Did you trade NSE FIEMIND Wave setup?

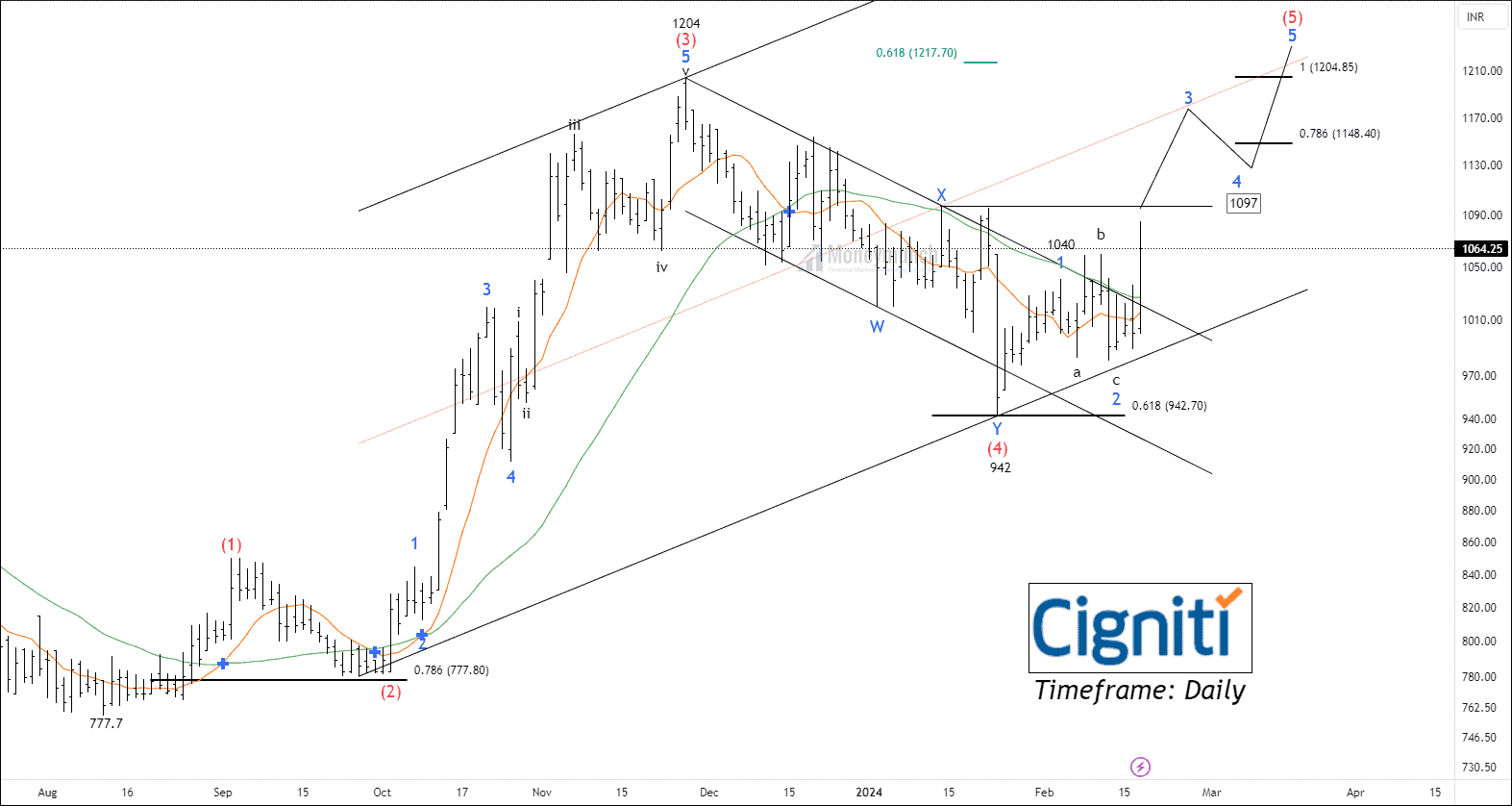

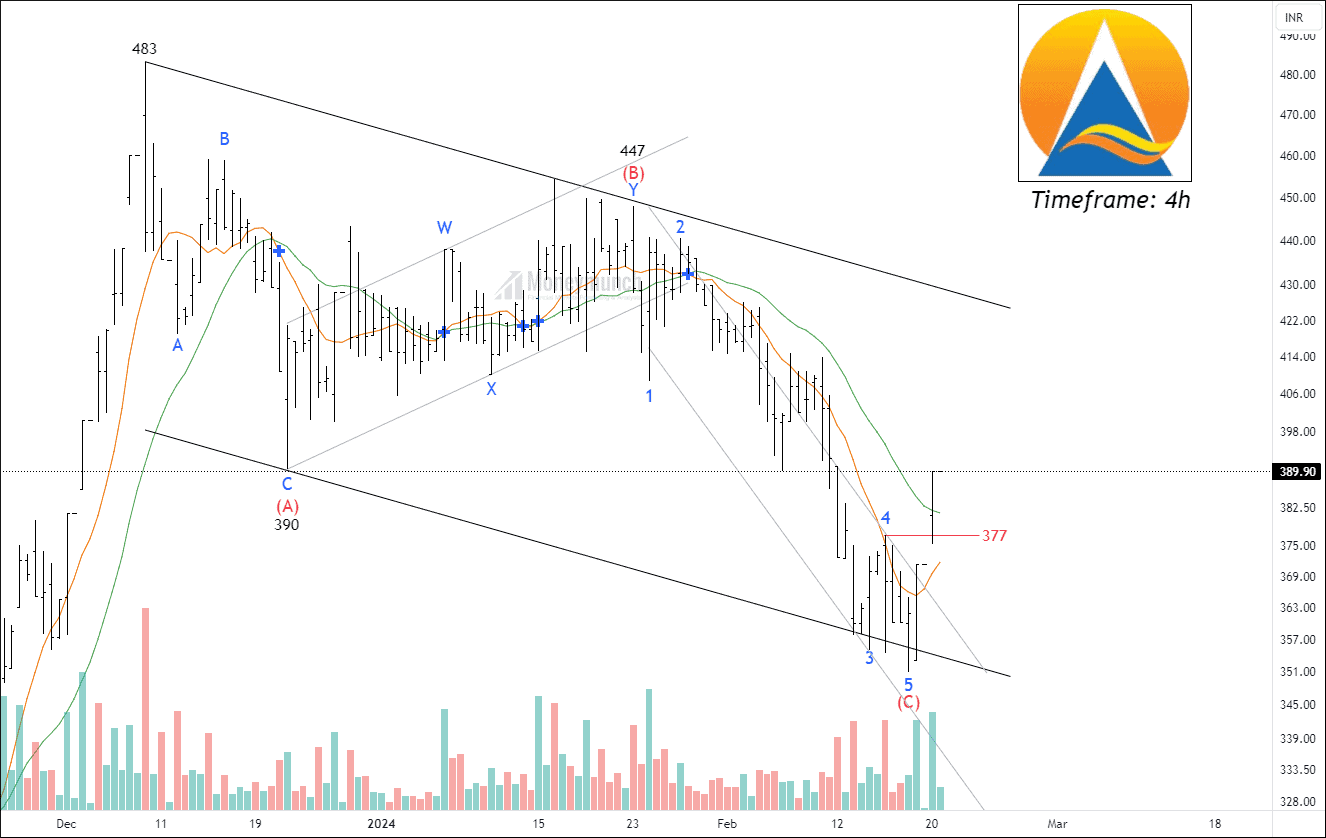

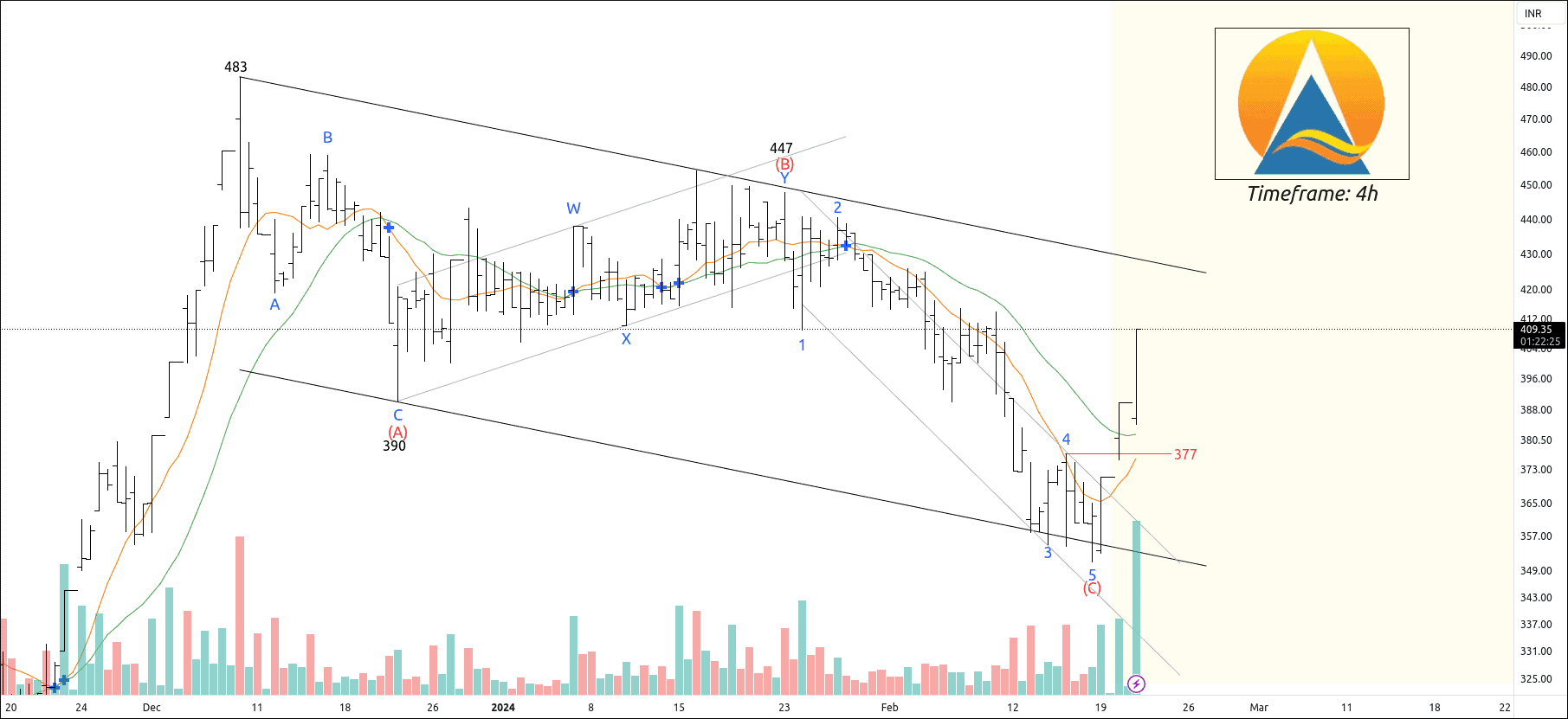

Click here: Trade Setup – BANCOINDIA, BHARTIARTL, CIGNITITEC & More

We had written clearly, “If the price manages to sustain above 2435, traders may consider trading for the following targets: 2494 – 2556 – 2636+”

[23 February 2024]

- 09:15 AM – NSE FIEMIND hit the first target of 2494.

[26 February 2024]

- 12:15 PM – Price touched the second target of 2556, and made a new high of 2572.

If you have traded this setup, you could have made more than 5.5% or 143 points in just four trading session.

Continue reading