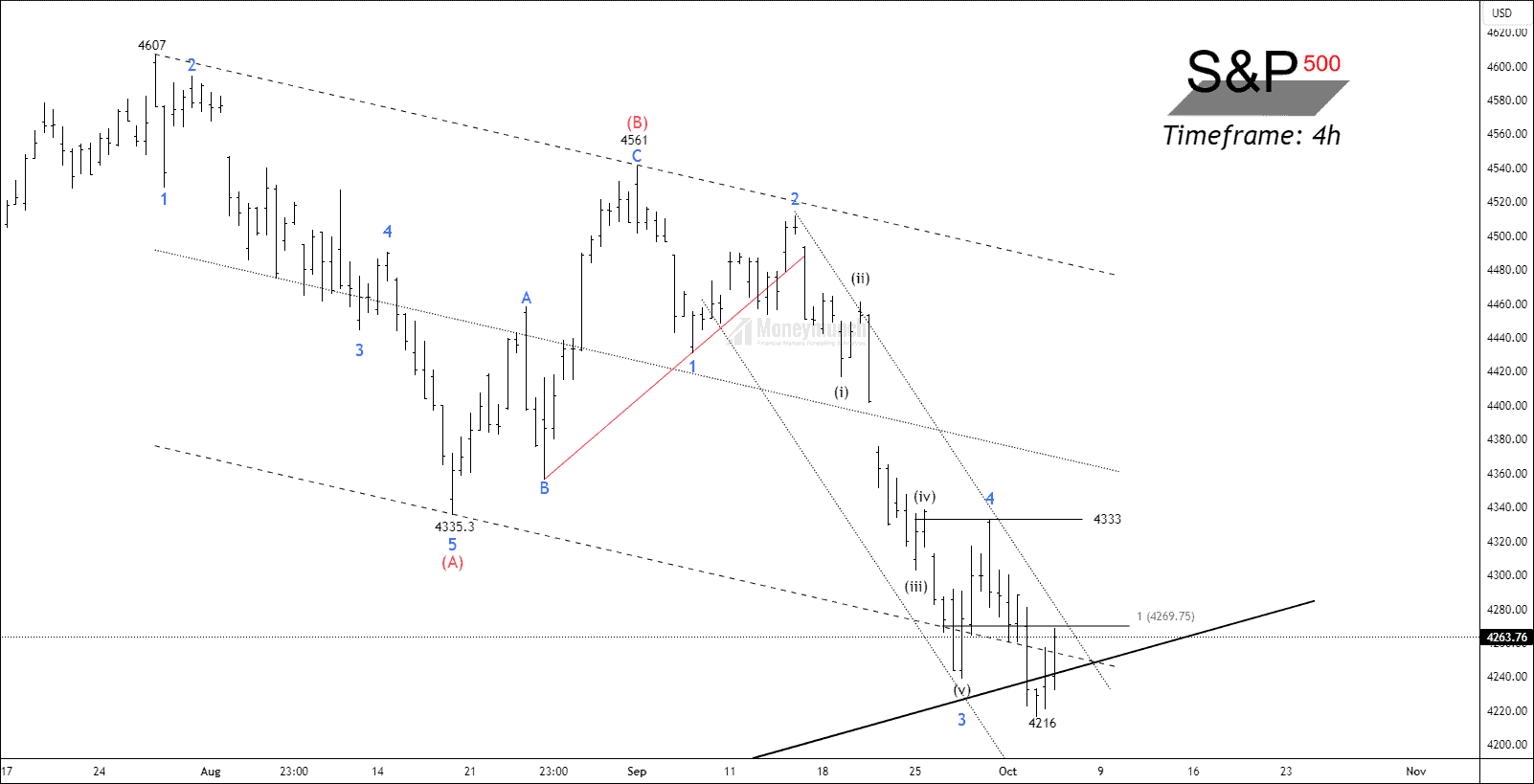

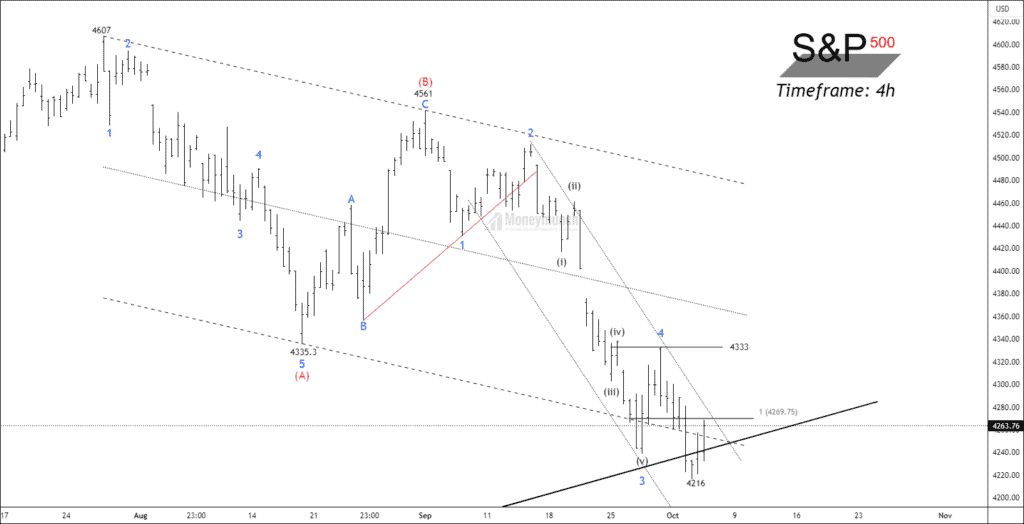

Timeframe: 4h

SPX has formed a corrective A-B-C zigzag formation on the hourly timeframe chart. The price has accomplished wave (b) at 4561, creating the final wave C of the corrective wave (c). SPX has occurred sub-wave 4 at 4333 and started forming sub-wave (5) of wave (C).

According to the Elliott wave principle, an impulsive cycle can only start after the breakout of the sub-wave (4). SPX has taken third support on the dynamic support line. Another clue could be the descending channel of subwave 2-4, and the breakout able to reach wave (B). If the price breakout wave sub-wave 4 of wave (C) at 4333, traders can trade for the following targets: 4416 – 4486 – 4540+.

We can see that the mid-term trendline is holding the price movement, and failure to sustain above the dynamic support can lead to worse conditions even if the price has retraced 61.8% of the overall move. Moving averages are trading above the price, and a rising RSI shows the strenth is about to come.

Premium subscribers will get trade setup with entry, exit, and invalidation levels.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Great work!

Appreciate your work, I have similar expectations.