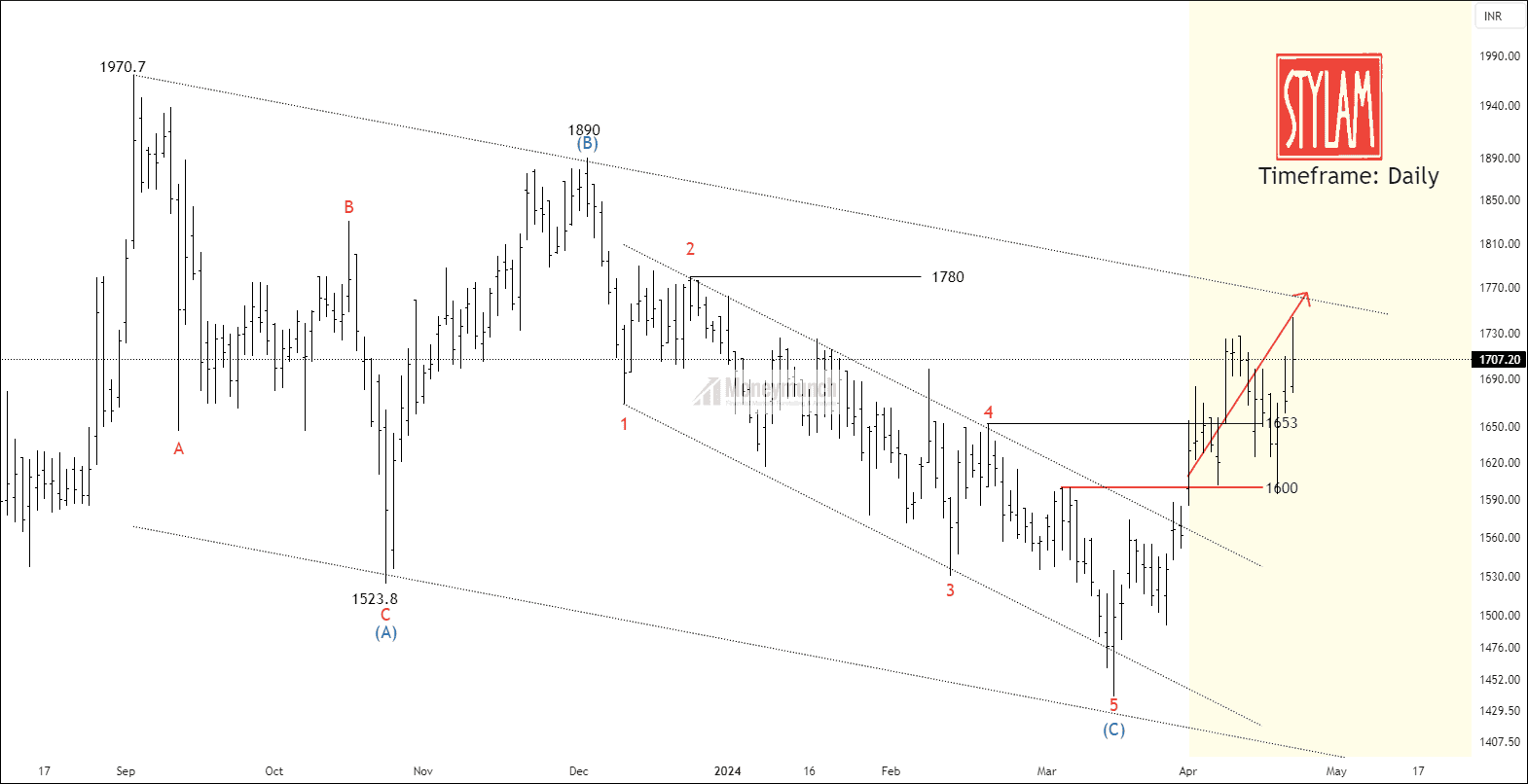

We had written clearly,”If the price breaks out the resistance, traders can trade for the following targets: 1653 – 1728 – 1780+“.

AFTER

AFTER