Gold May Yet Be Ready To Break Out 31,000

Gold is in reverse gear. This week reversal will end. As per our previous foretelling, gold will touch Rs.31,000 soon.

Gold is in reverse gear. This week reversal will end. As per our previous foretelling, gold will touch Rs.31,000 soon.

Our regular blog/email readers asking us via emails: when will be the gold’s uptrend over?

Answer: Consecutively 2 Days closing 30200 below.

Intraday Targets & Best Entry Level will be Revealed on market hours for subscribers only.

Crude oil: Bull OR Bear

I don’t require writing on crude oil this week. Click Here – Read the previous crude oil report.

I don’t require writing on crude oil this week. Click Here – Read the previous crude oil report.

I had clearly written in big bold words that “…if crude oil remains above 4000 level then just buy. Targets: 4080 – 4120 – 4170+“.

In last trading session, it made high 4141 level. Crude oil touched the second target.

Will crude oil touch 4170 level or not? Yes! But this week crude oil volatility will increase. Trade carefully!

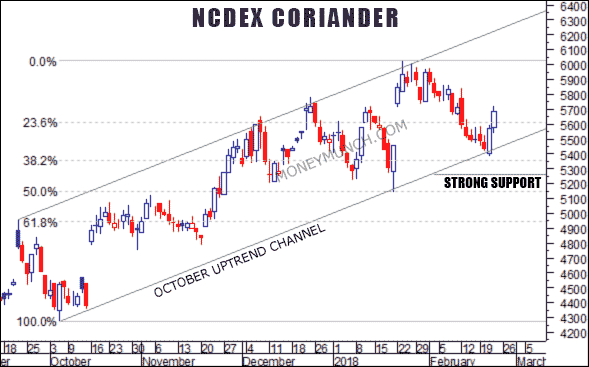

NCDEX Coriander – Technical Research

Coriander is making a trap for short-term investors. Closing above, 5760 will indicate higher demand. It will be the perfect time to take the entry for agri-commodity traders.

Targets: 5860-5950

In the above chart, there’s an October uptrend channel. This channel line breakout will attract the sellers. Buyers must wait for initiate new position till coriander touch the strong support level. Targets (5860-5950 levels) will remain same from strong support line. This information is sufficient for Smart NCDEX trader!

NCDEX Cotton Seed Oil Cake Akola Tips

Keep selling up to level 1580. Closing below level 1550 will increase the supply. Intraday/short-term traders may keep continuing selling after 2 days consecutive closing below 1550 level for the target Rs.1500.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock

nice tips report

Good crude call

Crude oil touched 4170. Book profit or exit? Please tell me

Thanks

In the month of February when I started reading your emails I was not very sure about your predication dear. But now I am! Today I am going to join you. Crude oil call was perfect. Thank you so much for your free advice.

Thank you for the tips. As usual, excellent timing, excellent work and great report!

silver me kya lagta he ji? plz tell me sir

hi