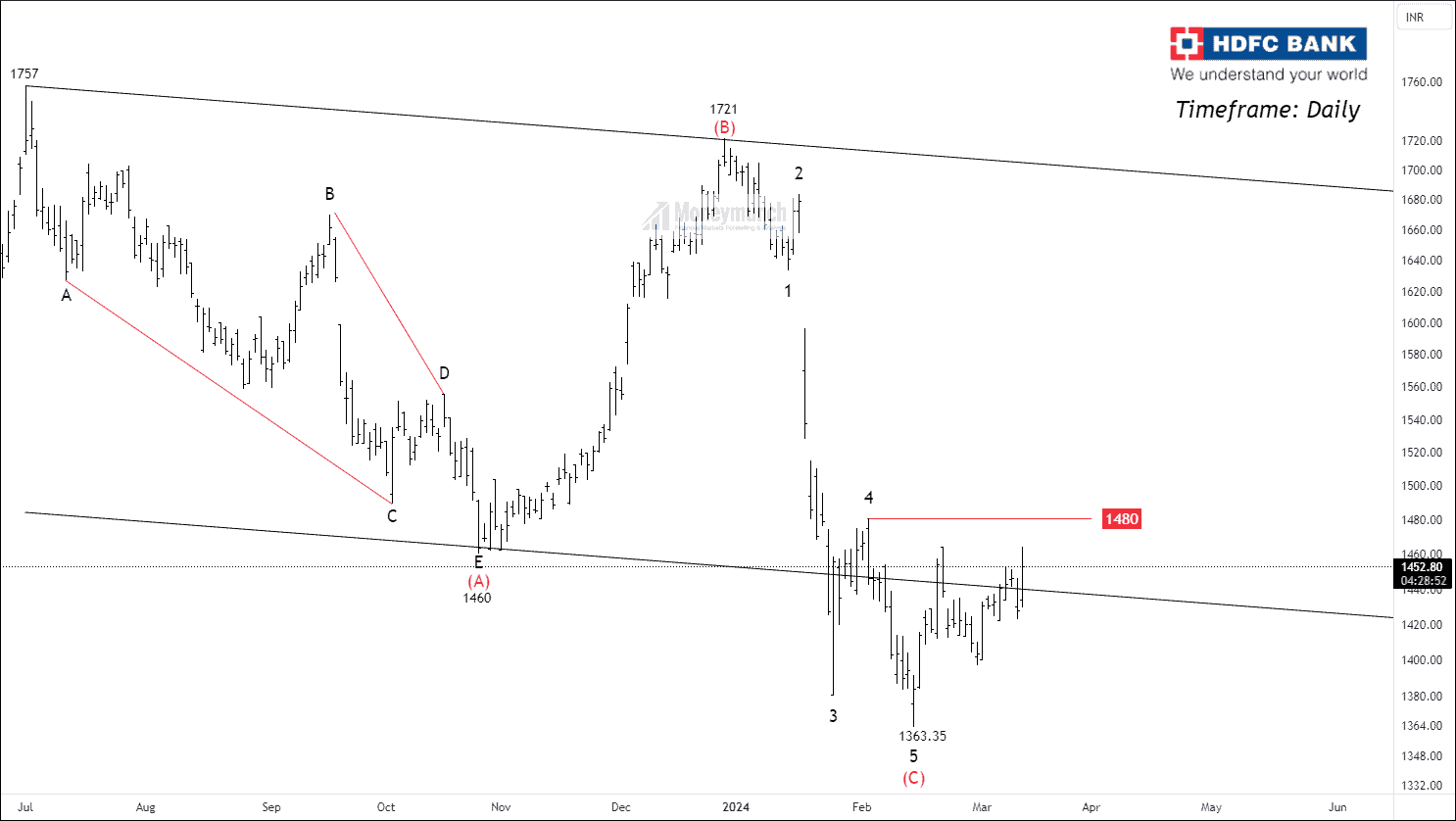

As per the chart, NSE HDFCBANK has entered the corrective channel after giving a throw-under. The price is resistance from the 35/50 Exponential moving average. The primary issue lies in the decreasing ATR and ADX, as a robust uptrend necessitates a supportive ADX.

Based on the wave principle, HDFC Bank has completed corrective wave (C) at 1363.35. To validate the uptrend structure, the price needs to surpass wave four at 1480. It’s advisable to refrain from entering the market unless there’s a robust breakout of the sub-structure. Targets can be projected up to 1600.

We will update further information soon.Continue reading