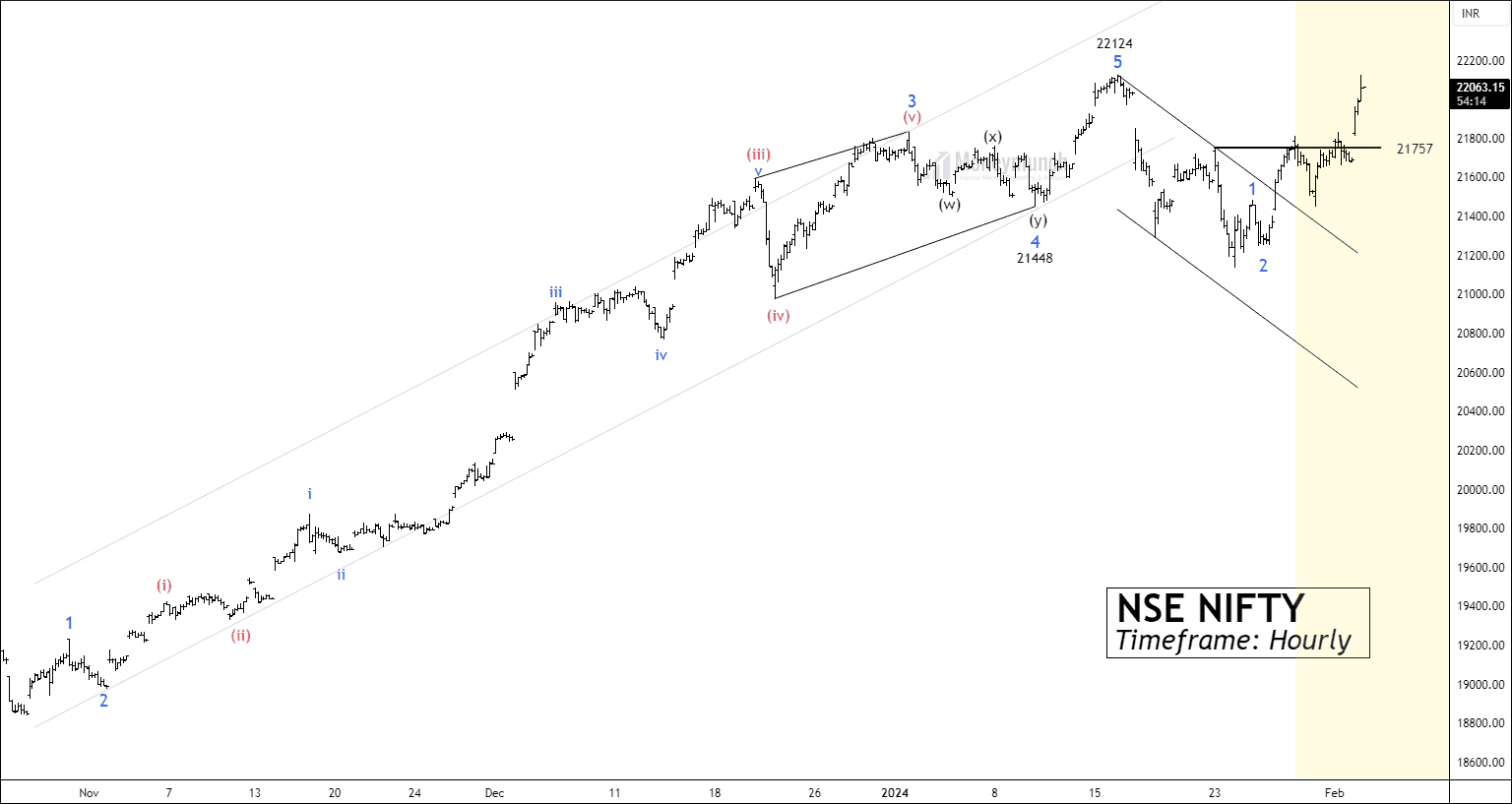

Did you trade NSE Nifty’s Elliott wave setup?

Click here: NSE NIFTY – Are Bulls sure about Their Strength?

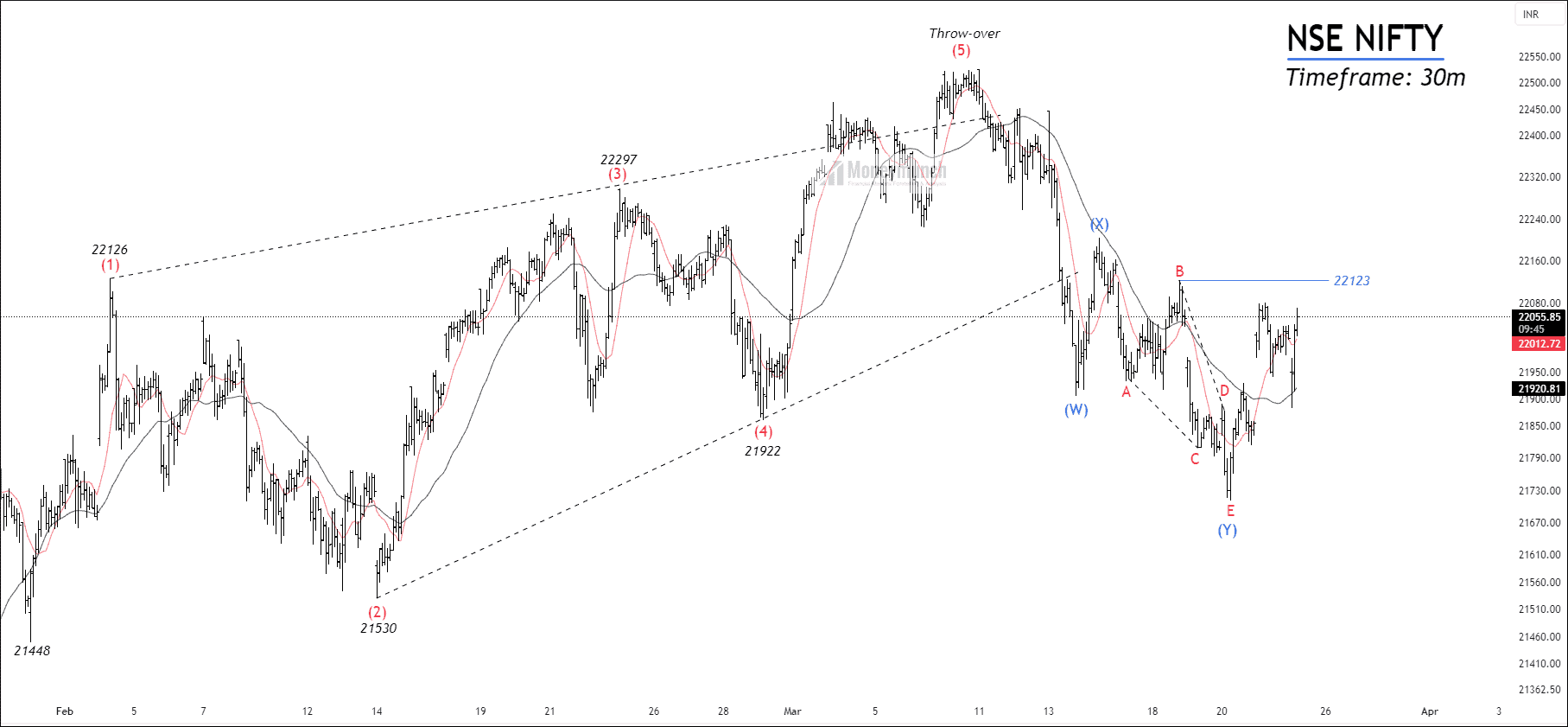

NSE NIFTY – Trading Insight & Update

We had written in clear words, “If the price breaks out of wave B, traders can trade for the 21856 – 21955 – 22100+.”

NIFTY FUT – Trading insights & Updates

Did you trade NSE NIFTY trade setup?

Click here: NSE NIFTY – Will Price Confirm Its bull run?

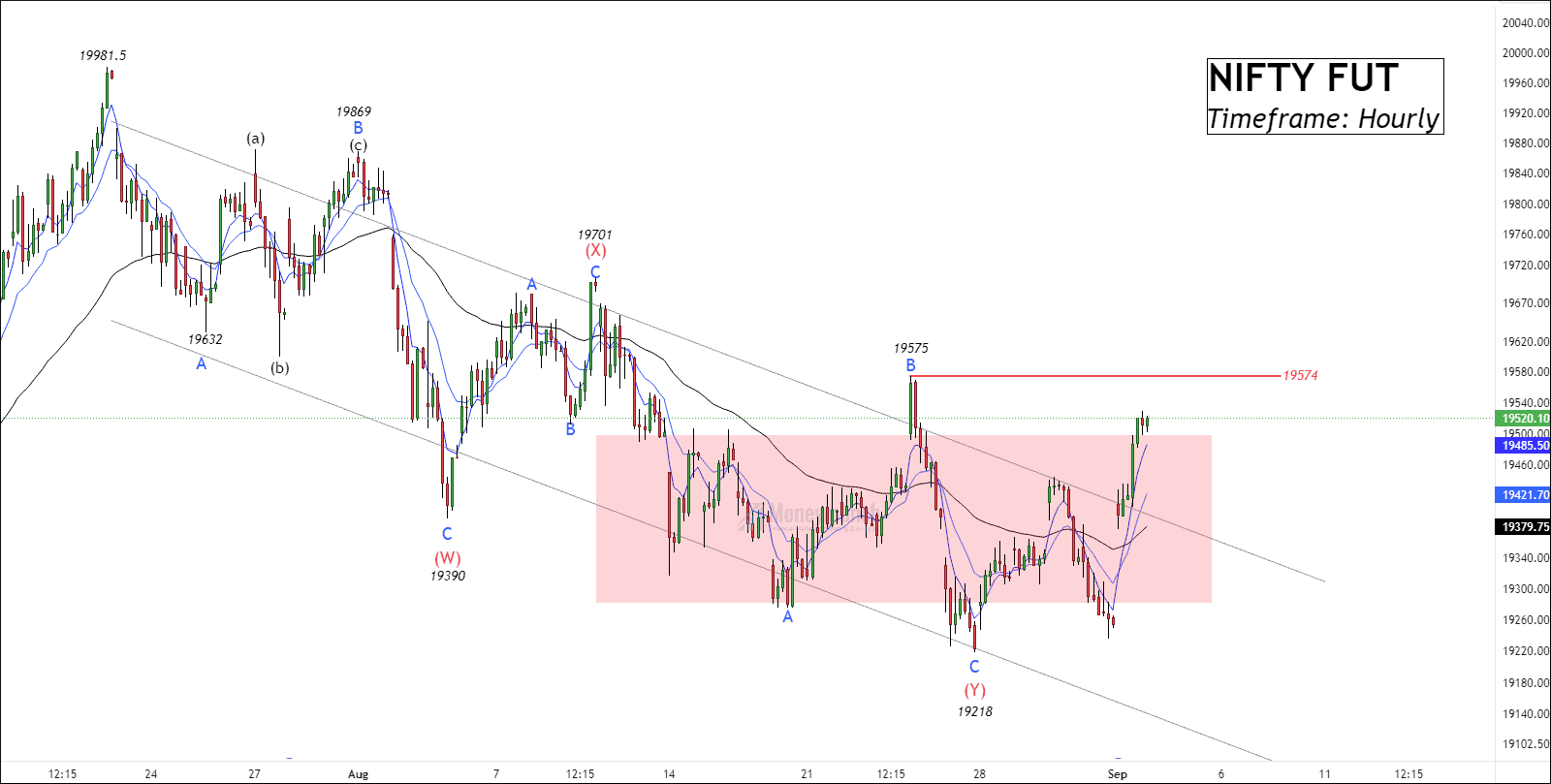

BEFORE

BEFORE

We had written clearly,”If the price breaks wave B, traders can trade for the following targets: 19680 – 19850 – 19940.”

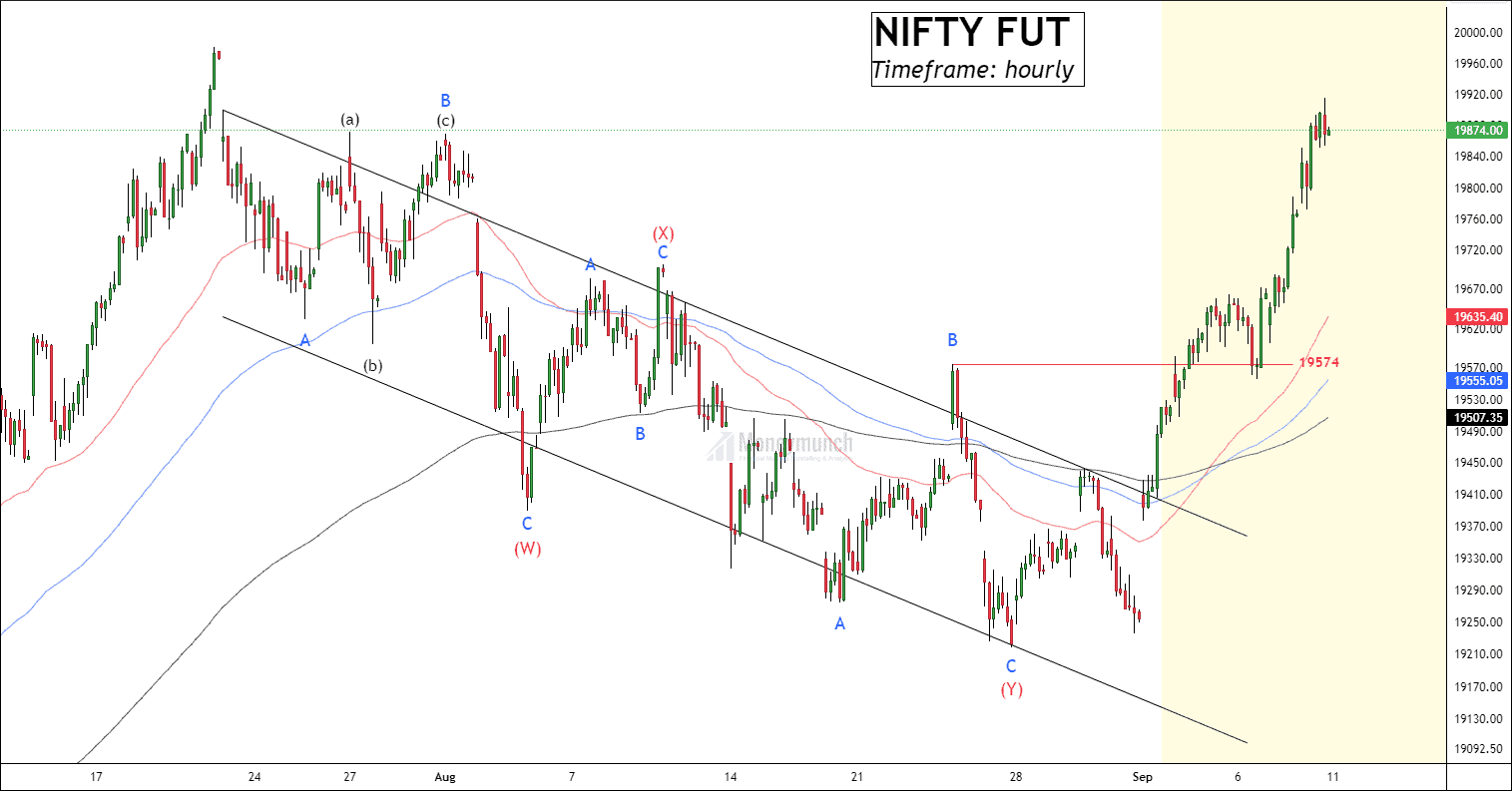

AFTER

AFTER

Lock

Lock