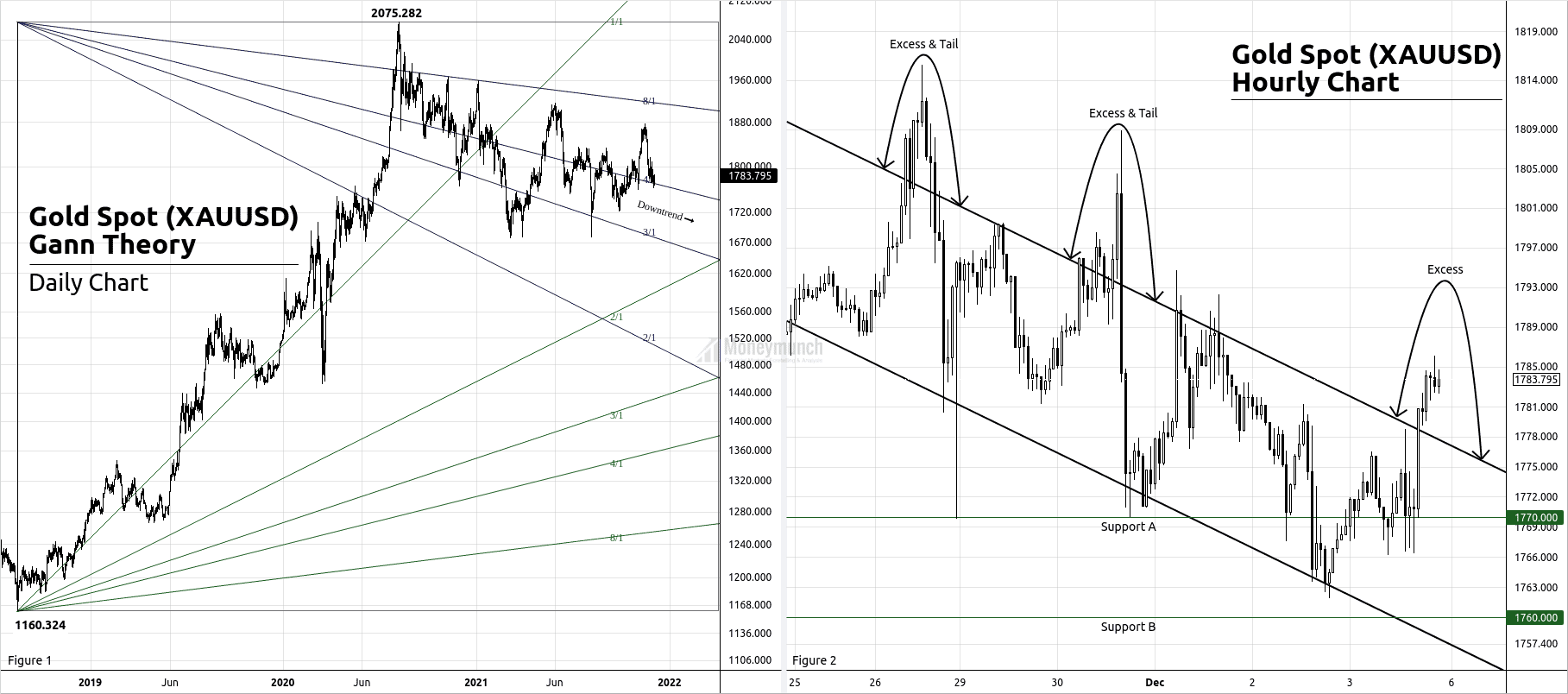

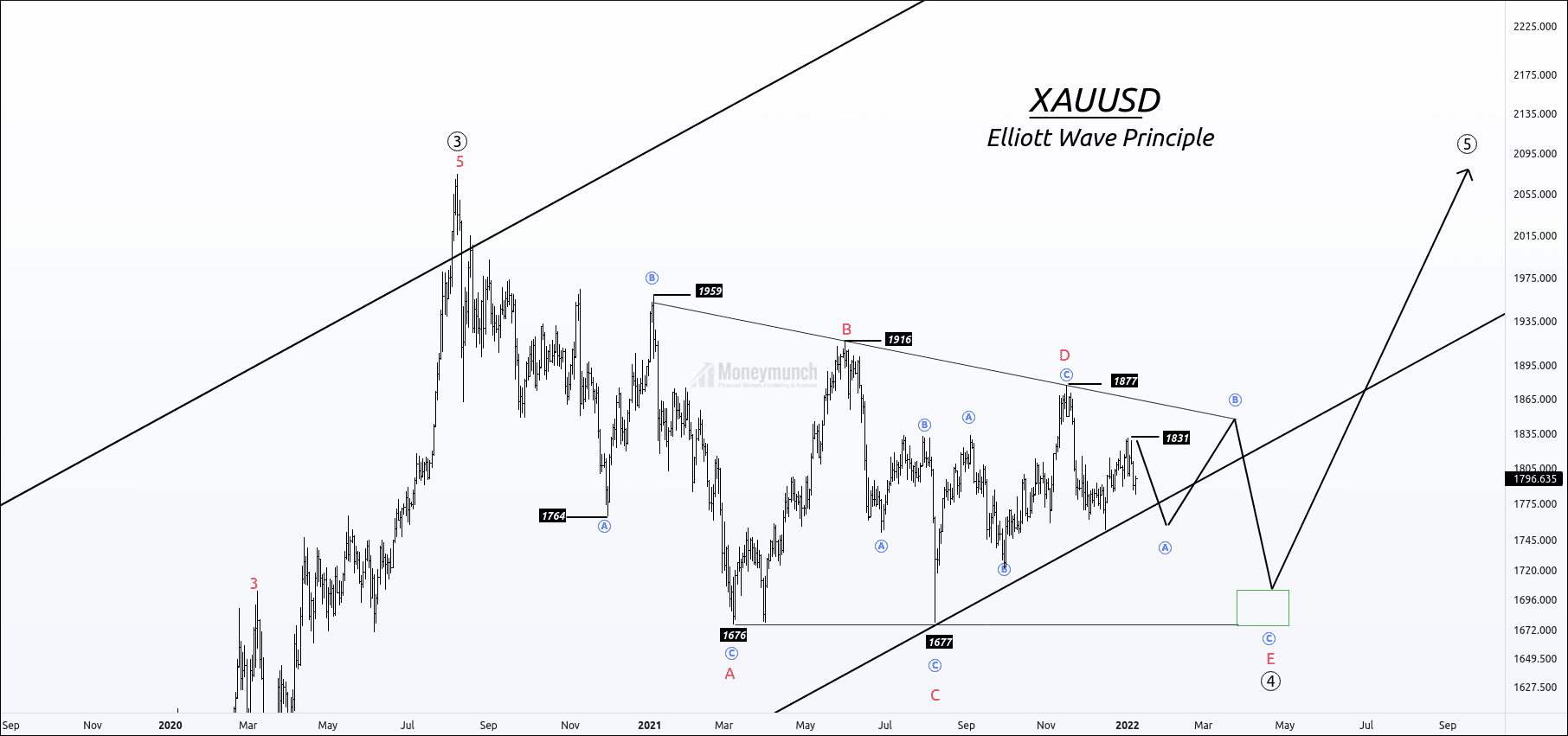

XAUUSD is forming a triangle on the wave ((4)).

This correction has taken more than 17 months, but the triangle is not over yet. Price has completed wave D of the 4th wave triangle, and wave E of wave A is in progress.

After completing the wave sub-wave A, the price will start wave B & then wave C.

The ending point of wave E is the starting point of the impulsive cycle.

Calculation of wave E:

Wave E can end 100% of wave sub-wave A at 1726.

Wave E can end near previous sub-wave B at 1719

Wave E can end at 100% of wave D at 1704.

Traders can wait for the breakout of the B-D trend line. Note that if the price doesn’t break the B-D channel, sideways will be continued.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock