NSE FINCABLES – Premium Setup

Only subscribers can read the full article. Please log in to read the entire text.

NSE COFORGE- Swing Setup

Only subscribers can read the full article. Please log in to read the entire text.

Looking for reliable and free stock tips? Look no further than Moneymunch! We provide intraday and positional trading calls, technical analysis, research reports, and daily or weekly charts to help you make informed trading decisions in the stock market. Subscribe now and stay ahead of the game!

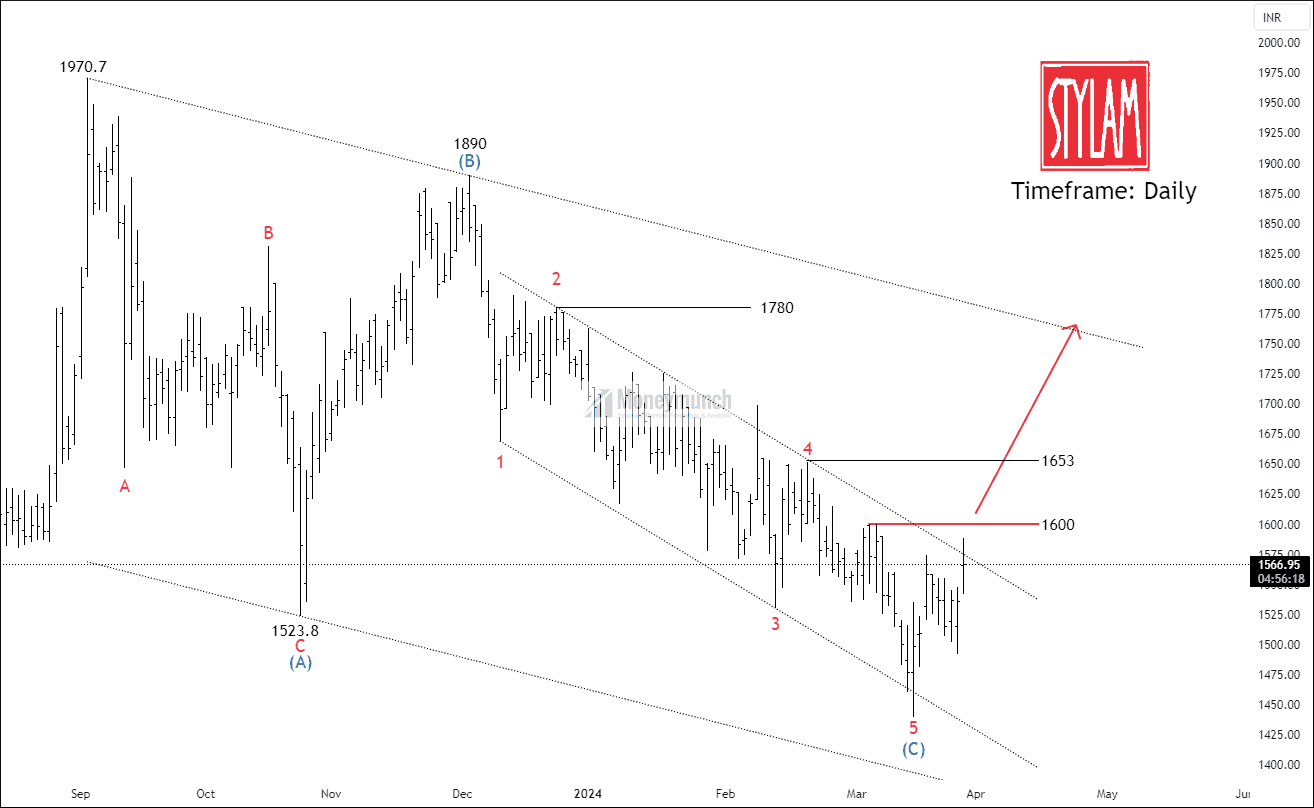

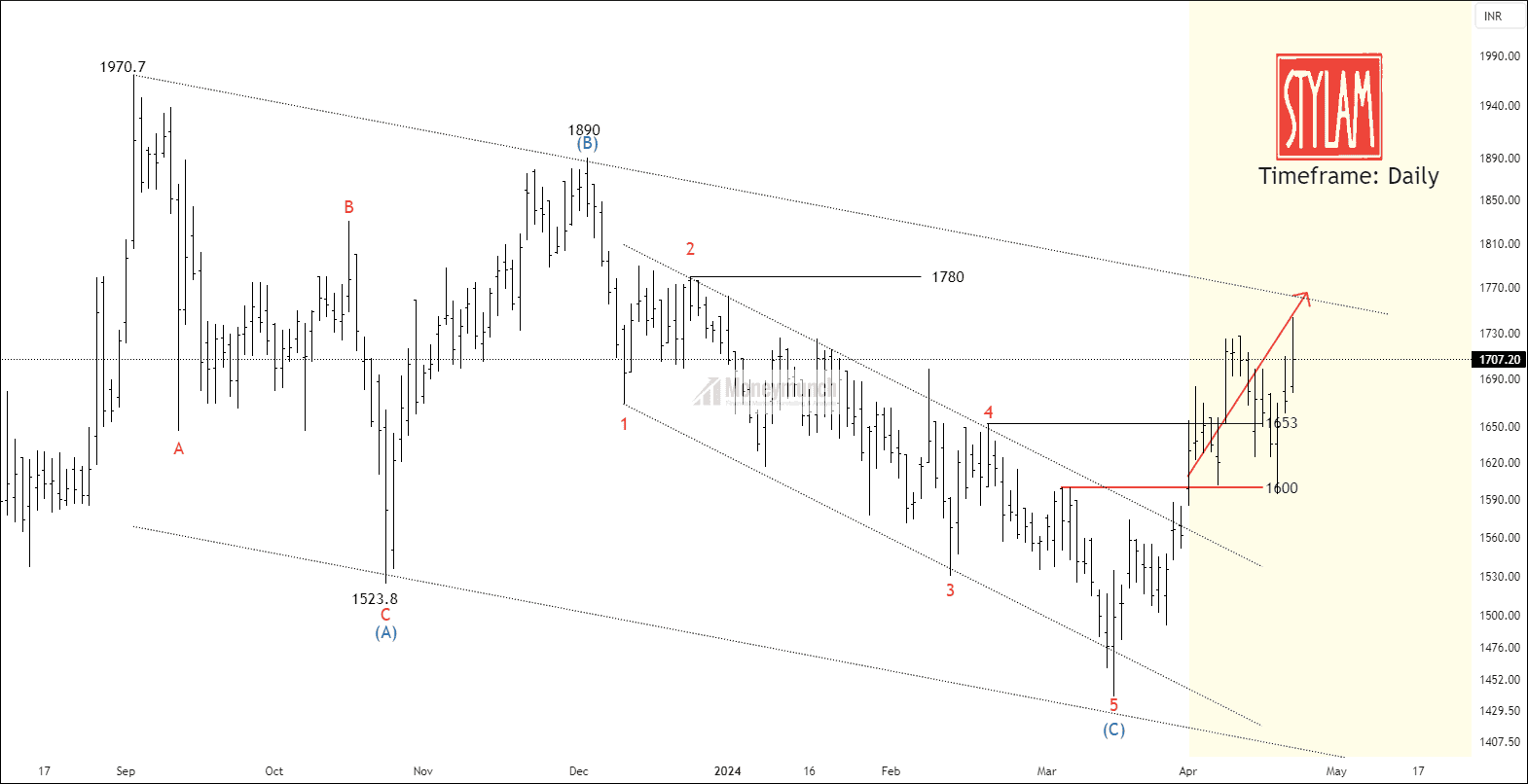

Do you remember the NSE STYLAM Wave projection?

Visit here: NSE STYLAM – Elliott Wave Projection

BEFORE

BEFORE

We had written clearly,”If the price breaks out the resistance, traders can trade for the following targets: 1653 – 1728 – 1780+“.

AFTER

AFTER