NSE FINCABLES – Premium Setup

Only subscribers can read the full article. Please log in to read the entire text.

NSE COFORGE- Swing Setup

Only subscribers can read the full article. Please log in to read the entire text.

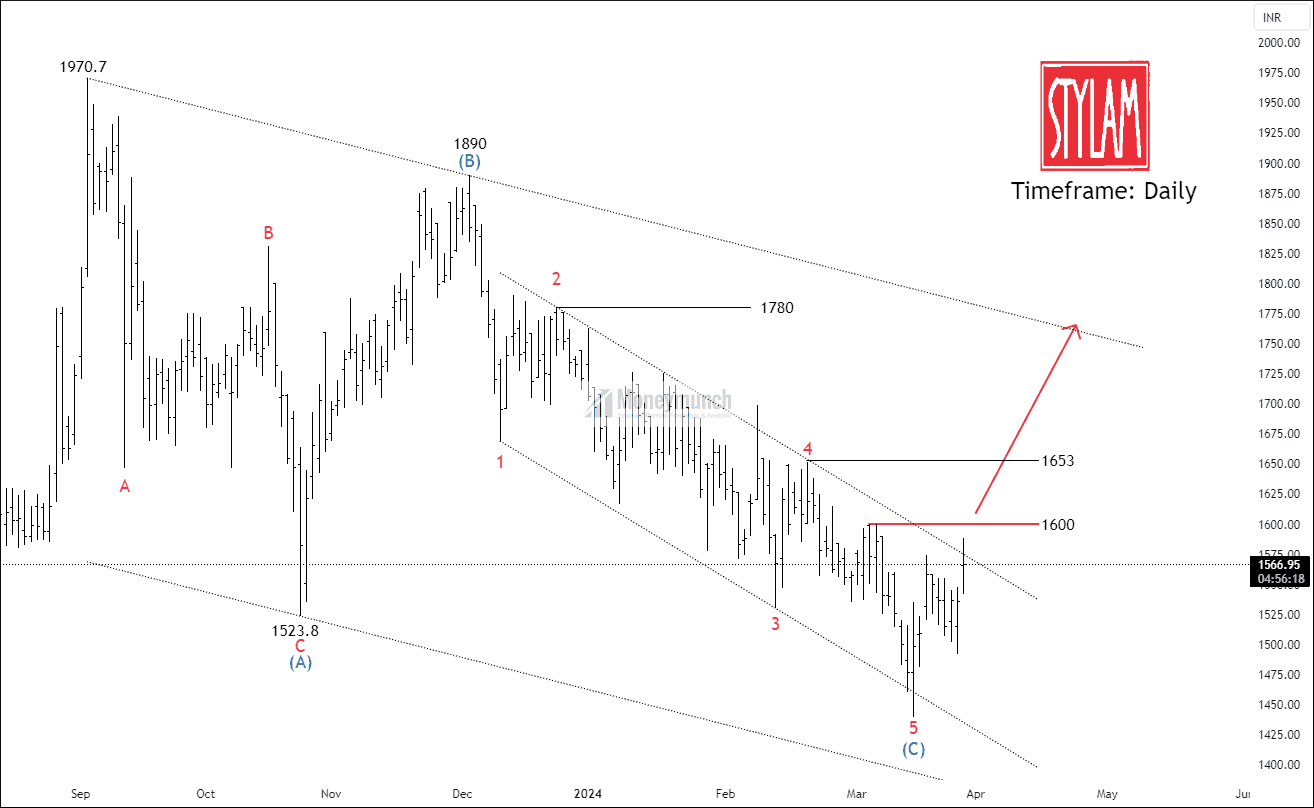

Do you remember the NSE STYLAM Wave projection?

Visit here: NSE STYLAM – Elliott Wave Projection

BEFORE

BEFORE

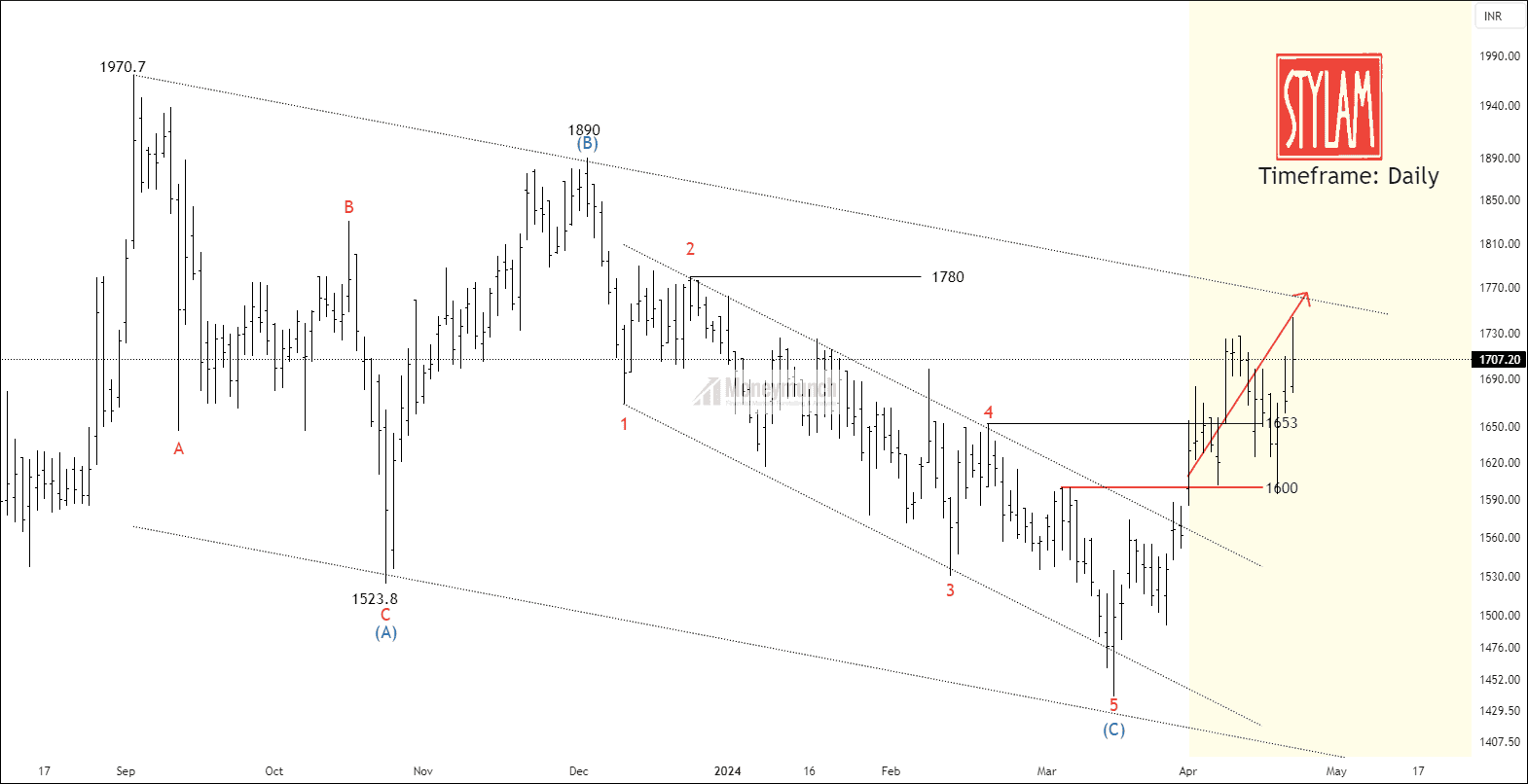

We had written clearly,”If the price breaks out the resistance, traders can trade for the following targets: 1653 – 1728 – 1780+“.

AFTER

AFTER