This is the 36th Day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

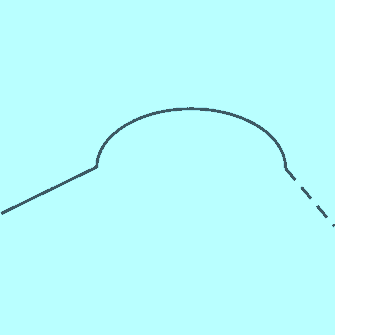

Rounded Top Chart Pattern

Implication

A Rounded Top is regarded as a bearish signal, showing a potential reversal of the existing uptrend to a new downtrend.

Description

A Rounded Top is dome-shaped, as well as is occasionally introduced to as an anatropous container or a disk top. The construction is confirmed when the cost divides down under its moving average.

Following are important characteristic to look for in a Rounded Top.

Shape

Robert D. Edwards and John Magee explain the round top as becoming a “progressive, innovative, and very molded modification in the improvement way, produced by a innovative change in the security between buying and supplying”.

Volume

Amount can modification, then again amount normally looks to be acetabular, and follow the mutual of the cost framework. Subsequently, as the money start to go up, amount appears to lessen. Once the top of the cost structure begins its reduced turn, quantity tends to improve

Duration of the Rounded Top

Rounded Tops usually happen over a duration of about 3 weeks, but can also be noticed over countless years.

Trading Considerations

Duration of the Pattern

The duration of the pattern suggests the importance of the price motion. Clifford Pistolese writes, “a rounding top that is finished in a couple of months will generally be less important than one that takes a much longer time to finish.”

Target Price

After a downside breakout, technical analysts may choose the beginning price at the left side of the concave shape to determine where the price may mind. Nevertheless, you will want to track the stock with attention. Price may end greater than it was at the beginning of the pattern. Moreover, there is the potential for the price to increase after the rounded top finishes. Thomas N. Bulkowski writes that, “most of the time prices increase after a rounding top finishes”.

Criteria that Supports

Volume

Volume should diminish as the pattern forms.

Moving Average

Moving averages assistance to identify whether the rounded top has the potential to descend. For a rounded top, the price should get across under the moving average when it starts to descend. When this crossing over happens, the pattern is “confirmed”.

There is an variety of writing about moving averages if you are considering in knowledge how they work. In easy terms, the moving average can be used to identify a potential pattern achievements or failing. Commonly, a moving average signifies the closing price of a stock over a set number of days, and can be used to expect the basic way of a stock. Depending on the type of stock, investors may determine to use a long, medium or short term moving average. For example, short duration patterns generally use a 50-day moving average, and longer patterns generally use a 200-day moving average.

Trendlines

Price trendlines supply investors with a way to track and confirm a rounded top. To track a potential rounded top, technical analysts bring a line just beneath the lower limitations of the price uptrend. The trendline is directly, irrespective of the variations of the price. When the price drops below the line, there is indicator that the uptrend has ended.

Whenever the downtrend starts, technical analysts draw different line just above the upper limitations of the price pattern, and continue down towards the start price of the pattern development. When the price rises above the line, there is an indication that the new downtrend has finished.

Criteria that Refutes

Upside Breakouts

A promising-looking rounded shape with an breakout above the moving average, instead of below, may not establish or maintain a new downtrend.

Underlying Behavior

A Rounded Top forms as investor belief shifts slowly from bullishness to bearishness. As the belief transforms up toward the top, there is a drop off in trading volume due to the indecisiveness in the market. There is a stage of combination at the top as trading bounces within a certain range, then lastly there is a steady downturn tagging the shift to bearishness. As investors become additional important about the bearishness, there is an increase in trading volume.

Message for you(Trader/Investor): Google has the answers to most all of your questions, after exploring Google if you still have thoughts or questions my Email is open 24/7. Each week you will receive your Course Materials. You can print it and highlight for your Technical Analysis Training.

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?

TABLE OF CONTENTS

Candlestick and Chart Patterns (15 Days)

7 Most Important Candlestick Chart Patterns

- Gap Down Chart Pattern

- Gap Up Chart Pattern

- Gravestone Short-term Chart Pattern

- Hammer Candle Stick Chart Pattern

- Hanging Man Short-term Stock Chart Pattern

- Inverted Hammer Stock Chart Pattern

- Shooting Star Candle Stick Pattern

Top 2 Bearish Chart Patterns

Top 6 Bullish Chart Patterns

- Engulfing Line (Bullish) Chart Pattern

- Exhaustion Bar Chart Pattern (Bullish)

- Inside Bar Chart Pattern

- Island Bottom Chart Pattern

- Key Reversal Bar (Bullish) Chart Pattern

- Two Bar Reversal (Bullish) Chart Pattern

Indicators & Oscillators (12 Days)

Bullish or Bearish Indicators

Bullish or Bearish Oscillators

- Bollinger Bands Oscillator

- Commodity Channel Index (CCI)

- Fast Stochastic Oscillator

- Know Sure Thing (KST) Oscillator

- Momentum Oscillator

- Moving Average Convergence/Divergence (MACD) Oscillator

- Relative Strength Index (RSI)

- Slow Stochastic Oscillator

- Williams %R Oscillator

Classic Chart Patterns (29 Days)

Bearish Classic Chart Patterns

- Continuation Diamond (Bearish) Chart Pattern

- Continuation Wedge (Bearish)

- Descending Continuation Triangle Chart Pattern

- Diamond Top Chart Pattern

- Double Top Chart Pattern

- Downside Break Chart Pattern – Rectangle

- Flag Bearish Chart Pattern

- Head and Shoulders Top Chart Pattern

- Megaphone Top Chart Pattern

- Pennant Bearish Chart Pattern

- Rounded Top Chart Pattern

- Symmetrical Continuation Triangle (Bearish)

- Top Triangle/Wedge Chart Pattern

- Triple Top Chart Pattern

Bullish Classic Chart Patterns

- Ascending Continuation Triangle Chart Pattern

- Bottom Triangle Or Wedge Chart Pattern

- Continuation Diamond (Bullish) Chart Pattern

- Continuation Wedge Chart Pattern (Bullish)

- Cup with Handle Bullish Chart Pattern

- Diamond Bottom Chart Pattern

- Double Bottom Chart Pattern

- Flag Bullish Chart Pattern

- Head and Shoulders Bottom Chart Pattern

- Megaphone Bottom Chart Pattern

- Pennant Bullish Chart Pattern

- Round Bottom Chart Pattern

- Symmetrical Continuation Triangle Bullish

- Triple Bottom Chart Pattern

- Upside Breakout Chart Pattern – Rectangle

Best Trading Theories (4 Days)

- Basics of Dow theory trading strategy forecasts

- Motive (Impulse) Waves

- Corrective Waves

- Wyckoff Chart Reading

Kind attention: this course is helpful for beginner and intermediate traders. It’s free for everyone. Advanced modules, trading strategies, and data (in-depth) are available for Moneymunch’s premium subscribers.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.