This is the 49th Day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

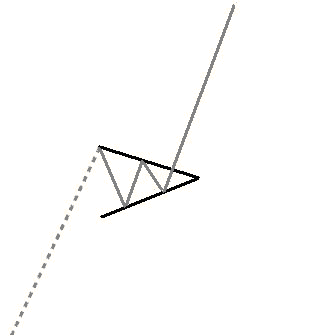

Pennant Bullish Chart Pattern

Implication

A Pennant (Bullish) is regarded a bullish signal, showing that the existing uptrend may proceed.

Description

A Pennant (Bullish) pursue a sharp, or basically vertical rise in cost, and consists of 2 converging trendlines that form a narrow, tapering flag shape. The Pennant shape generally appears as a horizontal shape, rather than one with a downtrend or uptrend.

Following are important characteristics for this pattern.

Trendlines

For Pennants, the amount trendlines choose to converge. At the beginning of the Pennant, the amount spikes, probably in answer to a beneficial items or income declaration. Implementing the amount spike, the amount variations continue until they taper out and become decreasingly less fickle. This attitude appearance on a amount chart with the initial amount spike creating what technical analysts refer to as the “mast” of the Pennant, observed by a triangular pennant profile.

Volume

As the Pennant develops, the volume appears to reduction. Martin Pring ideas in his publication, Technical Analysis Explained, “a pennant is in effect a very small triangle. If anything, volume tends to contract even more during the formation of a pennant than during that of a flag.” However, as with Flags, when the Pennant completes you will often observe a sharp spike in volume. Duration of the Pattern

Trading Considerations

Possibility of Price Reversal

In some rare cases, the amount will bust against the earliest amount activity, and generate a reversal trend. The pattern reversal may be signaled during the Pennant enhancement by an enhance in quantity, as compared to the additional typical decrease. Duration of the Pattern

Target Price

It is generally held that the duration of the mast suggests the potential amount enhance. Like the Flag, the Pennant is regarded to be a pause in an uptrend. Following the Pennant, the amount commonly advances to reproduce the elevation of the mast, while continuing in the movement of the incoming tendency.

Criteria that Supports

Volume

Volume should decrease visibly as the structure forms.

A powerful quantity spike on the day of the construction affirmation is a effective indication in assistance of the potential for this structure. The amount spike should be significantly above the average of the amount for the length of the structure.

Criteria that Refutes

Duration of the Pattern

According to Martin Pring, a pattern that exceeds “4 weeks to develop should … be treated with caution”. After 4 weeks, interest in the stock is likely to decrease to point that it is unlikely to continue in a strong uptrend. No Volume Spike on Breakout

Underlying Behavior

This pattern is effectively a pause in an uptrend. The cost has moved ahead of itself with a sharp rise; therefore market training requires a break before proceeding the uptrend. This pause is reflected in the reducing trading quantity.

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?

TABLE OF CONTENTS

Candlestick and Chart Patterns (15 Days)

7 Most Important Candlestick Chart Patterns

- Gap Down Chart Pattern

- Gap Up Chart Pattern

- Gravestone Short-term Chart Pattern

- Hammer Candle Stick Chart Pattern

- Hanging Man Short-term Stock Chart Pattern

- Inverted Hammer Stock Chart Pattern

- Shooting Star Candle Stick Pattern

Top 2 Bearish Chart Patterns

Top 6 Bullish Chart Patterns

- Engulfing Line (Bullish) Chart Pattern

- Exhaustion Bar Chart Pattern (Bullish)

- Inside Bar Chart Pattern

- Island Bottom Chart Pattern

- Key Reversal Bar (Bullish) Chart Pattern

- Two Bar Reversal (Bullish) Chart Pattern

Indicators & Oscillators (12 Days)

Bullish or Bearish Indicators

Bullish or Bearish Oscillators

- Bollinger Bands Oscillator

- Commodity Channel Index (CCI)

- Fast Stochastic Oscillator

- Know Sure Thing (KST) Oscillator

- Momentum Oscillator

- Moving Average Convergence/Divergence (MACD) Oscillator

- Relative Strength Index (RSI)

- Slow Stochastic Oscillator

- Williams %R Oscillator

Classic Chart Patterns (29 Days)

Bearish Classic Chart Patterns

- Continuation Diamond (Bearish) Chart Pattern

- Continuation Wedge (Bearish)

- Descending Continuation Triangle Chart Pattern

- Diamond Top Chart Pattern

- Double Top Chart Pattern

- Downside Break Chart Pattern – Rectangle

- Flag Bearish Chart Pattern

- Head and Shoulders Top Chart Pattern

- Megaphone Top Chart Pattern

- Pennant Bearish Chart Pattern

- Rounded Top Chart Pattern

- Symmetrical Continuation Triangle (Bearish)

- Top Triangle/Wedge Chart Pattern

- Triple Top Chart Pattern

Bullish Classic Chart Patterns

- Ascending Continuation Triangle Chart Pattern

- Bottom Triangle Or Wedge Chart Pattern

- Continuation Diamond (Bullish) Chart Pattern

- Continuation Wedge Chart Pattern (Bullish)

- Cup with Handle Bullish Chart Pattern

- Diamond Bottom Chart Pattern

- Double Bottom Chart Pattern

- Flag Bullish Chart Pattern

- Head and Shoulders Bottom Chart Pattern

- Megaphone Bottom Chart Pattern

- Pennant Bullish Chart Pattern

- Round Bottom Chart Pattern

- Symmetrical Continuation Triangle Bullish

- Triple Bottom Chart Pattern

- Upside Breakout Chart Pattern – Rectangle

Best Trading Theories (4 Days)

- Basics of Dow theory trading strategy forecasts

- Motive (Impulse) Waves

- Corrective Waves

- Wyckoff Chart Reading

Kind attention: this course is helpful for beginner and intermediate traders. It’s free for everyone. Advanced modules, trading strategies, and data (in-depth) are available for Moneymunch’s premium subscribers.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.