Yes, the government prints our businesses paper money. But thats just a little small fraction of the money in use. Most of the funds in state economies is made when banks write it directly into their customers’ accounts as a result of thin air as bank loans.

![]()

You earn Rs.10,000 and put it in the bank. And then…

![]()

The bank keeps RS.1000 in its RBI(Reserve bank of India) account …

This is the “reserve,” which the bank uses when customers withdraw funds. As a rule, depositors don’t take out more than 10% of the money they have on deposit on any given day.

![]()

Then loans Susie Rs.9,000, at interest.

![]()

Susie deposits the Rs.9,000 in her bank.

That bank keeps 10% (Rs.900) in reserve and loans Joe Rs.8,100, at interest.

![]()

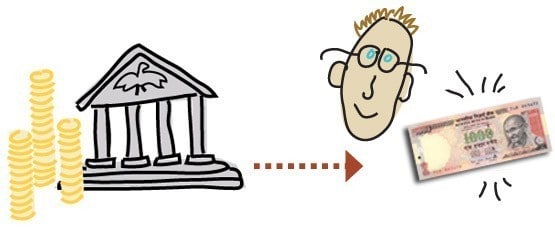

See how it all adds up—for the banks.

You now have Rs,10,000 in your account. Susie has Rs.9,000 in hers. Joe has Rs.8,100.

There’s now Rs.27,100 total in accounts that you and Susie and Joe can spend, and it all came from your Rs.10,000 deposit. The banks have created an additional Rs17,100 by loaning it into existence.

![]()

Imagine this money trick over and over.

If you do this operation 50 times, that Rs.10,000 turns into Rs.99500.25—Rs.88500.25 in loans, and your original Rs.10,000.

Mad math: If those loans are for one year at 10% interest, the banks will make Rs.8800.53. If they’d only been able to loan your Rs.10,000, they’d make Rs.1000.

Awesome calculations guru ji……

A very simple and nice example to explain banker way of earning from our simple deposits….

Great job !!

Thanks

Gaurav

Very informative information by you how banks make money and fool common people.

I do not understand then how banks make losses?

It is Secret…!

lol. its game…! not a loss but directors are playing a game with people…

Ididn’t know it so far. Thanks for the detailed iobnformation

THAT IS NOT SO SIMPLE GURU JI—ALL LOANS GIVEN BY BANKS ARE NOT DEPOSITED IN BANKS AGAIN IN CASH FORMS,INSTEAD LOANS ARE PROVIDED FOR RUNNING THE BUSINESSES AND COUNTRY’S ECONOMY=MONEY BORROWED BY ENTERPRENEURS ARE INVESTED IN MANUAFATURING,PROCEESING AND TRADING COMMODITIES AND NOT SIMPLT DEPOSITING IN THE BANKS SO MANY TIMES-DIRECTORS DON’T BEFOOL PUBLIC,INSTEAD BANK SUFFER LOSSES WHEN THY PROVIDE FOR BAD AND LOSS LOANS AND ASSETS OUT OF THEIR PROFITS—AND SO MANY OTHER FACTORS TO ENUMERATE…