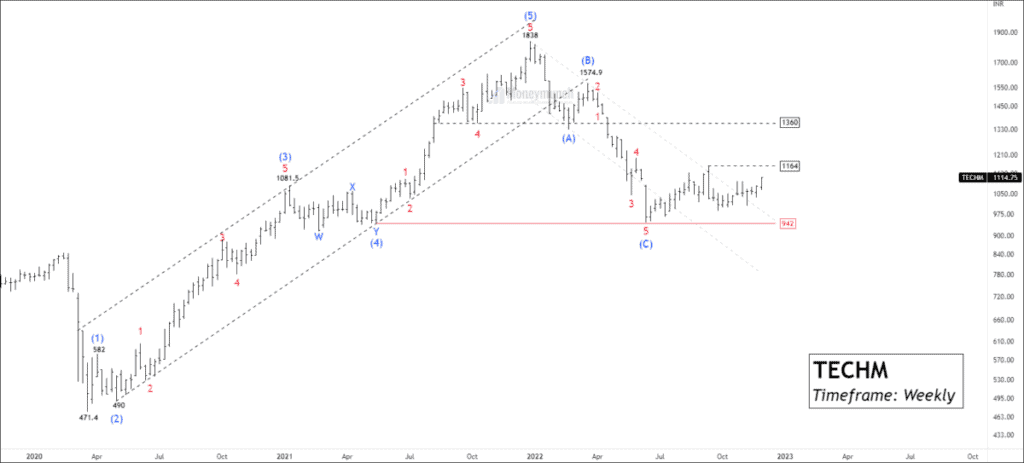

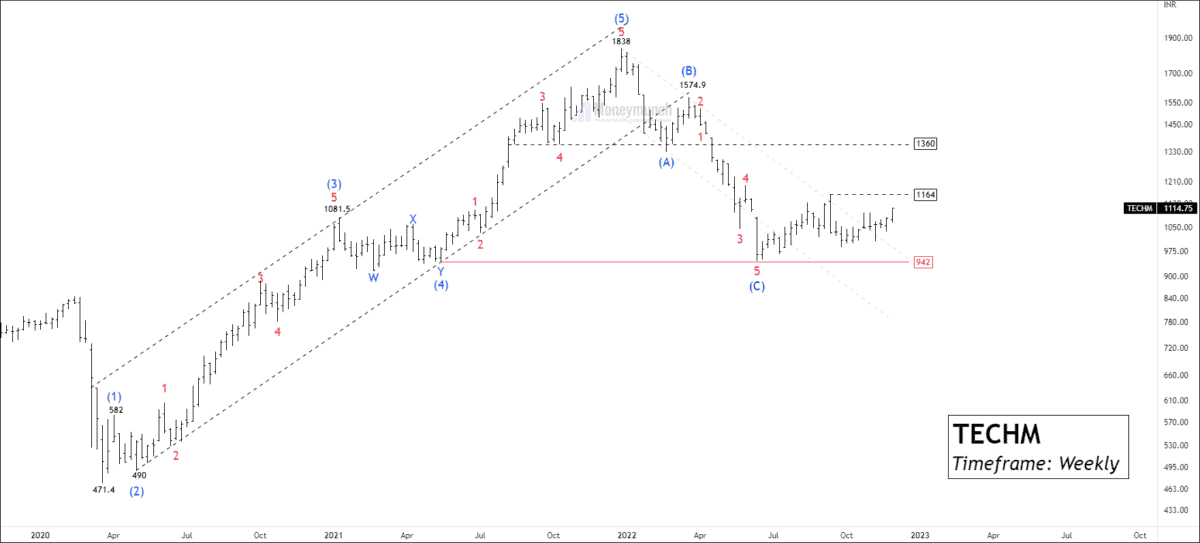

Timeframe: Weekly

TECHM has made a high of 1838 and completed the impulsive wave (5). It is the ending point of an impulsive wave that marks the beginning of a corrective wave. After the breakdown of the base channel, the price has stated an ABC correction.

TECHM has accomplished an impulsive wave at 943.7 with 2.618% reverse Fibonacci of wave (B) and 1.618% of wave (A). Wave (C) occurred nearby the previous sub-wave 4th at 943.

The current price movement is near the recent high of 1164, which represents a resistance level. This level should not be ignored if you have taken a long position. 1164 -1196 is a strong resistance zone that can abrupt upward momentum.

If the price breaks this range, swing/Positional traders can buy for the following targets: 1262 – 1360 – 1436+. Breaks out of the previous high suggest start of an impulsive wave, but the range breakout will be a strong evidence for an impulse.

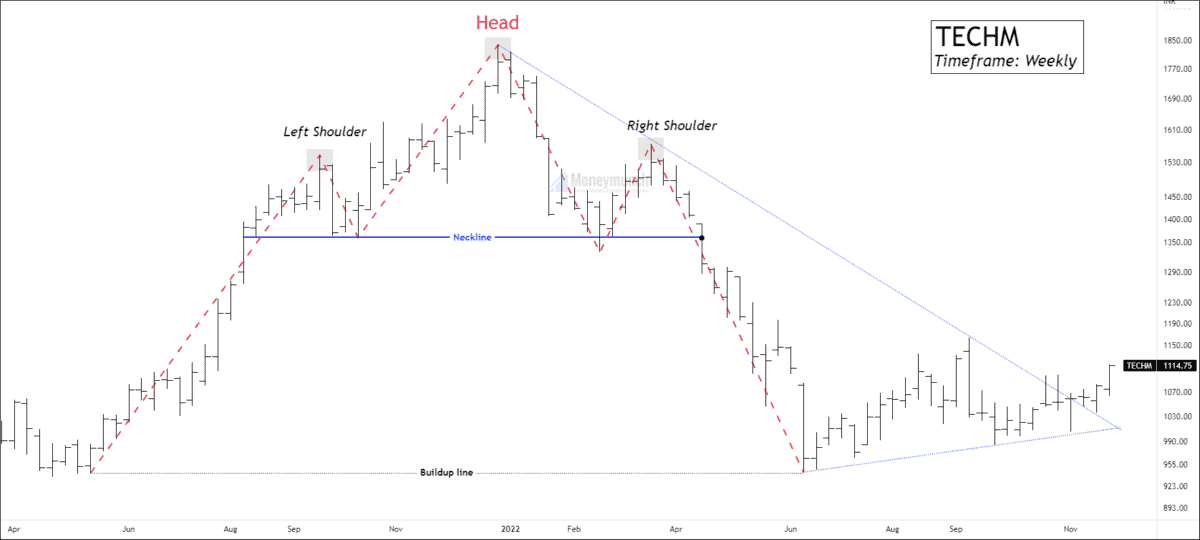

Timeframe: Weekly

Price has accomplished head and shoulders at the buildup zone. This level will work as crucial support in case of a trend reversal. After this, TECHM broken out resistance line and moving towards recent high.

Most traders use 7, 14, and 21 week EMA to analyze the weekly time frame. Price has broken out 21-week moving averages on weekly basis.This signals bulls are preparing to outnumber bears.

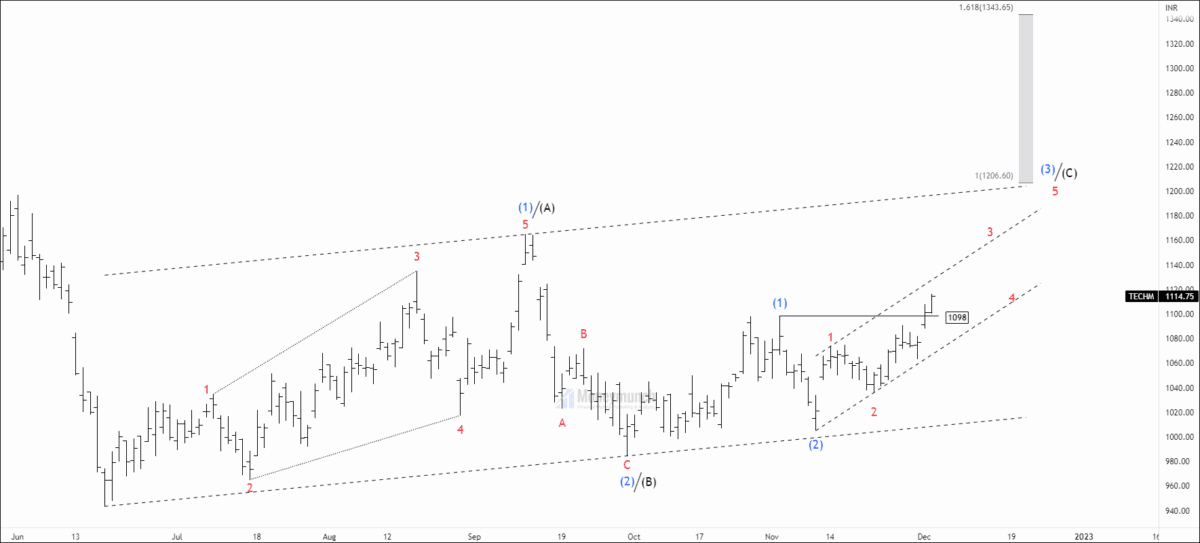

Timeframe: Daily

For Day traders:

(To become a subscriber, subscribe to our free newsletter services. Our service is free for all.)

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock

good explanation

Love to see this my man!

good pick