NSE NIFTY – Elliott Wave Projection

Publish date: March 2, 2023

Visit here: NSE NIFTY – Elliott Wave Projection

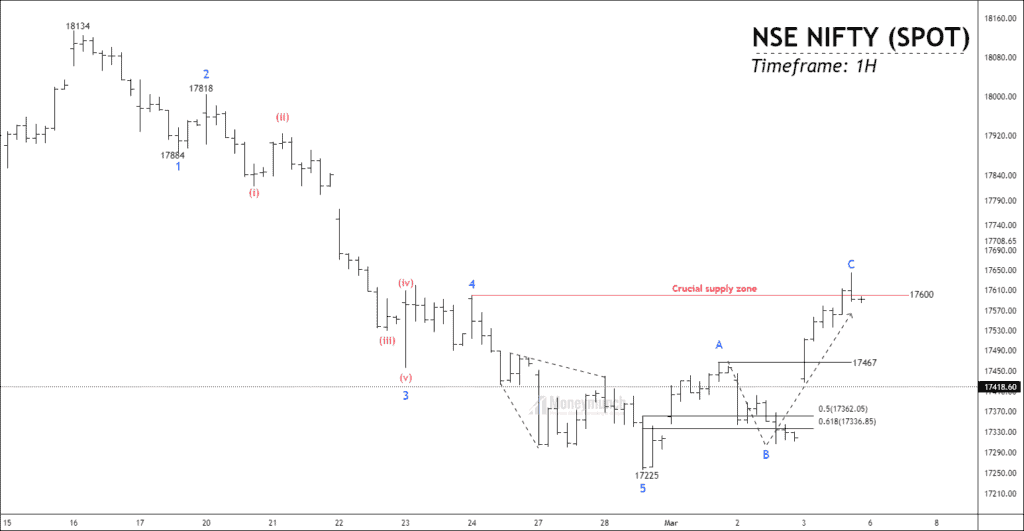

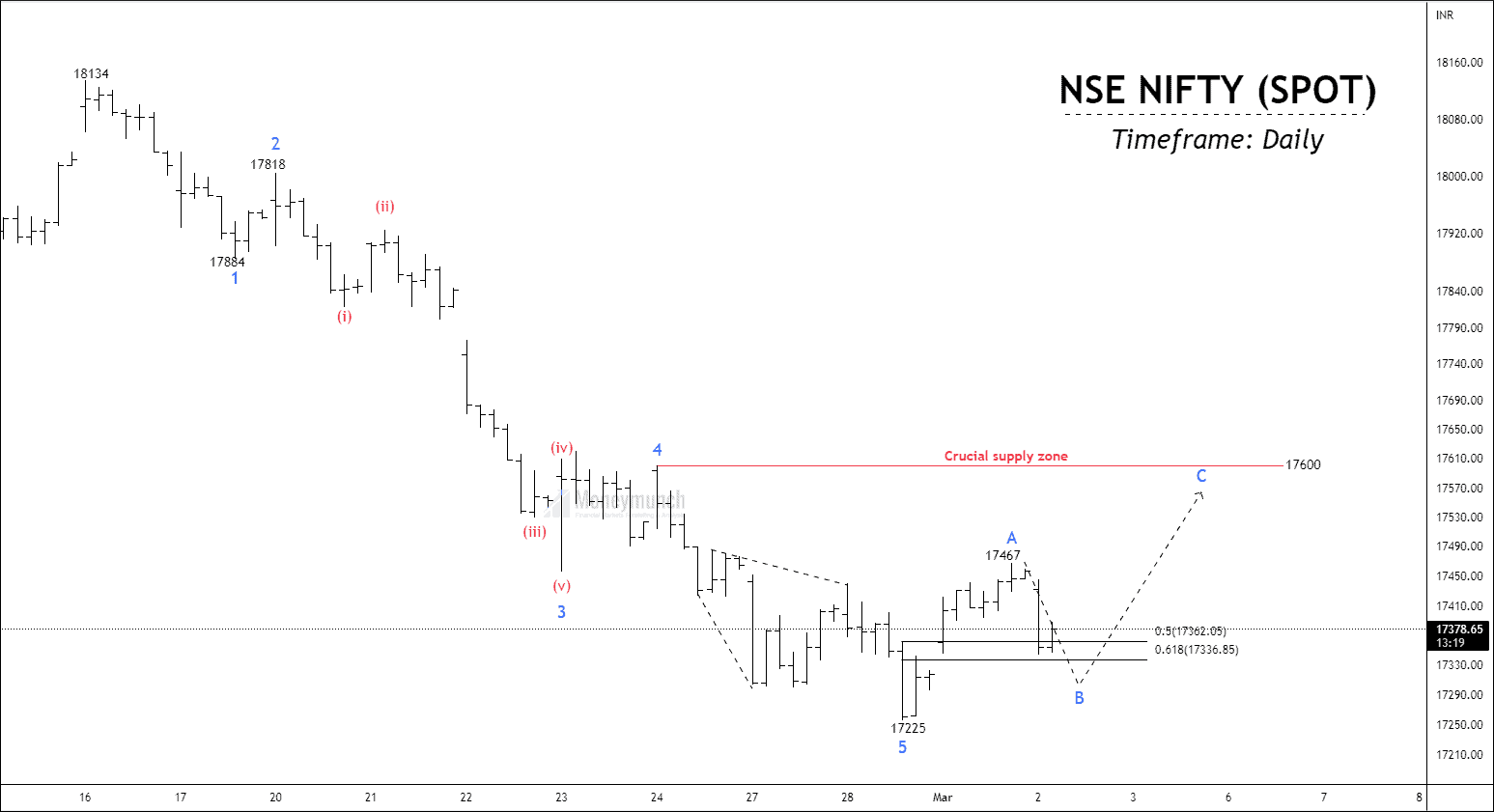

I have mentioned clearly, “We have published a Nifty research report. The Nifty was stuck between supply and demand. The bullish limit was 17300, while the bearish limit was 17600. Upon completing wave B, and sustaining above 17300, the price can move up to the next resistance level of 17600. “

Based on our expectations, NSE nifty closed exactly at 17300. The price gapped up in the next trading session and reached our expected level of 17600. It indicates that big moves can be caught by technicians using the Elliott wave principle.

NSE NIFTY – Research Outlook

Publish date – March 6, 2023

Visit here: Trade Setup – NSE NIFTY, TECHM & BIRLACORPN

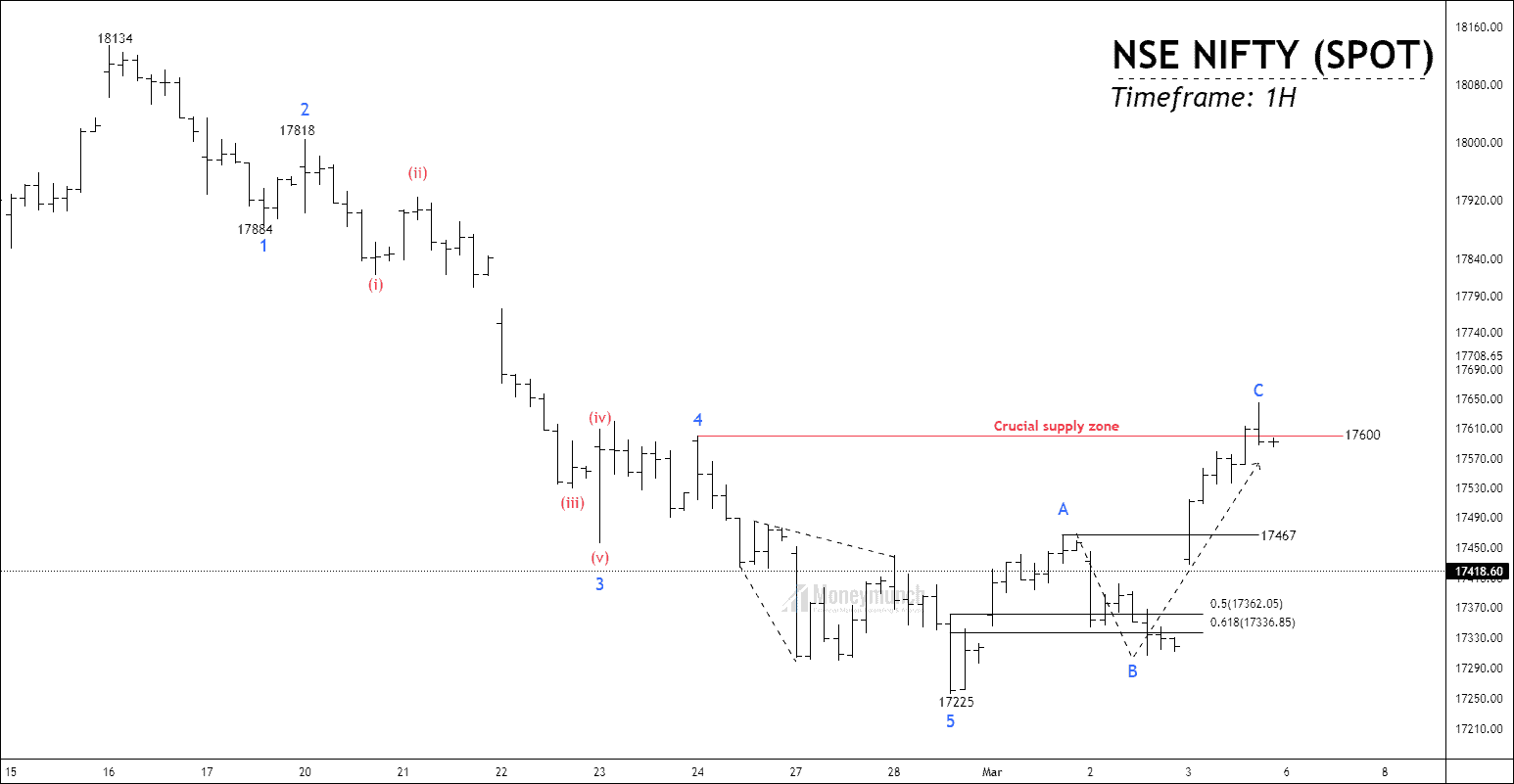

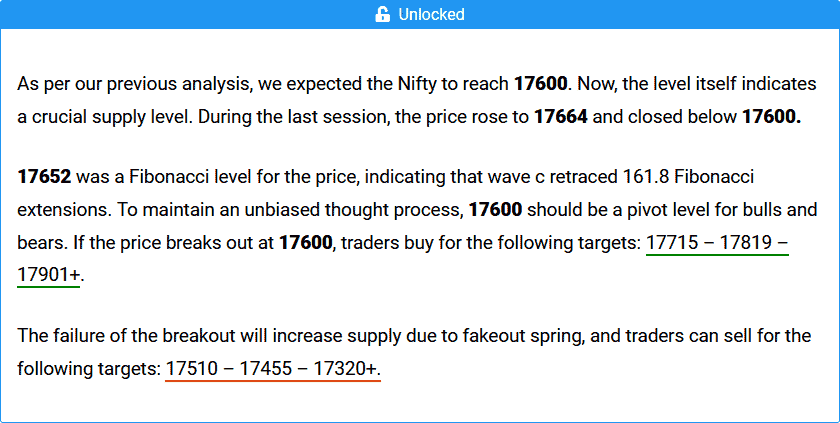

As a result of market volatility, we had given this outlook and were expecting two side moves. Having broken 17600, the price made a high of 17799, which was near our second target, and then the market fell due to Powell’s remarks.

Again after breaking down 17600, nifty made a new low of 17324, close to our final target of 17320. We end up making a profit in both situations.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.