This is the 43th Day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

Cup with Handle Bullish Chart Pattern

Implication

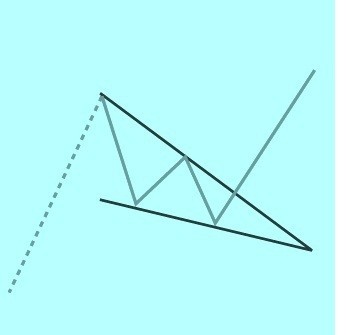

A Continuation Wedge (Bullish) is regarded a bullish indication. It signifies a potential extension of the existing uptrend.

Description

A Continuation Wedge (Bullish) includes of 2 converging tendency lines. The development lines are slanted downward. Unlike the Triangles where the apex is indicated to the appropriate, the pinnacle of this structure is slanted downwards at an perspective. This is considering costs advantage gradually lower in a converging

Pattern Duration

Give consideration to the timeframe of the structure and its connection to your investing time perspectives. The length of the structure is regarded to be an signal of the period of the impact of this structure. The longer the structure the longer it will take for the cost to move to the goal. The shorter the structure the earlier the cost transfer.

Target Price

The desired cost offers an significant indicator about the prospective cost move that this structure signifies. Give consideration to whether the desired cost for this structure is plenty to supply sufficient comes back after your prices have been utilized into profile. A ideal tip of thumb is that the desired cost must suggest a possible return of enhanced than 5% before a pattern should be considered effective.

Criteria that Supports

Volume

Volume should diminish as the pattern forms.

Criteria that Refutes

Moving Average

The penetration of the 200-day Moving Average by the price is a false bear signal.

Rising or Stable Volume

Volume should diminish as the pattern forms. If volume remains the same or increases this signal is less reliable

Underlying Behavior

In this structure cost edge gradually reduce in a converging structure .

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?

TABLE OF CONTENTS

Candlestick and Chart Patterns (15 Days)

7 Most Important Candlestick Chart Patterns

- Gap Down Chart Pattern

- Gap Up Chart Pattern

- Gravestone Short-term Chart Pattern

- Hammer Candle Stick Chart Pattern

- Hanging Man Short-term Stock Chart Pattern

- Inverted Hammer Stock Chart Pattern

- Shooting Star Candle Stick Pattern

Top 2 Bearish Chart Patterns

Top 6 Bullish Chart Patterns

- Engulfing Line (Bullish) Chart Pattern

- Exhaustion Bar Chart Pattern (Bullish)

- Inside Bar Chart Pattern

- Island Bottom Chart Pattern

- Key Reversal Bar (Bullish) Chart Pattern

- Two Bar Reversal (Bullish) Chart Pattern

Indicators & Oscillators (12 Days)

Bullish or Bearish Indicators

Bullish or Bearish Oscillators

- Bollinger Bands Oscillator

- Commodity Channel Index (CCI)

- Fast Stochastic Oscillator

- Know Sure Thing (KST) Oscillator

- Momentum Oscillator

- Moving Average Convergence/Divergence (MACD) Oscillator

- Relative Strength Index (RSI)

- Slow Stochastic Oscillator

- Williams %R Oscillator

Classic Chart Patterns (29 Days)

Bearish Classic Chart Patterns

- Continuation Diamond (Bearish) Chart Pattern

- Continuation Wedge (Bearish)

- Descending Continuation Triangle Chart Pattern

- Diamond Top Chart Pattern

- Double Top Chart Pattern

- Downside Break Chart Pattern – Rectangle

- Flag Bearish Chart Pattern

- Head and Shoulders Top Chart Pattern

- Megaphone Top Chart Pattern

- Pennant Bearish Chart Pattern

- Rounded Top Chart Pattern

- Symmetrical Continuation Triangle (Bearish)

- Top Triangle/Wedge Chart Pattern

- Triple Top Chart Pattern

Bullish Classic Chart Patterns

- Ascending Continuation Triangle Chart Pattern

- Bottom Triangle Or Wedge Chart Pattern

- Continuation Diamond (Bullish) Chart Pattern

- Continuation Wedge Chart Pattern (Bullish)

- Cup with Handle Bullish Chart Pattern

- Diamond Bottom Chart Pattern

- Double Bottom Chart Pattern

- Flag Bullish Chart Pattern

- Head and Shoulders Bottom Chart Pattern

- Megaphone Bottom Chart Pattern

- Pennant Bullish Chart Pattern

- Round Bottom Chart Pattern

- Symmetrical Continuation Triangle Bullish

- Triple Bottom Chart Pattern

- Upside Breakout Chart Pattern – Rectangle

Best Trading Theories (4 Days)

- Basics of Dow theory trading strategy forecasts

- Motive (Impulse) Waves

- Corrective Waves

- Wyckoff Chart Reading

Kind attention: this course is helpful for beginner and intermediate traders. It’s free for everyone. Advanced modules, trading strategies, and data (in-depth) are available for Moneymunch’s premium subscribers.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.