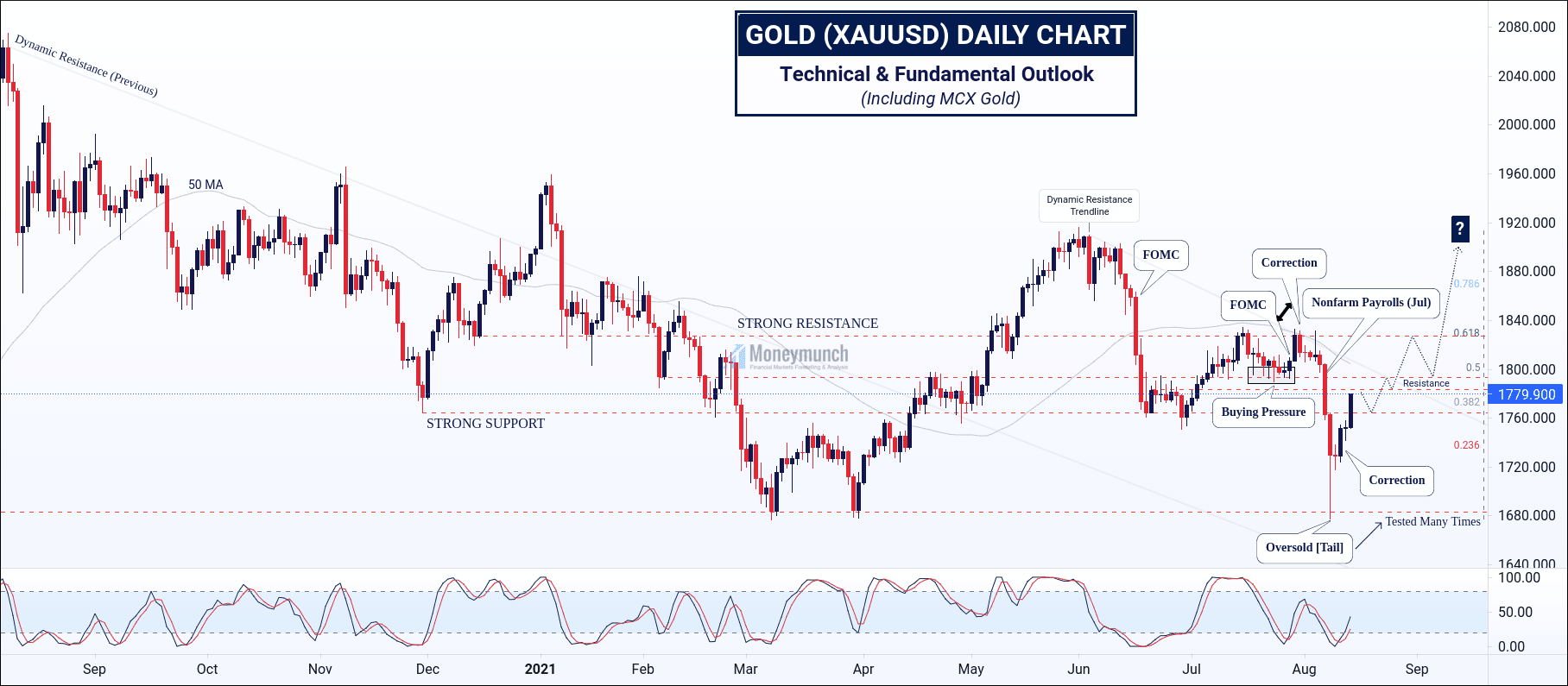

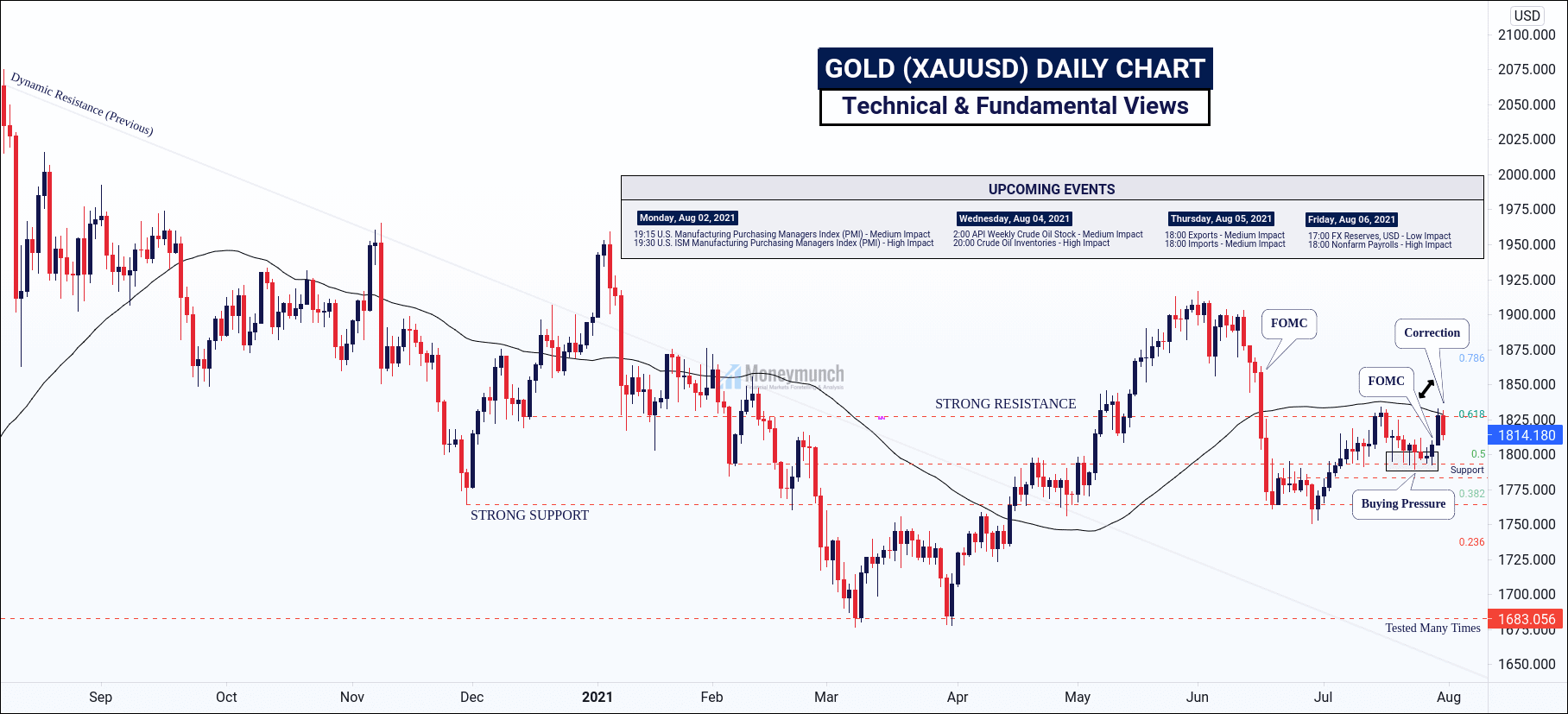

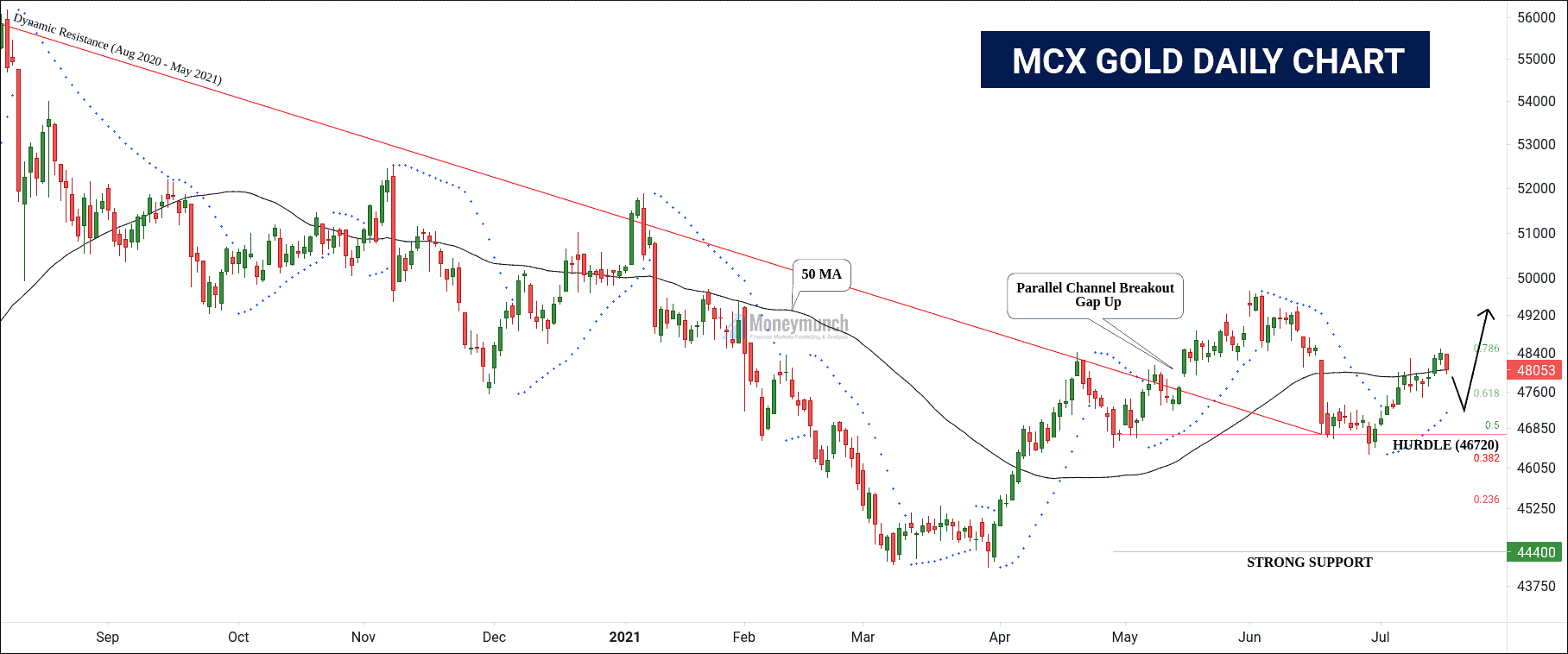

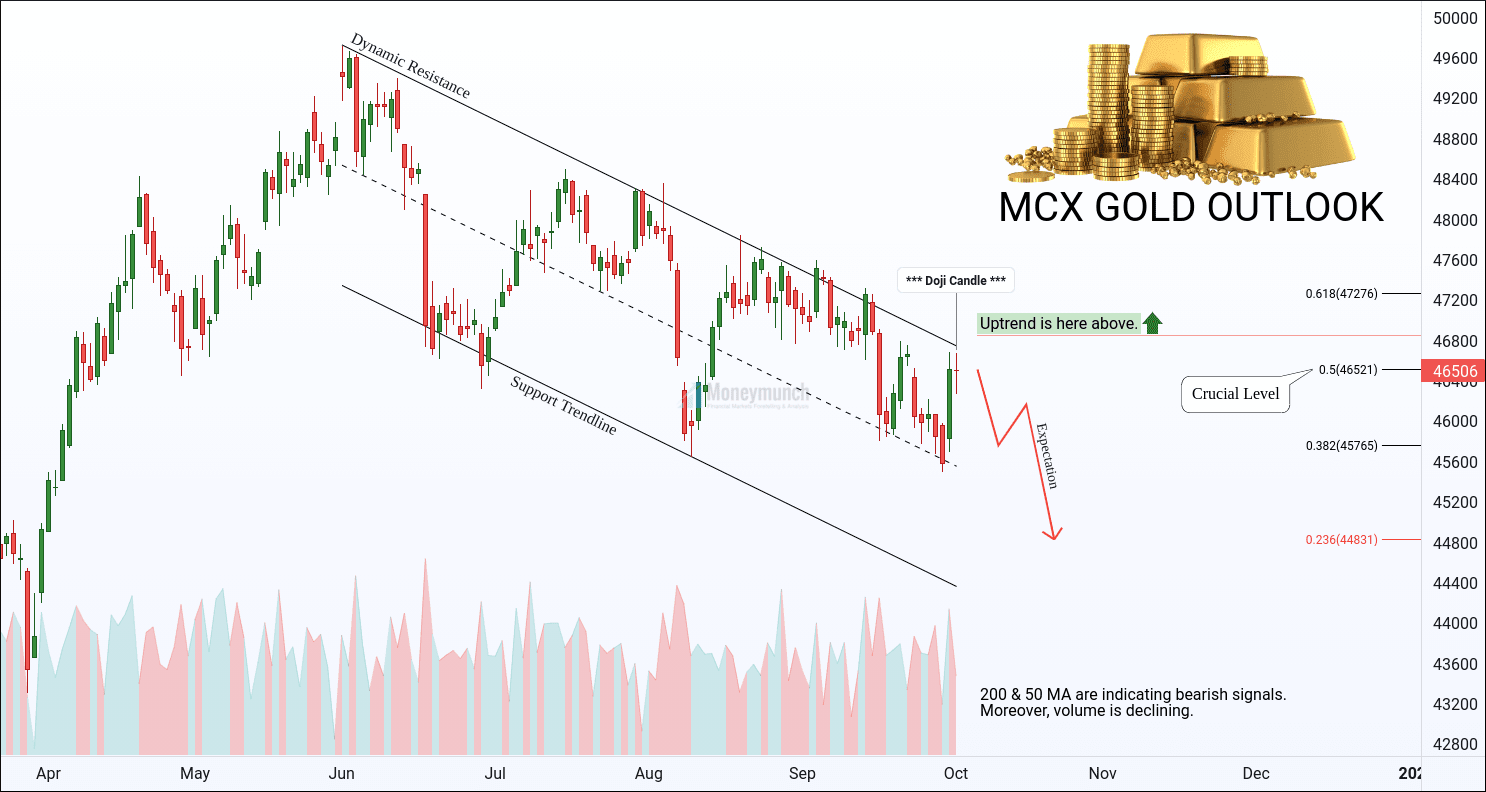

In the last trading session, it made a Doji candlestick. And that’s a sign of trend change. If gold does not break the crucial level, then it can drop up to 0.382 to 0.236.

In simple words, short-term targets: 46200 – 45960 – 45765

And for long-term traders: 45600 – 45060

But, the uptrend isn’t far away. If gold does breakout of 46860 level, then we may see 47276 – 47600 – 47960+.

Don’t get confused! You have to watch out the level 46860 for an uptrend, and the closing price below the Doji candle indicated a bearish trend signal.

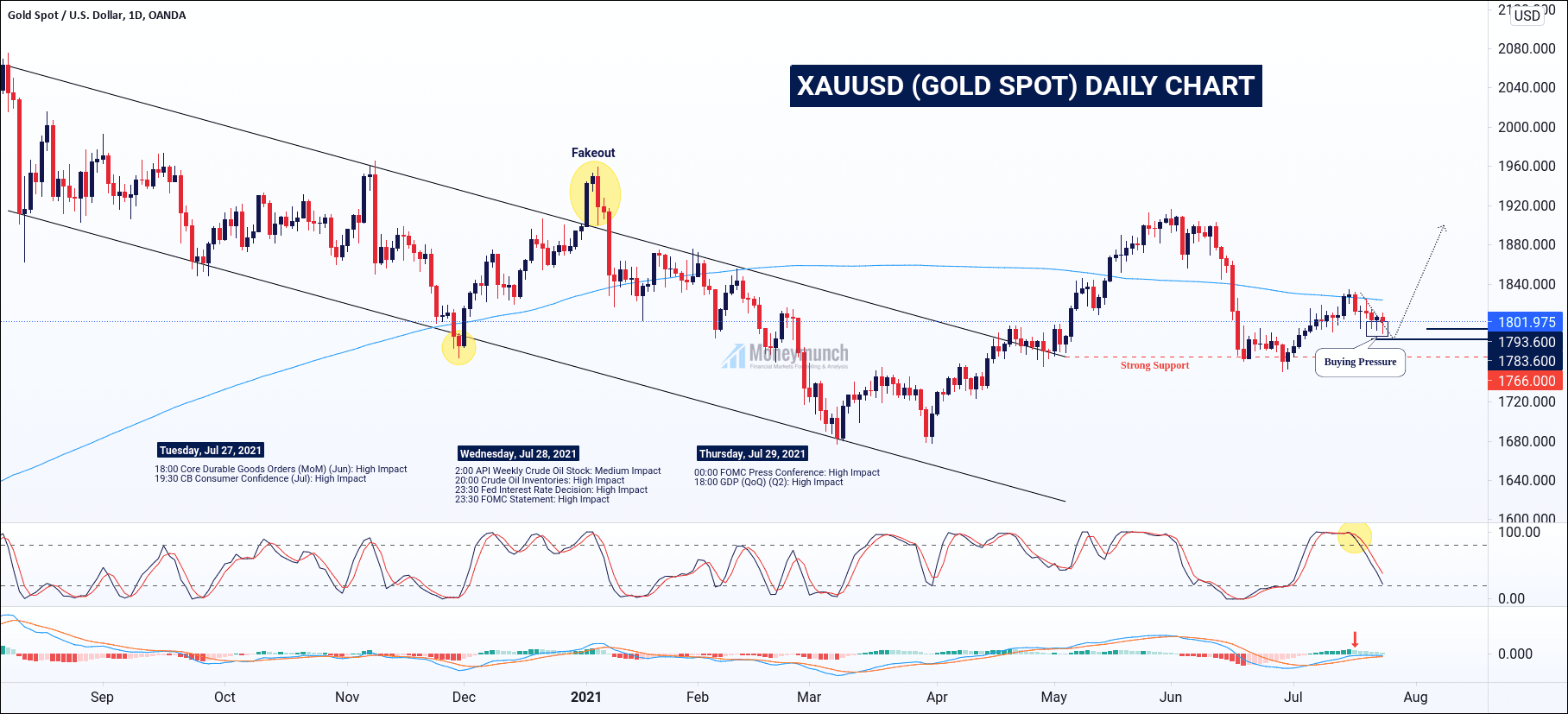

This week we may see higher fluctuations due to upcoming economic events. Watch the following significant releases or events that may affect the movement of gold, silver, crude oil, & natural gas:Continue reading

Lock

Lock