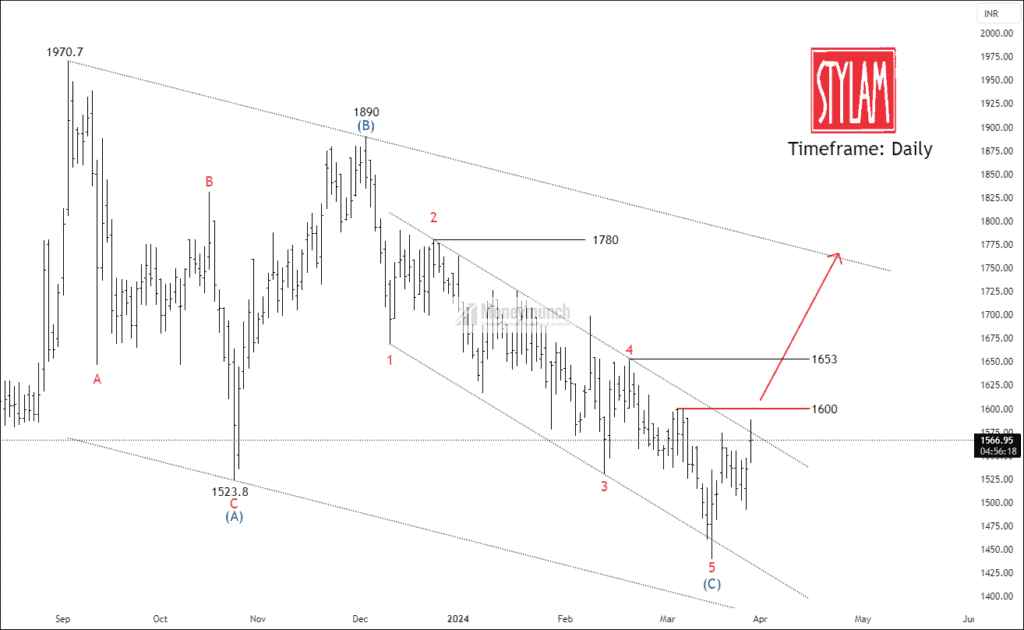

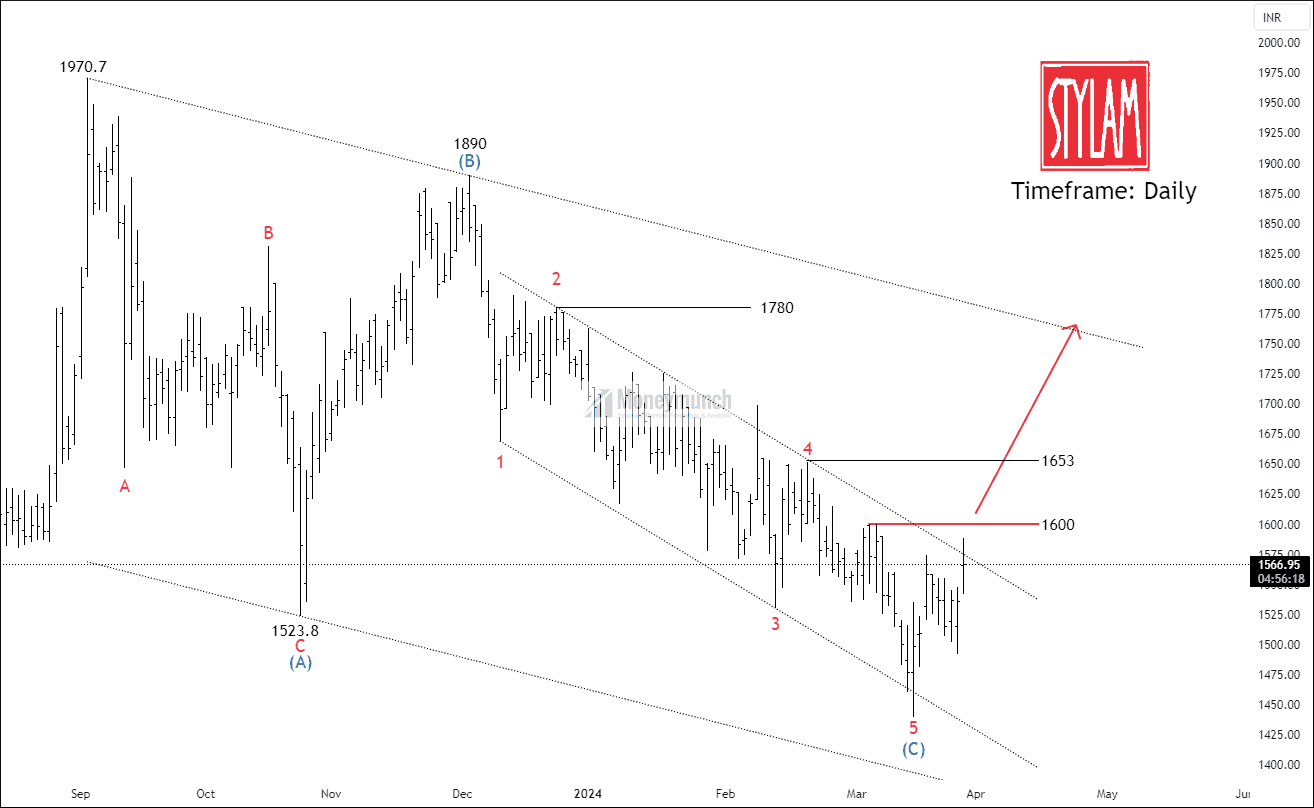

Timeframe: Daily

Following its peak at 1970.7, NSE STYLAM has exhibited a corrective A-B-C formation. This pattern suggests a potential reversal in the recent trend. Notably, the Average True Range (ATR) of the price stands at 49.84, indicating the typical volatility experienced within the given timeframe. Additionally, the Average Directional Index (ADX) has reached a value of 19.10, suggesting the emergence of a developing trend. In terms of key moving averages, the price currently resides within the 50/100/200 EMA band, signifying critical levels that may influence future price action.

According to wave principle, the price has occurred wave B at 1890. It looks like wave 5 of wave (C) has accomplished at 1440. The gut feelings are not enough to state the ending of the structure. The nearest resistance is 1600. If the price breaks out the resistance, traders can trade for the following targets: 1653 – 1728 – 1780+.

We will update further information for premium subscribers soon.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock

You are the Best analyst. please update nifty and bank nifty wave count.

Great chart