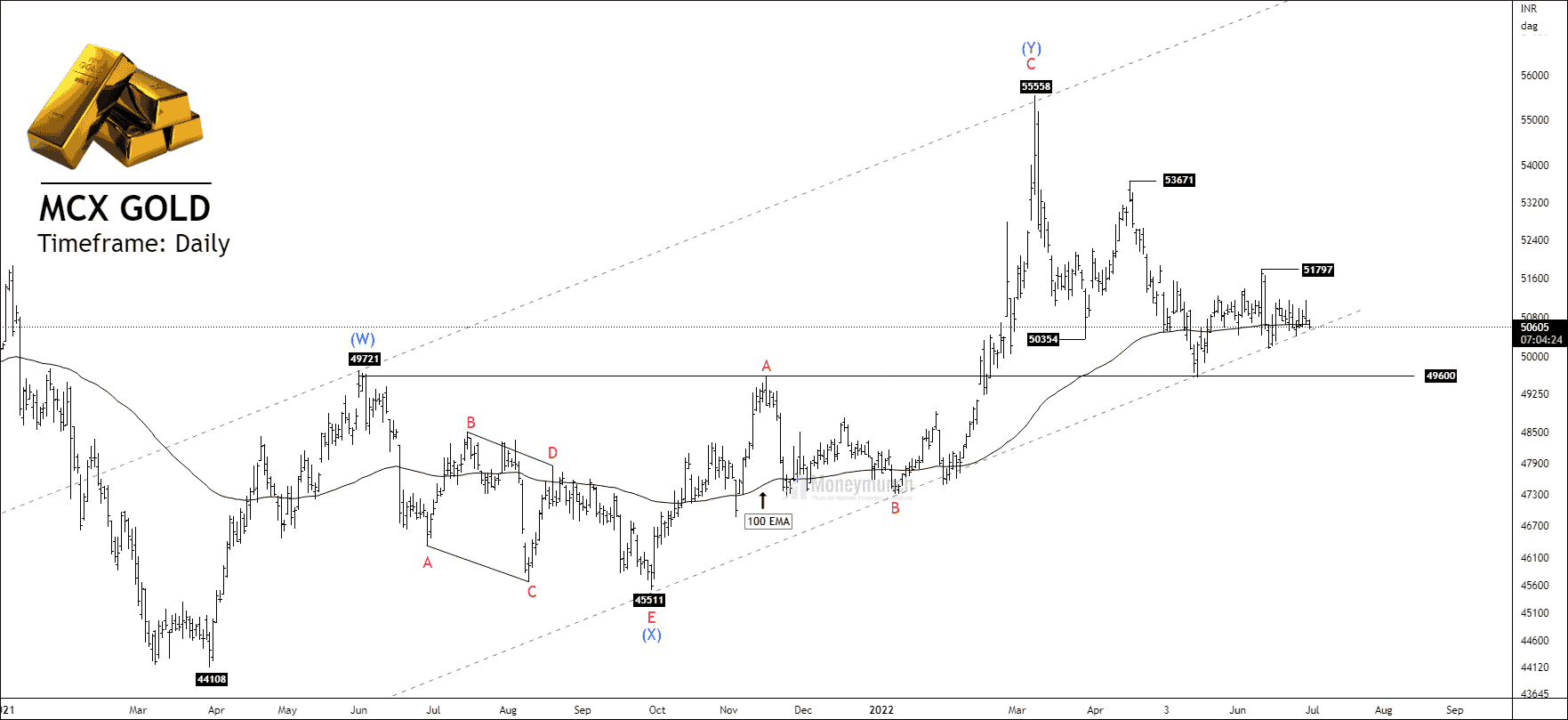

MCX Gold Elliott wave Projection For July 2022

Gold’s Next Bull Leg In Progress

Gold has created three consecutive positive bars in the last 25 trading sessions (36 days) for the first time. And it’s above 200 MA. That’s a good sign for buyers! If gold breaks the parallel channel, my upside targets Continue reading

Gold Price Predictions for 2022

To identify uptrend:

There are two hurdles to continuing the uptrend. It should break out the 5th May high or settle above the control line.

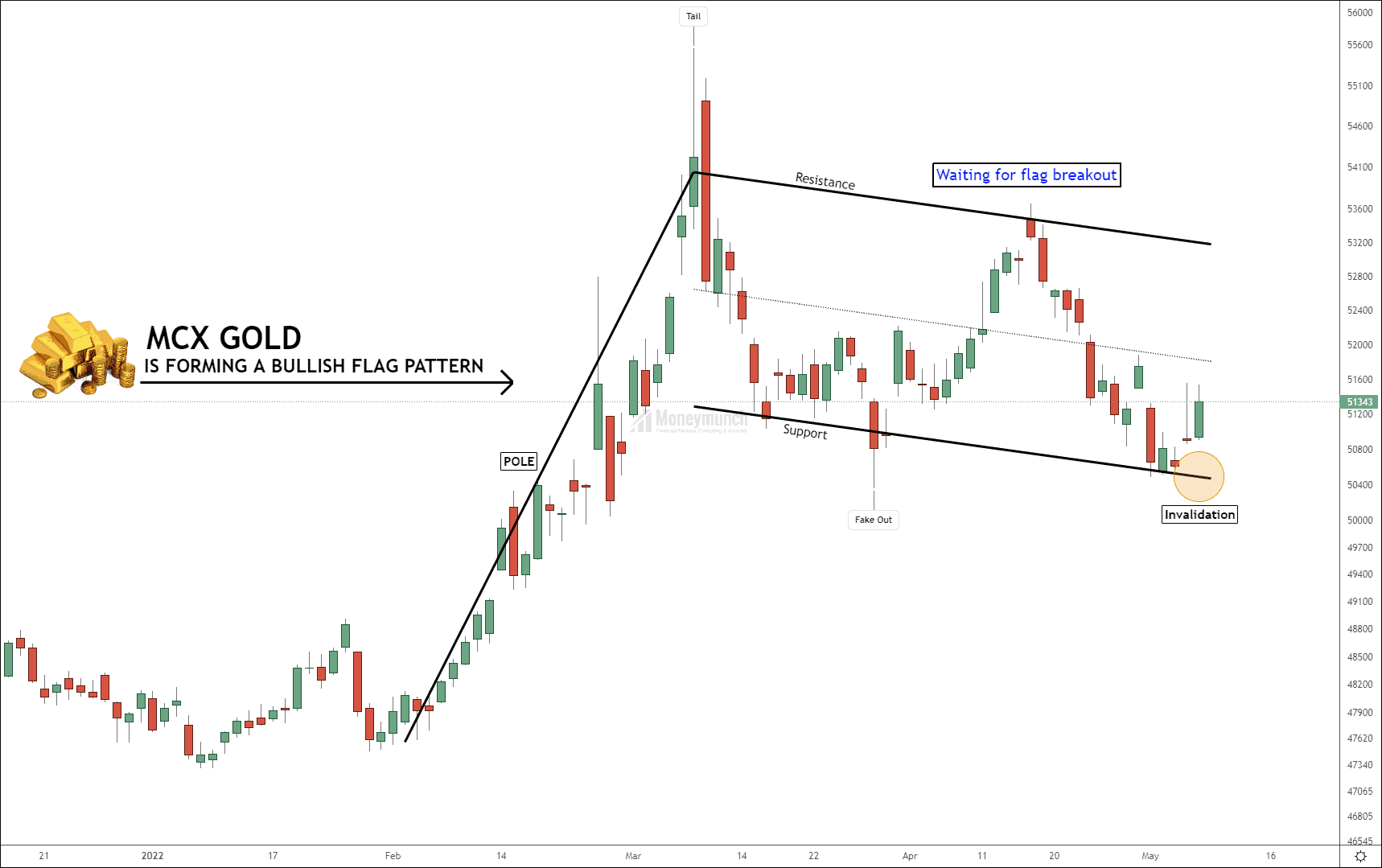

According to the above chart, Gold is forming a bullish flag pattern. And we’re waiting for a breakout of the flag pattern. This breakout will skyrocket the gold price, and we can see 6400+ points of bullish movement here. Long-term target for gold 58000 – 60000.

Gold downtrend confirmation:

MCX Gold & Nickel – Profit Booking Time

Did you read the gold report? If not, click the below link.

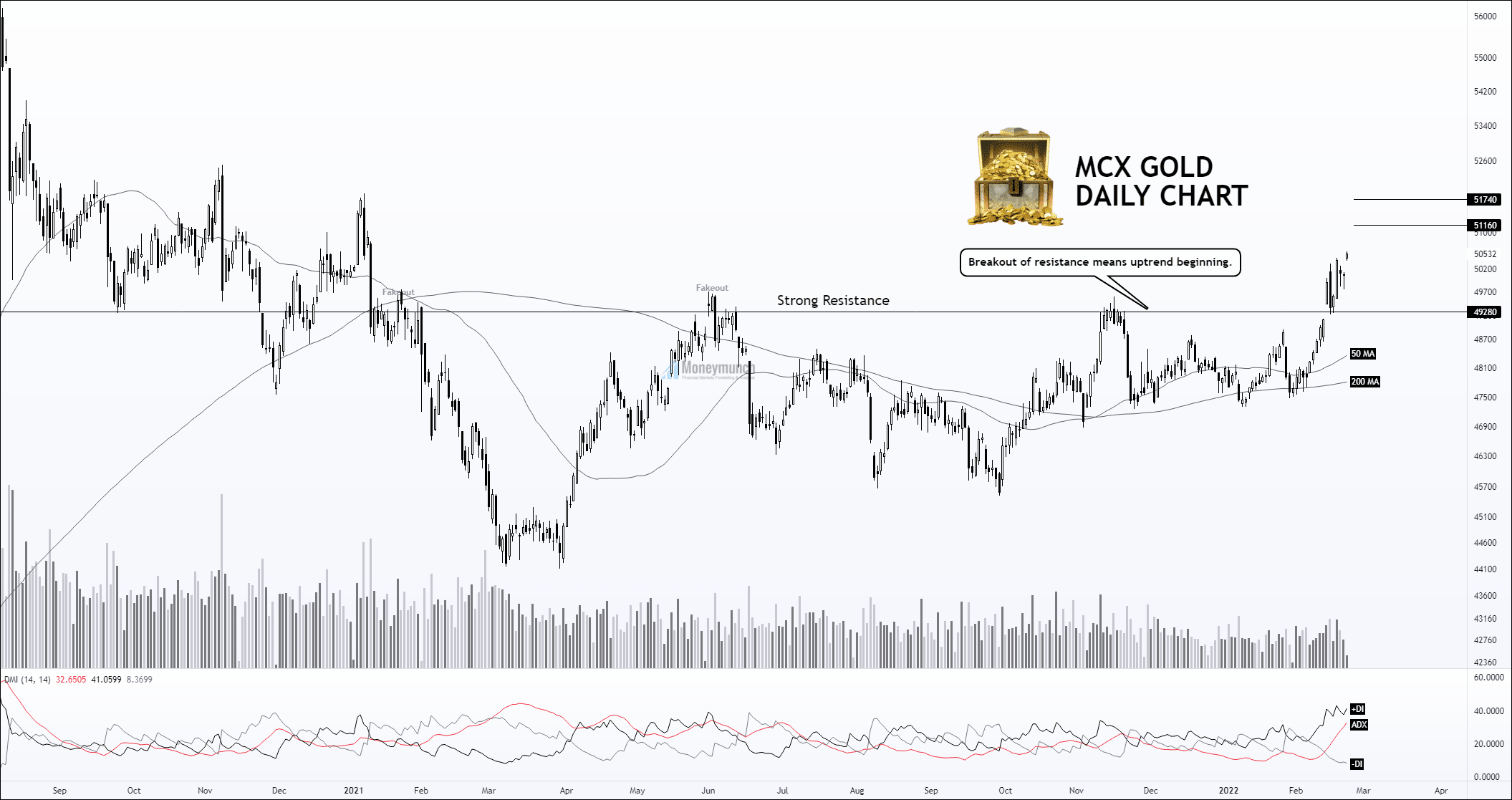

22 Feb 2022: MCX Gold’s Bullish Mode Activated

While the gold price at 50532, I had written, “we will see the gold price above 51160 – 51740“.

Today, it has touched the first & second target. Who bought it? Profit per lot: Rs.1,20,800

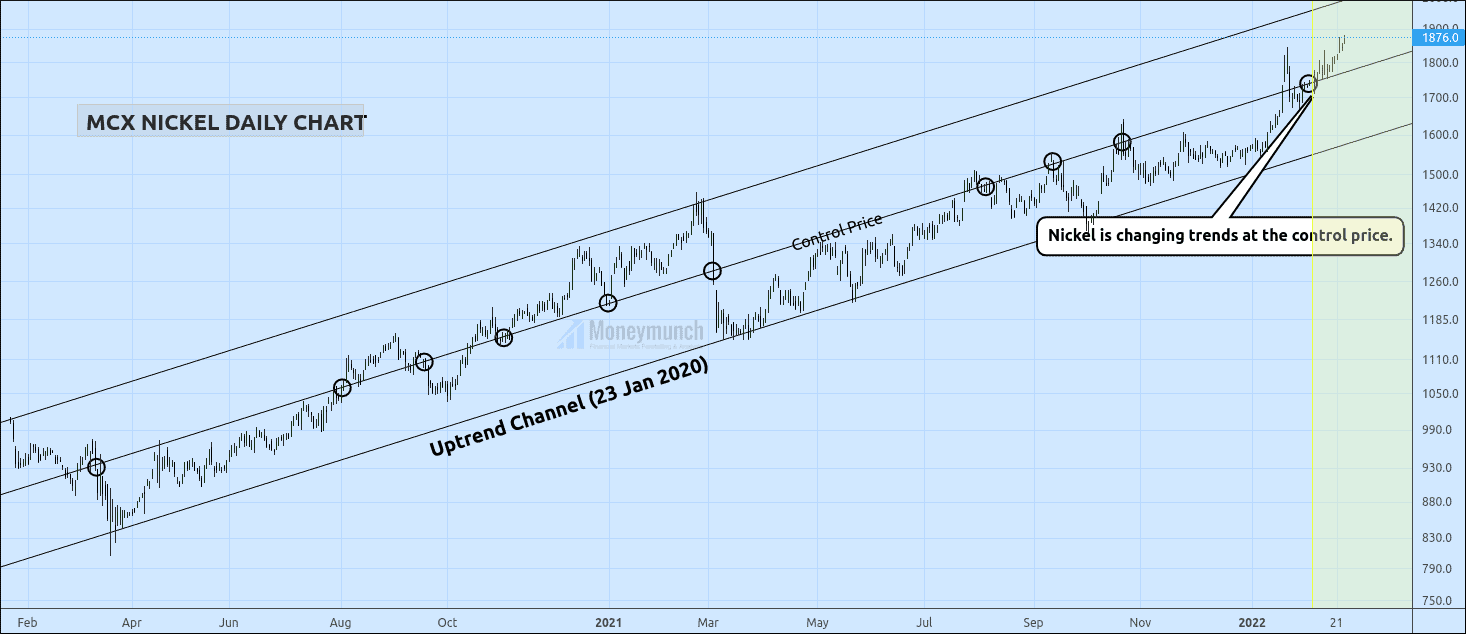

I have updated a full report of Nickel on Feb 6, 2022. Did you read it? If not, click the below link:

2020’s Uptrend Channel Is Everything For MCX Nickel

I had written, “It’s a sign for a buy signal. But intraday or short-term investors should confirm that breakout before proceeding. And they must look out for candle’s fakeout. Afterward, be ready for the targets of 1800 – 1840 – 1876+“.

Today nickel has touched all targets. Who bought it? The target was 133.4 points. Profit per lot: Rs.2,00,100

What else do you need from a free subscription!? To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

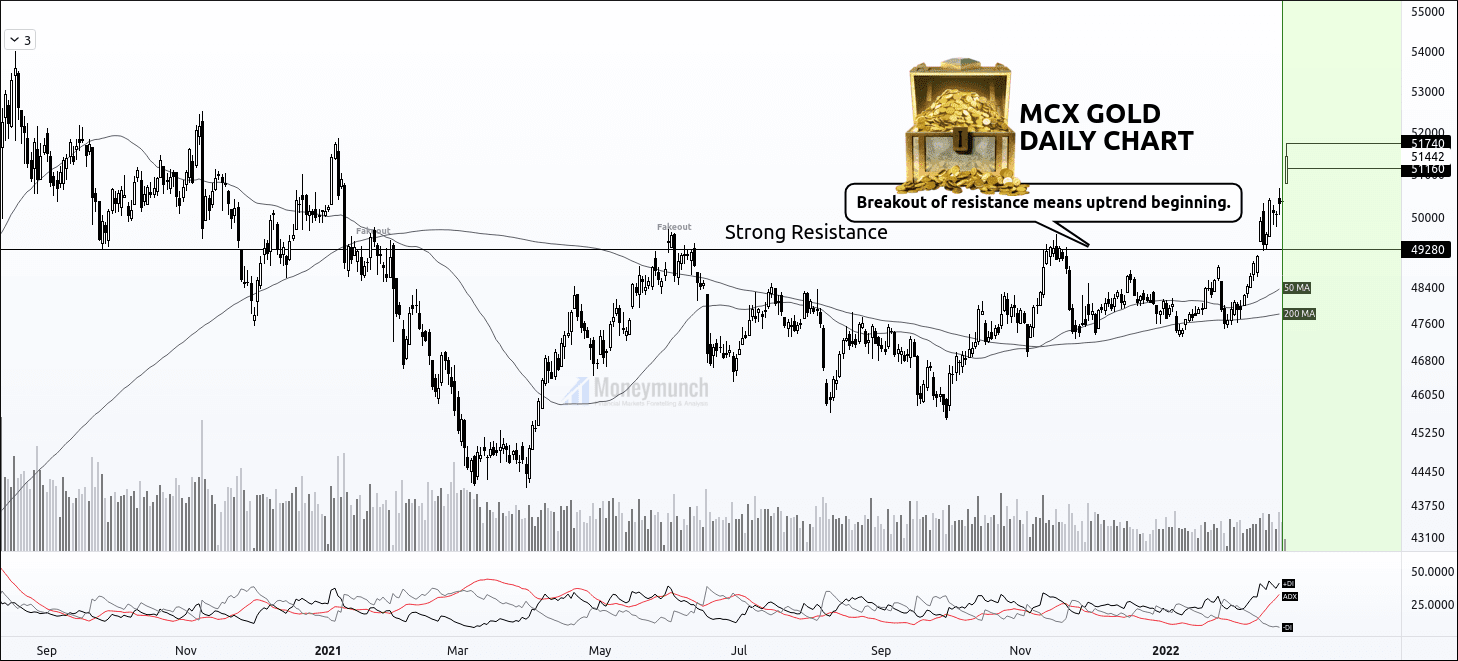

MCX Gold’s Bullish Mode Activated

Did you read the 26 Jan 2021 article on Gold?

Article: Don’t Get Yourself Into a Bull Trap With MCX Gold

Wherein I have highlighted a strong resistance (SR) which is 49280. It has broken down on 14 Feb 2022. That indicates the MCX gold uptrend is unfolding here. If it consecutively remains above the SR, we will see the gold price above 51160 – 51740.

The following indicators have been indicating impending advance:

ADX, DMI, and MA

Watch significant releases or events that may affect the movement of gold, silver, and crude oil.

Tuesday, Feb 22, 2022

19:30 S&P/CS HPI Composite – 20 n.s.a. (YoY) (Dec) – Medium Impact

20:15 Manufacturing, Markit Composite, & Services PMI (Feb) – Medium Impact

20:30 CB Consumer Confidence (Feb) – High Impact

Thursday, Feb 24, 2022

03:00 API Weekly Crude Oil Stock – Medium Impact

19:00 GDP (QoQ) (Q4), and Initial Jobless Claims – High Impact

21:00 Natural Gas Storage – Low Impact

21:30 Crude Oil Inventories – High Impact

22:30 FOMC Member Mester Speaks – Medium Impact

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock