Analyzing Gold’s Technical Trends and Economic Influences

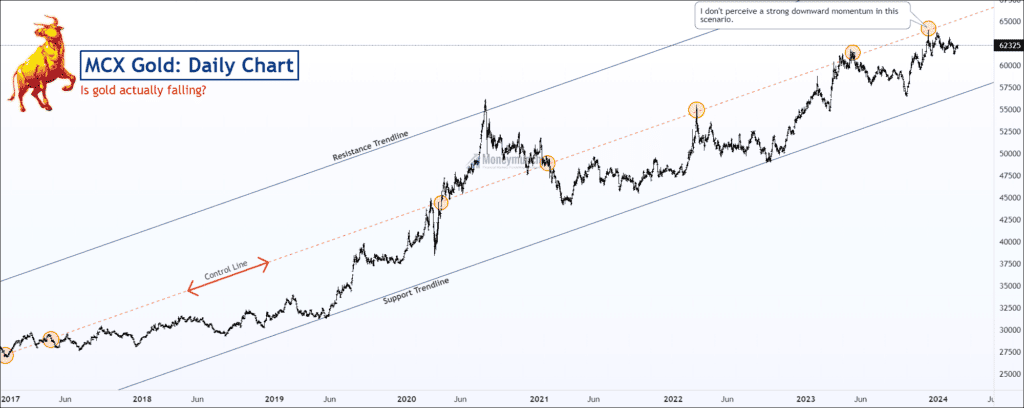

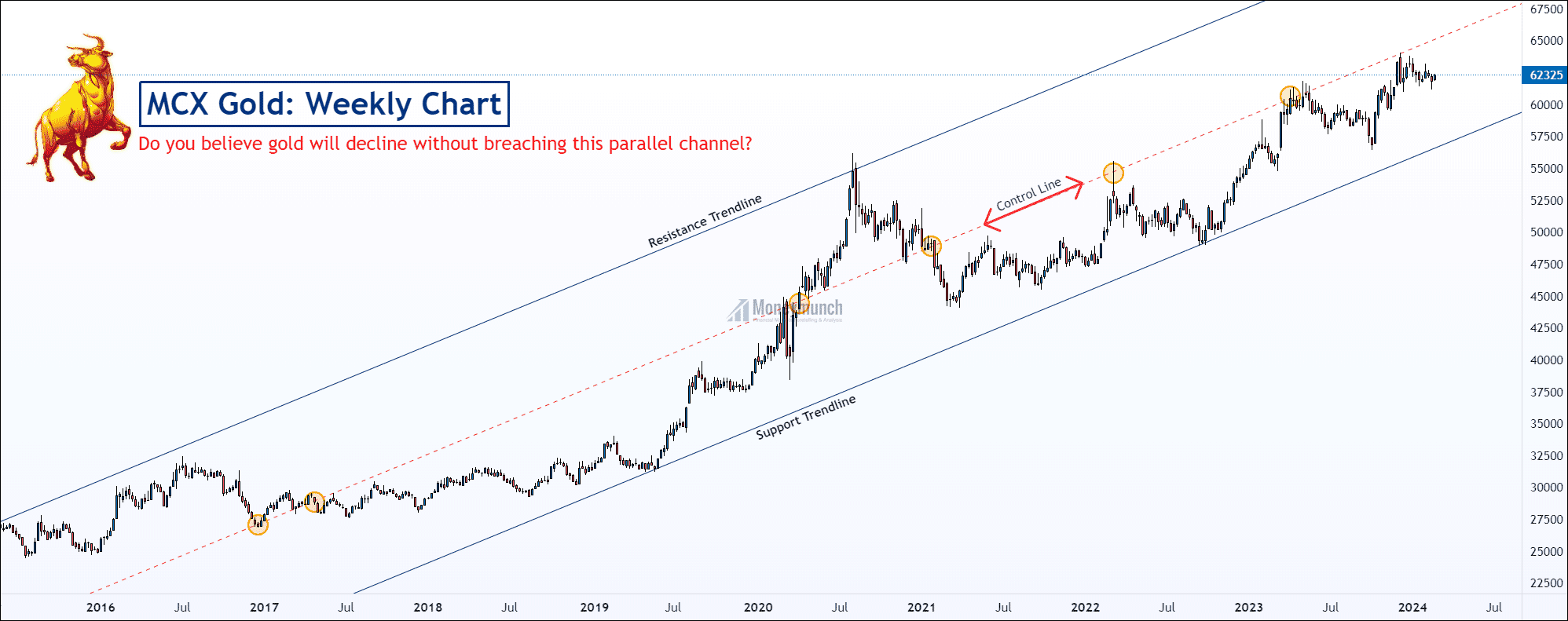

MCX Gold is currently moving within a parallel channel, suggesting potential upticks to 63600 – 64160 – 65000 levels. Last week, it rose by 0.75%, gaining 467 points.

Gold faces selling pressure near the Control Line. To maintain an upward trend, it must break the 62600 level. If not, it may drop to 61160 – 59600, especially for intraday traders.

Key Economic Events:

These events might affect gold, silver, crude oil, and natural gas prices:

Monday, Feb 26, 2024

18:30 Building Permits & MoM – Medium Impact

20:30 New Home Sales & MoM (Jan) – Medium Impact

Tuesday, Feb 27, 2024

19:00 Core Durable Goods Orders (MoM) (Jan) – High Impact

20:30 CB Consumer Confidence (Feb) – Medium Impact

Wednesday, Feb 28, 2024

19:00 GDP (QoQ) (Q4) – High Impact

21:00 Crude Oil Inventories – High Impact

22:30 FOMC Member Bostic Speaks – Medium Impact

23:15 FOMC Member Williams Speaks – Medium Impact

Thursday, Feb 29, 2024

17:30 GDP Growth Rate YoY Q4 – Medium Impact

19:00 Core PCE Price Index MoM JAN – Low Impact

Friday, March 01, 2024

ISM Manufacturing PMI FEB – Medium Impact

Stay tuned for our next month’s update on gold’s projection for the next decade.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.