Analyzing the Potential Impact of ECB’s Interest Rate Increase on Global and Indian Markets

- Event name – ECB Interest Rate Decision

- Date of the event – 16 March

- Impact – High

- Geography – Euro area

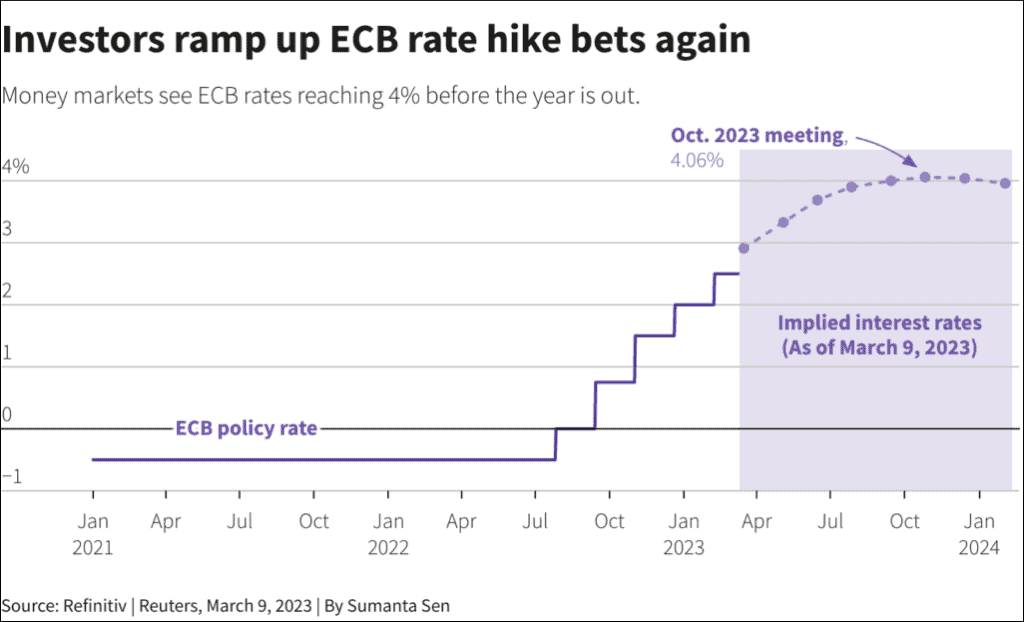

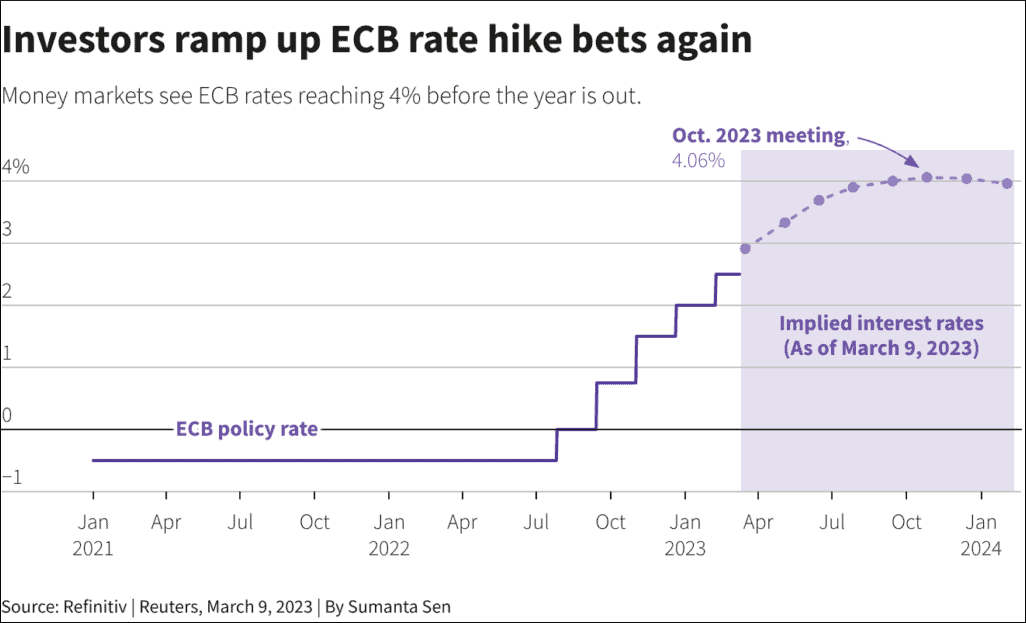

- Expected – 3.5%

Summary:

ECB agreed on tightening policy to fight inflation, but split on communication for the March meeting. Short-term core inflation momentum declining, but recent data showed record-high inflation. Markets expect a 50bps increase this month and a possible hike in May to bring inflation to target.

Impact on the Global market:

An interest rate increase by the ECB can impact global markets in several ways:

- Currency exchange rates: When the ECB raises interest rates, it can cause the Euro to appreciate against other currencies. This can make European exports more expensive and less competitive in global markets, which can have a negative impact on European businesses and economies. Conversely, it can make imports into the Eurozone cheaper, which can benefit consumers.

- Capital flows: An interest rate increase can also affect capital flows, as investors may seek to invest in the Eurozone to take advantage of higher interest rates. This can result in an inflow of capital into the region, which can lead to asset price inflation or bubbles.

- Stock markets: Stock markets can also be impacted by an interest rate increase, as higher interest rates can increase borrowing costs for businesses and reduce investor demand for equities.

- Global growth: An interest rate increase by the ECB can also impact global growth, as the Eurozone is a significant player in the global economy. A slowdown in the Eurozone can have spillover effects on other economies and regions.

Overall, an interest rate increase by the ECB can have significant implications for the global economy, and its impact can vary depending on the specific circumstances and responses of other central banks and policymakers around the world.

Impact on stock market:

An increase in interest rates by the European Central Bank (ECB) can impact the stock market in several ways:

- Cost of borrowing: When interest rates rise, it becomes more expensive for businesses to borrow money. This can lead to a decrease in corporate profits as companies may have to pay more in interest on their loans, which can negatively impact their stock prices.

- Investor behavior: Higher interest rates can also lead investors to shift their investments from stocks to bonds, as bonds become relatively more attractive due to their higher yields. This can result in a decrease in demand for stocks, which can lead to a decline in stock prices.

- Currency exchange rates: As mentioned earlier, an interest rate increase can cause the value of the Euro to appreciate against other currencies. This can impact multinational corporations whose earnings are heavily dependent on exports or foreign operations, as they may face currency headwinds that can reduce their profits and, in turn, impact their stock prices.

- Market sentiment: Interest rate increases can create uncertainty and a negative sentiment in the market, which can lead to increased volatility in stock prices. Investors may become more cautious and reduce their exposure to riskier assets like stocks.

Impact on Indian market

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock