The Over-trade Tornado Code: A Trader’s Roadmap

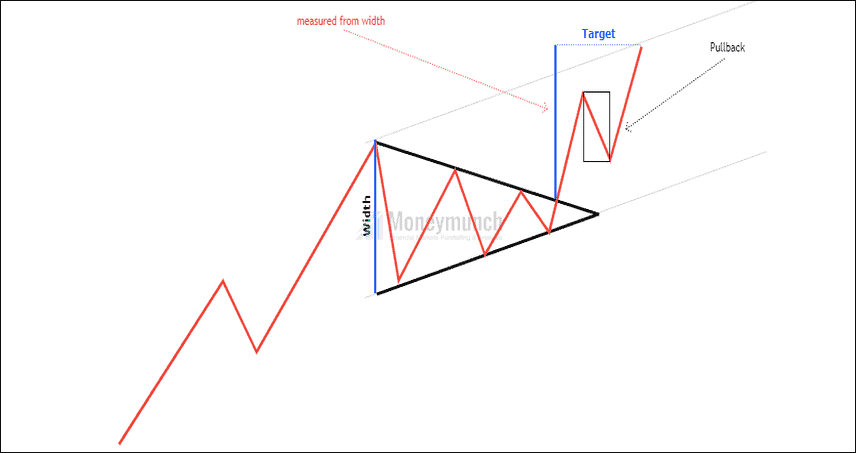

Quick Setup: How to Trade Symmetrical triangle (Coils)?

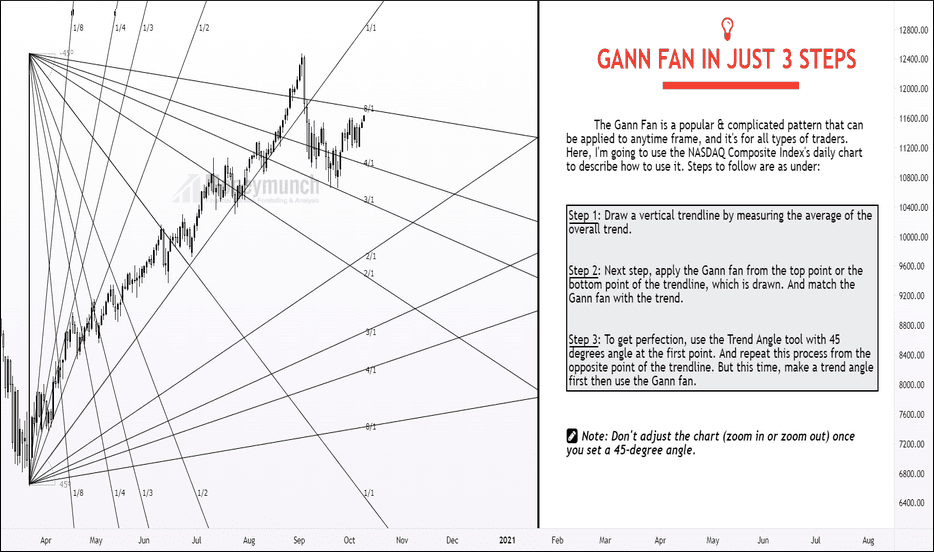

Learn the “Gann Fan” in just 3 Steps

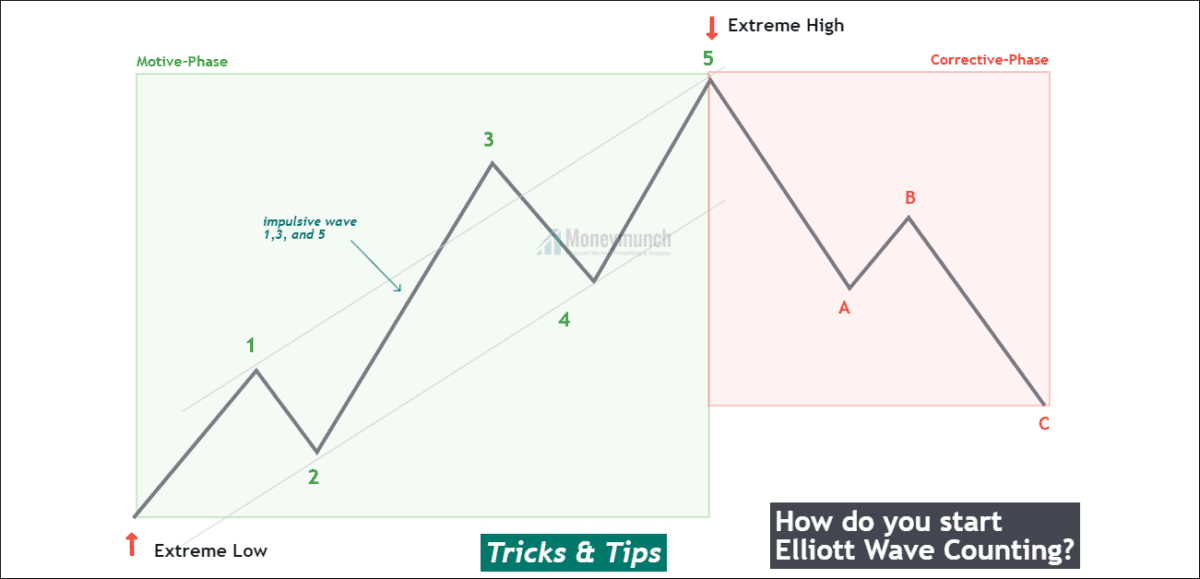

3-Tricks : Where to start Elliott Wave counting on the chart?

Publish Date: 26/08/2021

UPDATE 2.0

We get a lot of questions about Elliott Wave, but a set of questions often received from the followers:

- Where to start wave counting on the chart?

- How do I begin/start wave counting on the chart?

- How do you do Wave Counting?

As a part of establishing Elliott Wave Counting on a chart, we use three working tricks. These are my steps/processes or tricks that can help you to start counting waves.Continue reading

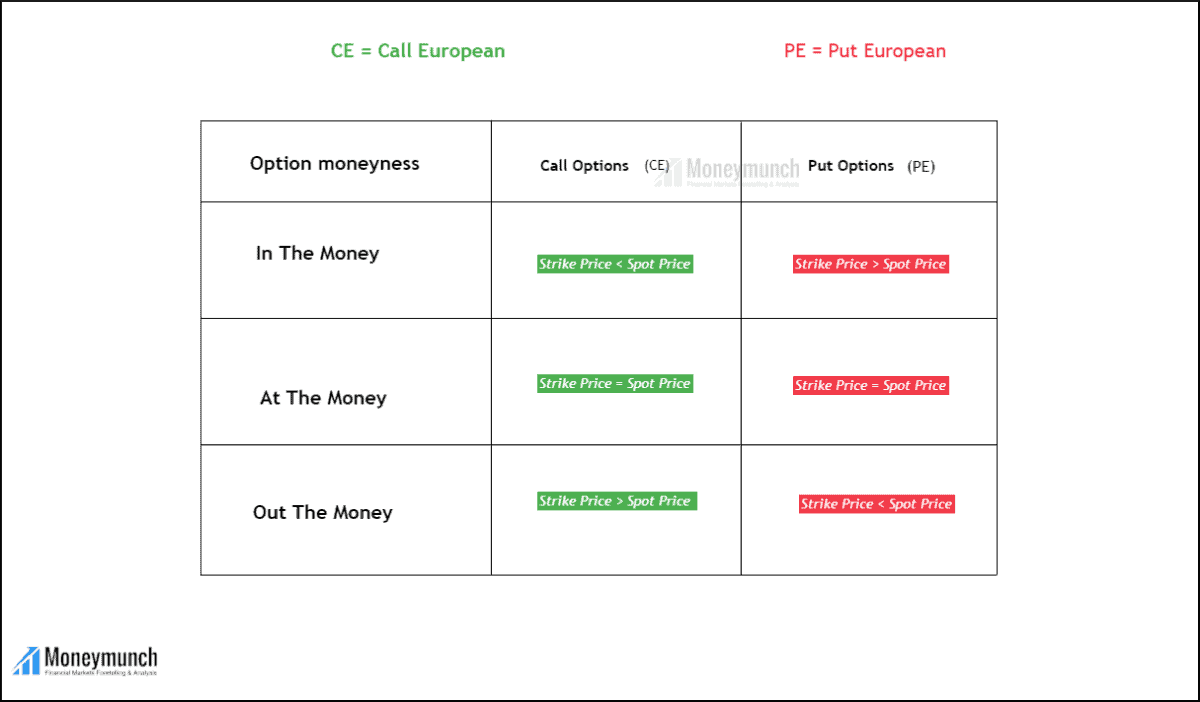

Part 1: Which Strike Prices Are The Most Money-Making?

There is tremendous importance in options trading when it comes to strike prices. Traders can reduce the pain of option decay by choosing the right strike price.

In terms of money, there are three kinds of strike prices.

1) ATM – At the Money

2) OTM – Out of the Money

3) ITM – In the MoneyContinue reading