“Technical Analysis Training”

This is the 17th Day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

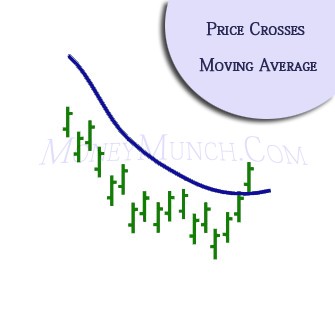

Price Crosses Moving Average

Effect of Price Crosses M.A.

When a security’s price crosses it is moving average (the event), a bullish or bearish alert is produced according to the direction of the crossover.

Story

A moving average is definitely an indicator which performances the average worth of a security’s price over a time period. This kind of Technical Researching happens whenever the price crosses a moving average. Three moving averages are really supported: 21, 50 and additionally 200 days. A price cross of the longer moving average indicates a longer term signal, since the safety might take a longer period of time to move within the anticipated direction.

A bullish alert is produced when the security’s price rises above it is moving average as well as a bearish alert is produced once the security’s price falls below it is moving average.

These events are really based on straight forward moving averages. A simple moving average is one where equal body weight is bearing in mind to any single price around the calculation period. For example, a 21-day simple moving average is calculated if you take the sum of the final 21 days of the stock’s close price and also then separating by 21. Different kinds of moving averages, that are not supported here, are really weighted averages and also exponentially smoothed averages.

Trading Factors

- Moving averages are really lagging indicators because the couple utilize historic information. Using them since indicators is not going to get an individual in at the bottom and additionally away during the top however can get an individual in and additionally out someplace between.

- They work ideal in trending price designs, where some kind of uptrend or downtrend is strongly put in place.

- In trending markets, moving averages can provide a simple and also effective approach to identifying styles.

- Moving averages also work as support areas. An individual will often see an extra stock in one uptrend advancement well above its 21 day moving average, return to it and additionally then advancement once again.

- Moving averages additionally become resistance areas. When an extra stock investments under a moving average, which average can provide since a resistance price and additionally it is difficult for the extra stock to move above it. This really is frequently really real when an extra stock has fallen below its 200 day moving average.

Factors that Supports

Indicators which are fine appropriate to using moving averages consist of the MACD and also Momentum.

Main Behavior

Moving averages do well in trending markets even so they generate numerous false signals in choppy, sideways markets.

Message for you(Trader/Investor): Google has the answers to most all of your questions, after exploring Google if you still have thoughts or questions my Email is open 24/7. Each week you will receive your Course Materials. You can print it and highlight for your Technical Analysis Training.

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?

TABLE OF CONTENTS

Candlestick and Chart Patterns (15 Days)

7 Most Important Candlestick Chart Patterns

- Gap Down Chart Pattern

- Gap Up Chart Pattern

- Gravestone Short-term Chart Pattern

- Hammer Candle Stick Chart Pattern

- Hanging Man Short-term Stock Chart Pattern

- Inverted Hammer Stock Chart Pattern

- Shooting Star Candle Stick Pattern

Top 2 Bearish Chart Patterns

Top 6 Bullish Chart Patterns

- Engulfing Line (Bullish) Chart Pattern

- Exhaustion Bar Chart Pattern (Bullish)

- Inside Bar Chart Pattern

- Island Bottom Chart Pattern

- Key Reversal Bar (Bullish) Chart Pattern

- Two Bar Reversal (Bullish) Chart Pattern

Indicators & Oscillators (12 Days)

Bullish or Bearish Indicators

Bullish or Bearish Oscillators

- Bollinger Bands Oscillator

- Commodity Channel Index (CCI)

- Fast Stochastic Oscillator

- Know Sure Thing (KST) Oscillator

- Momentum Oscillator

- Moving Average Convergence/Divergence (MACD) Oscillator

- Relative Strength Index (RSI)

- Slow Stochastic Oscillator

- Williams %R Oscillator

Classic Chart Patterns (29 Days)

Bearish Classic Chart Patterns

- Continuation Diamond (Bearish) Chart Pattern

- Continuation Wedge (Bearish)

- Descending Continuation Triangle Chart Pattern

- Diamond Top Chart Pattern

- Double Top Chart Pattern

- Downside Break Chart Pattern – Rectangle

- Flag Bearish Chart Pattern

- Head and Shoulders Top Chart Pattern

- Megaphone Top Chart Pattern

- Pennant Bearish Chart Pattern

- Rounded Top Chart Pattern

- Symmetrical Continuation Triangle (Bearish)

- Top Triangle/Wedge Chart Pattern

- Triple Top Chart Pattern

Bullish Classic Chart Patterns

- Ascending Continuation Triangle Chart Pattern

- Bottom Triangle Or Wedge Chart Pattern

- Continuation Diamond (Bullish) Chart Pattern

- Continuation Wedge Chart Pattern (Bullish)

- Cup with Handle Bullish Chart Pattern

- Diamond Bottom Chart Pattern

- Double Bottom Chart Pattern

- Flag Bullish Chart Pattern

- Head and Shoulders Bottom Chart Pattern

- Megaphone Bottom Chart Pattern

- Pennant Bullish Chart Pattern

- Round Bottom Chart Pattern

- Symmetrical Continuation Triangle Bullish

- Triple Bottom Chart Pattern

- Upside Breakout Chart Pattern – Rectangle

Best Trading Theories (4 Days)

- Basics of Dow theory trading strategy forecasts

- Motive (Impulse) Waves

- Corrective Waves

- Wyckoff Chart Reading

Kind attention: this course is helpful for beginner and intermediate traders. It’s free for everyone. Advanced modules, trading strategies, and data (in-depth) are available for Moneymunch’s premium subscribers.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

good call

Thanks for detailed tech analysis lessons.