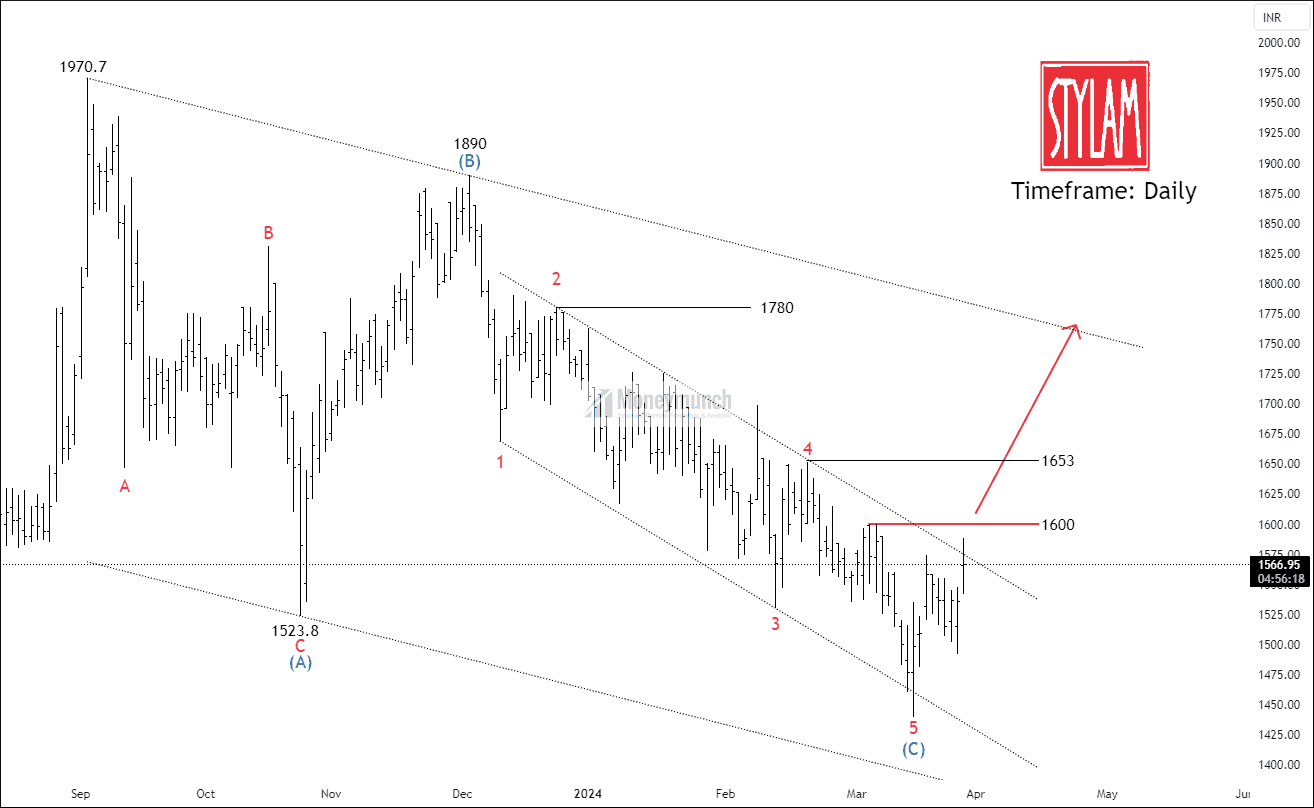

NSE STYLAM – Elliott Wave Projection

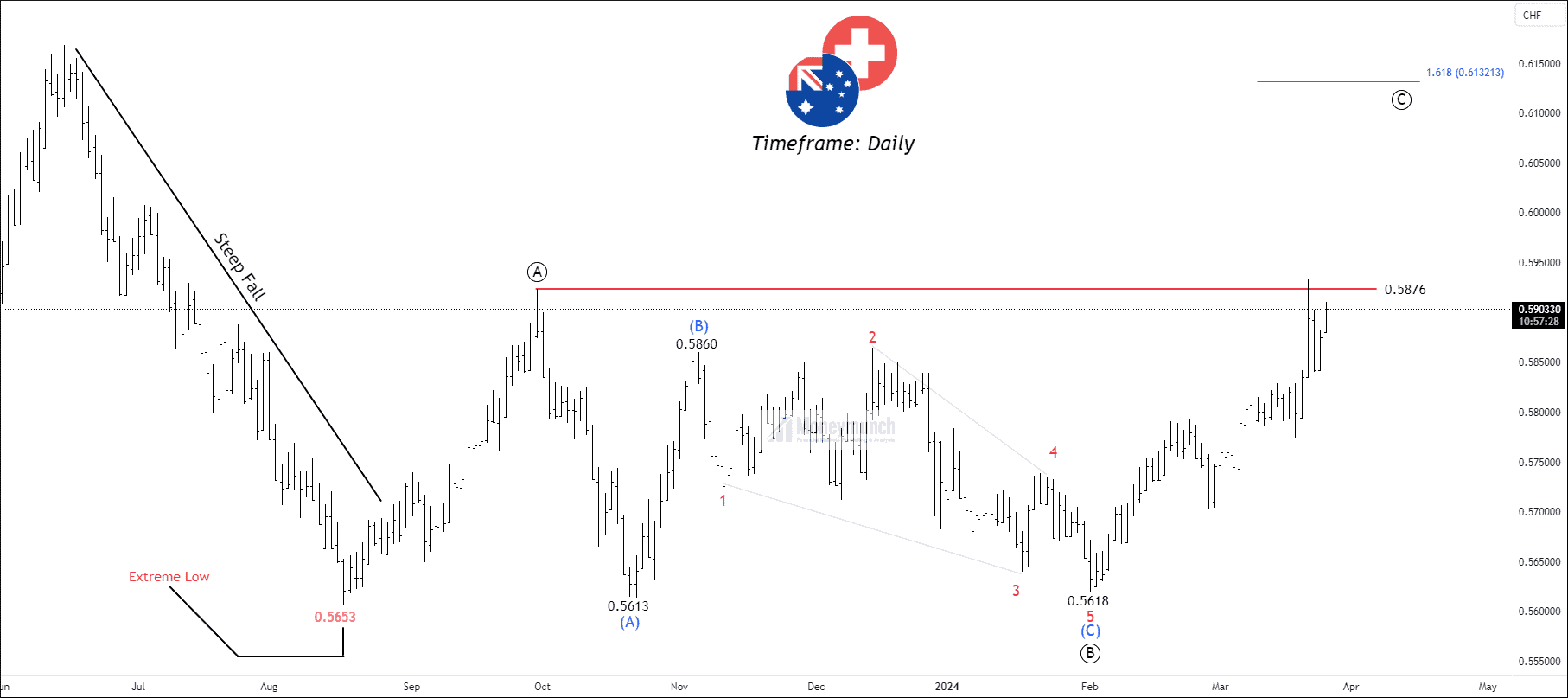

AUDCHF – Elliott Wave Projection

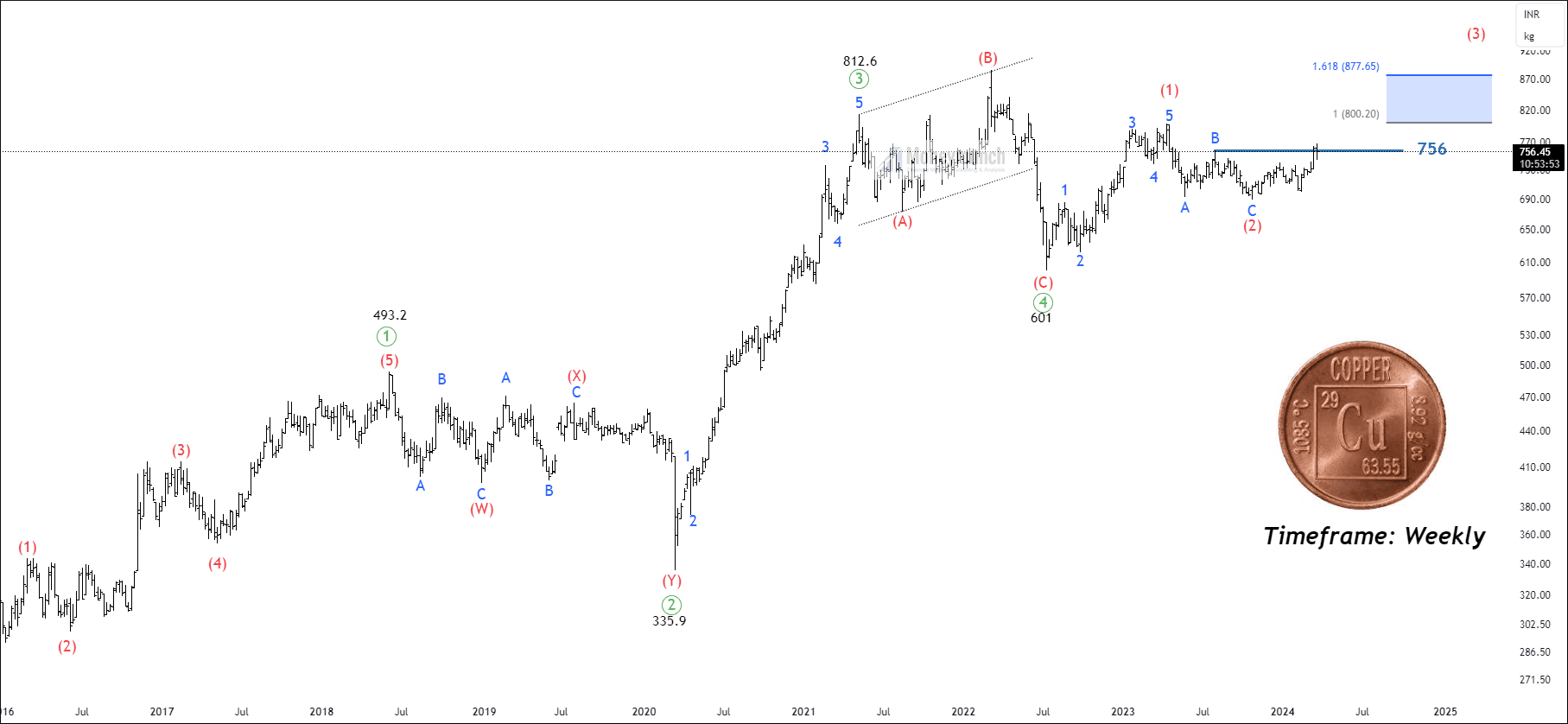

Long-Term View: IS MCX Copper Preparing For A Take-Off?

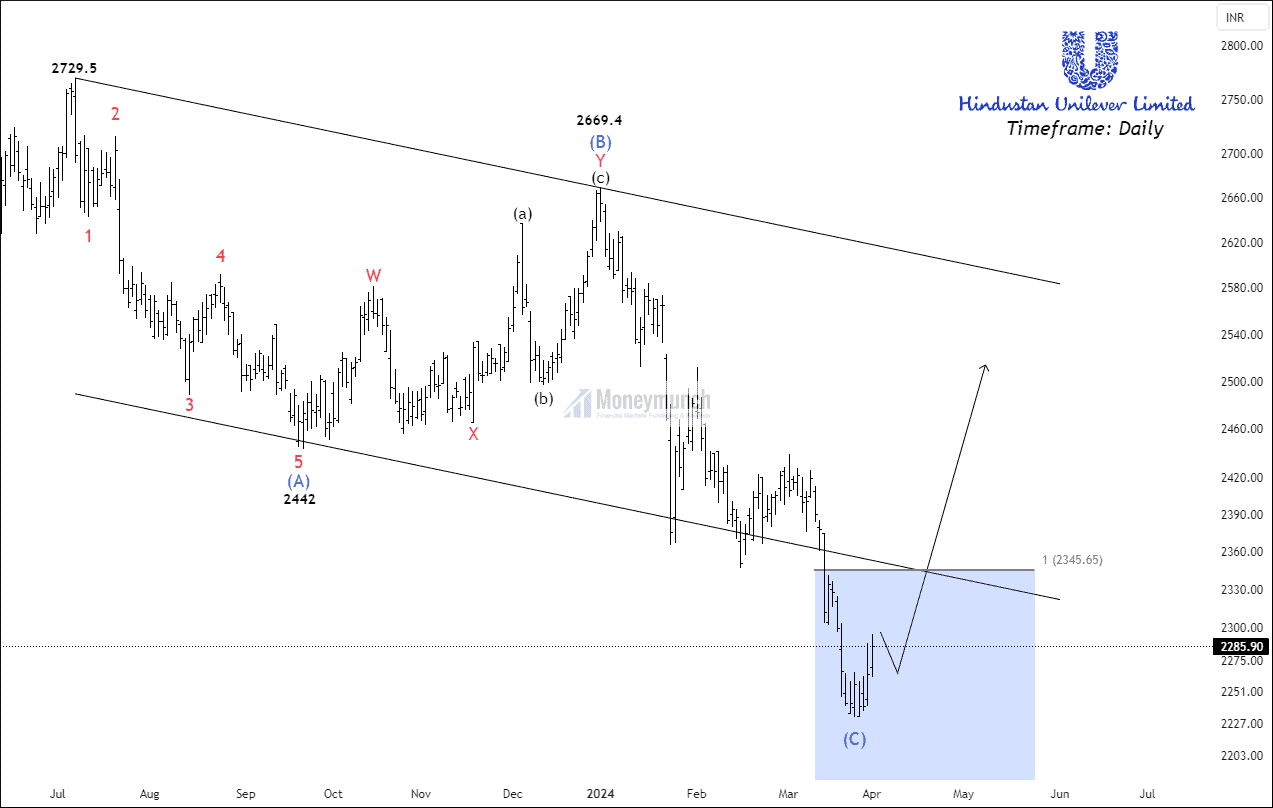

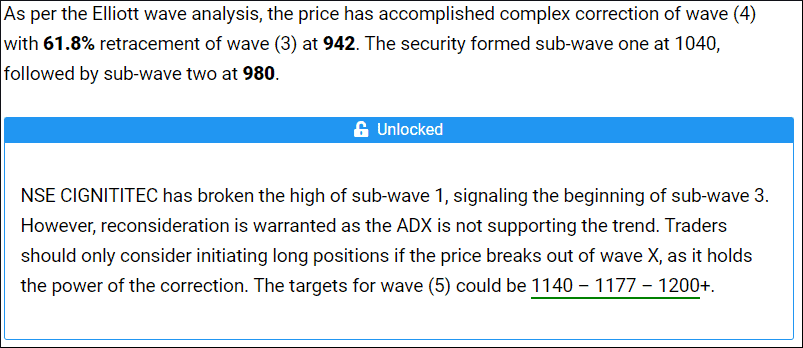

NSE CIGNITITEC – Trading Insights & Updates

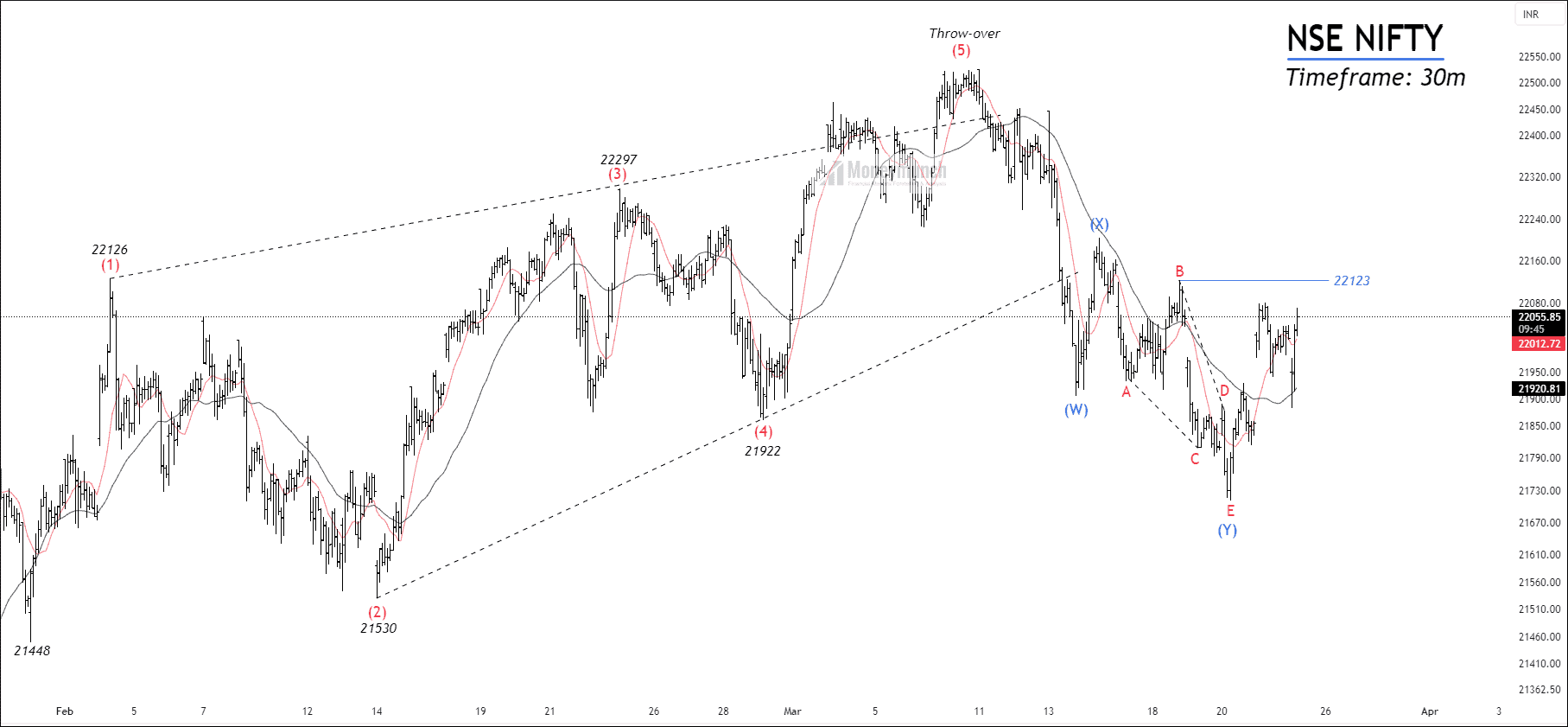

Do you remember NSE CIGNITITEC Wave projection?

Visit here: Trade Setup – BANCOINDIA, BHARTIARTL, CIGNITITEC & More

BEFORE

BEFORE