Did you read the previous Outlook of Nifty 50?

Click here: NSE NIFTY Weekly Overview – 31 October 2022

Result of the previous outlook:

We discussed the importance of closing above the pivot level in our previous outlook. The price was trading at 17786, and it has broken out of the dynamic resistance line. My outlook for the month was bullish.

I had written clearly, “Can you imagine that one bullish candle could reach the 19000 targets in every advisor’s notebook?”

- Price has made a new high of 18998 in the future market.

Where do we go from here?

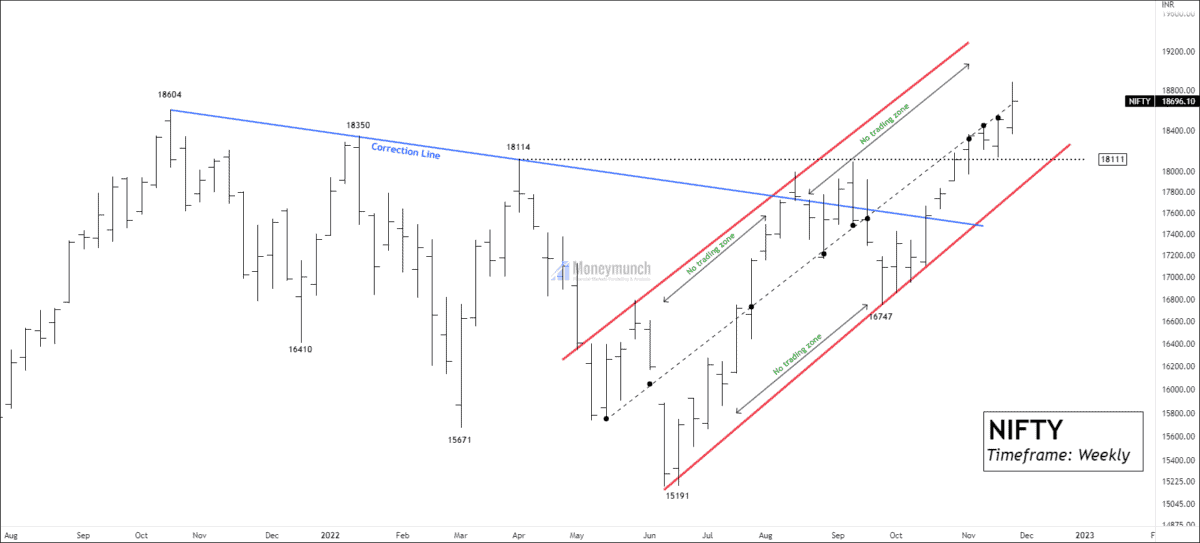

Timeframe: weekly

Nifty has surpassed its all-time high of 18604.45 and made a new high of 18887.6. Price started declining from ATH and collapsed by 248 points. Price is moving towards a crucial support level of 18500. The previous move’s 50% Fibonacci retracement is 18511.10.

Nifty has been forming in the acceleration channel for more than 24 weeks. There are nine touches on the Control line of the channel, and three no-trade zones. Prices are trading at the control line of the channel. If the price breaks the control line, we can see an upward thrust up to an upper band of the parallel channel.

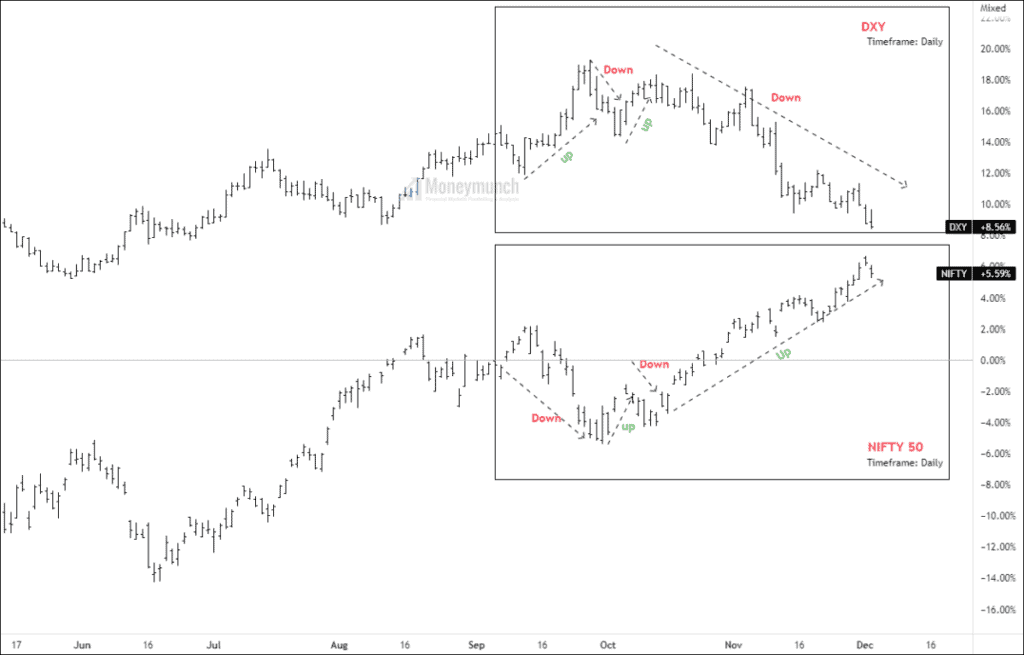

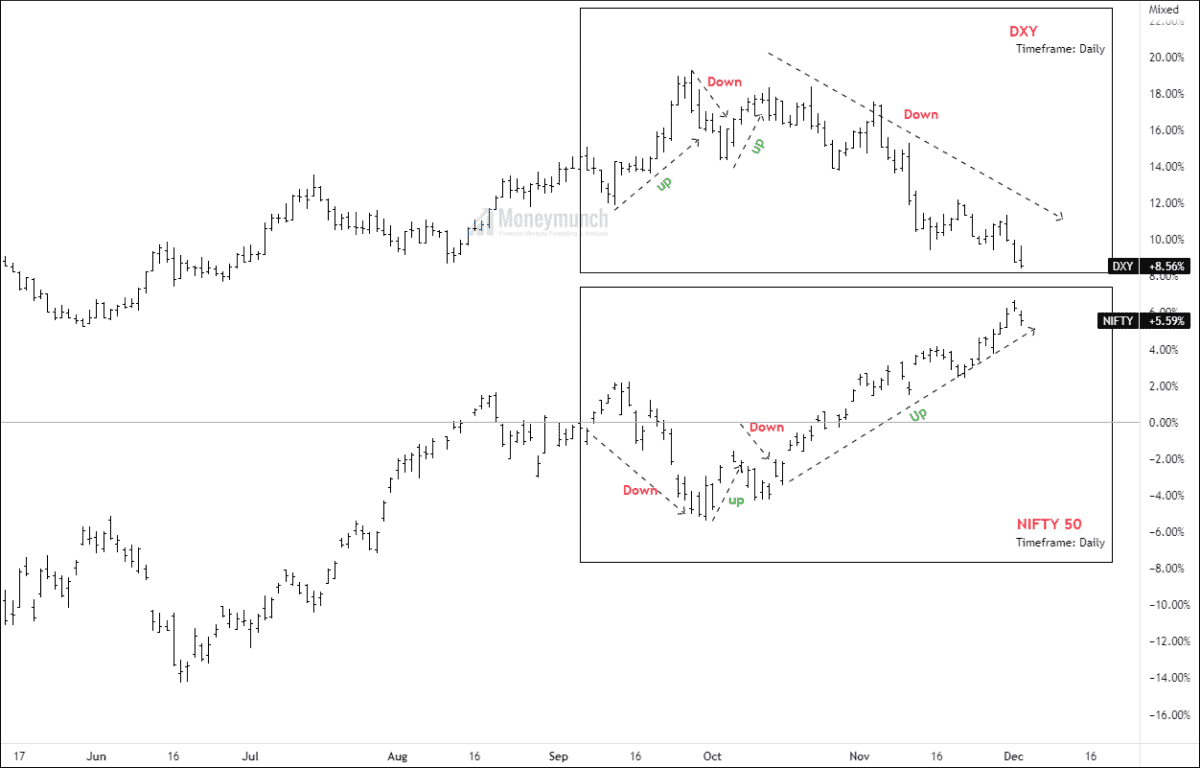

Correlation between NIFTY & DXY:

Timeframe: weekly

As per the chart, the Price movement in NIFTY is the opposite of DXY. During the fall of DXY on 13th October, Nifty started its impulse. DXY still has one down move to complete the cycle. So, nifty’s bullish argument seems logical.

Other informations:

The Gujarat Assembly election’s poll result will highly impact the market. If the ruling party is leading in the pool, the market will lay off all the negative news and start its bullish move, and vice versa.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock

Good insight sir, I totally agree with your analysis.

Impressive work. We are on a ride of 19000+.