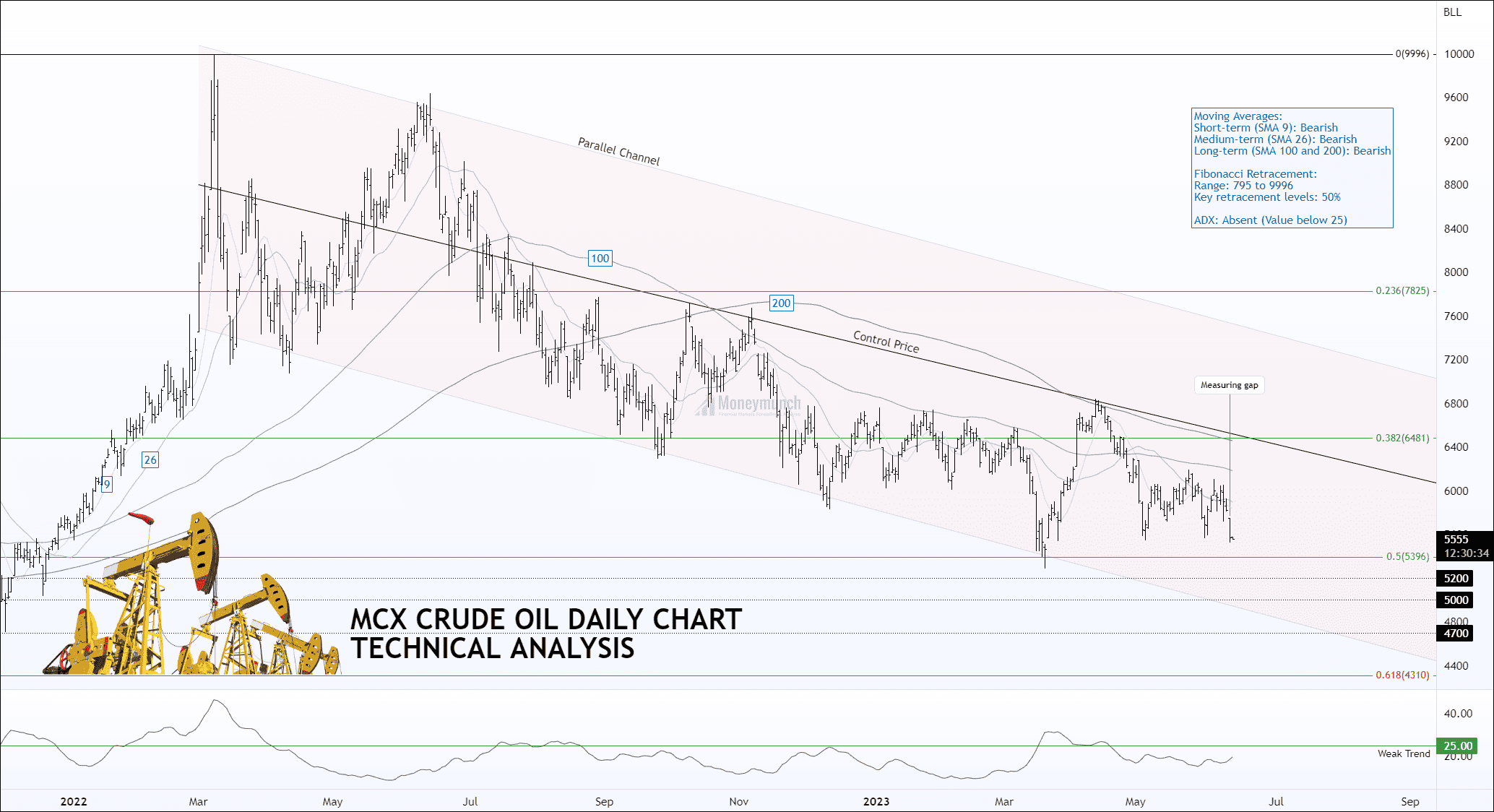

MCX Crude Oil: Retracement Analysis and Downside Targets

MCX Crude Oil: Will it Drop Below 5000 Before the Weekend?

In the wake of the COVID-19 pandemic, crude oil prices experienced significant volatility, hitting a low of 795 and reaching a peak of 9996 on March 8, 2022. Currently, the price is undergoing a retracement, approaching the key level of 50%.Continue reading

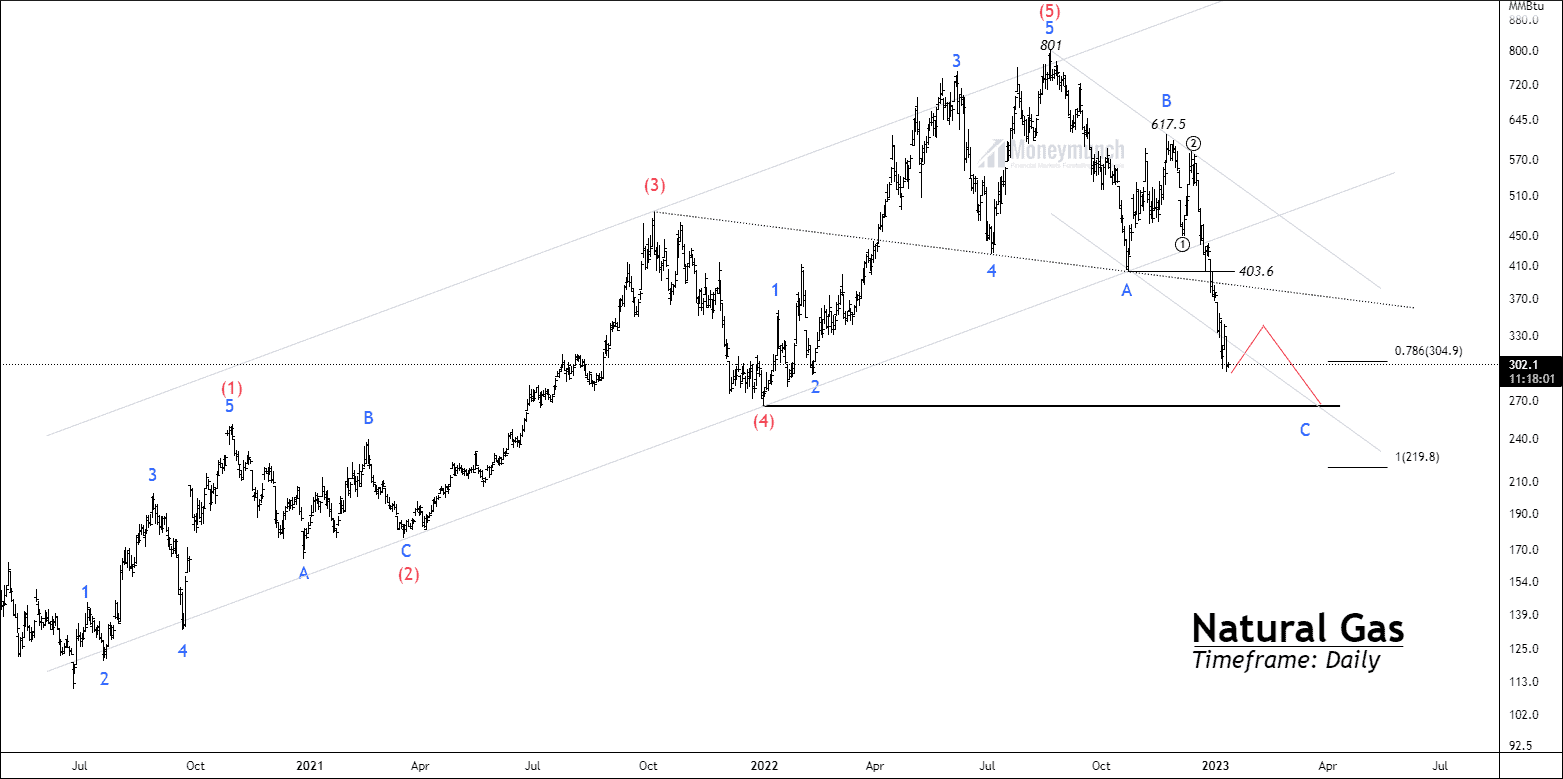

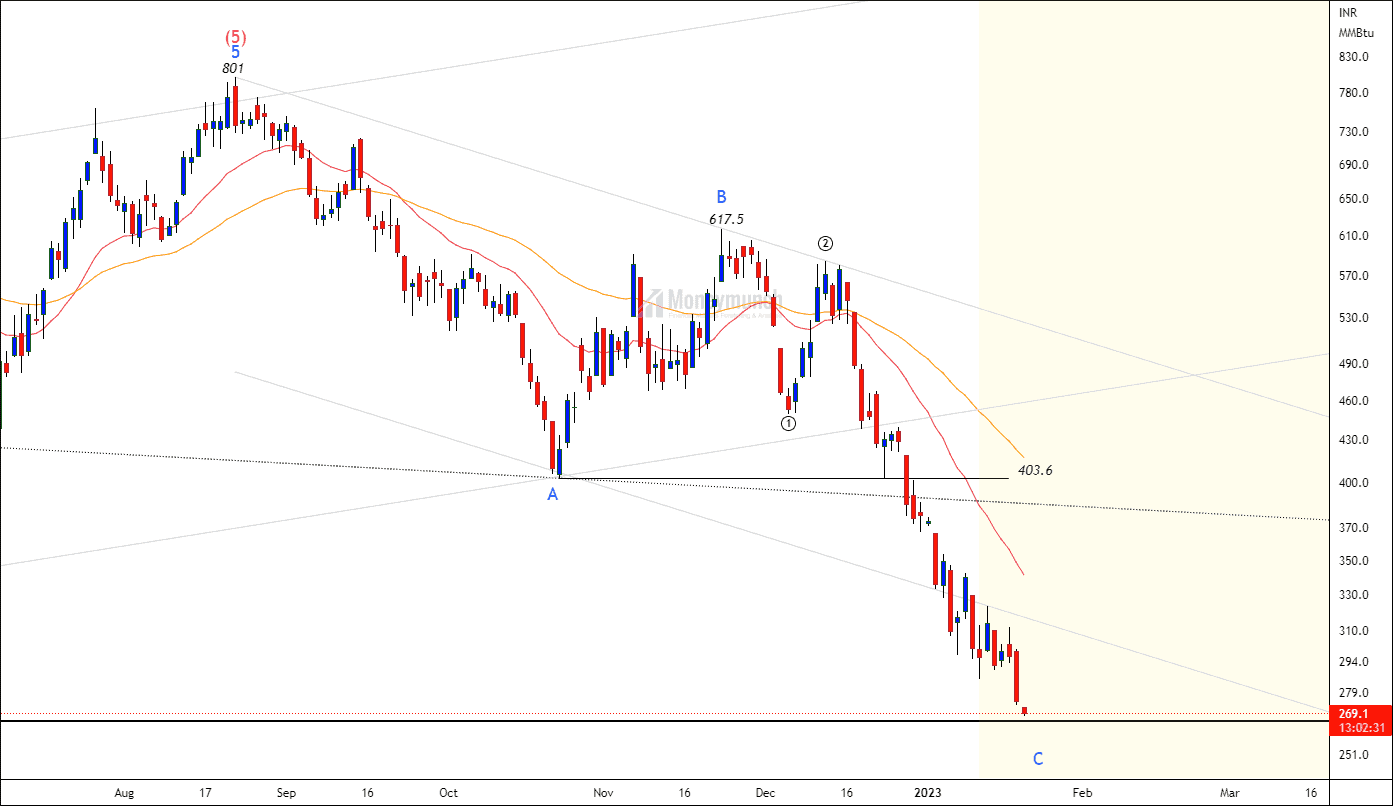

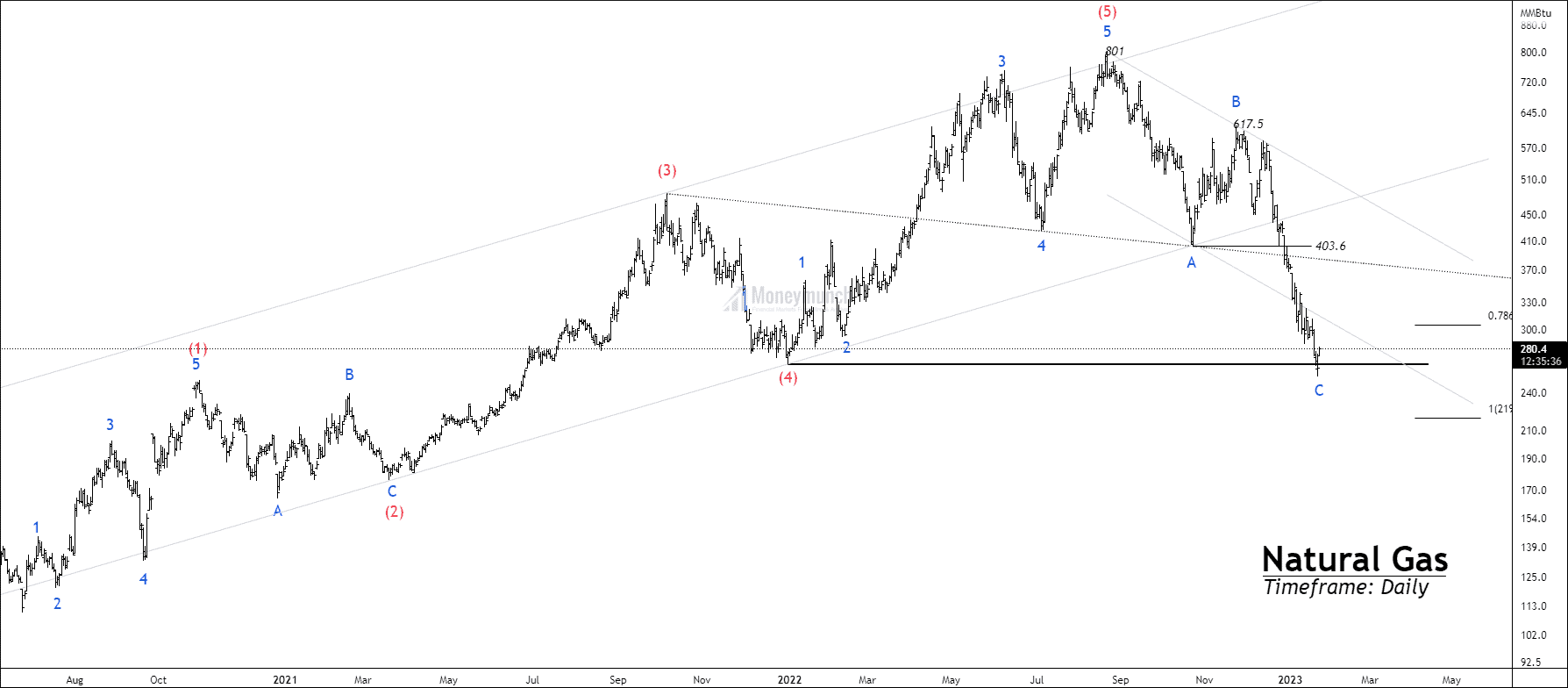

EWT – Is Natural Gas Prepared for a Reversal?

In our previous article, we discussed impulsive wave C and its continuation. On 20 January 2023, Price achieved our all given targets.

Click here: MCX Natural Gas – Elliott Wave projection

Continue reading

Continue readingMCX Natural Gas – Tips & Updates

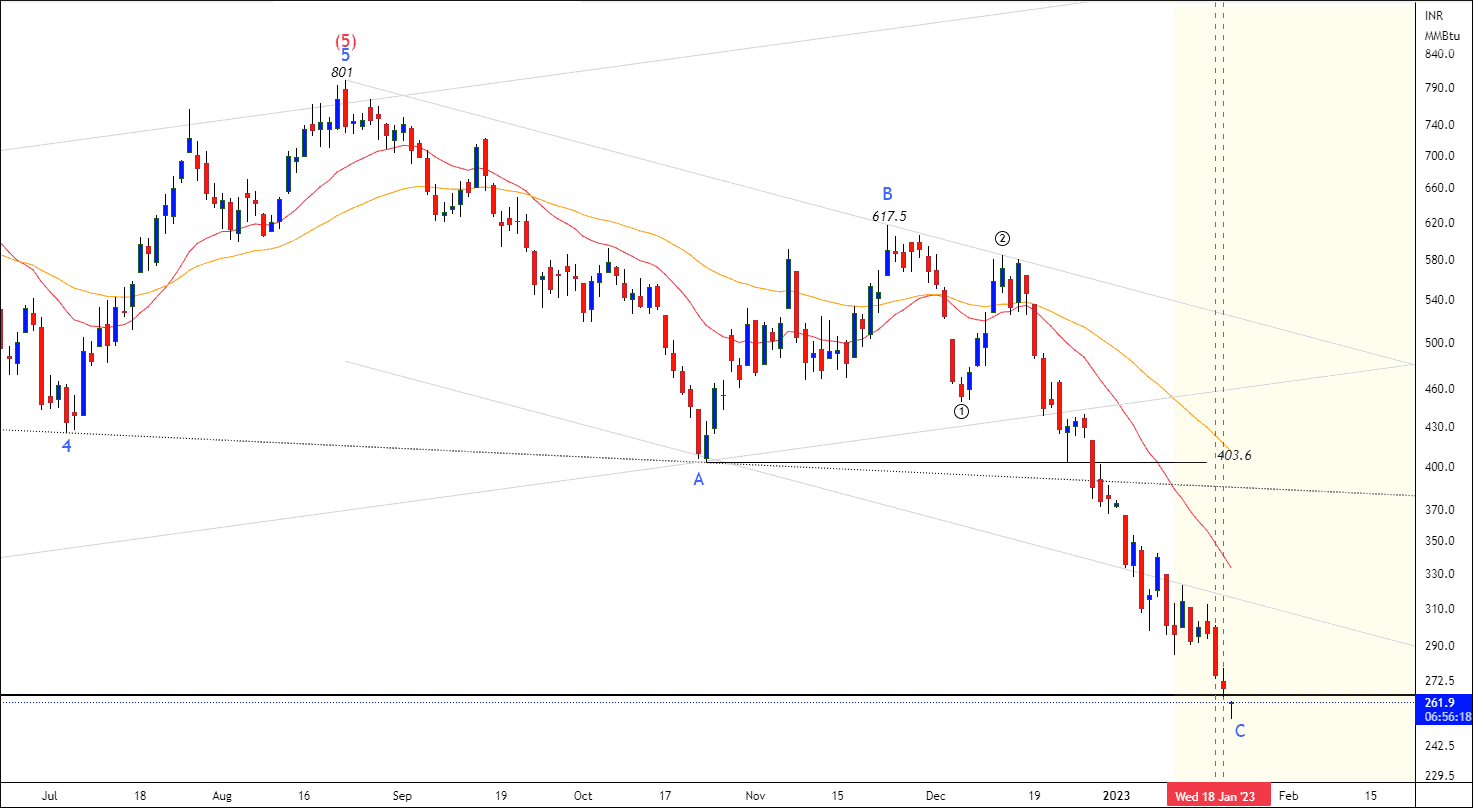

Do you remember MCX Natural Gas Wave Analysis?

Click Here: MCX Natural Gas – Elliott Wave projection

I have written clearly, “If the price sustains below the lower band of the channel, traders can expect the following targets: 288 – 275 – 267.”

MCX Natural Gas – Tips & Updates

Do you remember MCX Natural Gas Wave Analysis?

Click Here: MCX Natural Gas – Elliott Wave projection

I have written clearly, “If the price sustains below the lower band of the channel, traders can expect the following targets: 288 – 275 – 267.”