This is the 35th Day course in a series of 60-Days called “Technical Analysis Training”

You will get daily one series of this Training after 8 o’clock night (Dinner Finished)

Follow MoneyMunch.com Technical Analysis Directory and Learn Basic Education of Technical Analysis on the Indian Stock Market (NSE/BSE)

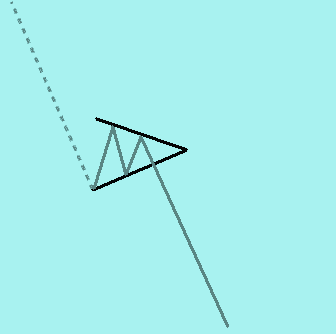

Pennant Bearish Chart Pattern

Implication

A Pennant (Bearish) is considered a bearish signal, indicating that the current downtrend may continue.

Description

A Pennant (Bearish) observe a high, or almost vertical decrease in price, and is made up of two converging trendlines that kind a narrow, tapering flag shape. The Pennant shape usually looks as a horizontal shape, instead than one with a downtrend or uptrend.

Aside starting its shape, the Pennant is comparable in all areas to the Flag. The Pennant is also like to the Symmetrical Triangle or Wedge continuation patterns nevertheless; the Pennant is generally smaller in period and flies horizontally.

Important Characteristics

Following are important characteristics for this pattern.

Trendlines

For Pennants, the rates trendlines tend to gather. At the begin of the Pennant, the price surges, possibly in reaction to an unanticipated and unfavorable company statement. Following the price increase, the price variations maintain till they pianoter out and become decreasingly less fickle. This attitude seems on a price chart with the original price spike developing what technical analysts recommend to as the “mast” of the Pennant, adopted by a triangular pennant shape.

Volume

As the Pennant grows, the volume tends to decline. St. martin Pring records in his book, Technical Analysis Explained, “a pennant is in impact a very small triangle. If something, volume tends to agreement still additional through the development of a pennant then during that of a flag.” Although, as with Flags, when the Pennant finishes you will frequently notice a sharp spike in volume.

Duration of the Pattern

In his book, Technical Analysis of the Financial Markets, John J. Murphy determines that Pennants and Flags are fairly short-term and should be finished within one to three weeks”. He also records that by contrast, the bullish patterns accept longer to build than the associated bearish patterns.

Trading Considerations

Possibility of Price Reversal

In some rare cases, the price will crack towards the initial price movement, and generate a reversal trend. The pattern reversal might be signaled during the Pennant development by an enhance in volume, as compared to the additional common decrease.

Duration of the Pattern

The period of the pattern counts on the level of the price variations (integration). The better the variations, the longer a pattern will accept to create.

Target Price

It is generally kept that the duration of the spar suggests the potential price enhance. Such as the Flag, the Pennant is regarded as to be a stop in a downtrend. Next the Pennant, the price commonly jumps to duplicate the height of the mast, while proceeding in the direction of the inbound trend.

Criteria that Supports

Volume

Volume should minimize significantly as the layout forms.

A powerful volume surge on the day of the pattern verification is a potent signal in support of the potential for this pattern. The volume spike should be considerably above the average of the volume for the period of the pattern. In inclusion, the volume more than the course of the pattern should be declining on average.

Criteria that Refutes

Duration of the Pattern

According to Martin Pring, a pattern that surpasses “4 weeks to build should … be addressed with care”. After 4 weeks, attention in the stock is likely to reduce to point that it is unlikely to maintain in a powerful downtrend.

No Volume Spike on Breakout

The lack of a volume spike on the day of the pattern verification is an indicator that this pattern might not be dependable. In inclusion, if the volume has stayed frequent, or was growing, over the duration of the pattern, subsequently this pattern must be regarded not so dependable and may really reverse.

Underlying Behavior

This pattern is successfully a pause in a downtrend. The price has relocated forward of itself with a steep go up; so market task requires a break prior to proceeding the downtrend. This pause is mirrored in the reducing trading volume. Likewise, a spike in volume marks the resumption of the downtrend

Wishing you a wonderful learning experience and the continued desire to grow your knowledge. Education is an essential part of living wisely and the Experiences of life, I hope you make it fun.

Learning how to profit in the Stock Market requires time and unfortunately mistakes which are called losses. Why not be profitable while you are learning?

TABLE OF CONTENTS

Candlestick and Chart Patterns (15 Days)

7 Most Important Candlestick Chart Patterns

- Gap Down Chart Pattern

- Gap Up Chart Pattern

- Gravestone Short-term Chart Pattern

- Hammer Candle Stick Chart Pattern

- Hanging Man Short-term Stock Chart Pattern

- Inverted Hammer Stock Chart Pattern

- Shooting Star Candle Stick Pattern

Top 2 Bearish Chart Patterns

Top 6 Bullish Chart Patterns

- Engulfing Line (Bullish) Chart Pattern

- Exhaustion Bar Chart Pattern (Bullish)

- Inside Bar Chart Pattern

- Island Bottom Chart Pattern

- Key Reversal Bar (Bullish) Chart Pattern

- Two Bar Reversal (Bullish) Chart Pattern

Indicators & Oscillators (12 Days)

Bullish or Bearish Indicators

Bullish or Bearish Oscillators

- Bollinger Bands Oscillator

- Commodity Channel Index (CCI)

- Fast Stochastic Oscillator

- Know Sure Thing (KST) Oscillator

- Momentum Oscillator

- Moving Average Convergence/Divergence (MACD) Oscillator

- Relative Strength Index (RSI)

- Slow Stochastic Oscillator

- Williams %R Oscillator

Classic Chart Patterns (29 Days)

Bearish Classic Chart Patterns

- Continuation Diamond (Bearish) Chart Pattern

- Continuation Wedge (Bearish)

- Descending Continuation Triangle Chart Pattern

- Diamond Top Chart Pattern

- Double Top Chart Pattern

- Downside Break Chart Pattern – Rectangle

- Flag Bearish Chart Pattern

- Head and Shoulders Top Chart Pattern

- Megaphone Top Chart Pattern

- Pennant Bearish Chart Pattern

- Rounded Top Chart Pattern

- Symmetrical Continuation Triangle (Bearish)

- Top Triangle/Wedge Chart Pattern

- Triple Top Chart Pattern

Bullish Classic Chart Patterns

- Ascending Continuation Triangle Chart Pattern

- Bottom Triangle Or Wedge Chart Pattern

- Continuation Diamond (Bullish) Chart Pattern

- Continuation Wedge Chart Pattern (Bullish)

- Cup with Handle Bullish Chart Pattern

- Diamond Bottom Chart Pattern

- Double Bottom Chart Pattern

- Flag Bullish Chart Pattern

- Head and Shoulders Bottom Chart Pattern

- Megaphone Bottom Chart Pattern

- Pennant Bullish Chart Pattern

- Round Bottom Chart Pattern

- Symmetrical Continuation Triangle Bullish

- Triple Bottom Chart Pattern

- Upside Breakout Chart Pattern – Rectangle

Best Trading Theories (4 Days)

- Basics of Dow theory trading strategy forecasts

- Motive (Impulse) Waves

- Corrective Waves

- Wyckoff Chart Reading

Kind attention: this course is helpful for beginner and intermediate traders. It’s free for everyone. Advanced modules, trading strategies, and data (in-depth) are available for Moneymunch’s premium subscribers.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.